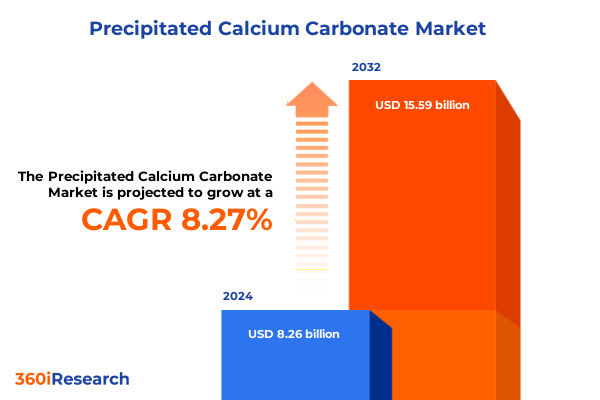

The Precipitated Calcium Carbonate Market size was estimated at USD 8.92 billion in 2025 and expected to reach USD 9.63 billion in 2026, at a CAGR of 8.30% to reach USD 15.59 billion by 2032.

Setting the Stage for Precipitated Calcium Carbonate Market Dynamics and Growth Drivers Amidst Rapid Technological and Regulatory Evolution

Precipitated calcium carbonate (PCC) has emerged as an indispensable additive across a wide spectrum of industrial and consumer applications, from enhancing paper brightness to reinforcing polymer matrices. As a synthetic mineral derived from limestone, PCC delivers superior purity and controlled particle morphology compared to natural alternatives, serving as a reliable performance enhancer in coatings, adhesives, food production, and pharmaceutical formulations. Its tunable surface chemistry and particle size distribution enable formulators to optimize viscosity, opacity, and mechanical strength, paving the way for innovations in nanocomposite materials and high-performance plastics.

Moreover, increasing environmental regulations have spurred a shift toward zero-waste manufacturing processes, elevating PCC’s appeal as a recyclable, low-carbon filler that reduces reliance on petroleum-based additives. In parallel, advancements in micronization and surface functionalization have unlocked new value propositions in personal care and biomedical sectors, where ultra-fine grades and tailored surface treatments are critical. Consequently, stakeholders across the value chain are reassessing raw material sourcing and production methods to capitalize on emerging opportunities in high-purity grades and next-generation applications.

In this context, understanding the underlying drivers, technological breakthroughs, and supply chain dynamics shaping the PCC landscape is crucial for decision-makers seeking to navigate evolving market conditions. This executive summary offers a concise yet comprehensive overview of market trends, regulatory influences, and competitive strategies poised to define industry trajectories over the coming years.

Identifying Transformative Shifts in Precipitated Calcium Carbonate Supply Chains, Technologies, and Sustainability Priorities

A series of profound shifts are redefining how precipitated calcium carbonate is produced, distributed, and deployed across end markets. Sustainability has risen to the forefront, prompting manufacturers to invest in closed-loop water reuse systems and carbon capture technologies that reduce greenhouse gas emissions during the calcination and carbonation stages. Concurrently, digitalization initiatives have enabled real-time monitoring of particle size distribution and surface chemistry, elevating quality control standards and accelerating innovation cycles.

In tandem, the advent of nano-engineered calcium carbonate grades is transforming high-performance composite design, offering unprecedented improvements in barrier properties for packaging films and enhanced filler-polymer interfacial bonding for lightweight automotive components. Meanwhile, stricter environmental regulations – particularly in Europe – are driving a pivot toward low-alkalinity grades and coated variants that mitigate corrosion risks in metal-working fluids and agricultural formulations.

Furthermore, strategic alliances are reshaping the competitive landscape, as leading producers collaborate with specialty chemical companies to co-develop tailored surface treatments and hybrid filler systems. This trend underscores a broader industry recognition that differentiation increasingly hinges on value-added services, from application testing and formulation support to end-use performance validation. As these transformative shifts gain momentum, stakeholders must remain agile and forward-thinking to capture emerging niches and address evolving customer demands.

Assessing the Cumulative Impact of 2025 United States Tariffs on Precipitated Calcium Carbonate Trade, Pricing, and Supply Strategies

In 2025, a landmark revision of U.S. trade policy introduced broad-based tariffs on imported minerals, with precipitated calcium carbonate among the products subject to a universal baseline duty. While the 10 percent tariff applied uniformly to most suppliers, country-specific rates for major exporters intensified cost pressures: China-origin grades faced surcharges exceeding 30 percent, and the European Union incurred an additional 20 percent duty. This two-tier structure elevated landed costs, compelling importers and distributors to re-evaluate sourcing strategies and inventory practices.

The layered tariff regime catalyzed a notable shift toward domestic production, as U.S. mineral processors accelerated capacity expansions and modernized plant infrastructure to capitalize on the cost differential. In particular, smaller regional players leveraged their agility to serve niche end markets with specialized coated and uncoated grades, while larger incumbents prioritized capital investments in continuous carbonation reactors and state-of-the-art micronization equipment.

Moreover, the interplay between tariff policy and contractual hedging mechanisms forced downstream formulators to renegotiate supply agreements, often adopting flexible pricing models tied to raw material indices. Although a recent court challenge has introduced some uncertainty regarding the permanence of these duties, the short-term impact is clear: a reconfigured supply chain that favors vertically integrated players, diversified sourcing from lower-duty jurisdictions, and intensified collaboration on cost optimization initiatives.

Uncovering Key Insights into Market Segmentation Based on Application, End Use, Type, Purity Grade, and Particle Size Dynamics

An insightful examination of market segmentation reveals nuanced demand drivers across multiple dimensions. When evaluating applications, PCC serves as an essential brightness and opacity enhancer in paper, while adhesives and sealants rely on its rheological control properties, and food and beverage formulators value the purity and consistent particle morphology of specialized food-grade grades. In healthcare and pharmaceutical settings, ultra-fine, pharma-grade precipitated calcium carbonate delivers critical benefits for tablet formulation and controlled-release matrices. Meanwhile, paints and coatings producers harness surface-treated grades to improve gloss and film strength, and plastics and rubber manufacturers incorporate standard- and technical-grade variants to optimize cost-performance balances.

End-use analysis further illuminates demand patterns, as the agricultural sector incorporates PCC into soil conditioning and animal feed supplements, while the automotive industry exploits lightweight composites enhanced by fine and ultrafine grades for fuel-efficiency gains. The construction industry utilizes medium and coarse grades for cementitious applications and wall-putty formulations, whereas packaging specialists integrate coated calcium carbonate to enhance barrier performance. Personal care brands formulate with fine and ultra-fine precipitated calcium carbonate to achieve gentle exfoliation, and pharmaceutical companies depend on high-purity, pharma-grade variants for accurate dosage and stability.

Product-type segmentation distinguishes coated from uncoated offerings, with coated grades commanding premium positioning in moisture-sensitive applications. Purity-grade distinctions range from food and pharma through standard and technical categories, each aligned with industry-specific regulatory and performance criteria. Particle-size segmentation spans coarse to ultrafine distributions, enabling formulators to dial in the precise balance of opacity, viscosity, and mechanical reinforcement required for their end uses.

This comprehensive research report categorizes the Precipitated Calcium Carbonate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Type

- Purity Grade

- Particle Size

- End Use

Exploring Regional Variations and Growth Drivers for Precipitated Calcium Carbonate across the Americas, EMEA, and Asia-Pacific

Regional dynamics underpin varied trajectories for precipitated calcium carbonate demand and innovation. In the Americas, mature paper and plastics industries drive steady growth in fine and medium grades, while domestic capacity expansions have enhanced self-sufficiency following the imposition of import tariffs. Infrastructure investment programs in North America have also fostered demand for coarse grades in cementitious systems and road-base applications, reinforcing the region’s role as both a consumer and producer of diverse PCC products.

Across Europe, the Middle East, and Africa, stringent environmental regulations and circular economy initiatives underpin a strong focus on recycled and low-alkalinity grades. European chemical clusters are spearheading research into bio-based carbonation processes, and coated PCC variants are gaining traction in corrosion inhibitor formulations for the oil and gas sector. Meanwhile, Middle Eastern petrochemical complexes are integrating technical-grade precipitated calcium carbonate into polymer compounding, and a rising construction sector in North Africa is fueling demand for coarse partitions of filler material.

In the Asia-Pacific arena, rapid industrialization in China, India, and Southeast Asia has sustained robust consumption of uncoated, standard-grade PCC for paper, plastics, and paints. At the same time, burgeoning automotive and consumer goods markets are driving appetite for specialty ultra-fine and coated grades, while government incentives for advanced materials research are accelerating the development of nano-engineered calcium carbonate solutions.

This comprehensive research report examines key regions that drive the evolution of the Precipitated Calcium Carbonate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation, Capacity Expansion, and Strategic Partnerships in the Precipitated Calcium Carbonate Market

A review of the competitive landscape highlights how leading producers are leveraging scale, innovation, and strategic alliances to maintain market leadership. Industry stalwarts have invested in next-generation manufacturing platforms, including continuous stirred-tank reactor systems that deliver tighter particle size distributions and lower carbon footprints. In parallel, smaller niche players are carving out specialized positions by focusing on high-purity pharma-grade and food-grade calcium carbonate, as well as ultra-fine micronized variants for premium applications.

Collaborative ventures with specialty chemical firms and equipment manufacturers have enabled co-development of surface-functionalized grades, tailored to deliver enhanced dispersion in polyolefin matrices and improved adhesion in advanced coating formulations. Some leading companies have also entered long-term feedstock supply contracts with limestone quarries, ensuring raw material security and cost stability amid market volatility. Concurrently, mergers and acquisitions in key geographies have reshaped the vendor landscape, with major players expanding their footprints in Asia-Pacific and Latin America to capture rising local demand.

Looking ahead, competitive advantage will likely hinge on integrated service offerings - from formulation support and application testing labs to digital platforms that provide supply chain transparency and predictive maintenance insights. Companies that successfully combine production excellence with value-added technical services will be best positioned to address evolving customer needs and regulatory pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precipitated Calcium Carbonate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carmeuse Group

- Elixsys Inc.

- GHCL Limited

- Graymont Limited

- Imerys SA

- J.M. Huber Corporation

- Lhoist

- Minerals Technologies Inc.

- Mississippi Lime Company

- Nordkalk Corporation

- Omya AG

- Shiraishi Calcium Kaisha, Ltd.

- Sibelco Group NV

- Solvay S.A.

Actionable Recommendations for Industry Leaders to Navigate Regulatory Changes, Optimize Supply Chains, and Capitalize on Emerging Opportunities

To thrive in a dynamic market environment, industry leaders should adopt a multifaceted strategy that balances operational efficiency, regulatory compliance, and customer-centric innovation. First, optimizing supply chains through diversified sourcing and strategic inventory buffering can mitigate the impact of fluctuating tariffs and geopolitical uncertainties. In parallel, investing in advances such as continuous reactor technology and energy-efficient milling systems will reduce production costs while minimizing environmental footprints.

Moreover, aligning product development with end-use requirements - whether that entails developing ultra-fine grades for pharmaceutical applications or specialized coated variants for corrosion inhibitors - will differentiate offerings in crowded markets. Engagement with policymakers and trade associations is also critical to shape favorable regulatory frameworks and avoid unforeseen trade disruptions. Equally important is the deployment of digital tools for real-time quality monitoring, enabling proactive control over particle size and surface properties to ensure consistent performance.

Finally, forging deep technical partnerships with customers through labs, pilot programs, and joint innovation centers can accelerate product validation and foster long-term loyalty. By embedding application expertise alongside high-quality PCC supply, industry leaders will be positioned to capture premium margins and spearhead the next wave of market expansion.

Detailing the Rigorous Research Methodology Underpinning This Analysis to Ensure Data Integrity and Strategic Relevance

This analysis was developed through a rigorous research framework combining primary and secondary data collection, expert interviews, and quantitative validation. Secondary research encompassed review of trade publications, regulatory filings, patent databases, and public company disclosures, providing an extensive backdrop on historical trends, technology advancements, and competitive strategies.

Primary data was gathered via structured interviews with industry stakeholders, including production managers, formulation scientists, procurement leaders, and trade association representatives. Insights from these conversations were synthesized to identify best practices in production optimization, sustainability initiatives, and market entry strategies. Additionally, comprehensive surveys of downstream users across paper, plastics, healthcare, and construction applications yielded granular perspectives on quality requirements, pricing sensitivities, and service expectations.

To ensure data integrity, multiple triangulation methods were employed, cross-referencing shipment statistics, trade data, and secondary market intelligence. Furthermore, a sensitivity analysis tested the robustness of key findings against potential shifts in tariff policy and raw material availability. The resulting insights combine quantitative rigor with nuanced qualitative context, ensuring that strategic recommendations are both actionable and reliable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precipitated Calcium Carbonate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precipitated Calcium Carbonate Market, by Application

- Precipitated Calcium Carbonate Market, by Type

- Precipitated Calcium Carbonate Market, by Purity Grade

- Precipitated Calcium Carbonate Market, by Particle Size

- Precipitated Calcium Carbonate Market, by End Use

- Precipitated Calcium Carbonate Market, by Region

- Precipitated Calcium Carbonate Market, by Group

- Precipitated Calcium Carbonate Market, by Country

- United States Precipitated Calcium Carbonate Market

- China Precipitated Calcium Carbonate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on Market Opportunities, Challenges, and the Path Forward for Precipitated Calcium Carbonate Stakeholders

In summary, the precipitated calcium carbonate market is undergoing a period of significant transformation driven by evolving regulatory landscapes, innovative production technologies, and shifting demand patterns. Sustainability imperatives and tariff headwinds have catalyzed supply chain realignment, prompting both domestic capacity growth and strategic sourcing diversifications. At the same time, advances in nanoparticle engineering and surface functionalization are unlocking new application frontiers in pharmaceuticals, coatings, and high-performance composites.

Segment-level insights underscore the importance of tailoring product portfolios to specific end-use requirements, whether by delivering ultra-fine pharma-grade powders or coated grades for moisture-sensitive applications. Regional analysis highlights that while the Americas continue to expand production to offset trade barriers, EMEA’s stringent environmental ethos drives innovation in low-impact processes, and Asia-Pacific’s industrial growth fuels demand for both standard and specialty grades.

Moving forward, market participants that embrace digital quality control, invest in differentiated service offerings, and proactively engage in policy dialogues will be best positioned to navigate uncertainty and capitalize on emerging growth opportunities. Ultimately, the ability to align operational excellence with customer-centric innovation will define the next generation of leaders in the precipitated calcium carbonate market.

Engaging with Ketan Rohom to Secure Comprehensive Market Intelligence and Strategic Guidance on Precipitated Calcium Carbonate

To explore the full breadth of insights on precipitated calcium carbonate market dynamics, tariff impacts, segmentation analysis, and regional nuances, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to secure a comprehensive copy of the market research report and to discuss tailored consulting services that align with your organization’s strategic priorities. Enhance your decision-making with in-depth data, best practice recommendations, and forward-looking analysis - all delivered through our premium research offering.

- How big is the Precipitated Calcium Carbonate Market?

- What is the Precipitated Calcium Carbonate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?