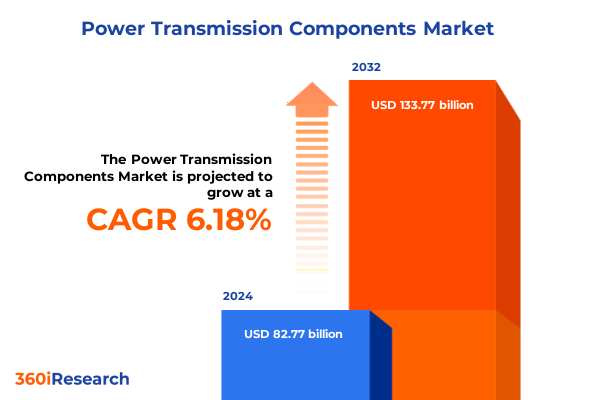

The Power Transmission Components Market size was estimated at USD 86.77 billion in 2025 and expected to reach USD 90.97 billion in 2026, at a CAGR of 6.37% to reach USD 133.77 billion by 2032.

Uncovering the Strategic Foundations and Industrial Significance Driving Demand in Power Transmission Components Landscape

The landscape of power transmission components underpins virtually every facet of modern industry, serving as the critical backbone that enables movement, energy transfer, and operational efficiency across sectors. From automotive drivetrains and industrial machinery to marine propulsion systems, these components deliver the mechanical linkage and torque conversion required for seamless operations. Additionally, the rising emphasis on automation and digitalization has magnified their importance, placing them at the forefront of strategic investment for manufacturers, system integrators, and end users alike.

As globalization intensifies competition and supply chains become more interconnected, companies face mounting pressure to optimize performance, reduce downtime, and deliver sustainable solutions. These imperatives translate directly into demand for advanced bearings, couplings, speed reducers, and other specialized elements that enhance reliability and efficiency. Moreover, innovation in materials science and manufacturing techniques has unlocked new potential, driving component miniaturization, weight reduction, and heightened resilience under extreme conditions. This introduction sets the stage for a comprehensive exploration of the forces shaping today’s power transmission components market.

Navigating the Convergence of Technological Innovations and Sustainability Imperatives Reshaping Power Transmission Components Sector

Industrial transformation is accelerating as companies embrace digital capabilities and sustainability mandates, fundamentally reshaping the way power transmission components integrate into complex systems. The proliferation of Industry 4.0 solutions, such as predictive maintenance platforms and real-time monitoring, is enabling end users to shift from reactive to proactive asset management, reducing unplanned downtime and extending component lifecycles. Concurrently, the growing emphasis on energy efficiency has heightened interest in low-friction materials and precision engineering, prompting manufacturers to develop components that minimize losses and maximize power density.

At the same time, electrification initiatives are redefining the technology stack for transmission architectures. Electric drive systems, once confined to niche applications, are now emerging across automotive, marine, and industrial uses, fostering demand for electrically compatible couplings, sensors, and control modules. In parallel, lightweight composite and aluminum alloys are supplanting traditional cast iron and steel in many applications, reflecting broader sustainability goals and the drive to reduce carbon footprints. These converging trends underscore a market in flux, characterized by rapid innovation, evolving regulatory landscapes, and an unwavering focus on performance and environmental stewardship.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Power Transmission Components Supply Chains and Cost Structures

The introduction of revised United States tariff measures in early 2025 has sent ripples through global supply chains, altering cost dynamics for power transmission components manufacturing. Components imported from designated tariff regions now incur elevated duties, compelling multinational producers to reevaluate sourcing strategies and explore alternative trade routes. As a result, many have accelerated regionalization efforts, establishing or expanding manufacturing footprints within North America to mitigate duty exposure and ensure supply continuity.

These shifts in sourcing have also triggered a recalibration of pricing strategies. Manufacturers and distributors are absorbing part of the increased import costs to maintain customer relationships, even as they negotiate longer-term contracts with domestic suppliers. Over time, this rebalancing is expected to spur investments in local production capabilities, enhancing resilience but also raising competitive pressures among regional producers. Meanwhile, the ripple effects extend beyond cost considerations; end users report reconfigured supply networks and longer lead times for certain critical components, underscoring the cumulative impact of these tariff policies on the entire value chain.

Drawing Actionable Insights from Diverse Segmentations That Illuminate Component Type, Technology, Material, Power Rating, Distribution Channel, and End Use Trends

An in-depth examination of component type segmentation reveals that adapters, bearings, belts and chains, bushings, clutches, couplings, gears, shafts, speed reducers, and universal joints each present unique performance requirements and lifecycle considerations. For instance, couplings and shafts designed for heavy-duty industrial machinery demand robust fatigue resistance, while belts and chains in agricultural equipment prioritize wear tolerance and ease of maintenance. These nuances guide manufacturers in aligning product portfolios with specific application demands, from precision robotics to large-scale construction fleets.

Turning to technology-based segmentation, the distinctions between electric, hydraulic, mechanical, and pneumatic systems have profound implications for design and integration. Electric transmission components increasingly incorporate smart sensors and adaptive controls, enabling granular torque management and remote diagnostics. In contrast, hydraulic solutions emphasize high-pressure resilience and fluid compatibility, while pneumatic assemblies focus on weight savings and rapid actuation. Mechanical linkages, such as gears and universal joints, maintain a central role where simplicity and mechanical advantage are paramount.

When categorizing by transmission type, the interplay between electrical, hydraulic, and mechanical architectures illuminates how system-level priorities shape component innovation. Electrical transmission pathways support high-efficiency designs but depend on advanced insulation and thermal management, whereas hydraulic routes excel in high-torque applications at compact form factors. Mechanical transmissions continue to evolve through precision gearing and novel surface treatments that extend service intervals and improve load distribution.

Materials-based segmentation highlights the shift toward aluminum and composite materials to achieve weight reduction and corrosion resistance, while traditional cast iron and steel offerings remain preferred for heavy-load scenarios due to their proven durability. Moving up the power rating continuum, components rated above 500 kilowatts target large industrial and energy sector applications, those up to 50 kilowatts cater to light machinery and robotics, and medium-power elements spanning 51 to 500 kilowatts bridge the requirements of versatile manufacturing systems.

Distribution channel analysis contrasts aftermarket and original equipment manufacturer pathways, revealing that aftermarket networks emphasize service readiness and retrofit capabilities, whereas OEM channels focus on integrated design partnerships and volume efficiency. Finally, end use industry segmentation across agriculture, automotive, industrial machinery, marine, mining and construction, and oil and gas underscores how sector-specific regulatory regimes, environmental conditions, and performance expectations drive distinct component lifecycles and aftermarket support strategies.

This comprehensive research report categorizes the Power Transmission Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Technology

- Transmission Type

- Material

- Power Rating

- Distribution Channel

- End Use Industry

Revealing Critical Regional Dynamics That Define Demand Patterns and Strategic Priorities Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics exert significant influence on both demand profiles and strategic priorities within the power transmission components market. In the Americas, robust investment in infrastructure modernization and renewable energy integration is propelling demand for advanced couplings, precision gears, and sensor-enabled transmission systems. The region’s proximity to major end users in automotive and mining sectors also fosters collaborative R&D partnerships and just-in-time manufacturing models that underscore cost efficiency and supply chain agility.

In Europe, the Middle East, and Africa, energy transition agendas and regulatory frameworks are driving heightened interest in components that support electrification and carbon reduction goals. Manufacturers in these interlinked markets are prioritizing modular designs that facilitate rapid configuration for diverse applications, from offshore wind farms to urban transit systems. At the same time, geopolitical considerations and regional trade agreements play a pivotal role in shaping cross-border sourcing strategies and localized production investments.

Across the Asia-Pacific landscape, a blend of large-scale industrial expansion and accelerated adoption of automation technologies is generating robust demand for both standard and customized transmission solutions. Key manufacturing hubs are actively scaling capacity for bearings, couplings, and speed reducers to serve domestic and export-oriented sectors. Moreover, technology partnerships between local producers and global component innovators are enhancing localized value-added services, particularly in aftermarket support and digital diagnostics, to meet evolving end user requirements.

This comprehensive research report examines key regions that drive the evolution of the Power Transmission Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Initiatives Partnerships and Innovations Transforming the Competitive Landscape of Power Transmission Components

Leading firms are advancing the frontier of power transmission components through targeted investments in R&D and strategic alliances. One major player has launched an integrated platform combining predictive analytics with condition-based monitoring, enabling real-time performance optimization for bearing and coupling assemblies. Another global innovator has formed joint ventures to develop next-generation composite materials that deliver exceptional strength-to-weight ratios in shafts and speed reducers.

At the same time, partnerships between established suppliers and emerging technology companies are creating hybrid solutions that blend digital capabilities with traditional mechanical expertise. This collaborative approach accelerates the commercialization of smart components that incorporate embedded sensors, wireless connectivity, and adaptive control algorithms. Additionally, vertically integrated manufacturers are expanding their service portfolios to include component remanufacturing and lifecycle extension programs, reflecting a shift toward circular economy principles.

Competition is further intensified by a cadre of regional specialists who focus on niche applications, such as marine-grade couplings and high-torque industrial gears. These companies often capitalize on local engineering talent and proximity to end users to deliver rapid customization and on-site support. As a result, established multinationals are refining their market entry strategies to balance global scale advantages with localized responsiveness, ensuring that product roadmaps align with regional performance standards and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Transmission Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- Dana Incorporated

- JTEKT Corporation

- NSK Ltd.

- NTN Corporation

- Rexnord Corporation

- Schaeffler AG

- SKF AB

- Tenneco Inc.

- The Timken Company

Formulating Practical Strategic Recommendations to Empower Industry Leaders to Navigate Risks Capitalize on Trends and Drive Sustainable Growth in the Sector

Industry leaders must proactively address supply chain vulnerabilities by diversifying sourcing across multiple regions and fostering deeper collaboration with tier-two and tier-three suppliers. By implementing advanced supply chain visibility platforms and real-time tracking, executives can anticipate disruptions and optimize inventory buffers without inflating carrying costs. Concurrently, aligning procurement strategies with strategic tariff landscapes will help organizations secure pricing stability and reduce exposure to fluctuating duty regimes.

To capitalize on emerging electrification and digitalization trends, companies should accelerate development of smart component lines that integrate sensor arrays, diagnostic software, and predictive maintenance algorithms. Cultivating partnerships with technology startups and software providers will enable rapid prototyping and seamless integration into broader automation ecosystems. Moreover, expanding aftermarket services through remote monitoring agreements and performance-based service contracts can create new revenue streams while strengthening customer loyalty.

Sustainability imperatives require leaders to embed circular economy principles into product lifecycle management. Prioritizing modular designs for ease of disassembly and remanufacturing can extend component lifecycles and reduce material waste. Finally, investing in workforce upskilling programs that combine mechanical expertise with data analytics capabilities will empower teams to unlock the full potential of digital solutions and ensure organizational readiness for the next wave of innovation.

Explaining the Rigorous Multi-Dimensional Research Approach Data Collection Techniques and Analytical Frameworks Underpinning the Study

This research follows a structured multi-dimensional framework, beginning with an extensive secondary review of industry journals, patent filings, regulatory publications, and technical white papers to establish foundational knowledge. Secondary data sources were meticulously filtered to exclude proprietary forecasts from vendors and maintain an unbiased perspective. The process also integrated consultation of financial statements and public disclosures to validate company performance narratives and R&D investments.

Primary research played a central role in enriching quantitative insights with qualitative depth. Structured interviews were conducted with senior executives, design engineers, procurement officers, and end users to capture firsthand accounts of market dynamics, technology adoption barriers, and future requirements. These dialogues provided nuanced context for interpreting segmentation findings and tariff impacts, ensuring recommendations were grounded in real-world operational realities.

Data triangulation methodologies were applied by correlating secondary metrics with primary feedback, enabling rigorous cross-validation and minimizing information gaps. Advanced analytical techniques, including scenario modeling and sensitivity analysis, were employed to explore alternative market developments and cost implications. Throughout the research lifecycle, a dedicated quality assurance team performed iterative reviews to uphold methodological consistency and maintain the highest standards of accuracy and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Transmission Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Transmission Components Market, by Component Type

- Power Transmission Components Market, by Technology

- Power Transmission Components Market, by Transmission Type

- Power Transmission Components Market, by Material

- Power Transmission Components Market, by Power Rating

- Power Transmission Components Market, by Distribution Channel

- Power Transmission Components Market, by End Use Industry

- Power Transmission Components Market, by Region

- Power Transmission Components Market, by Group

- Power Transmission Components Market, by Country

- United States Power Transmission Components Market

- China Power Transmission Components Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Implications to Illuminate Future Strategic Pathways for Power Transmission Components Ecosystem

The collective insights from this analysis underscore the evolving complexity and dynamism of the power transmission components sector. The interplay between technological innovation, regulatory shifts, and global trade policies necessitates a holistic approach that integrates design excellence with strategic supply chain management. The segmentation analysis highlights the importance of tailoring solutions to distinct application requirements, while regional perspectives reveal how market maturity and policy landscapes drive divergent adoption trajectories.

Looking ahead, the sector’s trajectory will be defined by companies’ abilities to embed digital intelligence into mechanical platforms, harness advanced materials for enhanced performance, and navigate shifting tariff environments through agile sourcing strategies. Those that succeed will combine deep technical expertise with data-driven decision-making, forging partnerships across ecosystems and leveraging circular economy principles to build resilient, sustainable operations.

In summary, the power transmission components market stands at a pivotal juncture where strategic vision and operational excellence converge. By synthesizing these findings, stakeholders can delineate clear pathways for innovation, collaboration, and growth, positioning themselves to lead in an increasingly competitive and transformative industrial era.

Engage Directly with Associate Director of Sales and Marketing to Unlock Comprehensive Market Insights and Tailored Research Solutions

To explore how cutting-edge insights can accelerate your strategic decision-making and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He brings deep expertise in the nuances of power transmission components markets and can tailor a research package that addresses your unique challenges. By engaging directly with Ketan, you’ll gain personalized guidance on accessing comprehensive data, custom analytics, and scenario planning tools designed for senior executives and technical stakeholders.

This direct dialogue ensures your organization taps into an actionable intelligence framework that aligns with your growth objectives. Don’t miss the opportunity to leverage specialized research methodologies and market perspectives that can drive more informed investments, streamline product development roadmaps, and optimize supply chain resilience. Contact Ketan Rohom today to discover how a tailored market research report can transform your strategic planning and accelerate your success in the evolving power transmission components sector.

- How big is the Power Transmission Components Market?

- What is the Power Transmission Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?