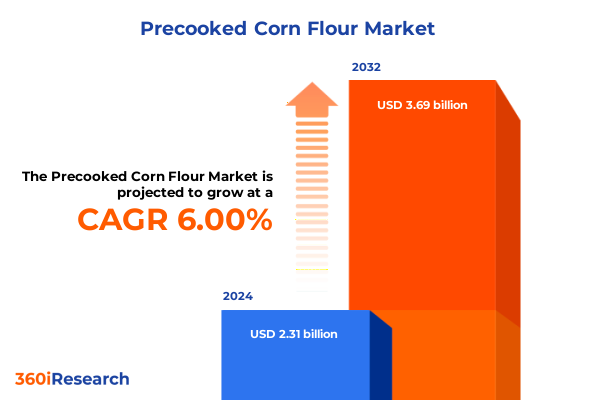

The Precooked Corn Flour Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.59 billion in 2026, at a CAGR of 6.05% to reach USD 3.69 billion by 2032.

Unveiling Strategic Importance and Rising Demand of Precooked Corn Flour Amid Evolving Consumer Preferences and Rapid Industry Innovations Across Global Markets

The origin of precooked corn flour dates back centuries and has long anchored traditional cuisines across the Americas, serving as the foundation for staples such as tortillas, tamales, and arepas. As the global food industry evolves, this versatile ingredient has transcended its cultural roots and emerged as a critical component in an array of modern applications spanning bakery, snacks, and convenient ready-to-cook and ready-to-eat products. The shift from small-scale nixtamalization practices to large-scale industrial production has enabled manufacturers to deliver consistent, fortified flour with extended shelf life, meeting the accelerating demand for convenient meal solutions in urban centers worldwide.

In recent years, health-conscious consumers have gravitated toward gluten-free alternatives, propelling precooked corn flour into the spotlight as a nutritious option rich in fiber and free from wheat-based proteins. As gluten-related disorders grow in public awareness and the broader population embraces plant-based diets, the flour’s low-gluten profile and fortification with essential vitamins and minerals have become powerful differentiators in retail and foodservice channels. Moreover, the urbanization trend-where more than half of the world’s population resides in cities and is projected to rise to nearly 68% by 2050-has further underscored the need for quick and dependable ingredients that streamline production processes for manufacturers and kitchens alike.

Exploring Transformative Shifts Reshaping the Precooked Corn Flour Landscape Through Technological Advances, Consumer Behavior Changes, and Supply Chain Modernization

The precooked corn flour landscape is undergoing a significant transformation driven by a convergence of technological advancements, evolving consumer expectations, and shifting supply chain paradigms. On the manufacturing front, automation and precision milling technologies are enabling producers to fine-tune granulation, optimize nutrient retention, and enhance product consistency across batches. This level of process control not only elevates the quality of bakery goods, extruded snacks, and tortilla products but also reduces waste and operational costs, fostering greater competitiveness.

Simultaneously, digital platforms and e-commerce channels have revolutionized distribution, offering both industrial buyers and end consumers seamless access to diverse product portfolios. Companies are leveraging data analytics to anticipate demand patterns, adjust production schedules, and manage inventory in real time, ensuring that supply aligns with dynamic market needs. Hand in hand with these logistical innovations is the sustainability imperative; producers are increasingly adopting non-GMO and organic certifications, investing in traceable sourcing of corn feedstock, and utilizing renewable energy to lower their carbon footprints. These combined developments are reshaping the competitive dynamics of the precooked corn flour market, compelling both established and emerging players to recalibrate strategies to stay ahead.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on the Precooked Corn Flour Industry’s Cost Structures, Supply Chains, and Competitive Dynamics

In 2025, a cascade of tariff measures imposed by the United States and its trading partners has exerted unprecedented pressure on the precooked corn flour industry’s cost structure and trade flows. Early in the year, a new wave of U.S. duties on agricultural imports valued at over $38 billion introduced input cost increases ranging from 7 to 12 percent for domestic producers, as processors scrambled to mitigate margin erosion under tighter trade policies. Concurrently, the European Union enacted a 25 percent counter-tariff on U.S. corn imports, aiming to counteract American steel and aluminum duties; this shift has prompted European buyers to pivot toward alternative feed grains from Ukraine and Brazil, further constricting export opportunities.

Beyond the bilateral measures, retaliatory tariffs from Canada and China have compounded the strain. Canada’s 25 percent levy on $20 billion of U.S. goods, including key agricultural commodities like corn, and China’s 34 percent duty on American imports have collectively fueled grain price volatility and disrupted long-standing trade relationships. In response, manufacturers and exporters have had to diversify sourcing strategies, adapt logistics networks, and reevaluate supplier partnerships to maintain continuity of supply. This complex tariff environment underscores the importance of agile risk management and underscores the need for industry stakeholders to continually monitor policy developments to safeguard their competitive positioning.

Deriving Key Segmentation Insights to Illuminate How Distribution Channels, Packaging Sizes, Applications, Product Types, Quality, and End-Use Industries Drive Market Nuances

The precooked corn flour market stratifies along several critical dimensions that illuminate distinct growth patterns and strategic priorities. Distribution channels bifurcate between brick-and-mortar and digital platforms, encompassing traditional convenience stores, supermarkets and hypermarkets that cater to broad-based retail demand, as well as specialized e-retail and marketplace operators driving direct-to-consumer engagement. Packaging size tiers span under one kilogram offerings for household experimentation, one to five kilogram multi-use formats favored by small foodservice operators, and bulk formats exceeding five kilograms that support large-scale industrial kitchens and bakeries.

Application categories delineate the value chain into bakery formulations that leverage corn flour’s moisture retention and texture enhancements, snack manufacturing that prizes its crisping qualities in extruded and fried products, and tortilla production where authentic taste and pliability are paramount. End-use industries divide between household consumption-where product attributes such as convenience and gluten-free claims influence purchase behavior-and foodservice segments that prioritize consistency and cost efficiency. Within product types, instant variants deliver rapid hydration for on-demand manufacturing, whereas traditional offerings remain integral for artisanal and heritage recipe preservation. Lastly, quality designations from conventional to non-GMO and organic grades reflect consumer willingness to pay premiums for sustainable and health-oriented credentials. These intersecting stratifications reveal nuanced market pockets, guiding stakeholders on where to allocate innovation efforts and commercial investments.

This comprehensive research report categorizes the Precooked Corn Flour market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Size

- Application

- End Use Industry

- Product Type

- Quality

- Distribution Channel

Uncovering Key Regional Insights to Reveal How Precooked Corn Flour Market Dynamics Vary Across the Americas, Europe Middle East Africa, and Asia Pacific Regions

Regional market behavior for precooked corn flour diverges markedly, shaped by cultural drivers, regulatory frameworks, and consumer preferences. In the Americas, strong ties to traditional corn-based cuisines underpin robust demand, particularly as North American and Latin American consumers seek both heritage and health-focused ingredients. The United States has seen a surging uptake of gluten-free bakery and snack products, spurring manufacturers to launch fortified and specialty-grade corn flours that meet clean-label standards, while Mexico remains a powerhouse for tortilla and masa harina production leveraging brands with deep cultural resonance.

Europe, the Middle East, and Africa present a dynamic mix of mature and emerging markets. Western Europe’s emphasis on organic and non-GMO certifications has driven premiumization, whereas Eastern European markets are still expanding basic product penetration amid growing awareness of gluten sensitivities. In the Middle East and North Africa, rising urban populations and an increasing trend toward packaged and convenience foods are fueling import growth. Meanwhile, Asia-Pacific is marked by rapid urbanization and rising disposable incomes, with Southeast Asian markets experimenting with corn flour in traditional snacks and fusion bakery applications. China and India, as large agricultural producers, are also exploring export potential, seeking to integrate precooked corn flour into both local foodservice and retail portfolios. These regional distinctions inform tailored go-to-market strategies and highlight the importance of localization in product development.

This comprehensive research report examines key regions that drive the evolution of the Precooked Corn Flour market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Companies’ Strategies and Competitive Positioning That Shape the Global Precooked Corn Flour Market Through Innovation, Expansion, and Brand Leadership

A concentrated set of multinational enterprises and regional specialists shape the competitive fabric of the precooked corn flour market. Gruma, under the flagship Maseca and Mission Foods brands, maintains global leadership in corn flour production, operating more than 79 plants worldwide and commanding dominant market shares in multiple regions. Recent antitrust scrutiny by Mexico’s competition authority underscores the breadth of its influence, as the company’s market power in certain domestic regions ranged from 50 to 90 percent, prompting calls for divestitures to restore competitive balance.

Cargill leverages comprehensive identity preservation protocols and a diversified masa flour portfolio to serve both industrial and consumer segments, ensuring consistent quality across applications such as tortilla chips, taco shells, and extruded snacks. Archer-Daniels-Midland Co and Bunge Limited underpin their market positions through integrated supply chains spanning grain origination to finished flour, while regional leaders like Harinera del Valle and Empresas Polar address localized demand with tailored formulations. Specialty players such as Bob’s Red Mill Natural Foods and Lifeline Foods focus on organic, non-GMO, and ancient grain variants, catering to discerning consumers and artisanal foodservice providers. This competitive mosaic underscores the importance of brand equity, supply chain integration, and product differentiation in sustaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precooked Corn Flour market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Bunge Limited

- Cargill, Incorporated

- Goya Foods, Inc.

- Grain Processing Corporation

- Gruma, S.A.B. de C.V.

- Ingredion Incorporated

- Molino de Minas, S.A. de C.V.

- Puratos Group N.V.

- Roquette Frères S.A.

- Tate & Lyle PLC

Formulating Actionable Recommendations for Industry Leaders to Navigate Trade Pressures, Consumer Trends, and Supply Chain Vulnerabilities in the Precooked Corn Flour Sector

To fortify resilience in the volatile precooked corn flour industry, companies should prioritize diversification of sourcing to mitigate tariff exposure and supply disruptions. Establishing multi-country procurement networks for raw corn, coupled with strategic partnerships in low-tariff jurisdictions such as Mexico and select Southeast Asian hubs, can smooth supply continuity and optimize landed costs. Further, investing in value-added product innovation-ranging from fortified instant flours to premium gluten-free and organic lines-will capture evolving consumer preferences and justify margin expansion in premium segments.

Operational efficiency must be enhanced through digital supply chain platforms that provide end-to-end visibility, enabling demand sensing and agile inventory management. Embracing scalable production technologies-such as modular milling and in-line fortification systems-supports rapid product changeovers and reduces waste. Concurrently, companies should strengthen go-to-market agility by leveraging omnichannel distribution models that align the rapid growth of online marketplaces with established retail partnerships. Lastly, fostering a culture of sustainability through non-GMO, organic certifications, and renewable energy usage will resonate with environmentally conscious stakeholders and reinforce brand reputation amid intensifying ESG scrutiny.

Detailing the Robust Research Methodology Employed to Generate Comprehensive Market Insights Through Primary Interviews, Secondary Data, and Expert Validation

This report integrates a rigorous blend of primary and secondary research methodologies to ensure the robustness and reliability of its insights. Primary data collection included in-depth interviews with senior executives, production managers, and supply chain specialists across leading precooked corn flour manufacturers and distributors. These qualitative discussions provided nuanced perspectives on technological adoption, tariff mitigation strategies, and evolving consumer demands.

Secondary research encompassed a comprehensive review of industry publications, government trade databases, and proprietary market intelligence platforms, capturing both the historical context and the latest policy shifts affecting the sector. Market segmentation frameworks were developed through systematic analysis of distribution channels, packaging sizes, applications, end-use industries, product types, and quality grades. Finally, all findings underwent a validation process with an expert panel of agronomists, food technologists, and trade policy analysts to reconcile disparate data points and uphold analytical rigor. This multifaceted approach underpins the strategic recommendations and future outlook presented in this document.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precooked Corn Flour market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precooked Corn Flour Market, by Packaging Size

- Precooked Corn Flour Market, by Application

- Precooked Corn Flour Market, by End Use Industry

- Precooked Corn Flour Market, by Product Type

- Precooked Corn Flour Market, by Quality

- Precooked Corn Flour Market, by Distribution Channel

- Precooked Corn Flour Market, by Region

- Precooked Corn Flour Market, by Group

- Precooked Corn Flour Market, by Country

- United States Precooked Corn Flour Market

- China Precooked Corn Flour Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Drawing Strategic Conclusions on the Precooked Corn Flour Market’s Evolution, Challenges, and Opportunities to Empower Stakeholders in Informed Decision Making

The precooked corn flour market stands at an inflection point, where traditional culinary heritage converges with modern imperatives of convenience, health, and sustainability. Evolving consumer preferences, particularly the rise in gluten-free and organic product adoption, have catalyzed innovation in both instant and traditional flour formulations. Simultaneously, transformative shifts in supply chain digitalization and advanced milling technologies are redefining production efficiencies and product quality standards.

Trade policy turbulence, marked by a succession of tariffs in 2025, underscores the need for agile risk management and diversified sourcing strategies. Regional disparities across the Americas, EMEA, and Asia-Pacific necessitate tailored approaches to market entry, product positioning, and regulatory navigation. Leading companies continue to leverage brand equity, integrated supply chains, and targeted product differentiation to capture market share. As the industry navigates these converging currents, stakeholders who align operational excellence with strategic innovation and sustainability commitments will be best positioned to secure long-term growth.

Engage with Ketan Rohom to Acquire the Full Precooked Corn Flour Market Research Report and Unlock Strategic Insights for Competitive Advantage

To gain deeper insights, unparalleled data, and actionable strategies for navigating the intricate dynamics of the precooked corn flour market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He is poised to provide personalized guidance on accessing the full market research report, ensuring you obtain comprehensive analysis, competitive benchmarking, and forward-looking recommendations tailored to your organization’s needs. Engage with Ketan today to secure the intelligence required for confident decision-making and to position your business at the forefront of this evolving industry landscape.

- How big is the Precooked Corn Flour Market?

- What is the Precooked Corn Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?