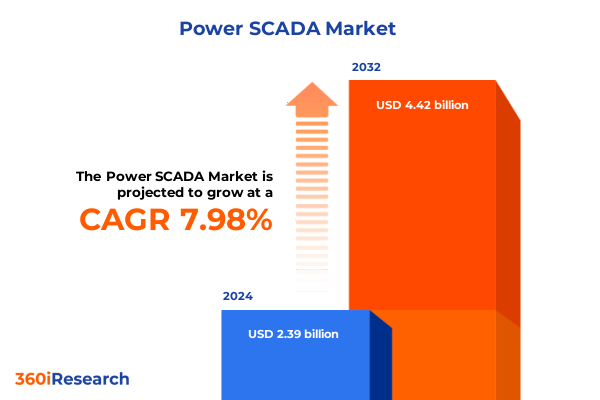

The Power SCADA Market size was estimated at USD 2.58 billion in 2025 and expected to reach USD 2.78 billion in 2026, at a CAGR of 8.00% to reach USD 4.42 billion by 2032.

Unveiling the Role of Advanced Power SCADA Frameworks in Enhancing Operational Resilience, Reliability, and Digital Transformation Across the Energy Sector

Modern power systems are evolving at an unprecedented pace, driven by the twin imperatives of digital innovation and heightened reliability demands. At the heart of this transformation lies advanced Power SCADA, an integrated control framework that spans hardware sensors, intelligent software, and robust services to monitor and regulate energy networks in real time. By unifying asset management, communication protocols, and human-machine interfacing under a single operational umbrella, Power SCADA platforms empower utilities and industrial operators to anticipate faults, optimize performance, and comply with rigorous regulatory standards.

This report opens with a comprehensive exploration of how Power SCADA underpins grid modernization, enabling distributed energy resources and renewables integration at scale. It details the convergence of legacy supervisory systems with cloud-enabled analytics and edge computing architectures, illustrating how organizations can transition from reactive operations to predictive maintenance. Emphasizing resilience, the introduction also addresses cybersecurity imperatives, highlighting best practices for safeguarding mission-critical infrastructure against emerging threats. With an authoritative overview, readers will gain clarity on the technological enablers and organizational prerequisites necessary for harnessing the full spectrum of Power SCADA capabilities

Examining the Paradigm Shift Toward Intelligent Automation, Edge Computing, and Decentralized Control in Next-Generation Power SCADA Infrastructures

The landscape of Power SCADA is undergoing a paradigm shift fueled by advancements in intelligent automation, edge computing, and decentralized control architectures. Historically, SCADA systems relied on monolithic designs that centralized data processing at control centers. Today, the proliferation of IIoT-enabled devices and interoperable communication software has ushered in an era in which critical decision-making can occur at substations and field nodes, reducing latency and bolstering grid reliability.

As edge analytics assume a more prominent role, organizations are migrating portions of their supervisory functions closer to physical assets. This shift minimizes bandwidth dependencies and enhances system responsiveness, particularly during contingencies. Concurrently, digital twin models of power systems enable stakeholders to simulate operational scenarios with high fidelity, supporting proactive asset management. The integration of open communication standards, such as IEC 61850, further accelerates interoperability among diverse vendor solutions.

Together, these transformative shifts are redefining the boundaries of SCADA excellence, enabling dynamic load balancing, real-time voltage regulation, and sophisticated feeder automation. By embracing decentralized intelligence and cloud-native platforms, utilities and industrial users can achieve unprecedented levels of operational agility, scalability, and security in their power management endeavors

Assessing the Cumulative Impact of 2025 United States Tariffs on Manufacturing Costs, Supply Chain Dynamics, and Technology Deployment in Power SCADA

United States tariff policies have exerted a compound influence on Power SCADA supply chains, affecting import costs, component availability, and vendor strategies. Over the past several years, Section 301 levies on critical electronic and semiconductor imports have driven hardware suppliers to recalibrate their manufacturing footprints. In response, many vendors have diversified sourcing to Southeast Asian and European facilities, mitigating tariff risk while maintaining quality standards.

At the same time, steel and aluminum duties have escalated structural costs for rack enclosures, actuator assemblies, and mounting hardware. These increases, though incremental on a per-unit basis, have translated to higher total cost of ownership for large-scale substation modernization programs. Software providers have indirectly felt the impact through reduced discretionary budgets among end users, prompting more flexible licensing arrangements and heightened demand for cloud-based SCADA-as-a-Service models.

Despite these headwinds, tariff-driven realignments have accelerated onshore integration services and support offerings. By localizing integration, consulting, and maintenance capacities, the industry has strengthened its domestic service ecosystem, enabling faster deployment cycles and improved compliance with Buy America provisions. Ultimately, the cumulative effect of tariff measures in 2025 underscores the strategic importance of supply chain resilience, diversified sourcing, and scalable service architectures in sustaining Power SCADA innovation

Uncovering Critical Segmentation Insights to Support Strategic Decision Making in Power SCADA through Component, Application, End User, Deployment, and Communication Technology Analysis

A nuanced segmentation framework reveals the multifaceted nature of Power SCADA market dynamics, encompassing component types, application scenarios, end-user segments, deployment modalities, and communication technologies. When examining the component landscape, hardware elements such as actuators, programmable logic controllers, remote terminal units, and sensors form the physical foundation for field data acquisition and control. Software modules, including asset management suites, communication middleware, human-machine interfaces, and dedicated SCADA platforms, orchestrate real-time analytics and supervisory commands. Complementing these are essential services-consulting, system integration, and ongoing support and maintenance-that guide successful deployment and lifecycle management.

Application-based segmentation highlights distinct operations across distribution, generation, and transmission domains. Distribution networks leverage feeder automation and volt-var optimization to manage load fluctuations and power quality. Generation facilities deploy SCADA across hydro, nuclear, thermal, and renewable plants, with solar and wind farms increasingly requiring specialized monitoring capabilities. Transmission corridors benefit from high-voltage monitoring systems and substation automation to ensure grid stability over expansive distances.

From an end-user perspective, manufacturing sectors-ranging from automotive assembly lines to food and beverage processing and pharmaceutical production-utilize Power SCADA to synchronize energy consumption with production schedules. Oil and gas operators employ supervisory systems for pipeline monitoring and safety management, while transportation entities, including airport operations, rail networks, and shipping terminals, rely on SCADA to optimize power distribution. Utilities, spanning electric, gas, and water and wastewater services, represent the backbone segment with the most extensive supervisory requirements.

Deployment modalities further differentiate market opportunities, as cloud-based SCADA solutions-available in hybrid, private, and public configurations-offer rapid scalability and reduced capital expenditure. Conversely, on-premises architectures continue to serve customers with stringent data sovereignty or latency demands. Finally, communication technology underpins system responsiveness: wired networks use Ethernet, fiber-optic links, and serial protocols for high-bandwidth, deterministic performance, whereas wireless options-cellular, radio frequency, and satellite-enable connectivity in remote or mobile environments

This comprehensive research report categorizes the Power SCADA market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Communication Technology

- Application

- End User

- Deployment

Revealing Regional Dynamics Shaping Power SCADA Adoption and Innovation across Americas, Europe Middle East & Africa, and Asia-Pacific Energy Markets

Regional dynamics exert a profound influence on Power SCADA adoption, shaped by regulatory environments, infrastructure maturity, and investment priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, grid modernization initiatives in North America focus on integrating renewable energy and enhancing system resilience against extreme weather events. South American markets are accelerating rural electrification and demand-side management projects, driving interest in scalable SCADA solutions tailored to emerging utilities.

Across Europe, Middle East & Africa, stringent regulatory frameworks and ambitious decarbonization targets are catalyzing SCADA-driven asset optimization. Western European utilities prioritize legacy system upgrades, cybersecurity hardening, and digital twin deployments. Meanwhile, in the Gulf Cooperation Council countries, rapid infrastructure expansion and smart city programs are sparking demand for turnkey supervisory systems. In Sub-Saharan Africa, electrification agendas underscore the need for cost-effective, modular SCADA architectures that can accommodate off-grid and microgrid installations.

Asia-Pacific presents a dichotomy of mature markets and high-growth economies. In Australia and Japan, advanced SCADA deployments focus on interconnector management and renewable integration, bolstered by robust telecom infrastructures. Emerging markets in Southeast Asia and South Asia pursue large-scale generation and transmission projects, often collaborating with international technology partners to expedite digitalization. Across the region, communication networks are being enhanced to support remote monitoring and predictive maintenance, reflecting a shared commitment to operational excellence and grid resilience

This comprehensive research report examines key regions that drive the evolution of the Power SCADA market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Power SCADA Providers and Their Strategic Initiatives Driving Innovation, Collaboration, and Competitive Advantage in the Global Market

Key players in the Power SCADA domain are driving innovation through strategic partnerships, product diversification, and expanded service portfolios. Global automation leaders have introduced modular SCADA platforms that integrate edge intelligence, enabling seamless interoperability with IIoT devices and third-party analytics tools. These providers continue to invest in cybersecurity modules, embedding advanced threat detection and anomaly analytics directly into supervisory software to protect critical infrastructure.

Simultaneously, specialist software firms are enhancing user experiences through intuitive human-machine interface designs and augmented reality overlays for field technician guidance. On the hardware front, manufacturers are optimizing sensor accuracy and reliability, developing self-diagnostic RTUs and PLCs to reduce maintenance cycles. Service organizations are expanding their consulting capabilities, offering outcome-based contracts that align vendor incentives with operational performance metrics.

Moreover, collaboration between telecommunications operators and technology vendors has yielded integrated communication solutions, combining private cellular networks with SCADA protocols to deliver resilient connectivity. These strategic moves are reinforcing competitive positioning and unlocking new revenue streams across maintenance, analytics-as-a-service, and training offerings. As the market matures, the interplay of these corporate strategies will define the pace of digital transformation and the evolution of ecosystem partnerships

This comprehensive research report delivers an in-depth overview of the principal market players in the Power SCADA market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Advantech Co., Ltd.

- Belden Inc.

- Cisco Systems, Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi Energy Ltd

- Hitachi, Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Toshiba Corporation

- Valmet Automation

- Yokogawa Electric Corporation

Delivering Actionable Strategic Recommendations for Industry Leaders to Accelerate Digital Transformation, Enhance Cybersecurity, and Drive Operational Excellence in Power SCADA

Industry leaders seeking to capitalize on emerging Power SCADA trends should prioritize a holistic digital transformation roadmap that balances technology investments with organizational readiness. They must first conduct comprehensive cybersecurity assessments to identify vulnerabilities in control networks and implement zero-trust architectures that segment critical assets. Parallel to this, companies should adopt edge computing frameworks that decentralize processing, reducing latency and enabling real-time analytics at field locations.

Next, fostering interoperability through open standards will ensure seamless integration of legacy equipment with next-generation SCADA platforms. Undertaking pilot projects that leverage digital twins can validate performance improvements before full-scale rollouts, mitigating risk and demonstrating return on investment. Furthermore, investing in workforce development-through targeted training programs and augmented reality field tools-will enhance operational proficiency and minimize downtime.

To address supply chain uncertainties, organizations should establish strategic sourcing partnerships and cultivate local service ecosystems capable of rapid deployment and maintenance. Embracing cloud-native SCADA-as-a-Service offerings can provide scalability and flexible cost models, but must be balanced with on-premises deployments where data sovereignty and latency constraints exist. By executing these actionable recommendations in an integrated manner, industry leaders can drive sustainable growth, reinforce grid resilience, and maintain a competitive edge in an increasingly digitalized energy landscape

Overview of Rigorous Mixed-Methods Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Validation Processes for Comprehensive Power SCADA Insights

This study combines qualitative and quantitative research methodologies to deliver an authoritative view of the Power SCADA market. Initially, extensive secondary research was conducted, including analysis of industry journals, regulatory filings, and publicly available corporate disclosures, to establish a foundational understanding of technology trends and regulatory impacts. Publicly reported tariff schedules and trade data were examined to gauge the cumulative influence of U.S. levy measures on hardware costs and supply chain resilience.

Complementing the secondary phase, primary research involved structured interviews with senior executives, control system engineers, and cybersecurity specialists across utilities, manufacturing, and infrastructure operators. These conversations provided deep insights into deployment challenges, integration best practices, and future technology priorities. Data triangulation techniques were applied to reconcile divergent viewpoints, while scenario modeling was employed to simulate tariff-driven supply chain adjustments.

Throughout the research process, rigorous validation workshops were held with domain experts to ensure both the accuracy of findings and their applicability to strategic decision-making. All data points were cross-verified against multiple sources, and any discrepancies were resolved through follow-up inquiries. The resulting methodological framework ensures that this report delivers reliable, actionable insights and a comprehensive perspective on the evolving Power SCADA ecosystem

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power SCADA market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power SCADA Market, by Component

- Power SCADA Market, by Communication Technology

- Power SCADA Market, by Application

- Power SCADA Market, by End User

- Power SCADA Market, by Deployment

- Power SCADA Market, by Region

- Power SCADA Market, by Group

- Power SCADA Market, by Country

- United States Power SCADA Market

- China Power SCADA Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Inform Stakeholder Strategies and Future Developments in Power SCADA Ecosystems

The findings presented in this report underscore the transformative potential of advanced Power SCADA systems in shaping the future of energy and industrial utility management. As decentralized intelligence becomes more prevalent and tariff-driven supply chain realignments continue to influence cost structures, organizations must adopt integrated strategies that harmonize technology, processes, and people. The convergence of hardware innovation, cloud-native software, and specialized services will define competitive differentiation in the years ahead.

Grid operators and industrial users alike need to leverage digital twins, edge analytics, and interoperable communication frameworks to drive predictive maintenance and operational efficiency. Regional adoption patterns reveal distinct regulatory and infrastructure priorities, necessitating tailored approaches for the Americas, Europe Middle East & Africa, and Asia-Pacific markets. Furthermore, leading vendors are setting the innovation agenda through strategic partnerships, cybersecurity enhancements, and outcome-based service models.

By synthesizing these insights, stakeholders can chart a clear path toward enhanced reliability, resilience, and sustainability. The recommendations outlined herein offer a strategic blueprint to navigate emerging challenges and harness opportunities in the Power SCADA landscape. With a solid methodological foundation and a forward-looking perspective, this report equips decision-makers to lead their organizations confidently into a digitally empowered energy future

Engage Ketan Rohom to Access the Comprehensive Power SCADA Market Research Report for Detailed Insights, Strategic Guidance, and Customized Solutions

Engaging directly with Ketan Rohom is the first step toward unlocking the full potential of this Power SCADA market research report and translating rich insights into strategic action. Ketan’s deep expertise in sales and marketing within the energy technology sector ensures a tailored consultative process that aligns with your organization’s unique challenges and growth objectives. By partnering with Ketan, you gain access to an in-depth understanding of emerging trends, competitive benchmarks, and regulatory dynamics, all synthesized into actionable strategies that drive operational excellence and digital innovation.

During an introductory call, Ketan will guide you through the report’s most critical findings, highlighting bespoke opportunities to optimize your technology investments and fortify your cybersecurity posture. He will collaborate with your leadership team to develop a bespoke roadmap that integrates advanced SCADA architectures, cloud-native deployment models, and next-generation analytics. Through this engagement, you will benefit from ongoing support, including periodic updates on tariff shifts, regional policy changes, and vendor performance metrics.

Contacting Ketan Rohom ensures that you are not only informed but also empowered to implement immediate improvements across your power SCADA landscape. His collaborative approach extends beyond report delivery, offering workshops and executive briefings to cement your competitive advantage. Seize this opportunity today to partner with an expert who can convert complex market data into decisive, revenue-generating actions that elevate your operational resilience and strategic foresight

- How big is the Power SCADA Market?

- What is the Power SCADA Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?