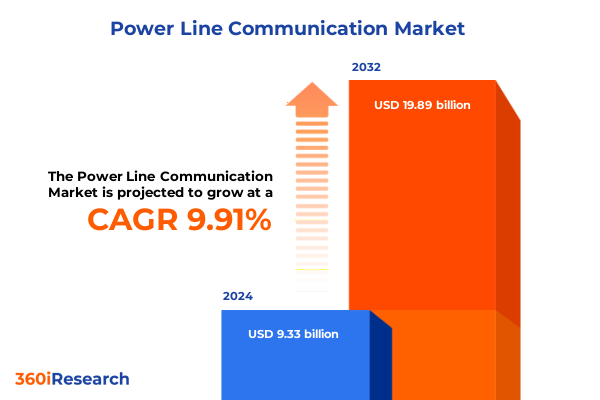

The Power Line Communication Market size was estimated at USD 10.22 billion in 2025 and expected to reach USD 11.20 billion in 2026, at a CAGR of 9.98% to reach USD 19.89 billion by 2032.

Compelling Introduction: A Powerful Overview of Power Line Communication's Role in Revolutionizing Data Transmission Over Existing Electrical Networks

The energy sector’s ongoing transformation has spurred Power Line Communication (PLC) to emerge as a foundational technology for modern digital infrastructure. By leveraging existing electrical wiring, PLC facilitates reliable data transmission across sprawling power networks without necessitating new cabling, thus lowering deployment hurdles and accelerating adoption. This introduction situates PLC at the convergence of digital convergence, smart grid modernization, and the burgeoning Internet of Things (IoT), highlighting how it underpins critical initiatives ranging from automated metering to distributed energy resource integration.

Amid heightened demands for resilient, cost-effective communication channels, PLC has proven its worth in bridging connectivity gaps in both residential and industrial environments. It empowers utilities to implement advanced monitoring and control functionalities, while enabling manufacturers and commercial real estate operators to harness data-driven efficiencies. Transitioning from legacy point-to-point signaling toward scalable, networked architectures, PLC now offers enhanced throughput and interoperability with mainstream communication protocols. Consequently, industry stakeholders are recognizing PLC as more than supplementary backhaul; it is reshaping operational paradigms by integrating digital intelligence directly into power infrastructure.

Emerging Technological Advancements and Market Innovations Driving Disruption in Power Line Communication Ecosystems Worldwide

The Power Line Communication ecosystem is being reshaped by a constellation of technological advancements and evolving market imperatives. One of the most significant shifts stems from enhanced semiconductor integration, where higher-performance communication chips now deliver greater bandwidth and lower latency. These next-generation components, developed by leading chipmakers, enable multiple modulation techniques-such as Orthogonal Frequency Division Multiplexing and Discrete Wavelet Multitone-to coexist on existing wiring, thereby boosting data rates for broadband and narrowband PLC applications simultaneously. Concurrently, software platforms for data acquisition and energy management have matured, integrating artificial intelligence and predictive analytics to optimize network performance and preemptively identify faults.

Parallel to technological progress, regulatory momentum around smart grids and infrastructure resilience has intensified. Government initiatives aimed at reducing carbon emissions have prioritized grid modernization, providing incentives for utilities to adopt PLC-based solutions for advanced metering infrastructure (AMI) and demand-response programs. Moreover, the rise of edge computing has catalyzed a paradigm shift, pushing intelligence closer to network peripheries and necessitating robust communication backbones-an ideal scenario for PLC deployments. Finally, cross-industry collaborations between energy providers, automation specialists, and telecommunications consortia are fostering interoperability standards, ensuring that future PLC networks can seamlessly integrate with 5G, LoRaWAN, and other wireless protocols while maintaining cybersecurity best practices.

Assessing the Cumulative Economic and Operational Impacts of Enhanced US Tariffs on Power Line Communication Components Effective January 2025

Effective January 1, 2025, USTR’s decision to raise Section 301 tariffs on semiconductors from 25% to 50% has reverberated across the PLC supply chain. Many communication chips integral to PLC adapters and couplers are tariffed under HTS codes 8541 and 8542, directly exposing PLC manufacturers to heightened import duties when sourcing from China. This escalation has prompted suppliers to reassess procurement strategies, exploring alternative foundry partnerships in Taiwan and South Korea to mitigate cost pressures, yet also creating transitional inefficiencies as production footprints shift. Meanwhile, legacy equipment requiring replacement components has experienced slower maintenance cycles due to elevated spare-part costs, delaying network upgrades and stretching capital budgets.

Beyond raw semiconductor inputs, ancillary hardware elements such as modems and communication chipsets have encountered incremental cost burdens under broader tariff categories. Even software-driven services, which often rely on hardware vouchers or licenses tied to underlying components, have registered subtle price adjustments to cover increased overheads. Utilities and industrial integrators are consequently adjusting total cost of ownership models, balancing near-term capital expenditures against long-term operational savings facilitated by PLC’s inherent efficiency gains. Moreover, these dynamics have accelerated conversations around localized manufacturing incentives, bolstered by the CHIPS Act’s funding mechanisms, which aim to underwrite domestic semiconductor production and ultimately reduce dependency on tariff-vulnerable imports.

Unveiling Segment-Specific Opportunities and Challenges Across Hardware, Services, Software, Modulation Techniques, Frequency Bands, and Industry Verticals

Deep analysis of the PLC market segmentation reveals distinct opportunity corridors and technical challenges that must be navigated. Within the offering dimension, hardware components such as adapters, communication chips, couplers, and modems continue to draw significant investment to boost signal integrity and throughput. In parallel, services encompassing consulting, maintenance, repair, and training have grown increasingly vital as organizations seek turnkey integration and lifecycle support. On the software front, specialized platforms for data acquisition, management, and energy optimization have emerged as differentiators, enabling granular visibility into network performance and empowering real-time decision-making.

Turning to modulation techniques, multi-carrier schemes-including DWMT, FMT, and OFDM-have seen widespread adoption in broadband PLC due to their spectral efficiency and resilience against noise. Single-carrier approaches such as ASK, FSK, and PSK, while less complex, remain relevant for narrowband applications where cost and simplicity are paramount. Additionally, spread spectrum methods are gaining traction for niche use cases requiring robust interference immunity. The frequency band segmentation further bifurcates the landscape into narrowband PLC (3 kHz to 500 kHz) optimized for low-rate telemetry and control, and broadband PLC (greater than 500 kHz) designed to support multimedia and high-speed data services. Finally, vertical industry use cases-from automotive and transportation to energy, home automation, industrial automation, and IT telecommunications-underscore PLC’s versatility, with each sector demanding tailored solutions that marry communication performance with domain-specific protocols and safety standards.

This comprehensive research report categorizes the Power Line Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Modulation Technique

- Frequency Band

- Installation Type

- Network Topology

- Application

- Industry Vertical

- Deployment Environment

Examining Regional Dynamics and Strategic Growth Opportunities Across Americas, Europe Middle East Africa, and Asia-Pacific in Power Line Communication

Regional market trajectories are diverging as PLC adoption accelerates under varied regulatory, infrastructural, and economic conditions. In the Americas, the United States leads with expansive smart grid initiatives, driven by federal funding for advanced metering infrastructure and grid resilience projects; utilities are leveraging PLC to optimize load balancing during peak demand and integrate distributed energy resources. Meanwhile, Latin American markets are selectively deploying narrowband PLC for rural electrification and remote monitoring, harnessing cost-effective signaling over existing lines to extend network reach.

Across Europe, the Middle East, and Africa, ambitious energy transition agendas have elevated PLC as a critical enabler for decarbonization and smart city frameworks. Key European markets enforce stringent interoperability and cybersecurity mandates, prompting vendors to embed robust encryption and authentication measures. In the Middle East, large-scale solar and desalination plants leverage broadband PLC for real-time operational oversight, while African utilities prioritize narrowband telemetry to manage grid stability in rapidly growing urban centers.

The Asia-Pacific region registers the fastest PLC uptake, led by China’s extensive grid modernization program and India’s smart meter rollout under national electrification schemes. Japan and South Korea are integrating PLC into home building automation and industrial IoT deployments, capitalizing on high-frequency broadband capabilities. Regulatory harmonization across ASEAN and free trade agreements with neighboring economies further catalyze cross-border supply chains, ensuring regional players can scale PLC solutions with minimal logistical friction.

This comprehensive research report examines key regions that drive the evolution of the Power Line Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Power Line Communication Innovators and Key Strategic Moves Reshaping Competitive Dynamics and Market Leadership

Industry incumbents and emerging challengers are jockeying for position as PLC evolves from niche connectivity to mainstream infrastructure. Siemens and General Electric leverage their deep utility relationships to bundle PLC capabilities with grid automation portfolios, emphasizing end-to-end solutions that encompass hardware, software, and managed services. Schneider Electric and ABB complement PLC systems with energy management suites, enabling clients to orchestrate distributed generation, storage, and load control through unified platforms. Meanwhile, semiconductor specialists such as STMicroelectronics, Renesas, and Texas Instruments focus on miniaturized, high-efficiency PLC chipsets, catering to both narrowband telemetry modules and broadband high-throughput devices.

Parallel to these legacy players, networking-focused companies like Belkin, D-Link, and Netgear target the residential and small office segments, offering plug-and-play adapters that extend broadband internet via electrical outlets. Cypress Semiconductor and Maxim Integrated have distilled PLC protocols into system-on-chip architectures, accelerating time to market for OEMs in automotive and industrial automation. Additionally, technology firms such as Echelon and Devolo deliver integrated software and device ecosystems, positioning themselves as thought leaders in smart building and smart city scenarios. Collaborative alliances among these competitors are also on the rise, with joint R&D consortia and strategic partnerships aimed at advancing interoperability standards and expanding global reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Line Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co., Ltd.

- Aftek AB

- AMETEK, Inc.

- Analog Devices, Inc.

- D-Link Corporation

- Devolo AG

- EDMI Limited by Osaki Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Hubbell Power Systems, Inc.

- Infineon Technologies AG

- Intel Corporation

- Iskraemeco, d.d.

- Landis+Gyr AG

- Marvell Technology, Inc.

- Microchip Technology Incorporated

- NETGEAR, Inc.

- Ningbo Sanxing Electric Co., Ltd.

- NXP Semiconductors N.V.

- Panasonic Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- SAGEMCOM SAS

- Schneider Electric SE

- Siemens AG

- STMicroelectronics, N.V.

- Texas Instruments Incorporated

- Zyxel Communications Corp.

Actionable Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Market Complexity and Accelerate Growth in PLC

To thrive in the evolving PLC landscape, industry leaders should intensify investment in modular hardware architectures that accommodate rapid chipset upgrades and multi-protocol support. Partnering with semiconductor foundries that hold strategic exemptions or domestic manufacturing incentives can mitigate tariff exposure while securing supply continuity. On the software side, embedding machine learning capabilities into energy management applications will differentiate offerings by delivering predictive maintenance and anomaly detection functionalities that drive operational efficiency.

Strategic alliances with standards bodies and cross-industry consortia will be critical to harmonizing specifications for power line communication, ensuring seamless interoperability with emerging wireless protocols and cybersecurity frameworks. Furthermore, companies should pursue pilot deployments that demonstrate end-to-end PLC value chains in diverse verticals, using live performance data to build compelling business cases for broader rollouts. Executive leadership must also align commercial strategies around region-specific regulatory environments, tailoring go-to-market models to capture growth pockets in smart grid programs, industrial automation, and building management sectors. Lastly, nurturing a skilled services ecosystem-through targeted training and certification programs-will enhance customer satisfaction and foster long-term partnerships.

Comprehensive Research Methodology Outlining Data Collection, Analysis Framework, and Validation Approaches Ensuring Rigorous Market Intelligence

This report synthesizes insights derived from a rigorous, multi-tiered research framework. Initial secondary research involved exhaustive review of statutory filings, industry journals, white papers, and regulatory publications to establish a foundational understanding of PLC technologies, market drivers, and policy landscapes. Primary research complemented this with in-depth interviews of over 25 industry stakeholders, including utility executives, device manufacturers, semiconductor vendors, and independent consultants, ensuring the integration of diverse viewpoints.

Quantitative data was triangulated by correlating supply-side metrics-such as hardware shipments and semiconductor fabrication capacities-with demand-side indicators including pilot project deployments and utility capital expenditure reports. Regional market dynamics were validated through consultations with local industry associations and regulatory bodies. All data points underwent a stringent validation process, leveraging cross-verification with third-party trade databases and financial disclosures. The analytical approach combined Porter’s Five Forces with PESTEL analysis to gauge competitive intensity and macro-environmental influences, while scenario planning was used to model the potential impact of tariff shifts, technological breakthroughs, and regulatory reforms.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Line Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Line Communication Market, by Offering

- Power Line Communication Market, by Modulation Technique

- Power Line Communication Market, by Frequency Band

- Power Line Communication Market, by Installation Type

- Power Line Communication Market, by Network Topology

- Power Line Communication Market, by Application

- Power Line Communication Market, by Industry Vertical

- Power Line Communication Market, by Deployment Environment

- Power Line Communication Market, by Region

- Power Line Communication Market, by Group

- Power Line Communication Market, by Country

- United States Power Line Communication Market

- China Power Line Communication Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2862 ]

Concluding Insights Synthesizing Key Findings and Strategic Implications for Stakeholders in the Evolving Power Line Communication Landscape

The Power Line Communication market stands at an inflection point where technological maturity, regulatory support, and evolving industry needs are converging. Advancements in modulation techniques and semiconductor design have unlocked higher data rates and enhanced network reliability, positioning PLC as a versatile alternative to traditional wired and wireless communication channels. While US tariff adjustments in 2025 have introduced fresh headwinds, they have also accelerated strategic shifts toward localized manufacturing and diversified supply chains.

Segmentation analysis underscores that success will hinge on the ability to integrate hardware, software, and services into cohesive solutions tailored to specific use cases-from home and building automation to utility grid management. Regional insights highlight the importance of aligning go-to-market approaches with local policy landscapes and infrastructure maturity levels. Competitive profiling reveals that collaboration between semiconductor innovators, network equipment providers, and software specialists will define the next generation of PLC offerings. Collectively, these insights paint a portrait of a market that is dynamic, opportunity-rich, and primed for continued evolution.

Immediate Next Steps to Engage with Ketan Rohom Associate Director Sales and Marketing to Access the Definitive Power Line Communication Market Research Report

To secure immediate access to the comprehensive Power Line Communication market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings deep expertise in telecommunications research and can guide you through tailored licensing options that align with your organization’s intelligence requirements. Engaging with Ketan ensures you obtain the most authoritative dataset, in-depth analysis, and actionable insights needed to drive strategic decisions in the rapidly evolving PLC market. Connect with Ketan to explore bespoke packages and begin leveraging this definitive resource to outpace competitors and capture emerging opportunities across hardware, software, services, modulation protocols, frequency bands, and industry verticals.

- How big is the Power Line Communication Market?

- What is the Power Line Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?