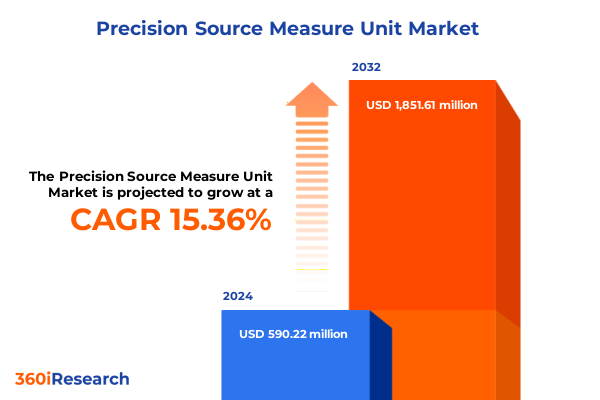

The Precision Source Measure Unit Market size was estimated at USD 673.01 million in 2025 and expected to reach USD 772.37 million in 2026, at a CAGR of 15.55% to reach USD 1,851.61 million by 2032.

Unveiling the Evolving Landscape of Precision Source Measure Units That Power Modern Technological Breakthroughs Across Aerospace, Automotive, and Semiconductor

The accelerating pace of technological innovation has elevated the precision source measure unit into a foundational instrument for industries demanding exacting control over electrical parameters. As development cycles shorten and complexity rises, the ability to source and measure voltage and current with sub-microamp accuracy is imperative for validating next-generation devices. This report opens by contextualizing the precision source measure unit not merely as a test instrument, but as a strategic enabler that underpins product reliability, safety, and regulatory compliance. It establishes the device’s role at the nexus of design verification, quality assurance, and production throughput, setting the stage for a deeper exploration of its transformative potential.

Within the aerospace sector, highly specialized avionics modules and satellite communication systems depend on rigorous testing protocols to ensure mission-critical performance. Meanwhile, the automotive industry has rapidly adopted electric powertrains, making battery characterization and power electronics evaluation integral to vehicle safety and efficiency workflows. In parallel, the semiconductor realm has witnessed a proliferation of advanced chip architectures and wafer-scale processes, intensifying the need for precise characterization at component and wafer levels. By tracing these industry-specific drivers, the report paints a comprehensive picture of how precision source measure units serve as the linchpin in innovation.

Moreover, the contemporary landscape is shaped by global digitalization trends, the drive for sustainable energy solutions, and increasingly stringent regulatory frameworks. Organizations now require test solutions that can accommodate diverse measurement scenarios without sacrificing accuracy or repeatability. Through this introduction, the report frames the precision source measure unit as not only a technical necessity, but also a strategic asset that accelerates time to market, mitigates risk, and underpins the next wave of technological breakthroughs.

Charting the Transformative Advances Redefining Precision Source Measure Unit Performance and Integration in Emerging High-Tech Applications

In recent years, the precision source measure unit has undergone a paradigm shift driven by convergent forces in miniaturization, software integration, and connectivity. Technological advances now permit modular architectures that support multi-channel configurations, enabling simultaneous sourcing and measurement across several channels. This evolution addresses the growing complexity of high-density test setups and reduces total cost of test by consolidating multiple instruments into a unified platform.

Furthermore, the infusion of smart instrumentation capabilities-such as embedded analytics, remote calibration, and cloud-enabled data management-has transformed the source measure unit into a networked node within the broader Internet of Test infrastructure. This connectivity empowers remote diagnostics, predictive maintenance, and rapid firmware updates, thereby enhancing uptime and facilitating continuous improvement cycles. As a result, engineers can iterate more rapidly, responding to design permutations and production anomalies with greater agility.

Transitional shifts in user expectations have also redefined performance thresholds. There is a growing demand for higher accuracy classes to support emerging applications like quantum computing and advanced wireless communications, where even minute deviations in voltage or current can compromise system integrity. Concurrently, sustainability imperatives have catalyzed the development of more energy-efficient units that reduce power consumption without sacrificing measurement fidelity. Consequently, the modern precision source measure unit stands at the crossroads of modularity, intelligence, and eco-friendly design, driving a transformative wave across the testing landscape.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on the Supply Chain Dynamics of Precision Source Measure Units

The introduction of new tariff structures in the United States in early 2025 has had a cascading impact on the global precision source measure unit ecosystem. Imposed duties on critical electronic components and finished test equipment have elevated landed costs, creating pressure on procurement budgets and prompting manufacturers to revisit supply chain strategies. In response, several original equipment manufacturers have relocated certain production and assembly processes to regions outside the tariff scope, seeking to minimize additional import levies.

At the same time, domestic tariff relief programs and targeted incentives have emerged as countermeasures to sustain local manufacturing competitiveness. Incentive frameworks supporting onshore production of specialized electronic modules have spurred a modest resurgence in domestic assembly operations. Nonetheless, the need to access high-grade semiconductor devices and precision analog components-many of which remain concentrated in East Asia-continues to expose supply chains to tariff-induced volatility. As companies grapple with these externalities, volume commitments and contractual renegotiations have become commonplace, reflecting an industry-wide recalibration of procurement strategies.

Looking ahead, the interplay between tariff policies and technology roadmaps will shape investment decisions regarding test infrastructure modernization. Companies are evaluating hybrid models that combine in-country production for key subassemblies with offshore sourcing for commodity elements, thereby hedging against future tariff shifts. The cumulative impact of 2025’s tariff regime underscores the imperative for agile supply chain architectures that balance cost, quality, and geopolitical risk, laying the groundwork for sustainable growth in precision measurement capabilities.

Decoding Market Segmentation Dynamics to Reveal Strategic Opportunities Across Products, End Use Industries, and Distribution Channels

A thorough examination of market segmentation reveals distinct avenues for strategic differentiation and targeted investment. When analyzing end use industry breakdowns, aerospace requirements for avionics and satellite systems drive demand for ultra-high stability and low-noise measurements, whereas the automotive sector shows bifurcated needs between electric vehicle battery testing-encompassing both EV and hybrid battery chemistries-and power electronics validation. Within semiconductor manufacturing, the focus on chip characterization and wafer test unfolds across RF and power testing modalities, each demanding specific performance attributes tied to frequency range, dynamic range, and throughput.

Turning to product types, alternating current source measure units continue to serve specialized test benches that require simulation of complex power line behaviors, while direct current variants demonstrate versatility through multi-channel designs-available in two-channel and four-channel configurations-and single-channel units optimized for either high power or low power applications. This granular breakdown underscores the importance of modular scalability and channel density in addressing evolving test requirements.

Accuracy class segmentation further stratifies the market into instruments certified to meet stringent 0.01 and 0.02 percent accuracy thresholds, catering to high-precision laboratory settings and demanding production environments alike. Distribution channels also merit careful consideration: direct sales relationships facilitate deep customer engagement and customization, distributors-both local and international-enhance market reach, and online platforms including manufacturer websites and third-party portals provide convenient access and flexible procurement options. Altogether, these segmentation insights inform targeted go-to-market approaches and product roadmaps that align with customer priorities.

This comprehensive research report categorizes the Precision Source Measure Unit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Accuracy Class

- End Use Industry

- Sales Channel

Comparative Regional Perspectives Highlighting Distinct Drivers and Challenges in the Americas, EMEA, and Asia-Pacific Precision Source Measure Markets

Regional market trajectories exhibit unique drivers and constraints that are shaping the adoption of precision source measure units worldwide. In the Americas, demand is underpinned by robust aerospace manufacturing clusters, an expanding electric vehicle ecosystem, and government-led initiatives to reshore critical electronics production. As a result, North American test labs and production facilities increasingly prioritize investments in flexible, multi-channel equipment that can support rapid design verification cycles and high-volume throughput.

Meanwhile, the Europe, Middle East & Africa region is characterized by stringent regulatory directives around sustainability and emissions compliance, driving demand for high-accuracy testing in the automotive and renewable energy sectors. European integrators often select locally produced instrumentation to satisfy content requirements, while Middle East markets exhibit growing demand driven by satellite communications infrastructure and emerging defense programs. In Africa, nascent industrial technology adoption still relies on tiered distribution networks that blend direct sales with regional distributors to address logistical challenges.

In Asia-Pacific, the convergence of advanced semiconductor manufacturing hubs, expansive consumer electronics production, and rapid electrification of transport networks fuels a voracious appetite for precision test equipment. Manufacturers in East Asia lead in high-volume production of core test modules, whereas Southeast Asian nations are emerging as service centers and assembly bases. As regional ecosystems mature, local OEMs demand integrated solutions that couple source measure functionality with automated test platforms, reinforcing the Asia-Pacific region’s position as both a manufacturing powerhouse and an innovation incubator.

This comprehensive research report examines key regions that drive the evolution of the Precision Source Measure Unit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Imperatives and Competitive Positioning of Leading Manufacturers in the Precision Source Measure Unit Sector

Leading instrument manufacturers have adopted diverse strategic postures to solidify their positions in the precision source measure unit space. Some companies focus on vertical integration, developing proprietary semiconductor front ends and embedding advanced calibration algorithms that deliver unmatched accuracy and error correction. These players often emphasize full-system solutions that integrate source measure capabilities with power supplies, load modules, and IoT-enabled analytics platforms.

Other firms pursue a modular approach, offering a portfolio of channel expansion cards and software-defined measurement suites that allow customers to optimize channel counts and performance specifications on demand. Their go-to-market strategies hinge on ecosystem partnerships, collaborating with automated test equipment providers and software vendors to deliver turn-key test cells tailored to specific industry requirements.

In addition, a subset of companies specializes in high-end niche segments-such as quantum device characterization or RF amplifier testing-where they leverage deep expertise in low-noise design and high-frequency precision. These niche leaders maintain close ties with research institutions and consortia, often co-developing customized instruments that push the boundaries of measurement science.

Across all these approaches, strategic imperatives converge around innovation velocity, customer-centric customization, and service excellence. By analyzing product roadmaps, patent filings, and strategic alliances, stakeholders can discern how each leading manufacturer is positioning itself to capture emerging opportunities and mitigate competitive pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precision Source Measure Unit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquisys

- Advantest Corporation

- Aim and Thurlby Thandar Instruments

- AMETEK, Inc.

- Amplicon Liveline Ltd.

- Artisan Technology Group

- B&K Precision Corporation

- Chroma ATE Inc.

- Dan-el Technologies LTD.

- Good Will Instrument Co., Ltd.

- ITECH ELECTRONIC CO., LTD.

- Keithley Instruments, LLC

- Keysight Technologies, Inc.

- Marvin Test Solutions, Inc.

- National Instruments Corporation

- Rohde & Schwarz GmbH & Co. KG

- Tektronix, Inc.

- YOKOGAWA Electric Corporation

Formulating Strategic Priorities and Tactical Roadmaps to Navigate Disruption and Drive Growth in Precision Source Measure Unit Adoption

To maintain a competitive edge, industry leaders must prioritize modular platform strategies that accommodate evolving test requirements and minimize capital expenditures on redundant instrumentation. By investing in scalable architectures-enabling seamless addition or removal of channels-organizations can align equipment capabilities with project-specific needs while preserving budgetary flexibility. Moreover, integrating smart analytics and predictive maintenance functions will ensure peak operational availability and reduce total cost of ownership over the long term.

In parallel, strengthening supply chain resilience through diversified sourcing and localized assembly can safeguard against geopolitical risks and tariff fluctuations. Executives should explore strategic partnerships with regional distributors and contract manufacturers to establish nearshore production nodes, thereby optimizing lead times and controlling input costs. Collaborative risk-sharing agreements and vendor-managed inventory programs can further enhance procurement agility.

Leaders must also develop targeted go-to-market frameworks informed by segmentation insights. Customizing value propositions for aerospace, automotive battery testing, and semiconductor wafer test-each with distinct performance and accuracy demands-will resonate more effectively with end users. Additionally, deploying omnichannel sales models that blend direct engagement with robust digital platforms can capture emerging customer segments and streamline ordering workflows.

Finally, forging innovation alliances with research institutions and standards bodies will keep organizations at the forefront of accuracy class advancements and test protocol developments. Such proactive collaboration drives joint roadmaps, shapes regulatory guidelines, and cultivates a talent pipeline equipped to tackle future measurement challenges.

Exploring Robust Multi-Source Research Frameworks That Underpin the Credibility of Precision Source Measure Unit Market Analysis

This analysis is grounded in a rigorous, multi-faceted research framework that synthesizes primary interviews, secondary literature review, and competitive benchmarking. Primary data was collected through structured dialogues with senior engineers, procurement leaders, and research scientists across aerospace, automotive, and semiconductor sectors, ensuring first-hand insights into emerging test requirements and decision criteria.

Secondary sources encompassed technical white papers, regulatory filings, equipment certification standards, and peer-reviewed articles that elucidate advancements in measurement science and instrument design. These references were meticulously vetted to validate performance benchmarks, accuracy class distinctions, and reliability metrics. Competitive intelligence was then triangulated through patents analysis, product datasheet comparisons, and channel performance evaluations, providing a holistic view of market positioning and innovation trajectories.

Quantitative findings were complemented by scenario-based modeling to assess supply chain sensitivities, tariff impact simulations, and adoption rate projections for multi-channel versus single-channel units. Regional dynamics were examined through trade flow data, distribution channel mapping, and policy impact assessments. Throughout the process, a cross-functional review team ensured methodological robustness and mitigated potential biases by applying peer review protocols and data quality checks.

This comprehensive approach underpins confidence in the report’s conclusions, offering stakeholders a transparent and replicable research foundation for strategic decision-making in the precision source measure unit domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precision Source Measure Unit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precision Source Measure Unit Market, by Product Type

- Precision Source Measure Unit Market, by Accuracy Class

- Precision Source Measure Unit Market, by End Use Industry

- Precision Source Measure Unit Market, by Sales Channel

- Precision Source Measure Unit Market, by Region

- Precision Source Measure Unit Market, by Group

- Precision Source Measure Unit Market, by Country

- United States Precision Source Measure Unit Market

- China Precision Source Measure Unit Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate the Path Forward for Stakeholders in the Precision Source Measure Unit Ecosystem

The examination of technological evolution, tariff dynamics, segmentation patterns, regional nuances, and corporate strategies paints a complex yet coherent narrative of the precision source measure unit landscape. Stakeholders must recognize the transformative potential of modular, intelligent instrumentation in addressing both current testing challenges and future application frontiers. The interplay of regulatory pressures, sustainability imperatives, and digital convergence demands an adaptive approach to product development and distribution.

Critical takeaways underscore the importance of leveraging advanced accuracy classes to unlock new domains such as quantum device testing and next-generation wireless systems. At the same time, the differential impacts of 2025 tariffs highlight the necessity of agile supply chain configurations and localized production capabilities. Regionally tailored strategies-reflecting the Americas’ aerospace resurgence, EMEA’s regulatory rigor, and Asia-Pacific’s manufacturing scale-further illustrate how market leaders can capture value by aligning offerings with distinct end market drivers.

Moreover, the competitive landscape reveals diverse strategic postures, from vertically integrated full-system suppliers to modular innovators and niche specialists. This variety underscores the availability of multiple pathways to differentiation, each with its own implications for R&D investment, partnership ecosystems, and customer engagement models.

In conclusion, a strategically orchestrated blend of technological excellence, supply chain agility, and customer-centric sales frameworks will define winners in the evolving precision source measure unit market. This synthesis serves as a compass for stakeholders aiming to chart their course through a dynamic and high-stakes environment.

Connect with Ketan Rohom to Unlock Comprehensive Insights and Secure Your Access to the Pivotal Precision Source Measure Unit Market Report

Engaging directly with Ketan Rohom offers decision-makers an exclusive avenue to harness in-depth intelligence and secure a competitive advantage. By reaching out to the Associate Director, Sales & Marketing, stakeholders can obtain a tailored discussion that addresses unique organizational priorities, enabling them to align technological roadmaps with real-world market developments. In this collaborative interaction, Ketan will guide clients through the comprehensive landscape of precision source measure unit insights, clarify any outstanding questions, and facilitate immediate access to the full market research report. This personalized engagement ensures that executives and procurement leaders alike gain actionable clarity on supply chain intricacies, segment nuances, and regional dynamics. By initiating this dialogue today, organizations can expedite informed procurement strategies, optimize vendor partnerships, and anticipate emerging market inflection points with unparalleled confidence.

- How big is the Precision Source Measure Unit Market?

- What is the Precision Source Measure Unit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?