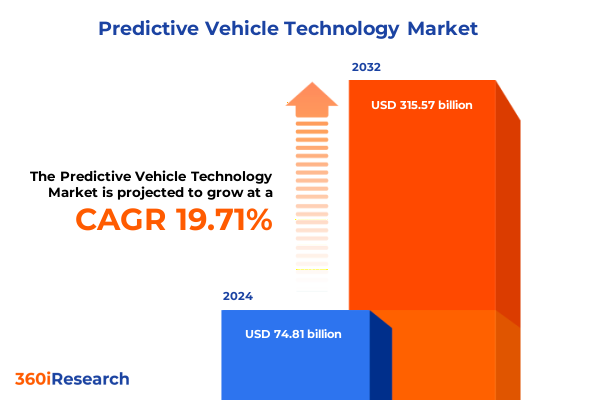

The Predictive Vehicle Technology Market size was estimated at USD 89.45 billion in 2025 and expected to reach USD 106.16 billion in 2026, at a CAGR of 19.73% to reach USD 315.57 billion by 2032.

Exploring the Emergence of Predictive Vehicle Technology as a Driving Force in Future Mobility Solutions and Intelligent Transport Ecosystems

Predictive vehicle technology represents a paradigm shift in how data and connectivity converge to enhance safety, efficiency, and user experience across the automotive landscape. Fueled by advances in artificial intelligence, sensor fusion, and telematics, these solutions transcend traditional reactive maintenance and navigation approaches. Instead, they empower vehicles to anticipate and respond to potential hazards, optimize routing in real time, and deliver proactive maintenance alerts that mitigate downtime.

Against this backdrop, manufacturers, fleet operators, and technology providers are forging collaborations to integrate machine learning algorithms with a diverse array of sensors and communication protocols. This collaborative ecosystem underpins the evolution of next-generation transportation, where vehicles not only process massive streams of data but also leverage predictive insights to inform critical decisions. As regulatory bodies tighten safety standards and consumers demand seamless connectivity, the stage is set for predictive vehicle technology to redefine mobility benchmarks and unlock new revenue streams across the value chain.

Uncovering the Transformative Shifts Redefining Predictive Vehicle Technology from Sensor Innovations to AI-Driven Predictive Analytics and Connectivity Advancements

Over the past year, the predictive vehicle technology landscape has undergone transformative shifts, most notably through the integration of deep learning frameworks that enhance object detection accuracy and decision-making speed. These AI-driven capabilities now complement traditional sensor-based systems, enabling vehicles to distinguish between complex driving scenarios, such as identifying pedestrians in low-light conditions or predicting the trajectory of erratic road users.

Simultaneously, the telecommunications backbone has evolved with the rollout of 5G networks, offering ultra-low latency and enhanced bandwidth for Vehicle-to-Everything (V2X) communication. This connectivity leap allows predictive models to tap into cloud-based processing and real-time updates, fostering an ecosystem where vehicles share insights across fleets and infrastructure nodes. Furthermore, regulatory incentives in key markets have accelerated the adoption of predictive maintenance solutions, reducing lifecycle costs and improving asset utilization. Together, these shifts converge to propel predictive vehicle technology from experimental prototypes into commercially viable systems that promise to reshape both personal and commercial transportation sectors.

Assessing the Cumulative Impact of United States Tariffs Introduced in 2025 on Predictive Vehicle Technology Supply Chains and Market Dynamics

In early 2025, the United States implemented a new tariff regime targeting vehicle components and advanced electronics critical to predictive systems, with rates increasing by up to 15 percent on imported sensors, telematics modules, and AI accelerators. These duties have introduced cost pressures across the supply chain, prompting domestic manufacturers to reassess sourcing strategies and accelerate local production of key components.

Consequently, tier-one suppliers have sought to diversify their manufacturing footprints, establishing assembly lines within free trade zones and leveraging tariff mitigation programs to maintain competitive pricing structures. At the same time, original equipment manufacturers have entered strategic partnerships with domestic semiconductor foundries and sensor fabricators to secure priority access to critical inputs. While these measures buffer end-user pricing from sharp escalations, increased production complexity and regulatory compliance obligations continue to influence product roadmaps and investment timelines. As a result, stakeholders are prioritizing modular architectures and software-centric upgrades to preserve agility amid shifting tariff dynamics.

Deriving Key Insights from Technology, Application, Vehicle Type, and Communication Technology Segmentations to Inform Strategic Positioning

Technology segmentation reveals that artificial intelligence drives the most advanced predictive features, with deep learning models learning from vast datasets to anticipate maintenance needs and safety events. Simultaneously, machine learning algorithms optimize driver behavior analysis and route suggestions. Sensor-based approaches complement these capabilities, as cameras, LiDAR, radar, and ultrasonic sensors each contribute unique perspectives that enable holistic situational awareness. Telematics further enhances this ecosystem by aggregating data from mobile devices and onboard vehicle networks to inform cloud-based analytics.

From an application standpoint, collision avoidance systems leverage fused sensor inputs with AI insights to pre-emptively detect hazards, while driver behavior analysis platforms draw on machine learning to identify fatigue or distraction patterns. Predictive maintenance solutions analyze telematics data to forecast component failures before they occur, and route optimization engines harness real-time traffic feeds to reduce fuel consumption and enhance delivery punctuality. These intertwined segmentations illuminate how modular technology stacks blend to deliver cohesive end-user experiences and create differentiated value propositions for stakeholders.

This comprehensive research report categorizes the Predictive Vehicle Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Communication Technology

- Application

- Vehicle Type

Unveiling Regional Opportunities and Challenges Across Americas, Europe Middle East & Africa, and Asia Pacific in the Predictive Vehicle Technology Domain

The Americas region has emerged as a frontrunner in pilot deployments and regulatory frameworks supporting predictive vehicle technology, driven by extensive testing corridors and incentive programs for safety-focused innovations. Progressive state-level mandates encourage the integration of advanced driver assistance systems, while commercial fleets adopt predictive maintenance to lower operational costs and reduce on-road incidents.

In Europe, the Middle East, and Africa, stringent safety regulations and robust automotive ecosystems in Western Europe propel adoption, while the Middle East’s smart city initiatives create fertile ground for V2X and route optimization trials. Conversely, Africa presents a landscape defined by infrastructural challenges but shows promise in leveraging mobile telematics for informal transport networks. Across Asia-Pacific, rapid vehicle electrification and high consumer demand in markets such as China and South Korea fuel investment in AI-driven predictive features, whereas Southeast Asian nations prioritize cost-effective sensor-based solutions to modernize growing automotive fleets.

This comprehensive research report examines key regions that drive the evolution of the Predictive Vehicle Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players in Predictive Vehicle Technology and Their Strategies for Innovation, Partnerships, and Competitive Differentiation

Industry leaders continue to innovate across product portfolios, with several global OEMs launching next-generation predictive platforms that integrate edge computing and over-the-air software updates. Technology incumbents specializing in sensor manufacturing have expanded into AI software services, while telematics providers have forged alliances with cloud infrastructure firms to deliver scalable analytics solutions.

Strategic partnerships also define this landscape, as semiconductor companies collaborate with camera and LiDAR vendors to co-develop application-specific integrated circuits optimized for predictive workloads. Similarly, software developers are forging ties with fleet management companies to embed predictive maintenance modules directly into operational dashboards. These dynamic collaborations underscore the imperative for cross-disciplinary expertise and highlight how convergence between hardware and software specialists drives market differentiation and accelerates time to market for new solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Predictive Vehicle Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Aurora Labs

- Azuga

- Baidu

- BMW Group

- Continental AG

- Daimler Truck

- Eatron

- Ford Motor Company

- General Electric Company

- General Motors

- Geotab Inc

- HARMAN International

- HERE Technologies

- Hitachi Ltd

- Honeywell International Inc

- IBM Corporation

- Lytx

- Mercedes-Benz Group

- Microsoft Corporation

- Mobileye

- NVIDIA Corporation

- Oracle Corporation

- Robert Bosch GmbH

- Samsara Inc

- SAP SE

- Siemens AG

- Tesla Inc

- Toyota Motor Corporation

- Trimble Inc

- Verizon Communications Inc

- Volkswagen Group

- Waymo

- ZF Friedrichshafen AG

Formulating Actionable Recommendations for Industry Leaders to Accelerate Growth and Drive Adoption of Predictive Vehicle Technologies Across the Ecosystem

Industry leaders should prioritize end-to-end data integration by establishing unified platforms that coalesce sensor inputs, telematics data, and AI-driven insights. By fostering strategic alliances with cloud providers and semiconductor foundries, organizations can secure scalable infrastructure and maintain preferential access to next-generation processing capabilities. Moreover, adopting modular architectures will allow rapid feature enhancements through software updates, thereby extending product lifecycles and improving return on investment.

In parallel, companies must engage with regulatory bodies to shape favorable standards for predictive safety and data privacy, ensuring that new solutions align with evolving compliance requirements. Developing robust training programs for fleet managers and technicians will further support seamless implementation and maximize user adoption. Finally, pursuing pilot programs in diverse operational environments-from urban ride-hailing fleets to heavy commercial transport corridors-will yield invaluable performance data and validate solution efficacy, paving the way for broader commercial rollouts.

Outlining Comprehensive Research Methodology Employed to Analyze Data Sources, Market Segmentation, and Emerging Trends in Predictive Vehicle Technology

This research employed a multi-tiered methodology beginning with a comprehensive review of primary and secondary data sources, including technical white papers, regulatory filings, and academic publications. Expert interviews with leading automakers, sensor manufacturers, and telematics providers provided qualitative insights into technology roadmaps and adoption barriers. Concurrently, a detailed analysis of patent filings and venture capital investments offered quantitative indicators of innovation trajectories and strategic priorities.

Market segmentation was delineated by technology, application, vehicle type, and communication protocol, enabling nuanced comparisons across distinct solution sets. Geographic assessments incorporated regulatory landscapes, infrastructure readiness, and regional adoption drivers. Data synthesis involved cross-validation against third-party analytics and case studies from pilot deployments to ensure accuracy. Throughout the study, iterative peer reviews and expert panels affirmed the integrity of findings and reinforced the strategic frameworks underpinning key recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Predictive Vehicle Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Predictive Vehicle Technology Market, by Technology

- Predictive Vehicle Technology Market, by Communication Technology

- Predictive Vehicle Technology Market, by Application

- Predictive Vehicle Technology Market, by Vehicle Type

- Predictive Vehicle Technology Market, by Region

- Predictive Vehicle Technology Market, by Group

- Predictive Vehicle Technology Market, by Country

- United States Predictive Vehicle Technology Market

- China Predictive Vehicle Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusions on Market Evolution, Strategic Imperatives, and the Path Forward for Predictive Vehicle Technology Adoption and Innovation

The convergence of advanced sensors, artificial intelligence, and high-speed connectivity is reshaping the future of vehicle autonomy and operational efficiency. As tariff dynamics and regional disparities present both challenges and opportunities, stakeholders who embrace modular designs and strategic partnerships will be best positioned to navigate the evolving landscape. The rising demand for proactive safety measures and cost-effective maintenance strategies underscores the enduring value of predictive capabilities across personal and commercial mobility.

Ultimately, success in this domain hinges on the ability to integrate diverse data streams into cohesive platforms that deliver actionable insights in real time. By aligning innovation roadmaps with regulatory trends and end-user requirements, companies can secure competitive advantage and drive widespread adoption. This synthesis of technological prowess, strategic foresight, and operational excellence defines the path forward for predictive vehicle technology.

Engaging with Ketan Rohom for Tailored Insights and Seamless Acquisition of the Definitive Predictive Vehicle Technology Market Research Report

For a deeper dive into the comprehensive analysis, tailored insights, and actionable strategies detailed in this report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in predictive vehicle technology market dynamics ensures a personalized consultation that aligns with your strategic objectives. Engage now to streamline your procurement process and secure the definitive resource for driving innovation and competitive advantage in predictive vehicle technologies.

- How big is the Predictive Vehicle Technology Market?

- What is the Predictive Vehicle Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?