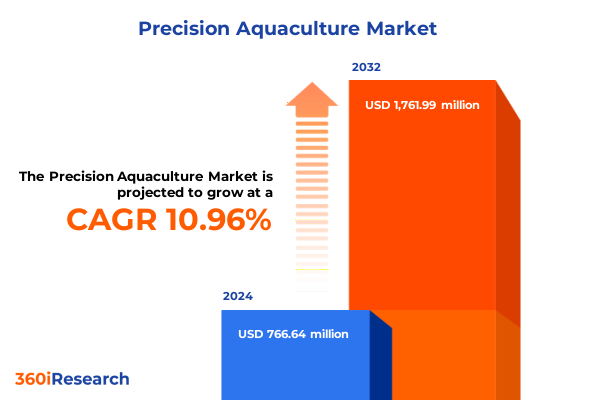

The Precision Aquaculture Market size was estimated at USD 847.29 million in 2025 and expected to reach USD 937.19 million in 2026, at a CAGR of 11.02% to reach USD 1,761.99 million by 2032.

Unveiling the Role of Precision Technologies in Transforming Aquaculture Practices Towards Enhanced Productivity, Sustainability, and Data-Driven Insights

Precision aquaculture represents a paradigm shift in how seafood is cultivated, combining cutting-edge technologies such as sensors, artificial intelligence, cloud-based platforms, and automated feeding systems to deliver real-time data on water quality, fish behavior, and environmental conditions. By leveraging these data streams, operators can optimize feed delivery schedules, maintain optimal water parameters, and detect early signs of stress or disease, thereby enhancing productivity while minimizing resource consumption. This approach transcends traditional reactive management, enabling proactive interventions that drive efficiency gains and bolster farm resilience against climatic and biological stressors.

As sustainability imperatives intensify and regulatory frameworks tighten, precision aquaculture adoption is accelerating across diverse geographies and species. Automated feeding solutions alone accounted for nearly half of system deployments in 2023, reflecting strong demand for technologies that reduce feed waste and improve feed conversion ratios. Meanwhile, the convergence of IoT-enabled sensors, AI-driven analytics, and remote monitoring platforms is fueling a digital renaissance in fish farming, where continuous process optimization and data-driven decision-making are rapidly becoming the industry standard.

Exploring the Paradigm Shifts Propelled by AI, IoT, and Sustainable Innovations That Are Redefining Modern Aquaculture Operations Worldwide

Environmental stewardship and technological innovation are converging to reshape modern aquaculture, with operators increasingly prioritizing sustainability alongside productivity. In November 2023, China launched the world’s first floating fish farm powered entirely by wind and solar energy, signaling a global drive toward low-carbon operation models that reduce reliance on fossil fuels and mitigate environmental footprints. These renewable energy integrations are complemented by closed-loop water systems and recirculating aquaculture setups that dramatically curtail effluent discharge and water consumption, aligning farm practices with stringent environmental regulations and consumer expectations.

Simultaneously, the industry’s digital transformation has reached an inflection point, propelled by the proliferation of IoT devices, AI algorithms, and advanced imaging technologies. Smart feeders and underwater cameras feed continuous data into cloud and edge computing platforms, enabling automated feeding protocols that adapt to real-time biomass assessments and water quality metrics. This symbiosis of hardware and software greatly reduces manual intervention, enhances biosecurity measures, and unlocks predictive maintenance capabilities, thereby securing both operational excellence and animal welfare in a rapidly evolving sector.

Examining the Comprehensive Effects of United States Trade Tariffs in 2025 on Aquaculture Equipment Costs, Supply Chains, and Domestic Seafood Markets

In early 2025, the United States imposed 25 percent tariffs on seafood imports from Canada and Mexico, triggering ripple effects throughout the aquaculture value chain. These levies, coupled with targeted tariffs of up to 170 percent on Chinese tilapia fillets, have constrained import volumes, driven up consumer prices by as much as 10 percent for key species, and prompted processors to curtail production in affected regions. While some domestic shrimpers welcome these measures as temporary relief against a flood of subsidized imports, broader market participants caution that such protectionist policies may erode competitiveness and stifle cross-border collaboration over time.

Deriving Actionable Intelligence from Multidimensional Segmentation to Navigate Species, Systems, Technology, Applications, and Distribution Dynamics in Aquaculture

The precision aquaculture market is dissected across multiple dimensions, beginning with species diversity where crustaceans such as shrimp and prawn capitalize on automated feeding technologies to reduce waste and improve growth rates, while finfish segments-led by salmon, trout, tilapia, and bass-are increasingly migrating to recirculating aquaculture systems for enhanced biosecurity. Molluscs, including clams, mussels, and oysters, are simultaneously benefiting from underwater vision systems that monitor shellfish health and optimize environmental conditions for sustainable cultivation.

Production system stratification reveals distinct growth trajectories: cage culture continues to serve as the backbone for high-volume coastal operations, yet freshwater cage farms are expanding rapidly for inland species. Pond and tank culture modalities persist in traditional setups, even as recirculating aquaculture systems-especially zero-discharge configurations-gain traction in water-scarce regions, leveraging hybrid and partial discharge designs to balance environmental impact with operational efficiency.

Technology segmentation highlights biosecurity and health management as a cornerstone, where antibiotic management protocols, real-time disease detection systems, and vaccination platforms safeguard stock and reduce mortality by approximately 40 percent. Feeding solutions, anchored by automatic and demand feeders, are automating nutrient delivery, while IoT platforms spanning cloud and edge architectures unify data ingestion and analytics. Sensors for imaging, vision, and water quality-spanning drone-based cameras to pH, oxygen, and temperature probes-form the sensory backbone that powers precision decision support.

This comprehensive research report categorizes the Precision Aquaculture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Species

- Component

- Farm Type

- End Use

- Distribution Channel

Unearthing Regional Dynamics and Adoption Patterns in Precision Aquaculture Across the Americas, Europe–Middle East–Africa, and Asia–Pacific

In the Americas, strategic tariffs have spurred a resurgence of domestic aquaculture investment, particularly in the United States where supply chain disruptions have prompted operators to localize production and integrate precision systems to fortify against external shocks. North American farms are leveraging automated feeding and real-time monitoring to enhance resilience, while regional associations caution that sustained policy volatility could undermine long-term growth.

Europe, the Middle East, and Africa exhibit a heterogeneous adoption profile: Europe leads in regulatory-driven sustainability, investing heavily in monitoring solutions and closed-loop recirculating systems to comply with stringent environmental directives. In the Middle East, exemplar projects such as the UAE’s first marine shrimp RAS farm underscore a strategic pivot toward technology-enabled food security, while African operators are at early adoption stages, exploring solar-powered feeding units and low-cost sensor networks to catalyze sustainable expansion.

Asia-Pacific remains the foremost adopter of precision aquaculture, commanding over one-third of global system deployments. Nations like China, India, Vietnam, and Indonesia are pioneering large-scale implementations of IoT-enabled feeders and AI-driven analytics, exemplified by floating wind-and-solar–powered farms that marry renewable energy with digital control systems to meet soaring protein demand in the region.

This comprehensive research report examines key regions that drive the evolution of the Precision Aquaculture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Moves, Collaborations, and Technological Innovations Driving the Leading Companies in the Precision Aquaculture Ecosystem

Key industry participants are forging the technological and commercial contours of precision aquaculture today. Established engineering firms such as AKVA Group, Akuakare, and CPI Equipment anchor the supply chain with robust feeding, monitoring, and RAS infrastructure, leveraging decades of marine and land-based aquaculture expertise to deliver turnkey solutions that integrate seamlessly with farm operations. These companies continue to invest in R&D partnerships and regional manufacturing hubs to accelerate technology diffusion and service responsiveness.

On the digital frontier, specialized technology providers like Aquabyte, Aqualine, and Innovasea are redefining data acquisition and analytics paradigms. Aquabyte’s machine learning algorithms decode fish behavior patterns, while Innovasea’s BiomassPro camera systems achieve over 95 percent accuracy in biomass estimation for multiple species. Strategic collaborations-such as Innovasea’s alliance with BiOceanOr for AI-powered oxygen forecasting-underscore a shift toward integrated platforms that unify environmental monitoring, predictive analytics, and automated control in a singular cloud-based ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precision Aquaculture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AKVA Group ASA

- Aquabyte AS

- AquaGro by Solnovation

- Aquamaof Aquaculture Technologies Ltd

- AquaSpy Inc.

- Benchmark Genetics

- BioFishency Ltd.

- Blue Ridge Aquaculture

- CageEye

- Circa Group Ltd.

- Coastal Aquaculture Research Institute Private Limited

- Eruvaka Technologies

- Evoqua Water Technologies Corp

- Imenco AS

- In-Situ Inc.

- Innovasea Systems Inc.

- KS Aquaculture

- Marine Instruments SL

- OxyGaurd

- Pentair PLC

- Planet Lighting

- ReelData

- ScaleAQ

- Skretting

- Unique Group

- XpertSea Inc.

Formulating Strategic Imperatives and Tactical Recommendations to Help Industry Leaders Seize Emerging Opportunities and Mitigate Risks in Aquaculture

Industry leaders must prioritize interoperability and open-architecture solutions to circumvent equipment silos and future-proof their operations. By adopting modular, standards-based communication protocols for sensors and actuators, farms can integrate emerging technologies without disrupting existing workflows, ensuring adaptability as AI, 5G connectivity, and edge computing evolve. This approach not only reduces integration costs but also fosters a competitive vendor ecosystem that accelerates innovation cycles.

Given the ongoing tariff volatility and supply chain constraints, diversification of hardware sourcing and strategic inventory management are imperative. Farms should explore regional manufacturing partnerships to mitigate import levies and establish buffer stock for critical components. Concurrently, vertical integration of feed and health management services can insulate operators from market fluctuations and streamline compliance with evolving regulatory mandates, fortifying resilience against macroeconomic headwinds.

To capitalize on the sustainability premium, companies should develop transparent traceability frameworks leveraging blockchain and RFID tagging, assuring end-consumers of product provenance and environmental stewardship. By quantifying carbon and water footprints through real-time telemetry, producers can align with certification standards and capture value through eco-labeling initiatives, unlocking premium markets and reinforcing brand equity in a competitive landscape.

Outlining a Rigorous Mixed-Method Research Framework Combining Primary Engagements, Secondary Analysis, and Triangulation to Ensure Data Integrity and Validity

This analysis integrates a structured mixed-method research design, commencing with secondary data collection from industry publications, regulatory filings, and peer-reviewed journals. Key secondary sources included market intelligence releases and scholarly reviews to map technology trends, tariff measures, and regional adoption profiles.

Primary research involved in-depth interviews with aquaculture operators, equipment manufacturers, technology vendors, and policy experts, providing qualitative insights into operational challenges, investment rationales, and emerging use cases. Sample selection prioritized diverse geographies and production scales to ensure representativeness. Data validation was conducted through triangulation across multiple sources, cross-referencing quantitative findings with expert testimony.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and value chain mapping were applied to dissect competitive dynamics and identify strategic inflection points. Statistical techniques, including regression modeling and scenario analysis, were leveraged to assess sensitivity to external drivers such as tariffs, energy costs, and regulatory changes, ensuring robust, actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precision Aquaculture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precision Aquaculture Market, by Species

- Precision Aquaculture Market, by Component

- Precision Aquaculture Market, by Farm Type

- Precision Aquaculture Market, by End Use

- Precision Aquaculture Market, by Distribution Channel

- Precision Aquaculture Market, by Region

- Precision Aquaculture Market, by Group

- Precision Aquaculture Market, by Country

- United States Precision Aquaculture Market

- China Precision Aquaculture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Key Insights to Deliver a Cohesive Perspective on Precision Aquaculture’s Evolution, Current Challenges, and Future Directions for Stakeholders

Precision aquaculture is at an inflection point where technological innovation, environmental stewardship, and market dynamics converge to reshape global seafood production. Operators that embrace real-time monitoring, AI-driven decision support, and sustainable system designs are poised to achieve superior operational performance while minimizing ecological impact. The combined pressures of consumer demand for traceable, responsibly sourced seafood and the volatility introduced by trade policies underscore the need for adaptability and strategic foresight.

As the industry evolves, success will hinge on collaborative ecosystems that integrate hardware, software, and service providers into unified solutions, underpinned by open standards and data transparency. Firms that balance technology investments with robust supply chain strategies and proactive regulatory engagement will navigate uncertainties more effectively, securing market leadership in a rapidly digitizing sector. The path forward demands a synthesis of innovation and resilience, charting a sustainable trajectory for aquaculture in the decades to come.

Engaging with Our Associate Director for Personalized Guidance on Acquiring the Definitive Market Intelligence Report to Strengthen Your Aquaculture Strategy

To secure exclusive insights and comprehensive analysis in precision aquaculture tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the report’s in-depth findings and custom advisory options, ensuring you harness the full potential of these market intelligence assets to drive innovation and competitive advantage. Contact Ketan directly to discuss enterprise licensing, volume discounts, and bespoke data solutions designed to accelerate your decision-making and optimization initiatives.

- How big is the Precision Aquaculture Market?

- What is the Precision Aquaculture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?