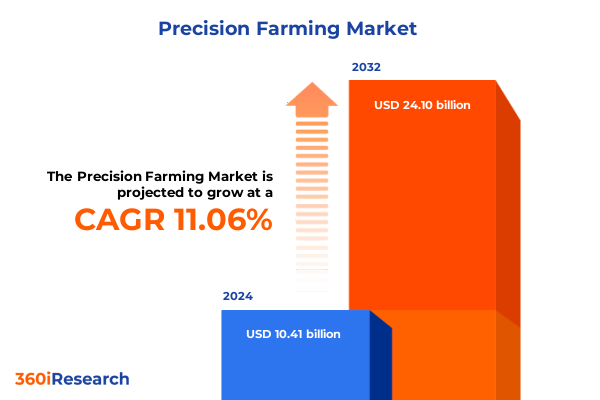

The Precision Farming Market size was estimated at USD 11.49 billion in 2025 and expected to reach USD 12.70 billion in 2026, at a CAGR of 11.15% to reach USD 24.10 billion by 2032.

Understanding the Role of Precision Farming in Driving Unprecedented Agricultural Efficiency and Sustainability Worldwide

In an era defined by resource constraints and environmental imperatives, precision farming emerges as a transformative paradigm, integrating advanced technologies to optimize agricultural processes. This approach harnesses data-driven decision-making, enabling farmers to allocate inputs such as water, fertilizers, and pesticides with unprecedented accuracy. Consequently, yields can be maximized while minimizing environmental impact, aligning agricultural productivity with sustainability goals.

The convergence of global food demand, climate variability, and labor shortages has accelerated the adoption of digital tools in agriculture. Precision farming encompasses an array of innovations-from satellite-guided machinery and sensor networks to advanced analytics platforms-that collectively enhance agronomic insight. By leveraging real-time data streams, agronomists and operators can identify spatial variability within fields, monitor crop health continuously, and respond swiftly to emerging issues.

Moreover, the rise of connected ecosystems, powered by the Internet of Things and cloud computing, facilitates seamless collaboration among stakeholders. Whether coordinating planting schedules or executing targeted interventions, the digital infrastructure underpinning modern farms drives efficiency and resilience. As the agricultural sector navigates the complexities of supply chain disruptions and evolving regulatory frameworks, precision farming stands at the forefront of a productivity revolution, reshaping how food is grown around the world.

Exploring the Transformative Technological and Operational Shifts Reshaping Global Farming Practices and Productivity

The precision farming landscape has undergone rapid transformation in recent years as emerging technologies reshape traditional agronomic practices. Precision guidance systems, once confined to large-scale grain operations, now extend to specialty crops, supported by breakthroughs in autonomous vehicles, robotics, and edge computing. As a result, machinery with centimeter-level accuracy navigates challenging terrains, ensuring seed placement and input distribution occur with pinpoint precision.

Concurrently, remote sensing technology has evolved from basic aerial imagery to multi-spectral and hyperspectral platforms, enabling detailed assessments of crop vigor, nutrient deficiencies, and disease hotspots. Drones and satellites deliver high-frequency data, which, when processed through machine learning algorithms, generate predictive models that anticipate stress events before they escalate. Furthermore, variable rate technology integrates granular soil and topographical data to tailor input applications across microzones, optimizing resource utilization and enhancing environmental stewardship.

At the same time, digital marketplaces and data exchange platforms are fostering new business models, where farmers can monetize agronomic data and access specialized advisory services on demand. Collaborative initiatives between equipment manufacturers, software developers, and agtech startups have accelerated innovation cycles, resulting in interoperable solutions that streamline workflows. Ultimately, these transformative shifts underscore the transition from intuition-based farming to precision agronomy, driving productivity gains and sustainability improvements at scale.

Assessing the Cumulative Impact of United States Tariffs Imposed in 2025 on Precision Farming Equipment and Service Adoption

In 2025, the United States implemented a new tranche of tariffs targeting imported agricultural equipment and precision-farming components, reflecting broader trade policy dynamics. These duties have particularly impacted sensors, guidance modules, and remote sensing hardware sourced from overseas manufacturers. As tariff obligations rose, input costs for precision farming equipment increased, prompting many operators to reevaluate procurement strategies and seek alternative sourcing channels.

Moreover, the cumulative effect of these tariffs has accelerated domestic manufacturing initiatives, with original equipment manufacturers investing in regional production facilities to mitigate exposure to import duties. This shift has stimulated job creation in localized supply chains while reducing lead times for critical technologies. However, during the transition, operators experienced disruptions in availability of specialized sensors and software licenses, leading some to adopt legacy systems or refurbished machinery to maintain agronomic continuity.

Policy responses have included incentive programs that offset tariff-induced cost escalations for small and medium-scale farms. Government grants and tax credits have been tailored to encourage adoption of domestically produced precision solutions, leveling the playing field for family-owned operations. Consequently, while the tariffs initially posed headwinds to technology integration, strategic alignment between industry stakeholders and policymakers has fostered a resilient ecosystem that balances trade objectives with agricultural innovation.

Unlocking Critical Market Segmentation Insights to Tailor Precision Farming Solutions Across Components, Technologies, and Applications

Precision farming solutions are highly nuanced, tailored across various components that include hardware instruments, service offerings, and software platforms. Hardware investments such as guidance systems and sensors form the tangible foundation of an integrated farm operation, while on-the-ground and remote advisory services provide the expertise needed to interpret complex datasets. Software applications, meanwhile, unify data streams, transforming raw measurements into actionable insights for farm managers.

The underlying technologies further differentiate solution sets: guidance technology ensures accurate machine navigation and seeding operations; remote sensing collects field-level imagery to assess crop health; and variable rate technology delivers inputs with spatial granularity, optimizing resource deployment. Importantly, each technology interacts with farm size in distinct ways: operations spanning less than 100 acres often prioritize turnkey guidance kits and subscription-based analytics, whereas enterprises managing 100 to 500 acres seek modular platforms that scale across multiple plots. Operations exceeding 500 acres typically integrate full-stack solutions encompassing advanced automation and bespoke consulting services.

Crop type also plays a critical role in solution configuration. Field operations cultivating cereals such as corn, rice, and wheat leverage precision algorithms for planting density and nutrient management, while fruit and vegetable growers focus on real-time scouting and yield monitoring. Oilseed and pulse producers, particularly those growing canola and soybean, benefit from variable rate applications to address soil heterogeneity. Meanwhile, plantation crops demand robust inventory management and weather forecasting to safeguard perennial assets. Across these parameters, applications range from field mapping and farm labor management to yield monitoring and financial oversight, serving both corporate-owned and family-owned farm models.

This comprehensive research report categorizes the Precision Farming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Produce Type

- Technology

- Farm Size

- Application

- End-user

Comparative Regional Perspectives Revealing How Precision Farming Strategies Vary Across the Americas, Europe, Middle East and Asia-Pacific

Precision farming adoption displays marked variations across regions, reflecting differences in infrastructure, policy frameworks, and agronomic priorities. In the Americas, robust technology ecosystems and strong financing options have driven widespread uptake of advanced guidance and variable rate applications. Farmers in North America often lead in integrating autonomous equipment and data-driven advisory services, supported by extensive network coverage and a culture of early adoption.

In Europe, the Middle East, and Africa, regulatory landscapes and subsidy programs dictate the pace of adoption. European Union initiatives emphasize sustainability and carbon reduction, encouraging practices such as precise nutrient management and remote sensing. In contrast, many African markets face connectivity constraints, prompting solutions that operate offline or leverage mobile networks for data transmission. Middle Eastern operations, particularly large-scale commercial farms, focus on irrigation efficiency through sensor networks and weather tracking.

The Asia-Pacific region exhibits a dual dynamic: highly mechanized commercial farms in Australia and parts of China pursue full-scale automation, while fragmented smallholder sectors in Southeast Asia adopt smartphone-based scouting tools and pay-as-you-go service models. Government-backed digital initiatives in India and Japan have accelerated pilot programs for remote sensing and yield monitoring, indicating growing momentum. These regional nuances highlight the importance of tailoring precision farming strategies to local conditions, ensuring technology aligns with regulatory demands and operational realities.

This comprehensive research report examines key regions that drive the evolution of the Precision Farming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies’ Approaches and Innovations Driving Competitive Advancements in the Precision Farming Ecosystem Worldwide

Leading companies in the precision farming arena leverage distinct approaches to capture value and drive innovation. One global equipment manufacturer has embedded advanced data analytics directly into tractors and combines, enabling in-cabin decision support that synchronizes machine settings with real-time field data. Meanwhile, a prominent software specialist has developed a flexible cloud-based platform that unites satellite imagery, sensor networks, and farm management tools into a single user interface.

At the same time, several agtech startups have forged strategic partnerships with established OEMs to integrate novel sensing technologies and AI-driven algorithms. One collaboration focuses on delivering hyperspectral drone surveys paired with edge-computing modules for instant crop health diagnostics. Another venture combines blockchain-enabled traceability with variable rate application systems, ensuring transparent supply chain verification from field to consumer.

Furthermore, consolidation has emerged as a key trend, with larger corporations acquiring niche technology providers to fill product gaps and expand service portfolios. These acquisitions have accelerated R&D roadmaps, driving the commercialization of autonomous cultivation platforms, predictive pest management solutions, and integrated labor management modules. Throughout this competitive landscape, success hinges on interoperability, data security, and the ability to deliver measurable agronomic returns for diverse farm profiles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precision Farming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AG Leader Technology

- AGCO Corporation

- Bayer AG

- Cargill Incorporated

- Climate LLC

- CNH Industrial N.V.

- Corteva, Inc.

- CropX Technologies Ltd.

- Deere & Company

- Dickey-John Corporation

- Farmers Edge Inc.

- Grownetics, Inc.

- Hexagon AB

- Kubota Corporation

- Lindsay Corporation

- METER Group Inc.

- SENCROP

- TELUS Agriculture Solutions Inc.

- Tetra Laval Group

- Topcon Positioning Systems, Inc.

- Trimble Inc.

- Yara International ASA

Strategic Actions and Practical Recommendations Empowering Industry Leaders to Capitalize on Precision Farming Opportunities and Overcome Emerging Challenges

Industry leaders should prioritize the development of interoperable platforms that facilitate seamless data exchange among machinery, sensors, and agronomic software. By embracing open architectures and standardized protocols, companies can foster collaborative ecosystems and reduce integration friction for end-users. Additionally, forging partnerships with local service providers and academic institutions can accelerate knowledge transfer and drive regional relevance.

Another crucial step involves investing in workforce development and farmer training programs. Technology adoption accelerates when end-users gain confidence in interpreting data outputs and applying recommendations effectively. Therefore, offering tailored educational resources, field demonstrations, and virtual coaching will bolster adoption across farm sizes and geographical areas. Furthermore, flexible financing options-such as subscription models, leasing arrangements, and pay-per-use plans-can lower entry barriers for smaller operations while ensuring predictable revenue streams for solution providers.

Finally, engaging proactively with policymakers and industry associations is essential to shape supportive regulatory frameworks. Collaborating on incentive programs, standard-setting initiatives, and sustainability benchmarks can align public and private objectives. By taking these strategic actions, industry leaders can outpace emerging challenges, unlock new growth vectors, and ensure precision farming delivers both economic and environmental value at scale.

Outlining Robust Research Methodology Ensuring Comprehensive Data Collection, Rigorous Analysis, and Transparent Insights in Precision Farming Studies

The research underpinning this executive summary relied on a multi-method approach to capture a holistic view of the precision farming landscape. Primary data were collected through in-depth interviews with farm operators, equipment manufacturers, technology developers, and policy experts. These qualitative insights were complemented by structured surveys conducted across diverse geographies, farm sizes, and crop types to validate emerging trends and quantify adoption drivers.

Secondary research included a thorough review of peer-reviewed journals, white papers from agricultural associations, and technical briefs published by leading agritech consortia. Trade publications and regulatory filings provided additional context on tariff developments, subsidy programs, and compliance requirements. Data triangulation techniques were employed to reconcile conflicting findings, ensuring robust conclusions.

Quantitative data analysis leveraged statistical software and geospatial mapping tools to identify spatial patterns and correlations among technology uptake, farm performance metrics, and regional variables. The methodology also incorporated expert panel reviews and cross-functional workshops, where preliminary findings were vetted by stakeholders representing equipment OEMs, service providers, and academic institutions. Ethical standards and data privacy regulations guided all research activities, ensuring integrity and transparency in the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precision Farming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precision Farming Market, by Offering

- Precision Farming Market, by Produce Type

- Precision Farming Market, by Technology

- Precision Farming Market, by Farm Size

- Precision Farming Market, by Application

- Precision Farming Market, by End-user

- Precision Farming Market, by Region

- Precision Farming Market, by Group

- Precision Farming Market, by Country

- United States Precision Farming Market

- China Precision Farming Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesis of Key Findings Highlighting the Critical Role of Precision Farming Innovations in Achieving Sustainable and Efficient Agricultural Outcomes

Precision farming stands at the intersection of technological innovation and sustainable agricultural practice. The synthesis of key findings underscores how data-driven decision-making optimizes resource allocation, enhances yield resilience, and drives environmental stewardship. From iterative improvements in guidance and variable rate applications to breakthroughs in remote sensing and autonomous operations, the sector is on the cusp of a productivity renaissance.

The examination of recent tariff measures reveals a trajectory toward localized production capacity and supportive policy frameworks, mitigating short-term cost pressures while nurturing long-term ecosystem resilience. Segmentation insights demonstrate the critical need for customized solutions across component categories, technological modalities, farm sizes, crop types, and end-use models. Regional perspectives highlight how infrastructure, regulatory landscapes, and cultural factors influence adoption pathways and value realization.

Ultimately, the combined lens of company strategies and actionable recommendations clarifies a roadmap for stakeholders to navigate complexities and seize opportunities. The imperative for interoperable systems, workforce enablement, and policy engagement emerges as a unifying theme. As precision farming continues to evolve, these insights form the foundation for strategic planning and investment, guiding the next wave of agricultural transformation.

Immediate Next Steps and Call to Action for Engaging with Associate Director to Access the Full Precision Farming Market Research Report

The precision farming landscape demands timely access to in-depth insights and strategic guidance, and collaborating with Associate Director Ketan Rohom can bridge that gap. This partnership offers a direct pathway to secure the comprehensive report, arming stakeholders with actionable intelligence to navigate emerging technologies, policy shifts, and competitive dynamics. By engaging now, decision-makers gain privileged access to tailored data analyses, customized scenario planning, and expert support for integrating precision agriculture solutions into their operations.

Initiating this engagement empowers organizations to proactively address supply chain complexities, leverage tariff impact assessments, and optimize investments across hardware, software, and service portfolios. Ketan Rohom’s expertise in sales and marketing for agricultural research ensures each conversation is solution-focused, delivering the precise information needed to inform procurement, R&D planning, and partnership development. Consequently, stakeholders can accelerate time-to-value, mitigating risks associated with fluctuating trade policies and evolving regional adoption patterns.

Reach out today to discuss licensing options, data customization features, and ongoing support packages designed to maximize returns on R&D and capital expenditure. By partnering directly with the report’s Associate Director, organizations position themselves at the forefront of precision farming innovation, equipped to translate cutting-edge data into operational excellence and sustainable growth.

- How big is the Precision Farming Market?

- What is the Precision Farming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?