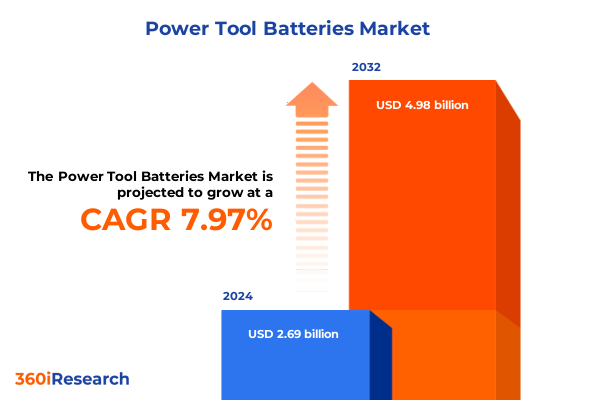

The Power Tool Batteries Market size was estimated at USD 2.89 billion in 2025 and expected to reach USD 3.11 billion in 2026, at a CAGR of 8.06% to reach USD 4.98 billion by 2032.

Navigating Rapid Innovation and Growing Demand in Power Tool Batteries Amidst Evolving Industry Dynamics and Sustainability Imperatives

The power tool battery landscape is undergoing a seismic transformation driven by relentless innovation and evolving end-user expectations. As industries shift toward greater mobility, cordless solutions have supplanted corded tools across residential, professional, and industrial applications. This shift is underpinned by advances in battery chemistry and energy density, which enable lighter, more powerful, and longer-lasting battery packs. Cordless power tools now routinely deliver comparable performance to their corded predecessors, unlocking new possibilities for job site productivity and user convenience.

Simultaneously, sustainability has become a core criterion for both manufacturers and consumers. Stricter environmental regulations and heightened awareness around lifecycle impacts are prompting technology shifts away from legacy chemistries toward more environmentally benign alternatives. The convergence of these forces-technological progress, user demand for flexibility, and environmental imperatives-has elevated power tool batteries to a pivotal role in the modern tools ecosystem. In this context, understanding the interplay between innovation, market drivers, and regulatory pressures is essential for stakeholders aiming to navigate, compete, and thrive.

How Advancements in Chemistry, Technology, and Business Models Are Reshaping the Competitive Landscape for Power Tool Battery Solutions

Breakthroughs in battery chemistry and system design are fundamentally reshaping competitive dynamics within the power tool battery sector. Lithium-ion technology, with its superior energy-to-weight ratio and absence of memory effect, has disrupted traditional nickel-based variants, catalyzing a rapid decline in nickel-cadmium and nickel-metal hydride adoption across professional tool lines. Furthermore, next-generation formulations-such as lithium iron phosphate (LFP) and silicon-anode materials-are gaining traction for their enhanced safety profiles and potential for extended cycle life.

Beyond chemistry, integration of intelligent battery management systems (BMS) and digital connectivity is transforming product offerings. Smart batteries capable of real-time state-of-charge diagnostics and predictive maintenance alerts are becoming standard in premium tool lines, reinforcing brand differentiation and fostering recurring service models. Partnerships between tool OEMs and battery specialists are proliferating, enabling co-engineered solutions that optimize performance metrics such as charge rate, thermal stability, and operational runtime. These collaborative ventures and technological leaps are elevating battery systems from simple power sources to strategic assets in the competitive arena.

Assessing the Far-Reaching Consequences of 2025 U.S. Trade Measures on Imported Power Tool Battery Components and Supply Chains

The cumulative impact of recent U.S. trade measures is exerting substantial upward pressure on the cost of imported power tool battery components. In September 2024, Section 301 tariffs on battery parts (non-lithium-ion) rose to 25%, while lithium-ion electric vehicle battery imports were also subject to a 25% duty-all under the same enforcement framework designed to address perceived unfair trade practices. In parallel, a broader 10% baseline tariff on all U.S. imports took effect in April 2025, further raising input prices for battery pack assemblies and raw cell imports. Notably, automotive part tariffs introduced in May 2025 under Section 232 included lithium-ion battery components among nearly 150 product categories, imposing an additional 25% levy on these critical inputs.

Moreover, new tariffs on Canadian and Mexican imports, effective March 4 2025, instituted a uniform 25% duty on most goods-excluding energy products-disrupting established North American supply chains and compelling OEMs to reassess sourcing strategies from border-adjacent facilities. Collectively, these trade measures are driving tool manufacturers to explore alternative procurement regions, accelerate domestic cell production initiatives, and pursue tariff exclusion requests. Yet, the ongoing tariff environment remains a significant headwind, with elevated landed costs filtering through to end-users and intensifying competition among industry players vying to secure low-cost, compliant battery supplies.

Decoding Market Dynamics Through Chemistry, Voltage, Application, End User, and Distribution Channel Segmentation in Power Tool Batteries

Insight into market segmentation reveals the multifaceted drivers behind power tool battery demand and guides targeted strategies. In terms of battery chemistry, lithium-ion predominates high-performance segments, prized for its high energy density and long lifecycle, while nickel-cadmium retains a niche in rugged industrial settings where robust performance in extreme temperatures remains critical; nickel-metal hydride maintains relevance in cost-sensitive consumer applications that value moderate capacity with reduced environmental concerns. Voltage segmentation further refines strategic focus: sub-12-volt platforms serve light-duty DIY tools with compact design requirements, 12-to-24-volt systems balance power and portability for professional prosumers, and high-voltage architectures exceeding 24 volts underpin industrial-grade tools demanding continuous high-power output.

When considering application, specialized batteries for cutting demand high discharge rates to sustain blade speed, whereas drilling and fastening require a blend of torque surge capacity and thermal management to withstand repetitive impacts. Grinding and polishing prioritize battery packs with consistent throughput for extended periods, while measuring and testing instruments depend on predictable self-discharge characteristics to guarantee accuracy. Welding and soldering operations leverage battery cells engineered for precise current control and thermal resilience. Discerning end-user segments underscores further nuance: automotive workshops look for batteries optimized for torque wrenches and ratchets, construction sites demand rugged batteries capable of enduring harsh environments, industrial facilities seek efficiency gains through standardized battery ecosystems, and residential consumers focus on user-friendly designs at accessible price points. Finally, distribution channels bifurcate between traditional offline retailers-valued by professionals for immediate availability and technical support-and burgeoning online platforms, which captivate DIY audiences with extensive product portfolios and competitive pricing.

This comprehensive research report categorizes the Power Tool Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemistry

- Voltage

- Application

- End User

- Distribution Channel

Unveiling Regional Demand Drivers and Growth Patterns Across Americas, EMEA, and Asia-Pacific Power Tool Battery Markets

Regional dynamics significantly shape the contours of power tool battery adoption and competitive intensity. In the Americas, the United States leads through robust DIY culture, mature professional trades, and accelerating electrification in construction and automotive sectors; Canada’s construction investment and Mexico’s evolving manufacturing hubs further boost regional demand. Across EMEA, stringent environmental directives, notably the European Union’s RoHS regulations, drive the transition away from legacy chemistries toward lithium-ion and LFP, while Middle Eastern infrastructure projects and African urbanization trends present emerging growth corridors for mid- and high-voltage battery platforms. Asia-Pacific stands out as the fastest-growing region, underpinned by rapid urbanization in China and India, expansive manufacturing capacity across Southeast Asia, and technologically advanced markets in Japan and South Korea, where innovation in solid-state and silicon-anode batteries is actively pursued.

Underlying these regional patterns, infrastructure investments, legislative frameworks, and local manufacturing policies converge to influence cost structures, supply chain resilience, and the pace of technology adoption. Stakeholders that align their go-to-market strategies with regional imperatives-such as incentivized domestic production in the U.S. or export-oriented battery manufacturing clusters in the Asia-Pacific-are best positioned to capture unparalleled growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Power Tool Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Portfolio Developments of Leading Manufacturers and OEMs in the Power Tool Battery Sector

Leading companies in the power tool battery landscape are executing distinct strategic initiatives to secure competitive advantage. LG Energy Solution, as the sole U.S. supplier of LFP-based energy storage products, is expanding its Michigan plant capacity and pivoting some EV battery lines toward energy storage module production to offset anticipated declines in EV demand driven by tariffs and subsidy changes. Meanwhile, established tool OEMs such as Bosch and Makita continuously broaden their lithium-ion platforms, integrating smart battery management features and modular designs to reinforce brand lock-in among professional users.

Incentivized by U.S. federal support, companies like Albemarle, Honeywell, Dow, and Clarios have secured portions of a $3 billion grant program aimed at bolstering domestic battery materials and component production, positioning them as pivotal suppliers for reshoring initiatives. Concurrently, conglomerates including Stanley Black & Decker and Techtronic Industries are forging joint ventures with cell manufacturers to safeguard supply continuity, accelerate R&D in next-generation chemistries, and streamline integration within their cordless tool ecosystems. These moves reflect a broader industry shift toward vertical integration, alliance-based innovation, and strategic use of government incentives to mitigate geopolitical and tariff-related uncertainties.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Tool Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Chervon Holdings Limited

- Contemporary Amperex Technology Co. Limited

- Emerson Electric Co.

- Festool GmbH & Co. KG

- Hilti Aktiengesellschaft

- Koki Holdings Co., Ltd.

- LG Chem Ltd.

- Makita Corporation

- Metabowerke GmbH

- Panasonic Corporation

- Robert Bosch GmbH

- SAMSUNG SDI CO.,LTD.

- Sony Group Corporation

- Stanley Black & Decker, Inc.

- Techtronic Industries Co. Ltd.

Strategic Recommendations for Industry Leaders to Enhance Resilience, Drive Innovation, and Capitalize on Emerging Opportunities in Power Tool Batteries

To thrive amid ongoing trade challenges and intensifying technological disruption, industry leaders should pursue a multifaceted strategy. First, diversifying the supply chain by establishing partnerships across multiple geographies and investing in domestic cell manufacturing can reduce exposure to tariffs and geopolitical risk while benefiting from incentive programs and grant allocations. Concurrently, companies must accelerate R&D into advanced chemistries-such as solid-state, silicon-enhanced anodes, and LFP-to deliver differentiated performance, safety, and cost profiles that appeal to diverse end markets.

Adopting modular battery platforms and smart BMS architectures will enable rapid customization for specific applications, bolster aftermarket service models, and unlock recurring revenue streams through predictive maintenance subscriptions. Industry participants should also engage proactively with policymakers to secure tariff exclusions for critical battery components and advocate harmonized regulatory standards. Lastly, embedding circularity through battery recycling partnerships and second-life applications enhances sustainability credentials and can offset raw material cost volatility. Together, these actions will foster resilience, fuel innovation, and position companies to capture emerging opportunities in a dynamic market landscape.

Comprehensive Approach to Data Collection, Validation, and Analysis Ensuring Accurate and Reliable Insights into Power Tool Battery Market Dynamics

The research methodology underlying this analysis integrates both primary and secondary approaches to ensure comprehensive and validated insights. Primary research entailed in-depth interviews with key industry stakeholders, including R&D leaders, supply chain executives, and distribution partners, yielding qualitative perspectives on technology adoption, competitive dynamics, and regulatory impacts. Secondary research synthesized data from public filings, government databases, trade associations, and leading industry publications to quantify supply chain shifts, tariff schedules, and regional demand profiles.

Data triangulation techniques were applied to reconcile discrepancies across sources and derive robust conclusions, while a standardized segmentation framework-spanning chemistry, voltage, application, end user, and distribution channel-provided consistent categorization for comparative analysis. Rigorous quality assurance protocols, including peer review and cross-validation against independent benchmarks, reinforced the credibility of findings. Confidentiality agreements and ethical guidelines governed stakeholder interactions, ensuring the integrity and impartiality of the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Tool Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Tool Batteries Market, by Chemistry

- Power Tool Batteries Market, by Voltage

- Power Tool Batteries Market, by Application

- Power Tool Batteries Market, by End User

- Power Tool Batteries Market, by Distribution Channel

- Power Tool Batteries Market, by Region

- Power Tool Batteries Market, by Group

- Power Tool Batteries Market, by Country

- United States Power Tool Batteries Market

- China Power Tool Batteries Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Market Evolution, Tariff Impacts, and Technology Trends to Illuminate the Path Forward for Power Tool Battery Innovation

The power tool battery sector stands at a pivotal juncture where relentless innovation intersects with complex global trade and regulatory currents. Lithium-ion’s ascendancy has redefined performance expectations, while evolving chemistries and smart technologies continue to raise the bar for safety, energy efficiency, and user connectivity. However, the imposition of multifarious U.S. tariffs-spanning battery parts, EV battery cells, and diverse import categories-has reshaped supply chain calculus, compelling stakeholders to reengineer sourcing strategies and domestically scale manufacturing competencies.

Segmentation insights underscore that tailored product architectures-differentiated by chemistry, voltage, and application-are essential to address nuanced end-user requirements across automotive, construction, industrial, and residential spheres. Regional analysis further reveals that opportunities and challenges vary markedly between the Americas, EMEA, and Asia-Pacific, dictating agile market entry and localization tactics. By adopting an integrated approach that harmonizes strategic investments, policy engagement, and sustainability initiatives, companies can navigate headwinds and capitalize on the inherent growth trajectory of cordless tool ecosystems. The strategic imperatives outlined herein form a blueprint for market participants to innovate, adapt, and lead.

Engage with Associate Director, Sales & Marketing Ketan Rohom to Secure Expert Insights and Access Comprehensive Power Tool Battery Market Research Reports

To explore tailored insights and strategic analysis that can empower your organization’s decision-making in the power tool battery arena, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He offers expert guidance on the report’s findings, ensuring you receive the most relevant data and recommendations for your unique business challenges.

Engaging with Ketan will grant you early access to in-depth market intelligence, exclusive executive summaries, and custom research options designed to address your specific needs. Elevate your competitive positioning and drive growth by leveraging these actionable insights today.

- How big is the Power Tool Batteries Market?

- What is the Power Tool Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?