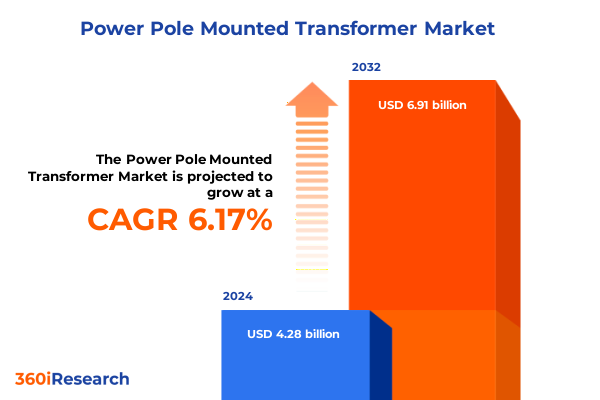

The Power Pole Mounted Transformer Market size was estimated at USD 4.48 billion in 2025 and expected to reach USD 4.78 billion in 2026, at a CAGR of 6.36% to reach USD 6.91 billion by 2032.

Uncovering the Strategic Landscape and Impetus Behind the Evolution of Power Pole Mounted Transformers Across Modern Energy Infrastructures

In today’s rapidly evolving energy environment, the demand for resilient and efficient power distribution solutions is stronger than ever. Power pole mounted transformers play a pivotal role in delivering reliable electricity across the final mile of distribution networks, supporting everything from dense urban districts to remote rural communities. As generation sources diversify and grids become more decentralized, these compact yet robust devices ensure that end users experience consistent voltage regulation and safe power delivery, even under variable load conditions and environmental challenges.

Recent shifts in generation mix and consumption patterns have intensified the focus on distribution assets that can adapt to advanced grid management and renewable integration. Pole mounted transformers, with their flexibility and relatively simple installation, have become indispensable in modernizing legacy infrastructure and extending service coverage to meet surging consumption trends. By facilitating low-cost upgrades and retrofits, they enable utilities and developers to accelerate electrification efforts while maintaining system reliability.

This executive summary sets the stage for a comprehensive exploration of the power pole mounted transformer market by examining the primary catalysts driving change, landmark regulatory and tariff developments, key segmentation frameworks, as well as regional dynamics and competitive trends. It also outlines the methodology underpinning this analysis and concludes with targeted recommendations for industry leaders seeking to capitalize on emerging opportunities and mitigate potential challenges in this critical segment.

Exploring Paradigm Shifts in Grid Modernization and Digital Integration That Are Reshaping the Power Pole Mounted Transformer Industry for Future Resilience

The power pole mounted transformer sector is undergoing a transformation propelled by a convergence of technological innovation, regulatory momentum, and shifting customer expectations. Grid modernization initiatives across mature markets have accelerated investments in smart grid infrastructure, embedding advanced monitoring, control, and communications capabilities directly into distribution networks. These enhancements extend to pole mounted transformers, which now integrate sensors and digital metering to deliver real-time performance data and predictive diagnostics, reducing maintenance costs and minimizing unplanned outages.

Simultaneously, the drive toward decarbonization has reshaped procurement criteria for equipment, with end users and utilities prioritizing lower-loss cores, eco-friendly insulating materials, and designs that support bi-directional power flows from distributed generation assets such as rooftop solar. Material science advancements are unlocking novel alloy formulations and resin composites that improve thermal performance and fire safety, enabling transformers to operate reliably under higher loads and extreme weather events.

Moreover, the expanding role of edge computing and the Internet of Things (IoT) in energy management is fostering interoperability between grid components. Pole mounted transformers now often serve as hubs for localized energy orchestration, interfacing with distributed generation, energy storage, and demand-response platforms. This integration not only enhances grid resilience but also offers new revenue streams through value-added services such as capacity markets and ancillary grid support.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Power Pole Mounted Transformer Supply Chains and Cost Structures

In 2025, the United States reinforced its protectionist trade posture by maintaining and, in certain instances, expanding tariffs on imported steel and aluminum under Section 232 measures. These actions directly influence the cost structure of pole mounted transformers, as core lamination steel and structural components predominantly rely on global supply chains. Manufacturers have encountered increased raw material pricing pressure, which has necessitated a reevaluation of sourcing strategies to sustain margin integrity.

To mitigate tariff-driven cost escalations, several industry players have accelerated efforts to localize procurement, forging partnerships with domestic steel producers and exploring alternative alloy sources. While these shifts have improved supply chain resilience, they have also introduced lead time complexities and capacity constraints, compelling some transformer manufacturers to adjust production schedules and optimize inventory buffers. End users and distributors have absorbed portions of the incremental cost through contract renegotiations and phased price adjustments, reflecting the delicate balance between market competitiveness and supply security.

Looking ahead, sustained tariff uncertainty continues to underscore the importance of dynamic procurement frameworks and collaborative forecasting models between suppliers and buyers. Companies that invest in transparent supply chain analytics and strategic supplier diversification will be better positioned to navigate evolving policy landscapes while maintaining operational agility and customer satisfaction.

Illuminating Critical Segmentation Perspectives Across Applications, Capacities, Voltage Ratings, Cooling Types, and Insulation Variants in Transformer Markets

A nuanced understanding of market segmentation reveals where growth and innovation converge. Within application categories, the residential segment is experiencing robust demand driven by rising multi-family dwellings outfitted with advanced metering infrastructure. At the same time, the commercial sub-category of retail facilities is increasingly seeking compact pole mounted solutions to support outdoor lighting and EV charging stations. Industrial applications, particularly manufacturing facilities, prioritize higher capacity ranges between 101–250kVA and beyond, capitalizing on advanced cooling types to manage intensive load cycles.

Capacity segmentation highlights a paradigm shift toward larger kVA ratings, as utilities and large-scale commercial operators scale pole mounted assets to accommodate distributed energy resources. Voltage rating segmentation further delineates market preferences, with medium voltage classes capturing significant attention for their balance of efficiency and cost. Within medium voltage, the 11–36kV range dominates new installations, yet above-100kV high-voltage configurations are gaining traction in specialized transmission-adjacent deployments.

Cooling and insulation modalities represent additional vectors of differentiation. The air natural dry type configuration remains popular for its simplicity and minimal maintenance requirements, whereas forced cooling oil immersed alternatives are preferred in high-temperature environments. Likewise, the shift toward resin-encapsulated insulation, particularly self-extinguishing variants, underscores the growing emphasis on fire safety and environmental compliance, influencing procurement decisions across end-user categories.

This comprehensive research report categorizes the Power Pole Mounted Transformer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Capacity

- Voltage Rating

- Cooling Type

- Insulation Type

Revealing Strategic Regional Dynamics and Demand Drivers Spanning the Americas, Europe Middle East Africa, and Asia Pacific Transformer Markets

Regional market dynamics in the Americas are shaped by the need to rejuvenate aging distribution networks while facilitating the electrification of transportation corridors. Legacy infrastructure upgrades in North America prioritize pole mounted transformers with integrated intelligence to streamline asset management, whereas Latin American markets exhibit strong growth in rural electrification projects that hinge on cost-effective transformer solutions.

In Europe, Middle East, and Africa, stringent regulatory frameworks and ambitious carbon reduction targets are accelerating the adoption of transformers with lower core losses and eco-friendly insulating media. Utilities and municipalities in Western Europe are pioneering pilot programs that embed digital condition monitoring within pole mounted platforms, while Middle Eastern markets leverage high-temperature tolerant designs to ensure reliability under desert extremes. African grids, often characterized by rapid extension into previously underserved regions, rely on modular transformer units to balance affordability with performance.

Asia-Pacific remains a powerhouse of demand fueled by urbanization and renewable energy integration. South Asian utilities are deploying pole mounted transformers en masse to support rooftop solar rollouts, while Southeast Asian island grids leverage compact, low-loss units to reinforce resilience against tropical storms. In the Asia-Pacific powerhouse of China, local manufacturers are advancing advanced cooling and self-extinguishing insulation technologies, setting a competitive benchmark for export to other regional markets.

This comprehensive research report examines key regions that drive the evolution of the Power Pole Mounted Transformer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Innovations Investments and Strategic Partnerships Driving Leading Power Pole Mounted Transformer Manufacturers Forward

Competition within the power pole mounted transformer domain is characterized by a blend of global OEM leadership and specialized regional innovators. Large manufacturers are differentiating through robust R&D investments, often embedding digital monitoring modules and hybrid cooling systems into their product portfolios. These advancements are frequently complemented by strategic joint ventures with telecom and IoT providers, enhancing data analytics capabilities and broadening service offerings around asset lifecycle management.

Local and regional players leverage their proximity to raw material suppliers and deep market knowledge to deliver cost-optimized solutions tailored to specific climatic and regulatory conditions. Through targeted acquisitions and technology licensing agreements, these firms are rapidly scaling their geographic reach while integrating novel insulation and core design innovations. Meanwhile, a growing slate of aftermarket service providers is emerging to offer predictive maintenance and upgrade services, enabling utilities and large end users to prolong transformer lifespans and reduce total cost of ownership.

Collaborative partnerships between transformer OEMs and renewable project developers are also gaining momentum, reflecting the critical role of pole mounted installations in grid edge applications. These alliances are fostering co-development of hybrid transformer systems that seamlessly integrate energy storage capabilities, underscoring the dynamic interplay between core manufacturing expertise and evolving energy market demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Pole Mounted Transformer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Anand Steemet India Private Limited

- Bharat Heavy Electricals Limited

- CCI Transformers Private Limited

- CG Power and Industrial Solutions Limited

- Daelim Industrial Co., Ltd.

- Eaton Corporation plc

- EVR Power Private Limited

- General Electric Company

- Gujarat Transformers Private Limited

- Hitachi Energy Ltd.

- Kirloskar Electric Company Limited

- Kotsons Private Limited

- Lamco Transformers Private Limited

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Servokon Systems Limited

- Siemens Energy AG

- Transformers and Rectifiers Limited

- Uttam Bharat Electricals Private Limited

Formulating Targeted Strategic Initiatives and Operational Recommendations to Empower Decision Makers in the Power Pole Mounted Transformer Sector

Industry leaders seeking to secure a competitive edge should prioritize the integration of smart sensor networks within transformer assets, enabling real-time monitoring and predictive analytics that substantially lower operational expenditures. Diversifying procurement strategies by establishing reciprocal agreements with multiple domestic and international suppliers will hedge against tariff volatility and strengthen supply chain continuity. Investing in material innovation, such as eco-friendly resin formulations and advanced core laminations, will not only satisfy tightening regulatory benchmarks but also enhance product differentiation in price-sensitive segments.

Engagement with policy makers and regulatory bodies is essential to anticipate future trade and environmental policies, allowing manufacturers to adapt product roadmaps proactively. Forming strategic alliances with renewable energy developers and energy storage integrators can unlock new markets in distributed generation and microgrid applications. Additionally, configuring flexible manufacturing lines capable of customizing capacity, voltage ratings, and cooling systems at scale will enhance responsiveness to evolving customer specifications and project requirements.

Finally, fostering a service-centric business model that includes condition-based maintenance contracts and digital performance guarantees will generate recurring revenue streams and deepen customer relationships. This approach leverages the growing demand for turnkey solutions, positioning organizations to move beyond commoditized supply into high-value advisory and support services.

Detailing Rigorous Hybrid Quantitative Qualitative Research Methodologies From Data Acquisition to Insight Validation for Transformer Market Analysis

This research leverages a hybrid methodology that synthesizes quantitative data analysis with qualitative expert insights. Primary data was gathered through structured interviews with utility executives, project developers, equipment distributors, and materials suppliers, ensuring a holistic understanding of end-user requirements and procurement dynamics. Concurrently, secondary sources such as publicly available regulatory filings, technical whitepapers, and patent databases were systematically reviewed to capture industry advancements and material innovations.

A rigorous segmentation framework was applied to categorize market data across application, capacity, voltage rating, cooling type, and insulation profiles. Data triangulation techniques validated findings by cross-referencing supplier shipment statistics, trade import-export records, and field performance reports from large-scale pilot deployments. Financial and operational metrics from leading public companies provided a benchmark for market sizing and competitive analysis, while scenario planning considered potential tariff and regulatory shifts.

All findings underwent a multi-stage validation process, including peer review by independent grid infrastructure consultants and workshops with in-field engineering teams. This ensures that the insights presented offer both strategic depth and practical applicability, enabling stakeholders to make informed decisions grounded in empirical evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Pole Mounted Transformer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Pole Mounted Transformer Market, by Application

- Power Pole Mounted Transformer Market, by Capacity

- Power Pole Mounted Transformer Market, by Voltage Rating

- Power Pole Mounted Transformer Market, by Cooling Type

- Power Pole Mounted Transformer Market, by Insulation Type

- Power Pole Mounted Transformer Market, by Region

- Power Pole Mounted Transformer Market, by Group

- Power Pole Mounted Transformer Market, by Country

- United States Power Pole Mounted Transformer Market

- China Power Pole Mounted Transformer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Critical Market Drivers Emerging Challenges and Future Outlook to Shape the Evolution of Power Pole Mounted Transformer Solutions

The power pole mounted transformer market stands at the intersection of robust infrastructure renewal, rapid technological advancement, and evolving regulatory paradigms. Key drivers such as the integration of distributed energy resources, the need for enhanced grid monitoring, and the urgency of carbon reduction have collectively redefined equipment specifications and procurement strategies. Moreover, emerging challenges-ranging from tariff-induced supply chain disruptions to heightened safety and environmental standards-are shaping the competitive landscape.

Segmentation analysis highlights the critical importance of targeting applications and configurations that align with specific end-user needs, whether in urban densification projects, rural electrification programs, or edge infrastructure supporting renewable microgrids. Regional dynamics further underscore the necessity of tailoring market approaches to distinctive regulatory frameworks, climatic conditions, and development priorities.

As the sector continues to evolve, stakeholders who embrace digitalization, invest in resilient supply chain structures, and foster cross-sector collaborations will be best positioned to capture new growth opportunities. The insights and recommendations provided herein serve as a strategic compass for companies seeking to navigate this dynamic environment and to capitalize on the transformative momentum propelling the power pole mounted transformer industry forward.

Take the Next Step Towards Informed Decisions by Engaging Ketan Rohom for Comprehensive Insights with the Full Market Research Report

To take full advantage of these critical market insights and ensure your organization is positioned at the forefront of strategic decision making, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to purchase the complete market research report. Engaging directly with Ketan will provide you with tailored guidance on how these data-driven findings apply to your specific challenges and opportunities. His expertise in translating complex analytics into actionable strategies will empower your team to accelerate growth, optimize investments, and navigate evolving regulatory and technological landscapes with confidence. Connect with him today to secure your copy of the comprehensive research and unlock the detailed intelligence that will underpin your next phase of expansion and innovation

- How big is the Power Pole Mounted Transformer Market?

- What is the Power Pole Mounted Transformer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?