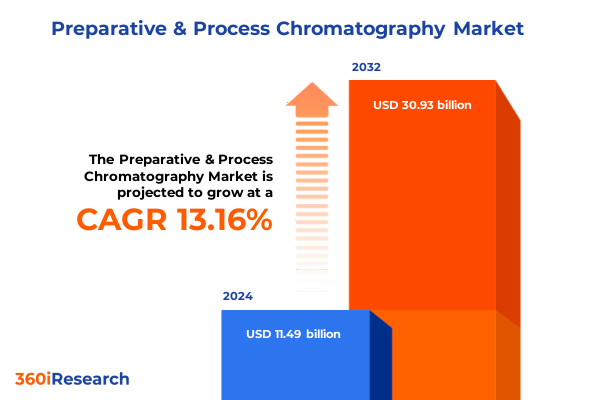

The Preparative & Process Chromatography Market size was estimated at USD 12.83 billion in 2025 and expected to reach USD 14.32 billion in 2026, at a CAGR of 13.39% to reach USD 30.93 billion by 2032.

Understanding the Critical Role and Evolving Value of Preparative and Process Chromatography in Modern Bioprocessing and Industrial Applications

Preparative and process chromatography has become an indispensable technique for isolating and purifying target molecules across pharmaceutical, biotechnology, food and beverage, and environmental applications. By selectively separating components based on physicochemical interactions with stationary phases, these methods offer unmatched purity and yield for peptides, proteins, small molecules, and macromolecular complexes. As research pipelines expand and regulatory expectations for product consistency intensify, reliable purification platforms have evolved from standardized protocols to highly customized solutions that address complex feed streams and stringent quality requirements.

Over the past decade, growing demands for monoclonal antibodies, recombinant proteins, and advanced biologics have driven significant innovation in resin chemistries, column designs, and process automation. Manufacturers now integrate single-use technologies and inline monitoring to enhance process control and reduce cross-contamination risks. In parallel, heightened environmental scrutiny has spurred the adoption of greener solvents and wastewater minimization strategies, positioning preparative chromatography not only as a performance imperative but also as a sustainability enabler. This introduction sets the stage for exploring how transformative shifts, regulatory pressures, and market segmentation insights are reshaping the landscape of preparative and process chromatography.

Unleashing Innovation Through Continuous Chromatography Automation and Green Solvent Strategies for Enhanced Efficiency & Sustainability in Separation Processes

The chromatography landscape is witnessing a paradigm shift as continuous processing emerges as a game-changing approach to purification. Unlike traditional batch operations, continuous chromatography platforms maintain a constant loading, washing, and elution cycle that significantly improves resin utilization and reduces buffer consumption. Automated control loops and advanced process analytical technology (PAT) allow real-time adjustments to flow rates, pH gradients, and conductivity, ensuring consistent product quality and accelerating development timelines.

Meanwhile, digitalization is transforming method development through machine learning algorithms that predict resin binding capacities and optimize gradient profiles, reducing experimental iterations. Single-use columns and prepacked cartridges have simplified scale-down studies and minimized cleaning validation burdens. At the same time, integrated membrane chromatography solutions are gaining traction for high-throughput applications, offering lower back pressures and rapid cycle times. Together, these innovations have not only enhanced the efficiency and robustness of separation processes but have also created new avenues for sustainable operations, cost containment, and accelerated time to market.

Evaluating the Far-Reaching Effects of 2025 United States Import Tariffs on Chromatography Equipment Supply Chains and Operational Costs

In 2025, the United States enacted revised import tariffs on a range of chromatography resins, columns, and ancillary components, prompting stakeholders to reassess their sourcing strategies. These levies have led to noticeable increases in the landed costs of key raw materials, particularly synthetic polymer and agarose resins procured from overseas manufacturers. Consequently, end users are evaluating alternative suppliers in domestic and allied markets to mitigate pricing pressures and maintain supply continuity.

The tariff-induced cost escalations have also prompted equipment vendors to localize certain manufacturing steps, invest in modular assembly lines, and expand regional distribution networks to bypass the steepest duties. Operational budgets have been restructured to balance capital expenditures on newer, higher-throughput systems against recurring expenses for buffer and resin inventory. In response, industry collaborations are forming to develop lower-cost chemistries and shared-service purification hubs that can amortize fixed expenses across multiple users. Overall, the recent tariff landscape underscores the importance of adaptable supply chain strategies and responsive procurement policies.

Dissecting Preparative Chromatography Market Segments Across Equipment Types, Operation Modes, Advanced Technologies, Resin Chemistries and End-Use Applications

A comprehensive view of the preparative chromatography market reveals distinct performance criteria and investment priorities for each equipment scale. At the laboratory scale, researchers emphasize flexibility and rapid method screening, whereas pilot-scale operations bridge laboratory insights to production, demanding scalable columns and robust control systems. Full production scale, by contrast, necessitates large-diameter columns, high-capacity resins, and rigorous validation workflows that ensure consistency across multiton batches. Simply put, the functional attributes and capital investments evolve as organizations transition from experimental to commercial bioprocessing.

Operational modes further refine these priorities. Batch chromatography dominates well-established product lines with predictable demand, offering familiar workflows and straightforward scale-up parameters. Continuous operations, however, appeal to high-volume, high-value streams such as monoclonal antibodies, delivering improved resin utilization and reduced facility footprints. By combining countercurrent fluid dynamics with automated buffer blending, continuous trains can achieve tighter purity profiles with fewer cycles.

Advanced technologies diversify the toolkit available to separation scientists. Adsorption strategies such as hydrophobic interaction and mixed-mode offer versatility for intermediate purification, while affinity modalities-including lectin, metal chelation, and Protein A-are indispensable for high-specificity capture steps. Ion exchange techniques, split between anion and cation exchange media, excel in polishing workflows. Reverse phase columns segmented into C18 and C8 chemistries are often integrated for small-molecule separations, and size exclusion formats, from gel filtration to high-performance systems, provide critical aggregate removal and desalting.

Selecting the appropriate resin foundation is equally pivotal. Agarose and cellulose matrices deliver proven mechanical strength and wide pH tolerances, while magnetic particles-either iron oxide cores or polymer-coated shells-facilitate rapid automated workflows. Synthetic polymers such as polyacrylamide and polystyrene bring high binding capacities and tailored functionalities. Finally, the applications landscape spans biopharmaceutical purification, chemical synthesis, environmental analysis, and food and beverage processing, each imposing unique performance, regulatory, and throughput demands.

This comprehensive research report categorizes the Preparative & Process Chromatography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Operation Mode

- Technology

- Resin Chemistry

- Application

Highlighting Dynamic Growth Drivers and Regional Variations in Preparative Chromatography Demand Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics in preparative chromatography usage reflect converging technological maturity, regulatory environments, and end-user demand profiles. In the Americas, leading biopharmaceutical hubs centered in the United States and Canada drive demand for high-capacity continuous systems and single-use technologies, supported by well-developed supplier networks and strong investment in process intensification. Emerging Latin American centers are also adopting mid-scale platforms for biosimilar and vaccine production, spurred by government incentives to foster local biotechnology industries.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks and established manufacturing clusters in Western Europe have cultivated advanced purification infrastructures. Companies here often focus on sustainability metrics, integrating solvent recycling and water footprint reduction into their chromatography workflows. In the Middle East and North Africa, growing life sciences initiatives and petrochemical refining applications are expanding the adoption of specialized resins for both biopharma and industrial separations.

The Asia-Pacific region is characterized by rapid capacity expansions in China, India, and Japan, where large-scale facilities cater to both domestic needs and global supply chains. Strategic partnerships between local firms and international equipment providers have accelerated technology transfer, while local resin manufacturers are scaling production to meet regional demand. Regulatory harmonization efforts across ASEAN and Pacific Rim governments are expected to streamline product approvals and foster further investment in purification process development.

This comprehensive research report examines key regions that drive the evolution of the Preparative & Process Chromatography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Chromatography Equipment and Resin Providers: Strategic Investments, Mergers, Innovation Pipelines, and R&D Driving Industry Leadership

The competitive arena of preparative and process chromatography is shaped by a combination of multinational life science suppliers, specialized resin innovators, and integrated service providers. Leading chromatography equipment vendors have bolstered their portfolios through targeted acquisitions of niche resin manufacturers and software analytics firms, ensuring end-to-end solutions for method development, scale-up, and validation. Investment in in-house application laboratories and turnkey purification services is ramping up, enabling these companies to co-develop processes with customers and accelerate adoption of next-generation technologies.

Resin chemistry specialists continue to differentiate through custom formulation capabilities, offering tailor-made ligands and functional groups for challenging separations. Partnerships between resin developers and downstream bioprocessing integrators are yielding novel mixed-mode and multi-modal media designed for high-throughput capture steps and aggregate removal. At the same time, digital platforms that connect instrumentation data with process modeling tools are becoming standard offerings, allowing real-time monitoring of binding capacities, column health, and buffer consumption.

To maintain market leadership, top-tier firms are expanding into adjacent segments such as membrane chromatography and continuous downstream processing modules. They are also investing in sustainability programs to reduce plastic waste and carbon footprints, aligning with customer mandates and global environmental goals. Collectively, these strategic initiatives are reshaping competitive dynamics, elevating service-oriented business models, and driving continuous innovation in preparative chromatography workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Preparative & Process Chromatography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc

- Akzo Nobel N.V.

- Altmann Analytik GmbH & Co. Kg

- Bio-Rad Laboratories, Inc.

- Biobase Biodusty(Shandong), Co., Ltd.

- Bruker Corporation

- Centurion Scientific

- Daicel Corporation

- Danaher Corporation

- General Electric Company

- Gilson, Inc.

- GL Sciences Inc.

- Hamilton Bonaduz AG

- Hitachi High-Technologies Corporation

- JASCO Corporation

- Merck KGaA

- Perkinelmer, Inc.

- Repligen Corporation

- Restek Corporation

- Sartorius AG

- Sykam GmbH

- Thermo Fisher Scientific Inc.

- Unimicro Technologies

- Waters Corporation

- Welch Materials, Inc.

Empowering Executives with Strategic Guidance to Optimize Chromatography Workflows and Strengthen Supply Chains While Embracing Sustainable Innovation

Industry leaders aiming to capitalize on the evolving chromatography landscape should prioritize the integration of continuous purification platforms into existing process trains. Conducting pilot studies to benchmark resin lifetime and throughput under continuous operation will illuminate productivity gains and inform investment decisions. In parallel, building flexible supply chains that incorporate regional resin suppliers and contract manufacturing partnerships will mitigate tariff disruptions and ensure consistent resin availability.

Digital transformation initiatives should focus on deploying advanced process analytics and machine learning tools for real-time method optimization. Embedding inline spectroscopic sensors and automated sampling modules can significantly reduce development timelines and support robust process control strategies. Simultaneously, investing in sustainable resin technologies and green solvent cycles will align with environmental regulations and customer ESG targets, reinforcing brand value.

Collaborative alliances with academic institutions, system integrators, and end users can accelerate the development of next-generation stationary phases and automation protocols. By establishing precompetitive consortia, organizations can share validation data, co-develop standards, and reduce time to regulatory approval. Finally, upskilling process development teams in continuous chromatography principles, digital tools, and sustainability metrics will position companies to execute these recommendations effectively and maintain a competitive edge.

Outlining Rigorous Research Methodology Combining Interviews, Data Analysis, Conference Review, and Triangulation to Guarantee Insight Integrity

The methodology underpinning this analysis blends multiple research techniques to ensure depth, reliability, and actionable clarity. Primary interviews were conducted with process development scientists, operations managers, and regulatory experts across biotechnology, pharmaceutical, and industrial sectors, capturing firsthand perspectives on technology adoption and supply chain challenges. These qualitative insights were complemented by rigorous secondary data analysis, including company disclosures, patent filings, standards publications, and government trade data.

A focused conference review provided context on emerging academic research, early-stage continuous chromatography demonstrations, and regulatory guidelines presented at leading industry gatherings. The triangulation of these sources enabled cross-validation of key findings and identification of consensus trends versus isolated developments. Throughout, quality assurance protocols ensured that interpretations remained unbiased and reflective of the latest scientific and commercial evidence. This multi-pronged approach guarantees that the insights delivered are robust, relevant, and poised to support strategic decision-making in preparative and process chromatography.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Preparative & Process Chromatography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Preparative & Process Chromatography Market, by Equipment Type

- Preparative & Process Chromatography Market, by Operation Mode

- Preparative & Process Chromatography Market, by Technology

- Preparative & Process Chromatography Market, by Resin Chemistry

- Preparative & Process Chromatography Market, by Application

- Preparative & Process Chromatography Market, by Region

- Preparative & Process Chromatography Market, by Group

- Preparative & Process Chromatography Market, by Country

- United States Preparative & Process Chromatography Market

- China Preparative & Process Chromatography Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Insights on Chromatography Market Dynamics, Segmentation Insights, Regional Outlook, and the Path Forward for Industrial Bioprocessing Leaders

The journey through the preparative chromatography landscape highlights the convergence of technological breakthroughs, supply chain adaptations, and strategic segmentation that define modern separation science. From laboratory screening to full-scale production, the nuanced requirements of equipment, operation modes, and resin chemistry underscore the need for tailored purification strategies. Regional variations further emphasize the importance of localized sourcing, regulatory alignment, and market-specific workflows.

Key players are accelerating their capabilities through strategic mergers, R&D investments, and service-based offerings that span method development to column stewardship. Meanwhile, actionable recommendations around continuous processing, digital integration, and sustainability initiatives provide a clear roadmap for industry leaders looking to enhance productivity, reduce costs, and meet environmental targets. By embracing these insights, organizations can navigate tariff headwinds, capitalize on segmentation advantages, and secure competitive differentiation.

As the chromatography sector continues to evolve, the fusion of innovative technologies, robust supply networks, and strategic partnerships will be instrumental in driving next-generation separations. This conclusion reaffirms the critical role of informed decision-making, collaborative development, and agile execution in realizing the full potential of preparative and process chromatography.

Contact Ketan Rohom Today to Secure Your Comprehensive Preparative and Process Chromatography Market Research Report and Unlock Strategic Advantages

Are you ready to leverage the most comprehensive insights on preparative and process chromatography that can drive your strategic advantage? Ketan Rohom, Associate Director of Sales & Marketing, invites you to secure your copy of the market research report and gain unparalleled visibility into emerging trends, technology advancements, and best practices. Engage directly with an expert who can tailor the findings to your organization’s unique needs, unlock customized data sets, and provide actionable guidance for capitalizing on opportunities.

Don’t miss the chance to partner with a leading authority on chromatography market dynamics. Reach out to Ketan Rohom today to discuss how this report can support your investment decisions, streamline your purification workflows, and position your company at the forefront of innovation in bioprocessing and industrial separation.

- How big is the Preparative & Process Chromatography Market?

- What is the Preparative & Process Chromatography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?