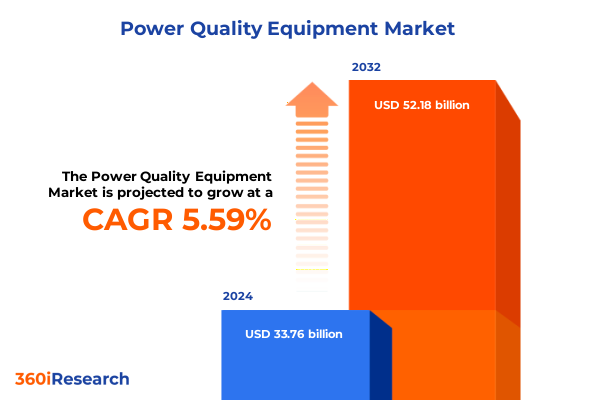

The Power Quality Equipment Market size was estimated at USD 35.57 billion in 2025 and expected to reach USD 37.51 billion in 2026, at a CAGR of 5.62% to reach USD 52.18 billion by 2032.

Introducing the Evolutionary Importance of Power Quality Equipment Amid Rising Reliability Expectations and Technological Advancements

As electrical infrastructures evolve to meet escalating demands for reliability and efficiency, the role of power quality equipment becomes ever more critical. Advances in renewable integration, electrification of transportation, and digitalization have placed unprecedented pressure on utilities and end users to maintain stable voltage levels, minimize harmonics, and ensure uninterrupted power delivery. Against this backdrop, stakeholders across the value chain are seeking both proven technologies and next-generation solutions that can adapt to variable grid conditions and support complex load profiles.

Rising awareness about the costs associated with power disturbances-ranging from equipment damage to unplanned downtime-has fueled investment in sophisticated monitoring, conditioning, and conversion devices. Decision makers are no longer content with reactive maintenance; they demand proactive strategies that leverage real-time analytics, intelligent controls, and scalable architectures. Consequently, the market is witnessing a paradigm shift from basic filtering and conversion toward integrated systems that deliver holistic visibility into power quality parameters and support predictive optimization.

In this context, our executive summary offers a concise yet comprehensive overview of the key dynamics shaping the power quality equipment landscape. We explore how regulatory changes, tariff measures, and shifting application requirements influence product adoption, identify the most significant segmentation insights, and highlight regional opportunities and competitive strategies. This distillation of complex data aims to empower executives, engineers, and procurement specialists with the strategic intelligence required to navigate a rapidly evolving market.

Highlighting Pivotal Technological and Regulatory Changes Driving the Transformation of the Power Quality Equipment Landscape

The power quality equipment market is undergoing transformative shifts driven by converging technological innovations and tightening regulatory frameworks. Digital equipment has rapidly gained ground over analog platforms, providing enhanced precision, remote diagnostics, and seamless integration with enterprise energy management systems. These digital solutions offer adaptive filtering algorithms, AI-driven anomaly detection, and cloud-based dashboards that transcend the limitations of traditional hardware-centric approaches.

Simultaneously, the proliferation of three-phase devices in commercial and industrial installations underscores the emphasis on high-capacity systems capable of addressing complex harmonic distortions. Advances in active power filters and smart meters facilitate dynamic compensation and granular data capture, enabling stakeholders to identify inefficiencies and implement corrective measures in near real time. At the same time, voltage and frequency conditioners tailored for sensitive applications-such as data centers and healthcare facilities-are evolving to deliver sub-microsecond response times and redundant backup capabilities.

Regulatory environments across key regions are also catalyzing innovation. Stricter enforcement of IEEE and IEC standards has heightened the demand for devices that comply with stringent total harmonic distortion thresholds and voltage regulation requirements. Furthermore, the integration of power quality considerations into sustainability mandates is prompting organizations to adopt solutions that support carbon reduction targets and resilience against grid disturbances. These combined forces of technology and regulation are reshaping the competitive landscape and creating new opportunities for disruptive entrants and established incumbents alike.

Analyzing How the 2025 United States Tariff Measures Have Reshaped Supply Chains and Cost Structures in Power Quality Equipment

The imposition of new tariff measures by the United States in early 2025 has had a pronounced cumulative impact on the power quality equipment supply chain and cost structures. Increased duties on imported converters and filters sourced from major manufacturing hubs in Asia have elevated input costs for OEMs, compelling many to reassess their procurement strategies. Those who previously relied heavily on low-cost analog components are now exploring near-shore or domestic suppliers of digital equipment to mitigate exposure to tariff volatility.

These tariffs have also accelerated conversations around vertical integration, as manufacturers seek to internalize production of critical semiconductors and control modules. Companies with established fabrication capabilities have leveraged this environment to capture market share by offering integrated solutions that bypass tariff burdens and ensure supply continuity. Conversely, smaller players dependent on outsourced manufacturing face margin compression and the challenge of passing costs onto end users without eroding demand.

On the end-user front, heightened equipment pricing has prompted an uptick in leasing and service-based models, enabling facilities to access advanced power quality management without incurring substantial capital expenditure. Service providers are bundling remote monitoring and maintenance contracts with equipment sales, positioning these offerings as total cost of ownership solutions that hedge against further tariff escalations. In aggregate, the 2025 tariff landscape has not only influenced pricing dynamics but also spawned innovative business models and strategic realignments across the value chain.

Uncovering Critical Segmentation Dynamics Across Product Types, Technologies, Phases, Applications, and Distribution Channels

A nuanced understanding of market segmentation reveals how diverse product types, technologies, phases, applications, and distribution channels each contribute unique dynamics to the overall landscape. When examining product categories, converters stand out with a bifurcation into AC-to-DC and DC-to-AC devices, each serving distinct industrial and renewable integration scenarios, while filters-subdivided into active and passive configurations-address harmonic mitigation across critical infrastructures. Meters and monitors, encompassing data loggers, power quality analyzers, and smart meters, provide tiered visibility from baseline logging to predictive analytics, and power conditioners-whether frequency or voltage-centric-offer specialized conditioning for sensitive loads.

Technology as a segmentation criterion delineates the market between analog systems, which retain a strong foothold in legacy installations, and digital equipment that drives advanced functionalities and connectivity. Similarly, phase considerations differentiate single-phase devices suited for residential and light commercial use from three-phase systems that underpin heavy industrial and utility scale deployments. Application areas span commercial environments, where space and energy management intersect; industrial settings with stringent uptime requirements; residential sectors focused on smart home integration; and utility applications demanding grid-wide stability.

Distribution channels further define go-to-market strategies, with direct sales teams fostering high-touch relationships for bespoke solutions, while distributors and suppliers broaden reach through standardized offerings and localized inventory. The interplay of these segmentation layers underscores why successful entrants must tailor their value propositions to specific use cases, balancing technological depth with channel expertise and regional compliance needs.

This comprehensive research report categorizes the Power Quality Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Phase

- Application

- Distribution Channel

Exploring Regional Variances and Opportunities in Power Quality Equipment Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the power quality equipment market reflect divergent regulatory drivers, infrastructure maturity, and investment priorities. In the Americas, utility modernization programs and renewable energy mandates have fueled demand for advanced converters and smart meters, while power conditioning solutions combat aging infrastructure in legacy grid territories. Commercial and industrial end users in North America are at the forefront of adopting digital monitoring platforms, leveraging federal incentives for grid resiliency and energy efficiency.

Across Europe, the Middle East, and Africa, stringent harmonics regulations and ambitious decarbonization goals have accelerated uptake of active power filters and frequency conditioners, particularly in mission-critical sectors such as data centers and petrochemicals. The Middle East’s oil and gas complexes invest heavily in voltage regulation hardware to protect sensitive drilling and processing equipment. In sub-Saharan Africa, distributed solar installations paired with DC-to-AC converters address electrification gaps, presenting growth avenues for both modular and integrated solutions.

In the Asia-Pacific region, rapid industrialization and urbanization drive robust demand for three-phase power quality equipment, with China and India leading in manufacturing and deployment volumes. Government incentives for smart grid rollouts catalyze smart meter installations, while Japan’s focus on resilience against natural disasters stimulates investment in redundant conditioning systems. Southeast Asia’s trajectory toward electrification of transportation and expansion of digital infrastructure offers fertile ground for next-generation power quality innovations.

This comprehensive research report examines key regions that drive the evolution of the Power Quality Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Approaches Shaping the Competitive Power Quality Equipment Market

Leading players in the power quality equipment space have adopted multifaceted strategies to secure competitive advantages and expand market reach. Several global conglomerates have prioritized R&D investments in digital control platforms, forging alliances with software providers to deliver end-to-end energy management ecosystems. Others have pursued acquisitions of niche filter and conditioning specialists to broaden their product portfolios and deepen technical expertise.

Strategic partnerships between OEMs and utilities or large industrial end users are increasingly common, enabling co-development of customized solutions that address specific harmonics profiles or voltage stability challenges. These collaborations often include pilot deployments and data exchange agreements, offering real-world performance insights that refine product roadmaps and accelerate time to market. Meanwhile, independent service organizations are capitalizing on the shift toward service-oriented models, bundling predictive maintenance contracts with advanced monitoring hardware.

Emerging regional champions in Asia-Pacific and the Middle East are leveraging local manufacturing capabilities and government incentives to undercut import-dependent competitors. By aligning product specifications with regional grid codes and offering accelerated delivery timelines, these players have captured significant share in nascent markets. In sum, the competitive landscape is characterized by a blend of organic innovation, strategic consolidation, and service-led differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Quality Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amtek, Inc.

- Bender GmbH & Co. KG

- Chauvin Arnoux S.A.

- Circutor, S.A.

- CyberPower Systems, Inc.

- Danfoss A/S

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Legrand SA

- LS Industrial Systems Co., Ltd.

- Mersen S.A.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Socomec SA

- Toshiba Corporation

Delivering Strategic Recommendations to Empower Industry Leaders in Navigating the Evolving Power Quality Equipment Sector

To thrive amid ongoing tariff pressures and technological disruption, industry leaders should adopt an agile sourcing strategy that blends domestic and near-shore manufacturing with selective global partnerships. Leveraging digital twins and advanced simulation tools will enable product teams to optimize converter and filter designs for both performance and cost efficiency. Concurrently, embedding AI-driven analytics within monitoring platforms can unlock predictive maintenance offerings that generate recurring revenue streams and strengthen customer loyalty.

Organizations must also refine their channel strategies by integrating direct sales expertise with distributor ecosystems to balance bespoke solution delivery and scalable reach. Investing in technical training programs for channel partners ensures consistent service quality and accelerates adoption of new digital equipment. From a customer engagement perspective, offering flexible procurement options-such as rental, leasing, or performance-based contracts-can alleviate capital barriers and position suppliers as trusted advisors rather than transactional vendors.

Finally, maintaining proactive engagement with standards bodies and regulatory agencies ensures that product roadmaps anticipate evolving compliance requirements. By participating in industry consortia and pilot initiatives, companies can influence harmonics and voltage regulation standards while securing early insight into forthcoming grid modernization policies. This forward-looking stance will be critical for translating emerging regulations into competitive product advantages.

Outlining the Rigorous Research Framework and Analytical Techniques Underpinning the Power Quality Equipment Market Evaluation

This research leverages a multi-tiered methodology combining primary and secondary data to ensure rigor and validity. An exhaustive review of technical standards from IEEE and IEC provided the foundational framework for understanding regulatory impacts. Secondary research encompassed proprietary databases, patent filings, company annual reports, and industry whitepapers to establish historical trends and technological trajectories.

Primary research included in-depth interviews with C-level executives, engineering directors, and procurement managers across utilities, industrial end users, and equipment manufacturers. Structured surveys supplemented these interviews, capturing quantitative insights on investment priorities, technology preferences, and service models. Regional workshops and focus groups were convened to validate findings and surface localized nuances across the Americas, EMEA, and Asia-Pacific.

Data triangulation techniques were employed to reconcile disparate sources, ensuring consistency between reported revenue breakdowns, segmentation dynamics, and growth drivers. Advanced analytical tools facilitated scenario modeling of tariff impacts and adoption curves for digital versus analog solutions. The synthesis of these methods underpins the robust conclusions and actionable recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Quality Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Quality Equipment Market, by Product Type

- Power Quality Equipment Market, by Technology

- Power Quality Equipment Market, by Phase

- Power Quality Equipment Market, by Application

- Power Quality Equipment Market, by Distribution Channel

- Power Quality Equipment Market, by Region

- Power Quality Equipment Market, by Group

- Power Quality Equipment Market, by Country

- United States Power Quality Equipment Market

- China Power Quality Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Insights to Provide a Clear Roadmap for Stakeholders in the Power Quality Equipment Domain

In reviewing the landscape of power quality equipment, it is evident that the convergence of tariff dynamics, technological innovation, and shifting end-user priorities is driving an era of rapid transformation. The delineation between analog legacy platforms and digital solutions has become a defining axis of competition, while three-phase devices and advanced conditioning systems are emerging as cornerstones in high-demand applications.

Segmentation analysis underscores that success hinges on the ability to tailor offerings to distinct product categories, technology preferences, phase requirements, application contexts, and channel capabilities. Regional variations further complicate this picture, with diverse regulatory environments and infrastructure maturity levels shaping localized demand patterns.

Ultimately, industry participants who adopt agile sourcing models, embed predictive analytics, and foster strategic partnerships with end users and regulatory bodies will be best positioned to capture growth and defend against market volatility. By internalizing the insights across this executive summary, stakeholders can chart a path forward that balances innovation, resilience, and customer-centric business models.

Partner with Ketan Rohom to Secure Comprehensive Market Intelligence and Propel Your Power Quality Equipment Strategies to Success

The depth of insight provided in this comprehensive market research report is designed to equip you with unparalleled clarity on emerging trends, cost drivers, and regulatory impacts shaping the power quality equipment sector. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, you gain direct access to consultative guidance on how to translate these findings into actionable strategies that drive operational efficiencies and competitive differentiation. Reach out to explore bespoke licensing options, enterprise packages, or tailored data modules that align with your organizational goals and accelerate ROI on intelligence-driven initiatives. Secure your copy of the report today to obtain the foresight needed to outpace market shifts, optimize procurement decisions, and safeguard your infrastructure investments in an era of evolving tariff landscapes and technological advancements.

- How big is the Power Quality Equipment Market?

- What is the Power Quality Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?