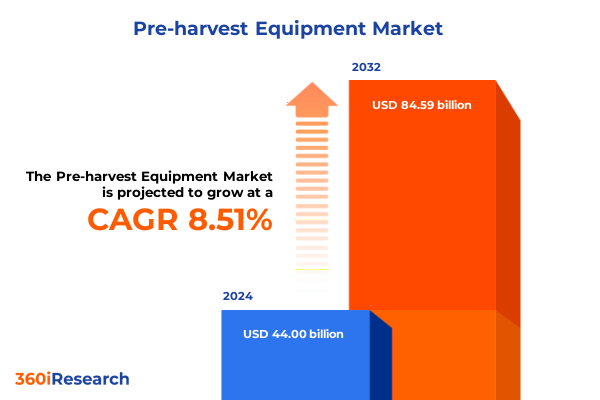

The Pre-harvest Equipment Market size was estimated at USD 47.83 billion in 2025 and expected to reach USD 51.10 billion in 2026, at a CAGR of 8.48% to reach USD 84.59 billion by 2032.

Empowering Agricultural Success Through Cutting-Edge Pre-Harvest Equipment Innovations and Industry Best Practices for Enhanced Operational Efficiency

Agricultural operations across the globe are undergoing a paradigm shift driven by the growing demands for higher yields, environmental stewardship, and cost-efficiency. As farms scale and diversify, pre-harvest equipment emerges as a critical enabler for cultivating soil, applying inputs, and safeguarding crops before harvest. This introductory overview lays the groundwork by highlighting how modern machines-ranging from tillage tools and fertilizer spreaders to irrigation systems and precision sprayers-serve as the backbone of robust, sustainable farming practices.

In this executive summary, the reader will gain a clear understanding of the report’s scope, which spans the identification of transformative market trends, an analysis of recent policy developments, key segmentation insights, and regional dynamics shaping machine adoption. Through both qualitative and quantitative research, this report illuminates the strategic inflection points that industry stakeholders must navigate. Ultimately, this section sets the stage for a comprehensive exploration of best practices, emerging technologies, and the practical considerations essential for optimizing pre-harvest operations amidst a rapidly evolving agricultural landscape.

Charting a Future Where Precision Technology Smart Automation and Sustainable Practices Revolutionize Pre-Harvest Equipment to Meet Modern Farming Demands

Over the past decade, the pre-harvest equipment sector has transitioned from purely mechanical solutions to integrated technology platforms that blend automation, data analytics, and sustainability. Precision sensors and IoT-enabled devices now collect real-time soil moisture and nutrient data, enabling equipment such as cultivators and sprayers to operate with pinpoint accuracy. Moreover, smart automation systems increasingly handle repetitive tasks, reducing labor reliance and minimizing human error.

Concurrently, environmental concerns have reshaped design priorities, with manufacturers incorporating energy-efficient drivetrains, biodegradable materials, and low-emission engines. Robotics and machine learning algorithms guide autonomous units through fields, dynamically adjusting operations based on crop type and terrain variations. In parallel, digital twin simulation tools allow engineers to model equipment performance under diverse conditions, accelerating product development cycles. These converging shifts redefine industry norms, positioning pre-harvest machinery at the forefront of the larger digital agriculture revolution.

Analyzing the Far-Reaching Consequences of 2025 United States Trade Tariffs on Pre-Harvest Equipment Supply Chains and Cost Structures

In early 2025, the United States implemented a series of tariffs targeting imported components critical to pre-harvest equipment manufacturing, including advanced sensors, hydraulic systems, and precision nozzles. These measures, aimed at protecting domestic producers, have introduced additional duties on products originating from key overseas suppliers. The cumulative effect has been a notable increase in landed costs for OEMs, compelling many to reevaluate sourcing strategies and renegotiate contracts with international partners.

Consequently, some manufacturers have accelerated efforts to localize component production, while others have diversified supplier portfolios to mitigate risk. Exchange rate fluctuations have further amplified cost pressures, leading to upward pricing adjustments in certain regions. Additionally, end users-particularly smallholder farms with tighter budgets-are exploring equipment rental models and aftermarket refurbishment services to manage capital expenditures. Looking ahead, the policy environment remains dynamic, underscoring the importance of flexible procurement policies and cross-border collaboration to sustain supply chain resilience.

Unpacking Critical Segmentation Dimensions to Unlock Deeper Understanding of Pre-Harvest Equipment Market Preferences and Buyer Dynamics

Delving into the pre-harvest equipment market through the lens of multiple segmentation dimensions reveals distinct usage patterns and investment priorities. Equipment type categories span from core machinery like cultivators, tillage equipment, and tractors to specialized solutions such as fertilizer spreaders-comprising broadcast spreaders, pneumatic spreaders, and rotary spreaders-and irrigation equipment that includes drip systems, pivot systems, sprinkler systems, and surface irrigation. Notably, UAV sprayers and boom sprayers are gaining traction among large-scale producers seeking rapid and uniform chemical application.

Application-based segmentation highlights that fertilizer application remains a dominant focus, followed closely by soil preparation and crop protection functions divided into fungicide, herbicide, and pesticide application. End users range from commercial farms and contract farming operations to government agencies and smallholder farms, each exhibiting unique purchasing behaviors shaped by scale, regulatory frameworks, and budget constraints. Crop type also influences equipment selection, with cereal producers tending toward high-capacity tillage equipment while fruit and vegetable cultivators prioritize precision sprayers and gentle transplanters. Distribution channels bifurcate into offline dealer networks offering extensive service packages and online platforms that provide streamlined ordering and digital support tools. By understanding how these segmentation layers interact, stakeholders can tailor product portfolios and marketing strategies to address specific customer needs and maximize market penetration.

This comprehensive research report categorizes the Pre-harvest Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Crop Type

- Application

- End User

- Distribution Channel

Revealing Regional Nuances and Growth Drivers Across Key Territories Encompassing Americas Europe Middle East Africa and Asia-Pacific

Regional variations in pre-harvest equipment adoption and innovation underscore the necessity of market-specific strategies. In the Americas, robust mechanization in the United States and Canada is complemented by large-scale row cropping in Brazil and Argentina, driving demand for high-horsepower tractors, specialty fertilizer spreaders, and center-pivot irrigation systems. Meanwhile, strong aftermarket ecosystems support rapid equipment turnover and value-added service models.

Europe, the Middle East, and Africa present a diverse tapestry of needs, shaped by stringent environmental regulations and incentives under the European Green Deal, which encourage adoption of low-emission engines and precision agriculture technologies. In North Africa and the Gulf region, irrigation efficiency is paramount, pushing sprayer and drip system innovations. Across Sub-Saharan Africa, programs led by government agencies and NGOs foster smallholder access to affordable, entry-level equipment.

In the Asia-Pacific region, government subsidies and mechanization initiatives in China, India, and Southeast Asia have catalyzed demand for compact tractors, pneumatic spreaders, and handheld sprayers. Smallholder farms dominate many markets, prompting manufacturers to develop modular equipment that scales with farm size. Additionally, an upsurge in online equipment marketplaces has begun to reshape distribution dynamics, offering remote diagnostics and digital agronomy support. These regional insights pave the way for targeted product launches and localized partnerships that resonate with diverse end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Pre-harvest Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Manufacturers and Innovators Shaping the Pre-Harvest Equipment Market with Strategic Partnerships and Technological Advancements

Leading equipment manufacturers and technology providers are vying to differentiate themselves through a combination of innovation, strategic alliances, and service-oriented offerings. Long-established OEMs are investing heavily in in-house research and development to integrate AI-driven control systems and telematics platforms into their machines. At the same time, smaller specialized firms and startups focus on niche applications such as UAV sprayers and autonomous tractors, securing venture capital funding to accelerate product development.

Partnerships between traditional machinery producers and software firms have led to bundled solutions that encompass hardware, connectivity, and agronomic decision-support tools. Several prominent players have announced joint ventures with sensor manufacturers to co-develop highly accurate nutrient application technologies. Additionally, aftermarket service providers are enhancing their portfolios by offering predictive maintenance packages and remote equipment diagnostics, thus extending equipment lifecycles and creating recurring revenue streams. By monitoring these competitive dynamics, stakeholders can identify potential collaborators, acquisition targets, and innovation hotspots that align with their growth objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pre-harvest Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- Alamo Group Inc.

- Art's Way Manufacturing Co. Inc.

- Bucher Industries AG

- CLAAS KGaA

- CNH Industrial N.V.

- Deere & Company

- Escorts Kubota Limited

- Exel Industries

- Great Plains Manufacturing Inc.

- Horsch Maschinen GmbH

- Iseki & Co. Ltd.

- J.C. Bamford Excavators Ltd

- Kubota Corporation

- Kuhn Group

- Kverneland Group

- Mahindra & Mahindra Ltd.

- Pellenc

- Rain Bird Corporation

- SDF Group

- The Toro Company

- Tractors and Farm Equipment Ltd.

- Valmont Industries Inc.

- Vermeer Corporation

- Yanmar Co. Ltd.

Implementing Forward-Thinking Strategies and Operational Excellence to Capitalize on Emerging Opportunities in Pre-Harvest Equipment Sector

For industry leaders aiming to capitalize on the evolving pre-harvest equipment landscape, a multi-pronged approach is essential. First, investing in modular machine architectures and scalable software platforms will allow rapid customization for diverse farm sizes and crop types, mitigating development costs and time-to-market. Concurrently, establishing robust supply chain partnerships-particularly with regional component manufacturers-can reduce exposure to tariff volatility and enhance logistical agility.

Furthermore, integrating comprehensive training and certification programs for dealer networks and end users will foster confidence in advanced technologies and drive uptake. Organizations should also prioritize data interoperability by adhering to open standards, ensuring seamless integration across the digital agriculture ecosystem. Finally, engaging proactively with policymakers and industry associations can influence regulatory frameworks in favor of innovation while maintaining environmental and safety compliance. By following these actionable recommendations, companies can strengthen their competitive positioning and secure sustainable growth amid shifting market conditions.

Demonstrating Robust Research Approach Combining Qualitative Expert Interviews Quantitative Data Analysis and Market Validation Techniques

This report’s findings emerge from a rigorous research methodology that combines primary interviews with industry executives, equipment operators, and technical experts alongside in-depth secondary analysis of public records, trade data, and technical publications. Qualitative insights were gathered through structured discussions, roundtables, and validation workshops conducted across major agricultural hubs to capture regional nuances and operational realities.

Quantitative data was sourced from harmonized customs databases, manufacturer disclosures, and financial filings, then subjected to statistical analysis to identify usage patterns and trend trajectories. All data inputs underwent triangulation against independent sources to ensure consistency and reliability. In addition, scenario modeling techniques and sensitivity analyses were applied to test the impact of policy shifts, disruptive technologies, and macroeconomic factors. This transparent and repeatable approach underpins the credibility of the insights presented, equipping decision-makers with a solid foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pre-harvest Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pre-harvest Equipment Market, by Equipment Type

- Pre-harvest Equipment Market, by Crop Type

- Pre-harvest Equipment Market, by Application

- Pre-harvest Equipment Market, by End User

- Pre-harvest Equipment Market, by Distribution Channel

- Pre-harvest Equipment Market, by Region

- Pre-harvest Equipment Market, by Group

- Pre-harvest Equipment Market, by Country

- United States Pre-harvest Equipment Market

- China Pre-harvest Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Stakeholders Through the Complex Landscape of Pre-Harvest Equipment Evolution

The convergence of technological innovation, evolving regulatory landscapes, and shifting end-user expectations has set the stage for a new era in pre-harvest equipment. Stakeholders who embrace precision technologies, reconfigure their supply chains, and adapt their product offerings to segmented market needs will be best positioned to capture value. Furthermore, understanding the ramifications of recent tariff measures and regional market drivers is crucial for aligning investment and operational strategies with the realities of 2025 and beyond.

By leveraging the detailed segmentation insights and regional analyses contained within this report, companies can tailor their go-to-market strategies and prioritize high-potential growth segments. The competitive intelligence on leading firms and emerging disruptors highlights collaboration and innovation pathways that can accelerate product development and customer adoption. Ultimately, decision-makers who adopt the actionable recommendations will not only navigate the complexities of the modern agricultural machinery landscape but will also secure a resilient and sustainable trajectory for their organizations.

Secure Exclusive Access to In-Depth Pre-Harvest Equipment Insights and Propel Your Strategy Forward by Engaging with Ketan Rohom

I invite you to take the next decisive step in elevating your pre-harvest equipment strategy by securing exclusive access to our comprehensive market research report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore tailored insights that align with your organization’s unique goals and operational challenges. This personalized consultation will guide you through the report’s in-depth analyses, ensuring you capitalize fully on emerging trends, segmentation nuances, tariff implications, regional dynamics, and actionable strategies.

By partnering with Ketan Rohom, you will benefit from expert guidance on implementing best practices, optimizing supply chains in light of 2025 tariff shifts, and harnessing technological innovations to boost efficiency and sustainability. Together, you can develop a bespoke roadmap for growth that addresses critical priorities such as modular design adoption, IoT integration, and market diversification. Reach out today to arrange a one-on-one session that will empower your leadership team with the confidence and clarity needed to outpace competitors and drive long-term success in the evolving pre-harvest equipment landscape.

- How big is the Pre-harvest Equipment Market?

- What is the Pre-harvest Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?