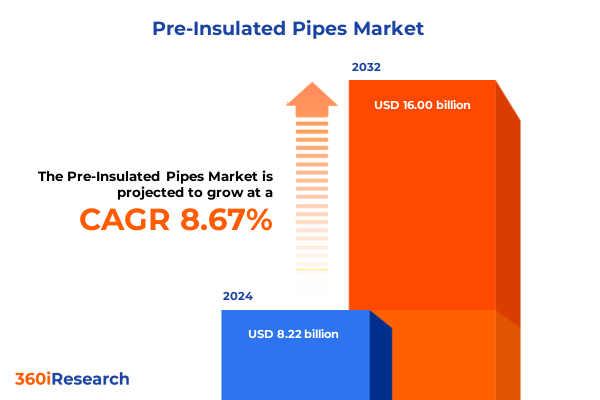

The Pre-Insulated Pipes Market size was estimated at USD 8.92 billion in 2025 and expected to reach USD 9.69 billion in 2026, at a CAGR of 8.69% to reach USD 16.00 billion by 2032.

Exploring How Pre-Insulated Pipe Solutions Are Revolutionizing Energy Efficiency Standards Across Infrastructure Ecosystems Worldwide

The pre-insulated pipe sector has swiftly transformed from a niche engineering solution into a cornerstone of modern infrastructure and energy efficiency initiatives. In today’s interconnected industries, these composite systems offer unparalleled thermal performance, significantly reducing energy losses and contributing to sustainability goals. This introduction sets the stage by highlighting how the unique construction of pre-insulated pipes integrates insulating material, pipe material, and protective outer casing into a unified product that meets stringent operational demands.

Increasing regulatory pressure on energy consumption and carbon emissions has further elevated the strategic importance of pre-insulated pipes. As governments and industrial stakeholders pursue net-zero targets and efficient resource management, these systems deliver a compelling value proposition. Energy policymakers and project developers alike recognize the dual benefit of minimizing operational costs while also aligning with broader environmental mandates. This convergence of efficiency, regulation, and environmental stewardship marks the beginning of a new era in pipeline technology.

How Shifting Global Energy Policies and Sustainability Mandates Are Redefining Demand Dynamics in the Pre-Insulated Pipe Sector

Global energy transition initiatives and mounting environmental regulations have converged to reshape demand dynamics in the pre-insulated pipe marketplace. Decarbonization efforts have prioritized district heating and cooling networks, while industrial sectors have intensified investments in thermal management solutions that reduce energy loss. This shift underscores a broader transformation in stakeholder expectations, where performance reliability and life-cycle efficiency now drive procurement decisions more strongly than upfront costs alone.

Meanwhile, advances in insulation materials and manufacturing techniques have accelerated innovation cycles. Next-generation polyisocyanurate formulations, high-density polyethylene jackets, and precision extrusion technologies are redefining thermal resistance and installation speed. In turn, these developments enable project engineers to conceive sprawling heat transfer networks with longer service intervals and reduced maintenance footprints. In tandem, digitalization and predictive analytics tools are becoming integral to pipeline monitoring, enabling proactive maintenance strategies that further enhance system integrity.

Consequently, stakeholders across infrastructure, industrial, and residential sectors are now navigating an environment where thermal performance benchmarks continuously evolve. This dynamic landscape compels suppliers, contractors, and end users to adopt agile models that accommodate emerging materials, evolving regulatory frameworks, and shifting cost-benefit analyses. Ultimately, these transformative shifts are not merely reshaping the supply chain; they are elevating the pre-insulated pipe category into a critical enabler of sustainable energy infrastructure.

Assessing the Far-Reaching Consequences of Recent United States Tariff Adjustments on Pre-Insulated Pipe Manufacturing and Supply Networks

Recent tariff revisions imposed by the United States have exerted significant influence on the economics of pre-insulated pipe production and distribution. Cost structures for both imported insulation materials and steel casings have adjusted, compelling manufacturers to reassess sourcing strategies and manufacturing locations. Domestic production lines have seen renewed investment, with some suppliers expanding local fabrication capacity to mitigate the impact of import duties and ensure stable supply chains.

These tariff changes have also affected downstream project timelines and contract negotiations. EPC firms and utilities have begun integrating potential duty fluctuations into procurement risk assessments, leading to more flexible supply contracts and price adjustment clauses. In parallel, some market participants have diversified supplier portfolios to include regional producers in Europe and Asia-Pacific, thereby balancing cost pressures against delivery schedules and quality standards. This strategic recalibration reflects a broader trend of supply chain resilience taking precedence in capital-intensive thermal infrastructure projects.

Moreover, the tariff environment has spurred closer collaboration between industry stakeholders and policy advocates. Trade associations have intensified efforts to engage regulatory bodies, arguing for exemptions on critical pipeline components that underpin energy efficiency or renewable integration. As these dialogues progress, the pre-insulated pipe sector remains vigilant, poised to adapt to evolving tariff frameworks while maintaining the momentum toward sustainability objectives.

Uncovering Essential Insights from Diverse Segmentation Parameters Spanning Insulation Material to Channel Strategies in Pre-Insulated Pipe Markets

Insights derived from segmentation data reveal differentiated performance drivers across insulation materials, where glass wool offers cost-efficiency and fire resistance, polyethylene delivers moisture tolerance with ease of installation, polyisocyanurate achieves high thermal conductivity resistance valued in district heating projects, and polyurethane excels in compact applications demanding superior R-values. When evaluating pipe material options, copper’s corrosion resistance and thermal conductivity appeal to specialized industrial installations, ductile iron’s mechanical strength supports municipal chilled water networks, high-density polyethylene variants such as PE100 and PE80 provide chemical inertness suitable for aggressive environments, and steel constructions including carbon and stainless varieties address heavy-duty applications with extended service life requirements.

End-use segmentation further clarifies market demands, as hospitals and hotels in the commercial sector prioritize uninterrupted thermal performance and noise reduction, office buildings and shopping malls require scalable network segments, and district cooling projects leverage absorption chillers and central plant designs to optimize peak load management. District heating installations incorporate biomass boilers, combined heat and power stations, solar thermal arrays, and waste heat recovery units, each dictating specific insulation thickness and pipe diameter profiles. In industrial settings, chemical processing, food and beverage lines, oil and gas transfer networks, and pharmaceutical installations demand adherence to stringent hygiene, safety, and thermal stability standards. Meanwhile, multi-family and single-family residences in the residential segment drive demand for seamless system integration, minimal visual impact, and adaptability to renovation or retrofit scenarios.

Application contexts add another layer of complexity, as above ground systems necessitate UV-resistant jacketing, underground configurations require enhanced mechanical protection and moisture barriers, and underwater deployments depend on specialized casing assemblies to withstand hydrostatic loads. Diameter ranges from less than fifty millimeters to above two hundred millimeters determine the scalability and pressure ratings of networks, while insulation thickness bands-less than fifty millimeters, fifty to seventy-five millimeters, and above seventy-five millimeters-align with specific thermal loss targets dictated by local energy codes. Lastly, channel analysis distinguishes between new installation projects that demand turnkey engineering and replacement initiatives focused on minimal downtime and seamless integration with existing pipelines. Together, these segmentation insights paint a holistic picture of the nuanced requirements that shape product design, supply chain logistics, and project delivery in the pre-insulated pipe ecosystem.

This comprehensive research report categorizes the Pre-Insulated Pipes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insulation Material

- Pipe Material

- Diameter

- Insulation Thickness

- Application

- End Use

- Sales Channel

Gaining Strategic Perspective from Regional Demand Drivers and Infrastructure Initiatives across Americas EMEA and Asia-Pacific Pre-Insulated Pipe Markets

Regional demand dynamics in the Americas stem from robust investments in district heating and cooling infrastructure fueled by stringent energy efficiency standards and urban redevelopment programs. In North America, municipal utilities are modernizing aging networks, while Latin American facilities are embracing thermal solutions to support rapid urbanization and industrial expansion. Emerging cross-border projects underscore the strategic importance of pipeline resilience and thermal performance in regions with extreme climate variations.

Within Europe, Middle East & Africa, market drivers are equally diverse. Western Europe’s legacy infrastructure programs are implementing deep retrofit initiatives, integrating high-performance pre-insulated solutions to meet stringent EU energy directives. Central and Eastern European nations are advancing district heating systems to reduce reliance on fossil fuels, with state-backed grants supporting pipeline modernization. In the Middle East, large-scale developments in urban centers and industrial parks prioritize cooling networks, while North African thermal projects harness solar thermal inputs, amplifying the demand for tailored casing and insulation assemblies.

Asia-Pacific’s pre-insulated pipe consumption is propelled by rapid industrialization, megacity expansions, and strategic energy projects. China’s renewable energy integration in industrial parks, combined with ambitious district heating pilots in northern provinces, underscores appetite for high-efficiency pipeline solutions. Southeast Asian economies are channeling investments into large-scale cooling plants for commercial complexes and data centers, necessitating adaptable pipe variants and localized manufacturing support. Meanwhile, Oceania’s focus on sustainable building practices further elevates the role of pre-insulated assets in new construction and retrofit endeavors.

This comprehensive research report examines key regions that drive the evolution of the Pre-Insulated Pipes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovation Trajectories Among Leading Pre-Insulated Pipe Manufacturers Shaping Industry Evolution

Leading global suppliers have accelerated their innovation roadmaps, integrating digital monitoring systems into pre-insulated assemblies to provide real-time thermal performance data and predictive maintenance alerts. These strategic initiatives not only enhance system uptime but also offer end users valuable lifecycle cost analytics. Concurrently, partnerships between insulation material specialists and pipe fabricators have yielded hybrid composite solutions that marry high-density foams with corrosion-resistant casings, exemplifying cross-sector collaboration that drives product differentiation.

In addition to product innovation, top manufacturers are leveraging regional production footprints to shorten lead times and optimize logistics. Investments in local extrusion lines for high-density polyethylene jacketing in Europe and modular fabrication centers in Asia-Pacific have strengthened supply chain agility. Moreover, several key players have diversified their offerings to encompass installation services and after-sales support, positioning themselves as full-service partners rather than commodity suppliers.

Mergers and acquisitions remain prevalent, as firms seek to augment their insulation portfolios, expand geographic reach, and gain proprietary technologies. These strategic moves underscore an industry landscape characterized by consolidation and expanding service ecosystems. As competitive intensity rises, the ability to anticipate market shifts and tailor integrated solutions will define the next wave of market leadership in the pre-insulated pipe arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pre-Insulated Pipes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AP S.p.A.

- Armacell International GmbH

- Emtas Boru Sanayi ve Ticaret A.Ş.

- isoplus Piping Systems Ltd.

- KC polymers Pvt Ltd.

- KE KELIT GmbH

- Kingspan Group

- Logstor A/S

- Nironit Ltd.

- Pipelife International GmbH

- Saint-Gobain PAM

- Thermofin GmbH

- Uponor Infra GmbH

- Wavin N.V.

Implementing Practical Pathways and Strategic Initiatives to Enhance Operational Efficiency and Market Position for Pre-Insulated Pipe Industry Leaders

Industry leaders should prioritize the adoption of advanced insulation chemistries that deliver superior thermal resistance while conforming to evolving environmental standards. By forging alliances with material innovators, pipeline providers can accelerate the introduction of next-generation foam cores and sustainable jacketing systems. In parallel, embedding digital sensors into pipe networks enables real-time monitoring, predictive analytics, and remote diagnostics, which collectively drive operational excellence and minimize the risk of unplanned outages.

Operational efficiency can also be enhanced by streamlining supply chains through regional fabrication hubs and modular assembly techniques. Companies that invest in localized production not only reduce freight costs but also improve responsiveness to project-specific requirements. Equally important is the development of turnkey service models that encompass engineering design, installation management, and post-installation support. This integrated approach creates stickier customer relationships and unlocks recurring revenue streams.

Finally, engaging proactively with regulatory bodies and industry associations can influence favorable policy outcomes and secure incentives for energy-efficient projects. By contributing technical expertise to standard-setting committees, organizations can help shape the regulatory framework while ensuring that pre-insulated pipe solutions remain recognized for their essential role in decarbonization efforts. These strategic recommendations provide a roadmap for companies seeking to enhance competitive positioning and drive sustainable growth.

Detailing Rigorous Research Methodology and Analytical Framework Underpinning the Comprehensive Pre-Insulated Pipe Market Analysis

The research methodology underpinning this executive summary integrates both primary and secondary data collection approaches to ensure comprehensive analysis. Primary research involved structured interviews with key stakeholders, including pipeline engineers, procurement managers, and project developers, to validate performance criteria, installation challenges, and future technology adoption trends. Secondary sources included technical journals, industry whitepapers, regulatory reports, and relevant trade publications, which provided historical context and macro-economic insights.

Quantitative analysis was conducted using a comparative framework that evaluated material performance metrics, regional infrastructure investments, and supply chain configurations. Segmentation parameters were applied to dissect market behavior across insulation materials, pipe substrates, end-use verticals, applications, diameter categories, insulation thickness classifications, and distribution channels. This layered approach facilitated granular understanding of demand drivers and product specifications. Cross-referencing of data points ensured consistency and highlighted emerging patterns.

To maintain objectivity, data triangulation methods were employed, cross-verifying findings from multiple sources and validating them against real-world case studies. Analytical models were stress-tested against historical project benchmarks and stress scenarios, such as tariff fluctuations and energy policy shifts. These rigorous processes guarantee that the resulting insights accurately reflect current market dynamics and support strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pre-Insulated Pipes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pre-Insulated Pipes Market, by Insulation Material

- Pre-Insulated Pipes Market, by Pipe Material

- Pre-Insulated Pipes Market, by Diameter

- Pre-Insulated Pipes Market, by Insulation Thickness

- Pre-Insulated Pipes Market, by Application

- Pre-Insulated Pipes Market, by End Use

- Pre-Insulated Pipes Market, by Sales Channel

- Pre-Insulated Pipes Market, by Region

- Pre-Insulated Pipes Market, by Group

- Pre-Insulated Pipes Market, by Country

- United States Pre-Insulated Pipes Market

- China Pre-Insulated Pipes Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Core Insights and Strategic Imperatives to Illuminate Future Opportunities within the Pre-Insulated Pipe Market Landscape

Throughout this executive summary, key insights have emerged around evolving policy landscapes, material innovations, and strategic segmentation dynamics. Shifting global sustainability mandates continue to elevate the importance of thermal efficiency solutions, while tariff adjustments underscore the critical need for supply chain resilience. Segmentation data reveal that nuanced requirements across insulation chemistries, pipe substrates, end-use sectors, application contexts, dimensional specifications, and channel strategies drive distinct market niches.

Regional analysis highlights the diversity of growth catalysts, from retrofit programs in Europe and district cooling expansion in the Middle East, to industrial pipeline modernization in Asia-Pacific and infrastructure renewals in the Americas. Concurrently, competitive strategies among leading manufacturers emphasize digital transformation, localized production, and end-to-end service models. These converging trends illustrate a market at the intersection of technological advancement and strategic collaboration.

As industry stakeholders navigate this dynamic landscape, the ability to harness detailed segmentation insights and leverage targeted partnerships will define future success. With a holistic understanding of demand drivers, regulatory trajectories, and operational best practices, decision-makers are well positioned to unlock value, optimize system performance, and advance the global adoption of pre-insulated pipe infrastructure.

Take the Next Step toward Operational Excellence and Market Leadership by Securing Your Comprehensive Pre-Insulated Pipe Market Research Report Today

For a deeper exploration of strategic insights, competitive dynamics, and region-specific opportunities within the pre-insulated pipe market, engage directly with Associate Director of Sales & Marketing Ketan Rohom. Ketan Rohom can guide you through tailored purchase options, enabling you to secure the full market research report that will empower your organization’s decision-making and strategic planning.

Connect today to ensure your team gains immediate access to the comprehensive analysis, in-depth case studies, and actionable data required to stay ahead of industry trends and capitalize on emerging opportunities in the pre-insulated pipe landscape

- How big is the Pre-Insulated Pipes Market?

- What is the Pre-Insulated Pipes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?