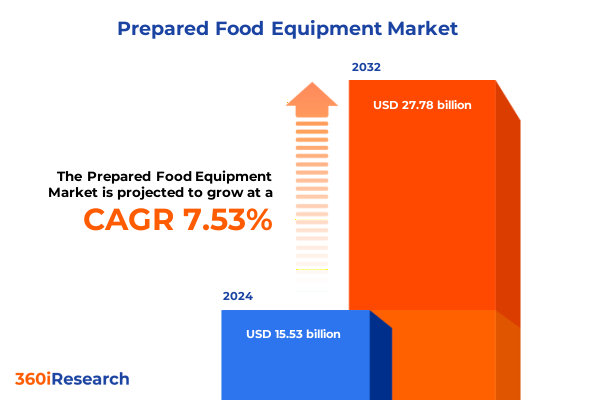

The Prepared Food Equipment Market size was estimated at USD 16.73 billion in 2025 and expected to reach USD 17.72 billion in 2026, at a CAGR of 7.51% to reach USD 27.78 billion by 2032.

Exploring the Dynamic Evolution of Prepared Food Equipment and Its Pivotal Role in Driving Efficiency Resilience and Innovation in Modern Food Manufacturing Processes

The prepared food equipment sector has emerged as a critical enabler of efficiency, hygiene, and innovation across the global food manufacturing landscape. Manufacturers of everything from baked goods to ready-to-eat meals depend on specialized equipment to meet ever-evolving consumer demands for convenience and quality. In response to rising preferences for personalized nutrition and minimal-contact production, the role of sophisticated machinery has moved beyond mere throughput to encompass agile configuration, real-time monitoring, and compliance with stringent safety standards.

Against this backdrop, this executive summary distills the most salient trends affecting prepared food equipment, including technology-driven transformations, tariff-driven cost pressures in the United States, nuanced segmentation insights, and regional performance variations. Organizations increasingly require a consolidated vantage point to navigate complexities ranging from supply chain disruptions to sustainability mandates.

By examining the dynamics shaping equipment type innovation, operational mode adoption, application-specific requirements, and distribution channel evolution, this analysis provides a holistic vantage that equips decision-makers with clarity. As a foundation for strategic investment and operational planning, these insights serve to inform procurement strategies, product development roadmaps, and market-entry assessments that align with both current realities and future trajectories.

Unveiling the Transformative Technological Operational and Consumer-Driven Shifts Reshaping the Prepared Food Equipment Industry Landscape

Over the past several years, advances in digital connectivity and automation have redefined the capabilities of prepared food equipment, delivering unprecedented levels of precision and consistency. Internet of Things integration has enabled continuous performance tracking, while artificial intelligence–driven algorithms optimize production parameters in real time. Beyond simple mechanization, robotics-assisted operations now manage tasks from delicate confectionery decoration to high-throughput packaging with minimal human intervention, reducing error rates and elevating throughput benchmarks.

Furthermore, the operational architecture underpinning these shifts has migrated toward modularity and flexibility. Equipment designs now prioritize quick-changeover capability, allowing manufacturers to pivot rapidly between product lines and batch sizes. Remote monitoring and diagnostics have emerged as indispensable features, minimizing unplanned downtime and streamlining maintenance protocols. Energy-efficient drives and thermal management systems also reflect growing corporate commitments to sustainability without sacrificing operational rigor.

Simultaneously, evolving consumer preferences are steering equipment innovation in new directions. The proliferation of plant-based alternatives and clean-label formulations demands machinery capable of delicate ingredient handling and variable viscosity control. Producers of sauces, dressings, and condiments seek dosing systems that ensure consistency across complex formulations, while snack and savory product lines rely on precision frying and seasoning attachment technologies.

As a result, sustainability considerations such as water usage reduction, waste recovery, and recyclable material processing have become integral to design objectives. Leading manufacturers now collaborate with equipment providers to embed circular economy principles at the heart of production workflows, ensuring that transformation in the prepared food equipment sector advances in tandem with environmental stewardship.

Analyzing the Cumulative Effects of 2025 United States Tariff Measures on Prepared Food Equipment Supply Chains Costs and Strategic Sourcing Decisions

In 2025, a series of tariff actions implemented by United States authorities targeting key metals, electronic components, and specialized subassemblies has created far-reaching implications for the prepared food equipment market. The imposition of duties on imported stainless steel frames and critical sensor modules has elevated landed costs substantially, prompting original equipment manufacturers and end users alike to revisit cost structures and sourcing strategies.

These escalated input costs have not only strained operating margins but also triggered a reconfiguration of supply chain models. Many equipment providers have increased minimum order quantities to offset tariff-induced unit cost burdens, placing additional inventory management pressures on processors. Consequently, organizations have accelerated discussions around nearshoring and local content development, exploring partnerships with domestic metal fabricators and electronic assembly firms to mitigate exposure to future tariff volatility.

Lead times have also been affected, as suppliers contend with imported component backlogs and re-export regulations. To maintain production schedules, manufacturers of prepared food equipment are adopting just-in-time inventory frameworks and forging alliances with logistics providers offering expedited customs clearance and bonded warehousing solutions. These tactical shifts help absorb short-term disruptions but also underscore the need for strategic supplier diversification.

Longer-term, industry leaders are evaluating alternative materials such as high-strength polymers and coated alloys to replace tariff-sensitive steel grades without compromising hygiene or durability requirements. In parallel, investments in automated yield monitoring and real-time cost analytics are becoming standard practice, empowering procurement teams to make data-backed sourcing decisions in an environment of heightened trade uncertainty and cost inflation.

Uncovering Critical Insights from Equipment Type Operation Mode Application and Distribution Channel Segmentation to Inform Strategic Decision Making

Insights derived from segmenting the prepared food equipment market by equipment type reveal distinct innovation trajectories across packaging, pre-processing, and processing machinery. High-speed labeling and sealing systems are seeing rapid incorporation of machine-vision inspection, while pre-processing lines focus on gentle washing and cutting technologies that preserve ingredient integrity. Processing equipment, particularly blending and volumetric filling units, continues to prioritize modularity for multi-product versatility.

When examining mode of operation, it becomes apparent that fully automatic systems dominate high-volume, standardized production environments due to their precision and throughput advantages. In contrast, manual equipment remains indispensable within small-batch artisanal applications, providing operators with tactile control over product attributes. Semi-automatic solutions occupy an intermediary niche, offering scalable automation with configurable labor inputs ideal for mid-level producers seeking balance between cost and functionality.

Application-oriented segmentation further nuances these findings, as the requirements of bakery and confectionery product lines differ markedly from those of meat and seafood processors. Dairy and refrigerated products necessitate robust cold-chain integration, while prepared meals demand hygienic quick-change configurations. Producers of sauces, dressings, and condiments seek high-accuracy dosing and emulsification capabilities, whereas snack and savory product manufacturers emphasize high-capacity frying, seasoning, and seasoning applicator precision.

Distribution channel analysis underscores the importance of dealer networks, direct sales, and online platforms in facilitating equipment procurement and after-sales service. National dealers provide broad coverage and standardized maintenance offerings, while regional dealers deliver localized support tailored to specific regulatory zones. OEM sales through contracts and tenders remain the primary route for large institutional buyers, and online direct sales via manufacturer websites and third-party platforms are steadily gaining traction among smaller operations seeking rapid turnaround and transparent pricing.

Taken together, the segmentation analysis highlights cross-segment opportunities, such as pairing modular automatic processing lines with online procurement channels to serve emerging artisanal meal kit producers, and combining regional dealer expertise with semi-automatic packaging solutions to accelerate market entry in cost-sensitive regions.

This comprehensive research report categorizes the Prepared Food Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Mode of Operation

- Application

- Distribution Channel

Highlighting Regional Variations Across Americas Europe Middle East Africa and Asia Pacific to Illuminate Prepared Food Equipment Market Dynamics Globally

Regional performance across the Americas is characterized by significant investments in automation and compliance with stringent food safety regulations. North American producers prioritize equipment with advanced sanitation features, given heightened regulatory scrutiny and consumer demand for transparency. In contrast, Latin American markets are at an earlier adoption stage, with growth propelled by rising urbanization and expanding cold-store infrastructure, creating opportunities for entry-level processing and packaging systems.

Within Europe, a focus on decarbonization and circular economy principles drives equipment specifications. Machinery tailored for minimal water consumption and waste recycling resonates with producers dealing with tight environmental standards. The Middle East is witnessing rapid capacity expansion funded by infrastructure diversification initiatives, and regional equipment preferences lean toward robust designs capable of handling high ambient temperatures. In Africa, burgeoning demand for processed foods is coupled with cost sensitivity, prompting suppliers to offer simplified, modular equipment that balances affordability with performance.

Asia-Pacific stands out for its dynamic market growth, fueled by urban population booms in China, India, and Southeast Asia. Local manufacturers are increasingly innovating to meet demand for convenience products, spurring adoption of high-speed packaging lines and inline quality inspection tools. In developed pockets such as Japan and South Korea, the emphasis is on precision and digital integration, with robotics and AI bolstering operational excellence.

Despite regional variations, common threads emerge: the convergence toward sustainability, the pursuit of automation for labor-constrained environments, and the growing role of digital connectivity in predictive maintenance. Understanding these cross-regional dynamics allows stakeholders to tailor market-entry strategies, align product development roadmaps, and forge partnerships that leverage regional strengths and address local challenges.

This comprehensive research report examines key regions that drive the evolution of the Prepared Food Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Competitive Strategies and Innovations Among Leading Prepared Food Equipment Manufacturers Driving Industry Advancement

The competitive landscape of the prepared food equipment sector is shaped by a blend of established global OEMs and agile niche players, each vying to deliver the next breakthrough in performance, connectivity, and sustainability. Key market leaders continue to differentiate their product portfolios through the integration of remote diagnostics, enabling predictive maintenance capabilities that minimize downtime for end users. Investments in artificial intelligence and machine-learning algorithms have become a hallmark of leading equipment lines, providing real-time insights into throughput efficiency and yield optimization.

Partnerships also define the competitive arena, with equipment manufacturers collaborating closely with software providers to deliver holistic Industry 4.0 solutions. These alliances facilitate end-to-end data integration, allowing processors to synchronize production planning, quality assurance, and inventory management through unified digital platforms. Simultaneously, strategic acquisitions of robotics specialists and sensor technology firms bolster incumbents’ ability to embed advanced functionality within legacy product lines.

Startups and emerging innovators further invigorate the market by introducing disruptive approaches, such as robotic pick-and-place systems for delicate confectionery handling and modular skids for rapid deployment. These entrants often engage in co-development agreements with larger manufacturers, accelerating time to market and fostering a two-way flow of technological innovation.

In parallel, mid-tier companies focused on cost-effective automation serve value-oriented segments, offering semi-automatic and manual solutions that are purpose-built for small to medium-scale operations. Collectively, the interplay between global giants, specialized newcomers, and value-based providers creates a dynamic ecosystem in which continuous improvement and strategic differentiation remain paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Prepared Food Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. S. Engineering Works

- Apollo Kitchen Equipments & Services Pvt. Ltd.

- Bucher Industries AG

- Bühler AG

- EssEmm Corporation

- Fagor Industrial, S. Coop.

- GEA Group Aktiengesellschaft

- Goyal Kitchen Equipments

- Grace Food Processing & Packaging Machinery

- JBT Corporation

- Kanchan Metals Pvt. Ltd.

- Key Technology, Inc.

- Krones AG

- Manjeet Kitchen Equipments

- Marel hf.

- Shiva Kitchen Equipments Pvt. Ltd.

- Sidel Group

- Somerset Industries, Inc.

- Tetra Pak International S.A.

- The Middleby Corporation

Presenting Actionable Recommendations for Industry Leaders to Navigate Disruption Capitalize on Emerging Trends and Strengthen Market Positioning

Industry leaders should diversify procurement networks to balance the impact of trade policy fluctuations, establishing relationships with domestic fabricators, component suppliers, and logistics partners to increase supply chain resilience. By integrating advanced cost-tracking systems into procurement workflows, organizations can maintain visibility into landed costs and make proactive adjustments to sourcing strategies as tariffs and trade regulations evolve.

Investing in next-generation automation technologies is imperative for sustaining competitive advantage. Executives ought to allocate resources toward equipment that features real-time performance analytics, remote diagnostics, and adaptive control systems. These capabilities not only improve throughput and yield consistency but also reduce unplanned downtime through predictive maintenance scheduling.

Sustainability must be embedded at every stage of equipment selection and operation. Decision-makers are encouraged to evaluate machinery based on water and energy consumption metrics, waste recovery capabilities, and end-of-life recyclability. Collaborating with equipment providers to pilot circular economy initiatives, such as modular component reuse, can further align operational practices with corporate environmental objectives.

Finally, embracing digital sales and service channels can unlock new revenue streams and customer engagement models. Companies should develop robust e-commerce platforms and mobile applications for order placement, spare parts provisioning, and virtual training. These digital touchpoints strengthen customer loyalty by offering transparency, convenience, and rapid support in an increasingly connected world.

Detailing the Rigorous Multi Source Research Methodology Employed to Deliver Comprehensive Reliable Insights into the Prepared Food Equipment Sector

This analysis draws upon a comprehensive research framework that integrates both primary and secondary methodologies to ensure depth, reliability, and objectivity. Primary data was collected through structured interviews and workshops with equipment manufacturers, processing plant executives, distribution channel partners, and regulatory bodies. These engagements provided firsthand insights into technology adoption patterns, procurement criteria, and operational challenges.

Secondary research encompassed an exhaustive review of industry white papers, trade association publications, regulatory filings, and academic research. This review supported the identification of macroeconomic factors, such as tariff regimes and regional regulatory landscapes, that influence capital equipment procurement decisions. Publicly available company disclosures and patent filings further enriched the analysis of innovation trajectories and partnership ecosystems.

Quantitative and qualitative data were triangulated through cross-validation, statistical correlation analysis, and scenario modeling to surface the most robust trends and insights. Where available, equipment performance benchmarks and supplier lead-time statistics were incorporated to add empirical rigor. Throughout the research process, findings underwent peer review by subject matter experts to validate assumptions and refine conclusions.

The resulting methodology provides a transparent, replicable foundation for understanding the prepared food equipment sector’s evolving dynamics, empowering stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Prepared Food Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Prepared Food Equipment Market, by Equipment Type

- Prepared Food Equipment Market, by Mode of Operation

- Prepared Food Equipment Market, by Application

- Prepared Food Equipment Market, by Distribution Channel

- Prepared Food Equipment Market, by Region

- Prepared Food Equipment Market, by Group

- Prepared Food Equipment Market, by Country

- United States Prepared Food Equipment Market

- China Prepared Food Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding with a Strategic Perspective on How Emerging Trends Tariff Impacts and Segmentation Insights Converge to Shape Future Opportunities

The prepared food equipment market stands at a pivotal juncture, driven by rapid technological innovation, shifting global trade dynamics, and evolving consumer preferences. The integration of digital connectivity and automation has transformed traditional processing and packaging paradigms, enabling greater agility and operational excellence. At the same time, tariffs and regulatory measures have reshaped cost structures and supply chain architectures, compelling manufacturers to reevaluate sourcing strategies and inventory models.

Segmentation analysis underscores the varied demands of different equipment types, operation modes, applications, and distribution channels, revealing targeted opportunities for specialized deployment. Regional disparities highlight unique growth drivers and challenges across the Americas, EMEA, and Asia-Pacific, underscoring the importance of localized approaches in market expansion and product development.

Competitive insights into leading and emerging players demonstrate an industry in flux, where collaborations, strategic acquisitions, and disruptive startups collectively fuel innovation. In this context, building resilience through diversified supplier networks, embedding sustainability in equipment selection, and investing in advanced analytics emerges as critical to securing long-term advantage.

By harnessing these insights, executives can chart a course that balances cost, compliance, and capability, ensuring preparedness not only for current market demands but also for the unforeseen pressures of tomorrow’s food manufacturing landscape.

Empower Your Organization’s Strategic Decisions by Connecting with Associate Director Ketan Rohom to Acquire the Comprehensive Prepared Food Equipment Report

To unlock the strategic insights and comprehensive analysis presented in this executive summary, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of the full market research report on prepared food equipment. Ketan brings a deep understanding of industry dynamics and can guide you through customized packages and licensing options that align with your organization’s unique objectives and investment requirements.

By partnering with Ketan, you gain priority access to exclusive sections on emerging technologies, detailed case studies of leading equipment deployments, and proprietary frameworks for evaluating supplier performance. His expertise will ensure that you receive not only the data you need but also the contextual guidance to apply these findings in strategic planning, capital investments, and operational optimization. Reach out today to transform your decision-making processes and stay ahead of competitive pressures in the evolving prepared food equipment landscape.

- How big is the Prepared Food Equipment Market?

- What is the Prepared Food Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?