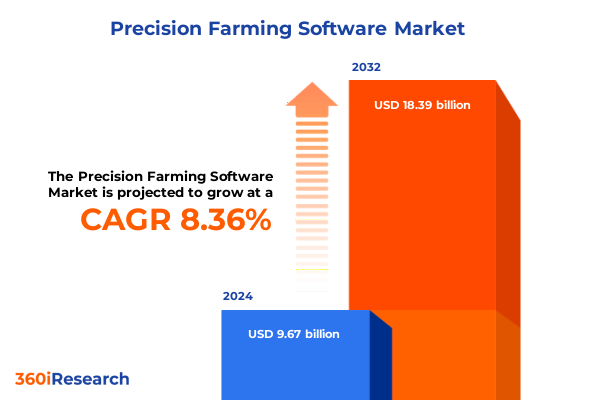

The Precision Farming Software Market size was estimated at USD 10.39 billion in 2025 and expected to reach USD 11.18 billion in 2026, at a CAGR of 8.49% to reach USD 18.39 billion by 2032.

Setting the Stage for Next-Generation Precision Agriculture Software: Unveiling Core Concepts, Drivers, and Strategic Imperatives for Sustainable Farming

Precision agriculture software represents a paradigm shift in how farming operations are planned, executed, and optimized. By harnessing advanced analytics, real-time sensor data, and geospatial intelligence, this suite of technologies empowers agribusinesses to make data-driven decisions that maximize yield while minimizing inputs. As climatic variability and resource constraints intensify, precision farming software emerges as an indispensable tool for practitioners seeking to enhance productivity and environmental stewardship simultaneously.

As these digital solutions evolve, they leverage machine learning algorithms trained on historical and live field data to deliver actionable insights on crop health, soil moisture, nutrient management, and pest risk. Integration of aerial imagery from drones and satellite platforms with on-ground sensors creates a unified view of farm operations. User-friendly dashboards and mobile interfaces ensure that agronomists and farm managers can swiftly interpret complex datasets and optimize resource allocation in real time.

This executive summary delves into critical shifts driving the precision farming software landscape, examines the cumulative impact of recent United States tariff measures, and highlights segmentation and regional dynamics shaping adoption patterns. It further outlines the strategic posture of leading solution providers, offers pragmatic recommendations for market participants, and clarifies the research methodology underpinning our analysis. Decision-makers will find a cohesive synthesis that illuminates pathways to sustainable growth and competitive differentiation.

Charting the Technological and Operational Revolution in Precision Farming Software That is Redefining Productivity, Resilience, and Data-Driven Agribusiness Models

The convergence of Internet of Things devices, artificial intelligence, and cloud computing has ignited a transformation in precision farming software. Sensors embedded in soil and equipment continuously stream data that machine learning models analyze to forecast nutrient requirements and optimize water use. At the same time, expanded access to high-resolution satellite imagery and drone mapping has sharpened the focus on microfield management, creating opportunities to treat individual plots according to their unique environmental conditions.

Moreover, the proliferation of edge computing and 5G connectivity has accelerated the responsiveness of digital farming platforms. Automated systems now integrate robotic sprayers and autonomous tractors with centralized decision engines, enabling on-the-fly adjustments based on real-time crop stress indicators. This tight feedback loop enhances operational efficiency, reduces manual labor requirements, and improves environmental compliance through precise input application.

As a result, agribusiness models are shifting from product-centric offerings toward service-oriented engagements that bundle software subscriptions with consulting, implementation support, and predictive analytics. The rising demand for outcome-based contracts challenges traditional vendor relationships, compelling providers to invest in robust data security, interoperability frameworks, and user-centric interfaces. Such developments underscore the industry’s pivot from isolated tools to integrated, intelligent ecosystems that deliver measurable performance improvements.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Precision Farming Software Supply Chains, Implementation Costs, and Technology Adoption Dynamics

In early 2025, the United States expanded its tariff schedule to include a broader range of agricultural machinery and associated technology components, introducing new duties on imported sensors, GPS modules, and precision application hardware. This policy shift aims to bolster domestic manufacturing, yet it has ripple effects across the precision farming software landscape. Software providers that rely on integrated hardware packages face higher input costs, while end users grapple with increased total cost of ownership for turnkey solutions.

The tariff-induced cost pressures have prompted many vendors to reassess global supply chain strategies and localize critical component assembly. Some have renegotiated contracts with hardware suppliers or adopted modular hardware approaches that allow software licenses to be sold separately from physical devices. Nevertheless, small and medium-sized farms, which often lack the capital to absorb sudden price increases, have delayed implementation projects, creating uneven adoption rates across geographies and crop types.

To mitigate these challenges, leading software companies are forging partnerships with domestic equipment manufacturers and investing in scalable, cloud-native architectures that decouple software performance from hardware dependencies. Bundled service packages and financing options have also emerged as effective risk-sharing mechanisms, ensuring that growers can access precision tools with predictable budgeting. These adaptive strategies highlight the sector’s resilience and capacity to innovate in response to evolving trade policies.

Revealing Critical Insights from Application, Component, Deployment, Farm Size, and End-User Segmentation That Shape Adoption and Value Extraction in Precision Farming Software

Understanding usage patterns across different applications reveals valuable distinctions in how precision farming software delivers value on the ground. Crop scouting modules are increasingly equipped with machine vision algorithms that identify early signs of nutrient deficiency or pest infestation, whereas farm management systems provide holistic dashboards for tracking labor, input inventories, and equipment maintenance schedules. Fertilizer management and variable rate application tools collaborate to ensure nutrients are delivered precisely where needed, while irrigation management software integrates weather forecasting and soil moisture data to optimize water usage. Similarly, yield monitoring systems, when combined with pest and disease management applications, create a comprehensive framework for continuous performance improvement.

Examining the underlying software and service component mix shows that many enterprises prefer subscription-based offerings that include consulting, implementation support, and ongoing maintenance. Desktop platforms continue to serve as the backbone for in-depth analysis, but mobile and web interfaces are accelerating field-level decision support. Cloud-based deployment remains dominant due to its scalability and ease of updates, yet certain organizations favor on-premise installations to meet stringent data sovereignty or cybersecurity requirements.

Farm size and end-user profiles further influence deployment choices and functionality requirements. Large operations often adopt full suites of modules with advanced analytics, while medium-sized farms balance a core set of features against budget constraints and seek intuitive interfaces to minimize training needs. Small farms tend to prioritize cost-effective weather forecasting and field mapping tools. Among end users, grain growers leverage yield monitoring and variable rate application to maximize hectarage efficiency, fruit and vegetable producers emphasize pest detection and fertilizer management, and livestock farmers integrate software to manage forage crops, pasture rotation, and feed optimization.

This comprehensive research report categorizes the Precision Farming Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Farm Size

- Application

- End User

Mapping Distinct Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific That Drive Divergent Adoption Patterns in Precision Farming Software

Regional contexts play a defining role in shaping precision farming software adoption trends across the Americas. In North America, widespread broadband access and supportive government incentives have driven extensive deployments of cloud-native platforms, mobile data collection tools, and precision hardware integrations. Latin American markets, while growing rapidly, continue to face bandwidth constraints in rural areas, leading solution providers to prioritize offline-capable interfaces and hybrid deployment architectures that sync data when connectivity is restored.

Across Europe, the Middle East, and Africa, a diverse regulatory environment and varied agricultural practices present both challenges and opportunities. European Union policy incentives for sustainable farming bolster uptake of pesticide reduction and soil health monitoring modules, whereas Middle Eastern producers focus on arid-land irrigation management and water-use analytics. In sub-Saharan Africa, pilot projects led by development agencies are introducing cost-effective precision tools tailored to smallholder farmers who require minimal technical overhead.

In the Asia-Pacific region, the convergence of large-scale row crop agriculture and smallholder tea, rice, and vegetable production has spurred differentiated offerings. Australia’s broadacre grain sector adopts full-suite precision systems with advanced drone-based scouting, while Southeast Asian rice paddies leverage sensor networks and flood forecasting analytics. Rapid smartphone penetration is enabling scalable, mobile-first solutions that bridge technology gaps, particularly in regions where traditional desktop environments remain less prevalent.

This comprehensive research report examines key regions that drive the evolution of the Precision Farming Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning, Partnership Initiatives, and Innovation Trajectories of Leading Software Providers in the Precision Farming Ecosystem

Leading providers in the precision farming software space are forging competitive edges through strategic partnerships, acquisitions, and relentless investment in research and development. Prominent multinational equipment manufacturers have integrated proprietary analytics engines into on-board consoles, creating seamless hardware-software ecosystems. Meanwhile, specialist software firms differentiate through advanced AI capabilities, open-architecture platforms that encourage third-party integrations, and a focus on user experience design to reduce barriers to entry for less-tech-savvy farm operators.

Several key players have pursued targeted acquisitions of niche analytics startups to enhance their disease-prediction modules or drone-based imaging services. In parallel, alliances with telecommunications companies are supporting field-wide sensor networks, while collaborations with agronomic research institutes are validating novel algorithms under real-world conditions. These strategic moves underscore an industry trajectory toward greater interoperability, standardized data schemas, and ecosystem-wide value chains.

Emerging entrants are also shaping competitive dynamics through business models that emphasize outcome-based pricing, where software fees correlate directly with realized yield improvements or input reductions. This shift challenges traditional per-acre or per-license fee structures and aligns vendor incentives with those of growers. Collectively, these developments illustrate a maturing market where innovation velocity and customer-centric service models will define long-term leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precision Farming Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- AgJunction Inc.

- Bayer AG

- Climate LLC

- CNH Industrial N.V.

- Conservis Corporation

- CropX Inc.

- Deere & Company

- Farmers Edge Inc.

- Gamaya SA

- GeoPard Ag

- Granular, Inc.

- Hexagon AB

- Proagrica Limited

- Raven Industries, Inc.

- SST Software

- Topcon Corporation

- Trimble Inc.

- Xarvio Digital Farming Solutions

Charting Pragmatic and Strategic Recommendations That Industry Leaders Can Implement Immediately to Enhance Market Reach, Product Differentiation, and Sustainable Growth in Precision Farming Software

To thrive in a market characterized by rapid technological evolution, providers should prioritize the integration of advanced analytics, such as predictive machine learning models that leverage historical and real-time data streams. Building modular architectures that allow customers to add or remove application-specific capabilities reduces friction during pilot phases and fosters incremental adoption. Furthermore, investing in intuitive user interfaces and mobile-native experiences ensures that both field technicians and executive teams gain immediate value without intensive training.

Strategically, industry leaders can expand market reach through alliances with regional agricultural cooperatives and equipment manufacturers. Co-developing certification programs for agronomy consultants and leveraging outcome-based pricing models can align vendor offerings with grower performance metrics. Additionally, addressing the evolving tariff landscape requires diversification of manufacturing and assembly locations, as well as the development of hardware-agnostic software suites that maintain functionality regardless of sensor or device origin.

Operationally, decision-makers should implement robust data governance frameworks to safeguard sensitive agronomic information, ensure compliance with emerging privacy regulations, and build customer trust. Providing tiered service packages that combine self-service analytics with expert consulting and support enhances long-term retention. Finally, continuous feedback loops between R&D teams and end users will illuminate feature gaps and drive iterative improvements, cementing a competitive advantage in this dynamic landscape.

Detailing the Comprehensive Research Framework, Data Collection Approaches, and Analytical Techniques Employed to Ensure Rigorous Insights in Precision Farming Software Analysis

Our research methodology integrates both qualitative and quantitative approaches to deliver a comprehensive analysis of the precision farming software market. Initial data collection involved in-depth interviews with agronomists, farm managers, and technology providers, ensuring that user experiences and functional requirements formed the backbone of our assessment. Concurrently, a systematic review of peer-reviewed academic studies, industry white papers, and government regulatory documents provided secondary insights that complemented primary observations.

Quantitative analysis was performed on usage statistics aggregated from leading software platforms, anonymized deployment case studies, and publicly available import-export records for relevant hardware components. We applied triangulation techniques to reconcile discrepancies between data sources, cross-validating software utilization trends against on-farm yield improvements, input cost savings, and field-level sensor performance benchmarks.

To uphold research integrity, all data underwent rigorous quality control processes, including consistency checks, outlier detection, and peer verification by subject matter experts. Limitations were cataloged transparently, with contextual notes on regional disparities in data availability and potential variances stemming from rapidly evolving technology standards. This structured approach ensures that our insights are both actionable and grounded in verifiable evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precision Farming Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precision Farming Software Market, by Component

- Precision Farming Software Market, by Deployment Mode

- Precision Farming Software Market, by Farm Size

- Precision Farming Software Market, by Application

- Precision Farming Software Market, by End User

- Precision Farming Software Market, by Region

- Precision Farming Software Market, by Group

- Precision Farming Software Market, by Country

- United States Precision Farming Software Market

- China Precision Farming Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing the Key Findings and Strategic Imperatives to Underline the Transformative Potential of Precision Farming Software Across Global Agricultural Value Chains

This executive summary has highlighted the main drivers reshaping the precision farming software landscape, including advances in artificial intelligence, sensor networks, and edge computing. We have examined how policy levers, such as 2025 tariff adjustments, influence cost structures and supply chain configurations. Furthermore, key segmentation insights reveal that application-specific modules-from crop scouting to yield monitoring-are tailored to distinct farm sizes and end-user needs, informing targeted go-to-market strategies.

Regional dynamics underscore that broadband infrastructure, regulatory incentives, and crop profiles lead to diverse adoption patterns across the Americas, EMEA, and Asia-Pacific. Meanwhile, leading software providers are responding with collaborative ecosystems, strategic acquisitions, and outcome-based business models to meet the nuanced demands of global agribusinesses. The resulting competitive environment rewards vendors that can deliver interoperability, user-centric design, and measurable ROI.

By synthesizing these findings, decision-makers can prioritize investments in modular, scalable platforms that align with evolving tariff landscapes and regional requirements. The combination of robust data governance, adaptive deployment options, and collaborative partnerships positions organizations to harness the full potential of precision farming software. Ultimately, the transformative impact of these solutions offers a pathway to enhanced sustainability, profitability, and resilience within modern agriculture.

Partner with Ketan Rohom to Secure Comprehensive Precision Farming Software Insights and Drive Informed Agribusiness Decisions That Catalyze Growth and Innovation

To obtain the full market research report on precision farming software and gain deep, actionable insights, reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing. He can guide you through the detailed findings, answer any specific questions about methodology or regional nuances, and help tailor a solution that aligns with your strategic objectives.

Securing access to this comprehensive analysis will empower your organization to stay ahead of emerging trends, navigate tariff impacts, and capitalize on segmentation and regional opportunities. Contact Ketan Rohom today to learn more about subscription options, customized dashboards, and the consultative support designed to accelerate your adoption of precision farming software solutions.

- How big is the Precision Farming Software Market?

- What is the Precision Farming Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?