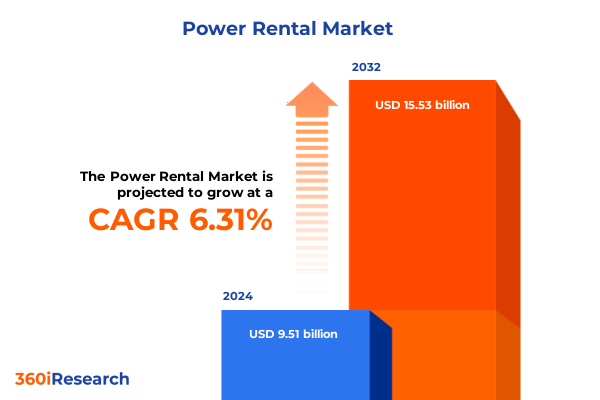

The Power Rental Market size was estimated at USD 10.03 billion in 2025 and expected to reach USD 10.59 billion in 2026, at a CAGR of 6.43% to reach USD 15.53 billion by 2032.

Exploring the Evolving Dynamics of the Power Rental Market to Frame the Context of Flexible Energy Supply Challenges and Opportunities

In recent years, the power rental market has become an indispensable pillar of resilience for businesses and communities facing an increasingly unreliable grid. Generator demand has surged in the wake of severe weather incidents such as hurricanes and wildfires, underscoring vulnerabilities in America’s aging electricity infrastructure. Leading equipment manufacturers and rental firms have expanded production capacity and service offerings to meet emergency needs, reflecting a broader shift toward contingency preparedness and operational continuity in critical sectors.

Parallel to this surge, the need for temporary power extends beyond disaster response into construction, data centers, and large-scale events. Major infrastructure projects continue to drive demand for high-capacity rental units, while digital transformation initiatives and the growth of cloud computing facilities place a premium on uninterrupted power supply. These converging factors have propelled the power rental industry into a strategic role, seamlessly integrating with broader energy management frameworks and shaping new service paradigms focused on flexibility, reliability, and holistic lifecycle support.

Key Transformative Shifts Reshaping the Temporary Power Rental Industry as Technological Innovation and Regulatory Pressures Converge

Convergence of decarbonization targets and grid reliability concerns has catalyzed a technological renaissance within the power rental sector. Rental fleets are increasingly adopting hybrid generators that blend traditional diesel engines with battery storage modules, enabling lower emissions and improved fuel efficiency. This shift is accelerated by corporate sustainability commitments and regulatory pressures aimed at reducing the carbon footprint of temporary power solutions.

The integration of digital platforms and Internet of Things (IoT) capabilities has redefined service delivery and asset management. Remote monitoring, predictive maintenance algorithms, and data-driven dispatching optimize equipment utilization and minimize downtime. These smart systems not only improve operational efficiency but also unlock new service offerings such as power-as-a-service models, where consumption-based pricing aligns directly with customer usage patterns. As digital innovation matures, industry participants will need to recalibrate skill sets, invest in cybersecurity measures, and foster partnerships that bridge traditional rental operations with emerging energy technology ecosystems.

Analyzing the Cumulative Impact of United States Tariff Policies in 2025 on Power Rental Equipment Costs Supply Chains and Deployment Trends

In 2025, the implementation of updated Section 301 tariffs and expanded safeguard measures has had a profound ripple effect across the power rental supply chain. Critical components such as solar cells, lithium-ion batteries, and power converters imported from China now face tariffs up to 50 percent, while semiconductors essential to generator control systems carry duties as high as 50 percent beginning this year. These elevated import taxes have significantly increased capital expenditures for rental operators, compelling them to accelerate cost-pass through mechanisms and renegotiate supplier agreements.

The repercussions extend beyond immediate cost inflation. Prolonged lead times for battery storage systems and control electronics have disrupted fleet modernization programs, delaying the deployment of next-generation low-emission generators. According to recent analysis, tariffs could drive battery energy storage project costs up by more than 50 percent, a trend that directly affects rental pricing structures and asset replacement cycles. Moving forward, rental providers must navigate complex trade compliance frameworks, diversify sourcing to alternative manufacturing hubs, and enhance domestic repair and remanufacturing capabilities to mitigate supply-chain vulnerability.

Unveiling Critical Segmentation Insights to Understand Diverse Equipment Types End Users Fuel Preferences Rental Durations and Delivery Preferences

Equipment type segmentation reveals distinct adoption curves across generator, lighting, UPS, and battery storage portfolios. Generators remain the backbone for many end-use scenarios, but the highest growth trajectory belongs to battery storage systems, driven by stakeholder demand for quieter, emissions-free solutions in urban and noise-sensitive environments. Lighting towers maintain steady utilization in construction and events, while UPS systems see rising uptake in data centers and critical infrastructure that cannot tolerate even momentary power interruptions.

End-user segmentation highlights construction, manufacturing, mining, and oil & gas sectors as core pillars of rental demand. Construction projects leverage a mix of generators and hybrid units to comply with environmental regulations and minimize site emissions. The oil & gas industry, particularly upstream and midstream operations, relies heavily on rental power for remote drilling and pipeline pumping, with downstream refining and processing facilities also tapping into rental fleets for maintenance and contingency planning. Industrial manufacturing continues to adopt UPS and generators to uphold production uptime and protect sensitive equipment from voltage disturbances.

Fuel type preferences underscore diesel’s resilience due to high reliability, but hybrid systems combining gas engines and battery modules are gaining traction in markets prioritizing cost efficiency and sustainability. Solar-augmented rental systems have begun to penetrate regions with high solar irradiance, offering a cost-effective supplement to conventional fuel-based generators. Rental durations vary from hourly and daily contracts for short-term events to weekly and monthly agreements for longer construction or emergency response engagements. Finally, delivery mode considerations-whether offsite staging or onsite full integration-are shaping pricing and logistics strategies, with on-demand last-mile deployment emerging as a key differentiator for time-sensitive applications.

This comprehensive research report categorizes the Power Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Fuel Type

- Rental Duration

- Delivery Mode

- End User

Highlighting Key Regional Dynamics in the Power Rental Market across the Americas Europe Middle East Africa and Asia Pacific Zones

Within the Americas, the United States and Canada stand out as the largest and most mature power rental markets, characterized by robust rental fleets, advanced service networks, and stringent environmental and safety regulations. Demand spikes during hurricane and wildfire seasons underscore the importance of scalable rental capacity, while infrastructure investment programs continue to fuel growth in construction-driven power needs.

In the Europe, Middle East & Africa region, regulatory frameworks targeting carbon emissions are driving a transition toward cleaner rental solutions. Hybrid and solar-supplemented generators are gaining traction, particularly in Western Europe, where noise and emissions standards limit diesel generator deployment. Middle Eastern oil & gas operations depend on rental power for remote and offshore installations, with Africa’s mining and resource extraction sectors similarly reliant on rental fleets to bridge gaps in grid coverage.

The Asia-Pacific region presents a mosaic of growth drivers, ranging from rapid urbanization and infrastructure build-outs in Southeast Asia to resource-intensive mining operations in Australia. China and India are expanding domestic manufacturing of generators and energy storage units, boosting local rental availability. Meanwhile, advanced markets such as Japan and South Korea are early adopters of digital service platforms and low-emission rental assets, reflecting a broader regional push toward sustainability and digitalization.

This comprehensive research report examines key regions that drive the evolution of the Power Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading and Emerging Power Rental Companies Shaping Industry Innovation Operational Excellence and Competitive Differentiation Strategies

The competitive landscape is anchored by global leaders such as Aggreko, Atlas Copco, and United Rentals, whose scale and geographical reach allow for rapid deployment and diversified equipment portfolios. These incumbents are investing in digital platforms, predictive maintenance capabilities, and hybrid asset programs to maintain differentiation and client loyalty.

Specialized regional players, including Herc Rentals and Ashtead Group, leverage deep local market knowledge to deliver tailored service models and niche equipment offerings. Their agility in structuring flexible rental packages, combined with strategic partnerships with original equipment manufacturers, positions them to capture mid-market and project-level demand segments.

New entrants and technology disruptors are targeting specific verticals with power-as-a-service models, emphasizing subscription-based pricing and integrated energy management solutions. By bundling analytics, remote monitoring, and turnkey maintenance, these innovators challenge traditional rental paradigms and compel established firms to accelerate service enhancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aggreko plc

- APR Energy Limited

- Ashtead Group plc

- Atlas Copco AB

- Caterpillar Inc.

- Cummins Inc.

- Kirloskar Electric Company Limited

- Rolls-Royce Power Systems AG

- SDMO Industries SAS

- United Rentals, Inc.

- Wärtsilä Corporation

- Wärtsilä Corporation

Actionable Strategic Recommendations for Power Rental Industry Leaders to Capitalize on Emerging Opportunities Mitigate Risks and Drive Sustainable Growth

Industry leaders should prioritize the modernization of rental fleets by accelerating the adoption of hybrid and battery-integrated solutions. Investing in retrofitting capabilities and supplier alliances will reduce exposure to fluctuating fuel costs and tightening emissions regulations.

Building robust digital ecosystems is essential. Companies must deploy advanced telematics, predictive analytics, and customer-facing portals to streamline maintenance, enhance transparency, and enable real-time utilization insights. Collaborating with technology partners on cybersecurity and data management frameworks will safeguard operational integrity.

Strategic expansion into underserved regions and verticals can unlock new growth corridors. Targeting high-growth sectors such as data center support, remote industrial projects, and emerging markets in Latin America and Southeast Asia will diversify revenue streams and mitigate concentrated risk.

Finally, embedding sustainability into core business strategies-through carbon offset initiatives, green fleet commitments, and transparent ESG reporting-will reinforce brand reputation and align with the evolving priorities of institutional and corporate customers.

Outlining Robust Research Methodologies Data Collection Techniques and Analytical Frameworks Underpinning the Comprehensive Power Rental Market Study

This study integrates primary interviews with senior executives at equipment manufacturers, rental operators, and end-user organizations, complemented by secondary research from industry publications, regulatory filings, and trade associations. A rigorous triangulation methodology ensures the validation of qualitative insights and quantitative data.

Market sizing and trend analysis leverage historical data from national energy agencies and independent research bodies, which are cross-referenced with proprietary rental fleet deployment records. Segmentation assessments apply a bottom-up approach, aggregating unit-level usage patterns and contract durations across equipment types, end users, fuel categories, and delivery modes.

Analytical frameworks such as Porter’s Five Forces and scenario planning models underpin competitive and risk analyses, while sensitivity testing quantifies the impact of key variables such as tariff fluctuations and regulatory shifts. Regional insights draw upon in-market surveys and case studies, allowing for granular assessment of local dynamics and market entry considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Rental Market, by Equipment Type

- Power Rental Market, by Fuel Type

- Power Rental Market, by Rental Duration

- Power Rental Market, by Delivery Mode

- Power Rental Market, by End User

- Power Rental Market, by Region

- Power Rental Market, by Group

- Power Rental Market, by Country

- United States Power Rental Market

- China Power Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on Power Rental Market Trends Strategic Imperatives and Forward Looking Considerations for Industry Stakeholders

The temporary power rental industry stands at a critical juncture, influenced by technological innovation, sustainability mandates, and evolving customer expectations. Companies that embrace hybridization, digitalization, and regional diversification will be best positioned to navigate tariff headwinds and supply-chain complexities.

Consolidation among major players may accelerate, driven by the need for scale economies and broader service capabilities. Meanwhile, smaller operators and technology disruptors will continue to carve out niche positions through specialized offerings and agile service delivery.

Ultimately, the ability to anticipate regulatory changes, adapt to shifting fuel landscapes, and deliver end-to-end solutions will determine market leadership. By aligning strategic initiatives with emerging market imperatives, industry stakeholders can forge resilient pathways to growth and secure competitive advantage in the dynamic power rental environment.

Immediate Invitation to Engage with Associate Director Sales Marketing to Secure Your Copy of the Power Rental Market Research Report Today

To acquire the full power rental market research report and unlock comprehensive strategic insights tailored to your organization’s goals, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in market dynamics and client needs ensures a smooth process to secure the report, clarify any questions, and explore customized packages or data add-ons. Contact him today to elevate your decision-making with detailed analysis, actionable intelligence, and expert guidance tailored for leadership teams seeking to capitalize on evolving power rental opportunities.

- How big is the Power Rental Market?

- What is the Power Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?