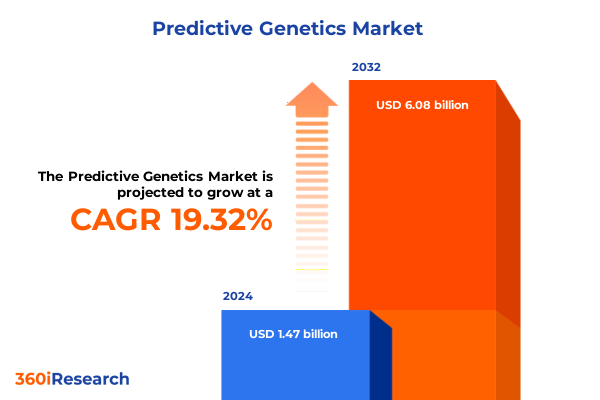

The Predictive Genetics Market size was estimated at USD 1.75 billion in 2025 and expected to reach USD 2.09 billion in 2026, at a CAGR of 19.39% to reach USD 6.08 billion by 2032.

Unveiling the Pivotal Role of Predictive Genetics in Transforming Healthcare and Driving Precision Medicine into a New Era of Preventive Strategies

Predictive genetics stands at the forefront of a transformational shift in healthcare, enabling practitioners to anticipate disease susceptibility and tailor preventive strategies at an individual level. This convergence of genomic science, bioinformatics, and clinical practice has evolved from foundational research in hereditary disorders to a sophisticated ecosystem that supports early intervention and personalized wellness plans. In recent years, advances in sequencing cost reduction and data analytical capabilities have accelerated the integration of predictive genetics into routine medical decision making, fostering a proactive rather than reactive approach to patient care.

As the realm of precision medicine deepens its roots, investors and research institutions are channeling resources toward cutting-edge technologies that can decode complex genetic variants and translate them into actionable insights. High-throughput platforms and machine learning algorithms now collaborate to unearth subtle genomic patterns, empowering clinicians with robust risk stratification tools. Consequently, healthcare providers are positioned to implement targeted surveillance protocols that minimize adverse outcomes and optimize resource allocation.

Looking ahead, the trajectory of predictive genetics will be shaped by interdisciplinary collaboration across data science, molecular biology, and clinical epidemiology. By harnessing real-world evidence and continuous learning systems, stakeholders can refine risk models, adapt screening guidelines, and ensure equitable access to novel diagnostics. In this dynamic environment, organizations that embrace innovation, foster strategic partnerships, and maintain rigorous quality standards will emerge as leaders in the pursuit of precision health.

Emergence of Advanced Sequencing Technologies and Data Analytics Redefining the Predictive Genetics Landscape with Unprecedented Precision and Scalability

The arrival of next generation sequencing and advanced data analytics has revolutionized the predictive genetics landscape, enabling a leap forward in genomic resolution and interpretive power. Platforms such as targeted sequencing deliver high-depth insights into specific genomic regions, while whole exome and whole genome sequencing provide panoramic views of genetic architecture, uncovering both common and rare variants. At the same time, comparative genomic hybridization and expression microarrays remain integral for assessing copy number variations and gene expression profiles. Together, these modalities create a comprehensive suite of tools for decoding genetic predispositions.

Simultaneously, enhancements in polymerase chain reaction technologies-particularly real time PCR and digital PCR-have bolstered diagnostic sensitivity, enabling quantification of low-abundance alleles with remarkable precision. The refined accuracy of these assays supports early detection of minimal residual disease and facilitates pharmacogenomic assessments that guide therapeutic selection. Sanger sequencing, though established for validation and small-scale applications, continues to underpin confirmatory workflows, maintaining its relevance in a landscape dominated by high-throughput methodologies.

Moreover, the synergy between these technological advances and artificial intelligence frameworks has unlocked new possibilities for predictive modeling. Machine learning algorithms synthesize vast genomic datasets with clinical and environmental variables, improving the specificity and predictive value of genetic risk assessments. This integration not only accelerates discovery but also ensures that patient-centric insights are continually refined as real-world data accumulates.

Assessing the Extensive Consequences of 2025 U.S. Tariffs on Predictive Genetics Supply Chains Regulatory Compliance and Market Dynamics

In 2025, new tariff measures in the United States have introduced significant considerations for the predictive genetics ecosystem, reshaping cost structures and supply chain strategies. As import duties increase on key instruments and consumables, organizations must navigate higher procurement expenses for microarray slides, sequencing reagents, and PCR kits. These fiscal inflations encourage stakeholders to reevaluate vendor agreements, explore alternative sourcing regions, and negotiate bulk purchasing arrangements to mitigate budgetary impacts.

Consequently, the evolving trade environment underscores the importance of supply chain diversification and local manufacturing capabilities. Firms are assessing partnerships with domestic producers and regional distributors to reduce exposure to cross‐border tariff fluctuations. At the same time, regulatory compliance requirements have become more intricate, as importers must document country‐of‐origin declarations and adhere to stringent customs protocols. Failure to do so can result in shipment delays and unanticipated penalties, further complicating project timelines and financial planning.

Amid these challenges, collaborative initiatives between industry consortia and government agencies have emerged to streamline tariff classifications and facilitate knowledge sharing. By adopting proactive risk management frameworks and leveraging predictive analytics for demand forecasting, organizations can better anticipate material shortages and optimize inventory levels. In turn, these strategic adaptations enable continuity in research and clinical programs, ensuring that vital predictive genetics services remain accessible despite the pressure of increased duties.

Revealing Key Segmentation Insights Illuminating How Technology Platforms Test Types and Applications Shape the Predictive Genetics Ecosystem

Examining technology platforms within predictive genetics reveals a nuanced spectrum of capabilities that cater to diverse research and diagnostic needs. Microarray solutions, divided between comparative genomic hybridization and expression arrays, continue to deliver high-throughput analysis of genetic variations and transcriptional activity. In parallel, next generation sequencing offers both targeted panels for focused variant detection and expansive approaches like whole exome and whole genome sequencing to capture comprehensive genomic landscapes. The advent of digital PCR and real time PCR further bolsters analytical precision by quantifying low-frequency alleles and monitoring gene expression in near real time.

Parallel to these technological vantage points, test types delineate the practical applications of predictive genetics across various clinical contexts. Cancer screening extends beyond conventional diagnostics through specialized BRCA, colorectal, and lung cancer assays that refine risk stratification and guide early intervention. Carrier screening practices differentiate between expanded panels and single gene evaluations, empowering prospective parents with insights into hereditary conditions. Meanwhile, pharmacogenomic testing, including CYP assessments and drug metabolism evaluations, assists clinicians in optimizing therapeutic dosing. Prenatal testing bifurcates into invasive and noninvasive methods, striking a balance between accuracy and procedural safety. Risk assessment tools, spanning cardiovascular and neurodegenerative domains, equip individuals with personalized forecasts of potential health trajectories.

Application-focused segmentation underscores the breadth of predictive genetics impact, spanning cardiovascular conditions such as heart disease and stroke, infectious disease detection, neurological disorder profiling, oncology interventions featuring breast, colorectal, and lung cancer subfields, and rare disease characterization. End users range from academic research institutes that drive foundational discovery, to diagnostic laboratories that translate findings into clinical services, to direct-to-consumer platforms that democratize genetic awareness, and hospitals delivering integrated patient care. The product portfolio encompasses consumables, instruments, services like genetic counseling and specialized sequencing offerings, as well as software solutions that unify data management and clinical decision support.

This comprehensive research report categorizes the Predictive Genetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Test Type

- Product Type

- Application

- End User

Uncovering Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific That Influence Adoption Patterns and Investment in Predictive Genetics

In the Americas, established centers of excellence in North America are complemented by emerging hubs in Latin America, where investments in genomic infrastructure are accelerating and regulatory frameworks are maturing. These developments enable a growing array of public-private partnerships that support translational research initiatives and broaden access to precision diagnostics. Furthermore, cross-border collaborations within the region facilitate knowledge transfer and reinforce capacity-building efforts in clinical genetics.

Within Europe, Middle East, and Africa, the landscape of predictive genetics exhibits considerable diversity. Western European countries maintain robust reimbursement policies and advanced regulatory oversight, fostering a favorable climate for innovation. In contrast, the Middle East is experiencing rapid growth fueled by national genomic programs and strategic alliances with international sequencing enterprises. Meanwhile, parts of Africa are focusing on population-specific genetic studies, leveraging predictive genetics to address unique health challenges and advancing local expertise through capacity enhancement and technology transfer.

Across the Asia-Pacific region, dynamic markets in East Asia and Oceania command attention with substantial investments in bioinformatics and high-throughput sequencing facilities. Regulatory agencies are streamlining approval pathways for genetic tests, encouraging clinical adoption. Southeast Asian nations are prioritizing cross-institutional research consortia, while South Asian markets are balancing cost-sensitivity with demand for advanced diagnostics. Together, these regional dynamics drive a competitive environment that encourages innovation and collaboration across governmental, academic, and commercial stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Predictive Genetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies and Strategic Collaborations Driving Innovation Disruption and Value Creation within the Predictive Genetics Industry Landscape

Leading players in predictive genetics consistently demonstrate their commitment to expanding capabilities through strategic acquisitions, partnerships, and collaborative research programs. For example, established sequencing providers have extended their service portfolios by integrating advanced data analytics platforms and offering end-to-end workflows encompassing sample preparation, sequencing, and bioinformatics interpretation. Diagnostic laboratories have forged alliances with academic institutions to co-develop novel assays, while software developers partner with clinical networks to refine decision support algorithms.

Moreover, industry disruption often arises from cross-sector collaborations that merge genomics and digital health. Technology firms with expertise in artificial intelligence form joint ventures with life science companies to co-create predictive modeling tools that translate genomic data into actionable clinical insights. At the same time, contract research organizations leverage their regulatory proficiency to assist domestic and international clients with trial design and companion diagnostic development, streamlining regulatory submissions and expediting time to clinical utility.

In addition, a wave of innovative entrants specializing in gene editing, single-cell analysis, and long-read sequencing is reshaping competitive dynamics. By focusing on niche applications-such as rare disease variant discovery and agricultural genomics-these companies drive innovation and create new growth corridors within predictive genetics. Observing these market movements, stakeholders can identify partnership opportunities to acquire complementary technologies, enhance service offerings, and sharpen their competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Predictive Genetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 23andMe Holding Co.

- Abbott Laboratories

- Color Health, Inc.

- Danaher Corporation

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- Fulgent Genetics, Inc.

- Gene by Gene, Ltd.

- Genomic Prediction, Inc.

- Guardant Health, Inc.

- Helix OpCo, Inc.

- Illumina, Inc.

- Invitae Corporation

- Labcorp Holdings Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Providing Actionable Recommendations for Industry Leaders to Drive Efficiency Elevate Competitive Position and Leverage Predictive Genetics Breakthroughs

To navigate the complexities of the predictive genetics arena, industry leaders should prioritize the integration of interoperable data platforms and invest in robust data governance policies. By ensuring seamless connectivity between laboratory information management systems and clinical databases, organizations can accelerate translational insights and support evidence-based decision making. Concurrently, fostering interdisciplinary teams that include bioinformaticians, clinical geneticists, and regulatory specialists will strengthen operational resilience and streamline project execution.

Additionally, diversifying supply chains by engaging multiple regional suppliers and cultivating in-house manufacturing capabilities can mitigate risks associated with geopolitical shifts and tariff fluctuations. Establishing strategic inventory buffers and digital monitoring solutions for reagent consumption will further enhance supply continuity. Leaders should also embed advanced analytics and machine learning frameworks into their R&D pipelines to uncover novel biomarker signatures and refine risk prediction models.

Finally, maintaining proactive engagement with regulatory bodies and participating in standard-setting consortia will help shape guidelines that balance innovation with patient safety. Organizations that adopt transparent validation protocols and prioritize real-world evidence collection will gain a competitive edge by demonstrating clinical utility and building trust among healthcare providers and patients.

Detailing a Rigorous Research Methodology Combining Data Collection Statistical Analysis and Expert Validation for Robust Predictive Genetics Insights

This research deploys a multi-pronged approach to capture the dynamic essence of predictive genetics. Initial phases involve extensive secondary research encompassing scientific journals, patent filings, regulatory documentation, and proprietary technical databases. These sources inform a comprehensive understanding of technology evolutions, competitive strategies, and policy developments. Subsequently, primary interviews with senior executives, academic researchers, and clinical practitioners enrich the dataset with real-world perspectives on implementation challenges and market needs.

Data triangulation ensures the reliability of gathered insights, as quantitative findings from procurement records, publication metrics, and clinical trial registries are cross-referenced with qualitative feedback from expert panels. Statistical analyses identify prevalent trends and correlations, while thematic coding of interview transcripts elucidates emerging themes in regulatory compliance, reimbursement trajectories, and technological adoption. Ethical considerations, including informed consent and anonymization of sensitive information, underpin every stage of research.

Finally, iterative reviews by domain specialists validate key findings and refine conclusions. Draft reports undergo rigorous scrutiny to verify factual accuracy, contextual relevance, and practical applicability. This rigorous methodology guarantees that the final report delivers dependable insights, equipping stakeholders with the clarity needed to make strategic decisions in the predictive genetics domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Predictive Genetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Predictive Genetics Market, by Technology

- Predictive Genetics Market, by Test Type

- Predictive Genetics Market, by Product Type

- Predictive Genetics Market, by Application

- Predictive Genetics Market, by End User

- Predictive Genetics Market, by Region

- Predictive Genetics Market, by Group

- Predictive Genetics Market, by Country

- United States Predictive Genetics Market

- China Predictive Genetics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Summarizing Core Findings and Strategic Implications Revealing How Predictive Genetics Is Shaping Future Healthcare and Guiding Evidence Based Decisions

Across the analysis, predictive genetics emerges as a powerful enabler of personalized healthcare, driven by a confluence of sequencing innovation, advanced analytics, and evolving regulatory landscapes. Core findings highlight the critical role of diverse technology platforms-from high-throughput microarrays to digital PCR-in capturing genetic variability and informing clinical pathways. Test types spanning cancer screening, carrier assessments, and pharmacogenomics underscore the sector’s capacity to deliver granular risk profiles across multiple therapeutic areas.

Strategic implications for stakeholders revolve around fostering technological agility, diversifying operational footprints, and engaging in collaborative ecosystems. Regional insights underscore varied adoption rates, influenced by local regulatory maturity and infrastructure readiness. Meanwhile, tariff-induced cost considerations in the United States reinforce the necessity for agile supply chains and proactive policy engagement. By aligning resource allocation with emerging application areas such as rare disease profiling and direct-to-consumer services, organizations can sharpen their competitive positioning and drive sustainable value creation.

Empowering Your Strategic Decisions with In-Depth Predictive Genetics Insights Connect with Ketan Rohom for Comprehensive Market Research Support Today

To advance your strategic objectives with comprehensive, expert-driven insights into the rapidly evolving predictive genetics landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Through his guidance, you will gain access to an in-depth market research report that dissects the technological innovations, regulatory shifts, competitive dynamics, and regional trends essential for making informed decisions. By partnering with an experienced professional familiar with the nuances of precision medicine, you can accelerate time to market, optimize your research and development investments, and strengthen your position amid intensifying competition. Connect with Ketan Rohom today to secure the detailed analysis you need to navigate this complex environment and unlock new growth opportunities in predictive genetics.

- How big is the Predictive Genetics Market?

- What is the Predictive Genetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?