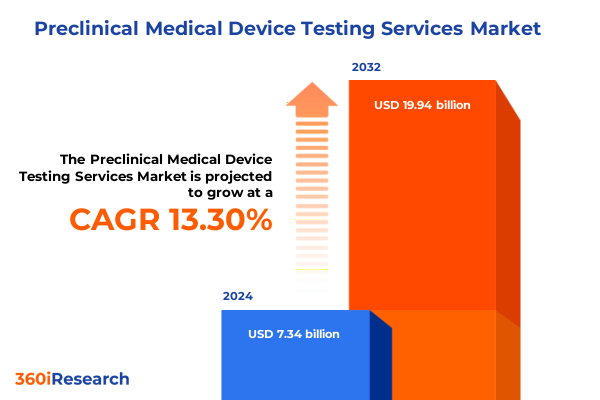

The Preclinical Medical Device Testing Services Market size was estimated at USD 3.86 billion in 2025 and expected to reach USD 4.25 billion in 2026, at a CAGR of 10.33% to reach USD 7.69 billion by 2032.

Navigating the Future of Preclinical Medical Device Testing with Insightful Analysis of Regulatory, Technological, and Stakeholder Imperatives

The preclinical medical device testing landscape has evolved into a complex arena where regulatory rigor, technological advancements, and stakeholder expectations intersect. Introduction to this intricate domain is essential for understanding how safety, efficacy, and performance assessments underpin the successful transition from concept to clinical application. In recent years, heightened scrutiny from regulatory authorities has elevated the importance of standardized testing protocols, while advancements in imaging, in vitro platforms, and animal modeling have expanded the analytical toolkit available to researchers and manufacturers.

Moreover, the introduction of novel biocompatibility assays, high-resolution imaging modalities, and advanced mechanical stress simulations has transformed the foundational stages of device development. These advancements are complemented by growing collaborations between device manufacturers, contract research organizations, and academic research institutes, creating an environment that fosters innovation yet demands rigorous adherence to evolving standards. By exploring the interplay between technological innovation and regulatory compliance, this section lays the groundwork for a broader discussion of the market’s defining shifts and strategic considerations.

Examining the Driving Forces Behind Preclinical Testing Evolution Highlighting Digital Innovations, Animal Models Advancements and Collaborations Redefining Standards

Several transformative shifts are redefining the contours of preclinical medical device testing, reshaping protocols and stakeholder priorities alike. First, the integration of digital technologies and artificial intelligence into imaging and data analysis is streamlining the identification of safety signals and device performance characteristics. Advances in machine learning algorithms now enable real-time interpretation of high-volume imaging datasets from CT, MRI, and ultrasound, enhancing predictive accuracy and shortening development timelines.

Concurrently, the evolution of in vitro models, such as tissue engineering platforms and complex cellular assays, is reducing dependency on animal testing while offering more human-relevant insights into device biocompatibility. In parallel, ethical and regulatory pressures are driving a more nuanced approach to animal model utilization, favoring refinement and reduction strategies. Collaborative networks between contract research providers, universities, and OEMs are further accelerating protocol standardization, ensuring that best practices in biocompatibility, mechanical fatigue, and functional testing become universally adopted.

Assessing the Cascading Effects of United States 2025 Tariff Policies on Supply Chains, Cost Structures, and Strategic Sourcing in Preclinical Device Evaluations

The cumulative impact of United States tariff policies introduced in 2025 has created a ripple effect across the preclinical testing value chain. Tariffs targeting specialized testing equipment and raw materials sourced from major manufacturing hubs have led to heightened cost structures for imaging components, reagents used in cytotoxicity assays, and precision instruments employed in tensile and fatigue testing. Consequently, organizations have been compelled to reassess supplier agreements and consider alternative sourcing strategies to mitigate cost pressures.

In addition, the tariff-induced supply chain disruptions have magnified lead-time uncertainties, particularly for advanced imaging services reliant on imported hardware. As a result, contract research organizations and medical device manufacturers are increasingly diversifying vendor portfolios, investing in local fabrication capabilities, and exploring strategic partnerships with domestic equipment producers. These adaptations underscore the necessity of resilient supply chain frameworks and reinforce the need for proactive tariff risk assessments during project planning stages.

Uncovering Crucial Segmentation Insights Revealing How Testing Techniques, Device Categories, End Users, Animal Models, and Applications Shape Market Dynamics

An in-depth examination of key segmentation dimensions reveals how preclinical testing techniques and device categories underpin the service landscape. Testing techniques span from detailed biocompatibility assays such as cytotoxicity, irritation, and sensitization to advanced imaging services including CT, MRI, and ultrasound. These modalities are complemented by in vitro testing performed on cellular assay platforms and tissue-engineered constructs, as well as in vivo evaluations conducted on rodent models like mice and rats alongside larger non-rodent models including dogs, pigs, primates, and rabbits. Mechanical testing regimes ranging from compression and tensile testing to rigorous fatigue protocols further deliver critical insights into device durability under simulated physiological conditions.

Parallel to methodological diversity, the device category segmentation spotlights specialized requirements across cardiovascular implants such as heart valves and stents, dental devices encompassing implants and orthodontic systems, neurological monitoring and neurostimulator platforms, ophthalmic solutions including intraocular lenses and laser-based treatments, and orthopedic constructs featuring both implantable hardware and prosthetic devices. Importantly, the end user dimension adds layers of complexity, reflecting distinct needs from academic research institutes and universities to full-service and niche contract research providers, research-focused and teaching hospitals, global OEMs alongside smaller medical device manufacturers, and big pharmaceutical concerns paired with innovative biotech firms. Coupled with the application-based focus on functional, performance, and safety testing-spanning electrical and mechanical functionality evaluations, fatigue performance and wear assessments, and cytotoxicity, hemocompatibility, and toxicity testing-the segmentation matrix provides a holistic view of service demand drivers across this multifaceted sector.

This comprehensive research report categorizes the Preclinical Medical Device Testing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Device Category

- Outsourcing Model

- Animal Model Type

- Application

- End-User

Delineating Key Regional Trends Across Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Geographical Drivers Influencing Preclinical Testing Investments

Regional dynamics exert a profound influence on preclinical testing priorities and investment patterns. In the Americas, advanced research infrastructure and strong collaboration between medical device manufacturers and contract research providers drive a robust emphasis on imaging services, mechanical validation studies, and in vivo modeling. The presence of research-focused hospitals and leading academic institutes accelerates the adoption of next-generation in vitro platforms and refined biocompatibility protocols.

Within Europe, the Middle East & Africa region, stringent regulatory frameworks paired with diverse research capacities shape a landscape where harmonized testing standards and ethical considerations around animal use are paramount. Investments in tissue engineering and cellular assays are on the rise, propelled by academia-industry partnerships across major European research hubs. At the same time, capacity-building initiatives in the Middle East and Africa are fostering the growth of localized contract research services, offering new avenues for collaborative testing programs.

The Asia-Pacific region stands out for its rapid infrastructure development, government-supported clinical research incentives, and burgeoning expertise in both small and large animal models. Innovative partnerships between regional universities, nascent biotech firms, and contract research organizations are accelerating the integration of performance and safety testing, particularly in markets with a high volume of orthopedic and cardiovascular device manufacturing. This mosaic of regional characteristics underscores the critical need for tailored service offerings aligned to local regulatory, ethical, and technological ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Preclinical Medical Device Testing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Industry Players Driving Innovation, Strategic Collaborations, and Competitive Differentiation within the Preclinical Medical Device Testing Ecosystem

Leading providers in preclinical medical device testing are distinguished by their strategic focus on technological differentiation, comprehensive service portfolios, and collaborative innovation models. Prominent CROs have expanded their offerings through strategic acquisitions of specialized imaging facilities and in vitro laboratories, enabling end-to-end solutions from biocompatibility assessment to complex mechanical fatigue testing. At the same time, equipment manufacturers are investing in modular testing platforms and AI-driven analytics, differentiating their value propositions through seamless integration of hardware, software, and data intelligence.

Innovation hubs embedded within academic research institutes are increasingly partnering with device developers to co-create next-generation assay platforms and refined animal models that offer enhanced predictive accuracy and ethical compliance. Furthermore, alliances between global OEMs and boutique testing laboratories are fostering the development of customized protocols, spanning cardiovascular and neurological device evaluations as well as advanced ophthalmic lens interactions. These collaborative models underscore the competitive imperative to excel not only in operational capabilities but also in cross-disciplinary knowledge exchange and regulatory expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Preclinical Medical Device Testing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGINKO Research AG

- Bureau Veritas S.A.

- Canyon Labs

- CERTANIA Holding GmbH

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- Gradient, Inc.

- ICON plc

- Inotiv, Inc.

- Intertek Group plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- Lahav CRO Ltd.

- Medistri SA

- Medpace Holdings, Inc.

- NAMSA, Inc.

- Pace Analytical Services, LLC

- Parexel International (MA) Corporation

- Pharmaron (Beijing) Co., Ltd.

- Porsolt SAS

- RQM+, Inc.

- SGS SA

- STEMart

- Sterigenics International LLC

- TÜV SÜD AG

- UL LLC

- Veeda Lifesciences

- Veranex, LLC

- WuXi AppTec Co., Ltd.

Articulating Actionable Recommendations for Industry Leaders to Optimize Preclinical Testing Strategies, Enhance Operational Excellence, and Strengthen Market Positioning

Industry leaders should prioritize strengthening supply chain resilience by diversifying supplier networks and engaging in strategic partnerships with domestic equipment manufacturers to mitigate tariff-induced disruptions. Investing in digital transformation strategies, including AI-driven imaging analytics and cloud-based data management, will be critical for accelerating study timelines and improving the reproducibility of preclinical evaluations.

Moreover, organizations must champion ethical and regulatory best practices by integrating alternative testing methodologies such as advanced in vitro platforms and refining animal model protocols to align with evolving guidelines. Proactively cultivating collaborations across academic, clinical, and industry stakeholders can unlock access to novel assay platforms and specialized expertise, enhancing both operational efficiency and scientific rigor. Finally, embedding actionable insights from segmentation and regional analyses into service development roadmaps will ensure that testing offerings remain aligned with device-specific and geographic requirements, maximizing relevance and competitive advantage.

Elucidating Rigorous Research Methodology Employed to Capture Market Intelligence, Validate Data Integrity, and Ensure Comprehensive Preclinical Testing Service Assessments

This report employs a multi-faceted research approach combining primary and secondary data collection techniques to ensure comprehensive coverage and data integrity. Primary research entailed in-depth interviews with key executives from contract research organizations, academic research institutes, medical device manufacturers, and pharmaceutical firms, providing qualitative insights into evolving service requirements and strategic priorities.

Secondary research incorporated an extensive review of published regulations, peer-reviewed scientific literature, industry white papers, and proprietary technology briefs to map regulatory developments, technological innovations, and supply chain dynamics. Detailed segmentation frameworks were validated through iterative consultations with subject matter experts, ensuring that classification criteria across testing techniques, device categories, end users, animal models, and applications accurately capture market realities. Data triangulation methodologies were applied throughout to reconcile divergent inputs and reinforce the robustness of the findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Preclinical Medical Device Testing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Preclinical Medical Device Testing Services Market, by Service Type

- Preclinical Medical Device Testing Services Market, by Device Category

- Preclinical Medical Device Testing Services Market, by Outsourcing Model

- Preclinical Medical Device Testing Services Market, by Animal Model Type

- Preclinical Medical Device Testing Services Market, by Application

- Preclinical Medical Device Testing Services Market, by End-User

- Preclinical Medical Device Testing Services Market, by Region

- Preclinical Medical Device Testing Services Market, by Group

- Preclinical Medical Device Testing Services Market, by Country

- United States Preclinical Medical Device Testing Services Market

- China Preclinical Medical Device Testing Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Summarizing the Convergence of Regulatory, Technological, and Market Forces Shaping the Preclinical Medical Device Testing Industry and Future Adoption Trajectories

In summary, the preclinical medical device testing domain is being reshaped by a confluence of regulatory tightening, technological innovations, and shifting supply chain parameters. Advanced imaging modalities, AI-powered data analytics, and alternative in vitro platforms are redefining the benchmarks for biocompatibility, performance, and safety evaluations. At the same time, tariff-driven cost pressures and regional regulatory heterogeneity underscore the imperative for resilient sourcing strategies and geographically attuned service offerings.

As industry leaders navigate this multifaceted landscape, the integration of segmentation insights and actionable recommendations will be key to unlocking operational efficiencies and maintaining competitive differentiation. The convergence of collaborative research models, ethical testing protocols, and cutting-edge technologies points toward a future where preclinical evaluations not only safeguard patient safety but also accelerate the pace of device innovation. By embracing these trends and embedding data-driven strategies into organizational roadmaps, stakeholders can confidently chart a path toward sustained growth and scientific excellence.

Engaging with Associate Director, Sales & Marketing to Acquire Comprehensive Preclinical Testing Insights and Propel Strategic Decision-Making with Expert Guidance

If you are seeking a deep dive into the complexities of preclinical medical device testing and wish to empower your organization with data-driven strategies, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at our firm. Ketan can guide you through the comprehensive report, answer any queries regarding the methodologies and insights presented, and facilitate tailored solutions that align with your strategic objectives. His expertise in sales and marketing for specialized market intelligence ensures that you will gain actionable findings applicable to your investment, development, and partnership decisions.

- How big is the Preclinical Medical Device Testing Services Market?

- What is the Preclinical Medical Device Testing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?