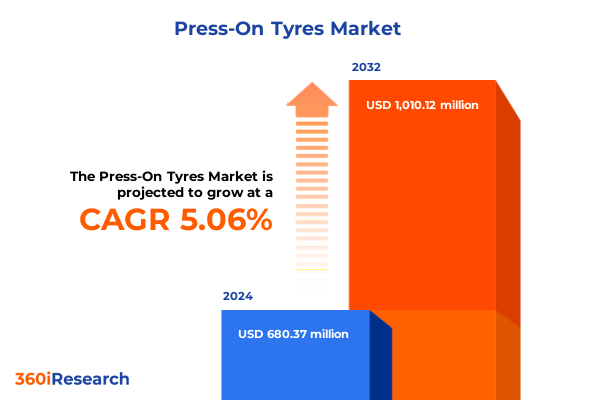

The Press-On Tyres Market size was estimated at USD 12.44 billion in 2025 and expected to reach USD 13.48 billion in 2026, at a CAGR of 8.37% to reach USD 21.84 billion by 2032.

Unveiling the Core Drivers and Emerging Trends Defining the Press-On Tyre Market as Mobility Shifts Accelerate Innovation and Adoption Strategies

The press-on tyre landscape is experiencing a fundamental transformation as mobility trends converge with evolving consumer expectations and material innovations. Fueled by increasing awareness of puncture risks and downtime costs, fleet operators and individual motorists are seeking advanced solutions that blend ease of installation with reliability under diverse driving conditions. At the same time, the rapid adoption of electric vehicles and the rise of autonomous mobility services emphasize the need for tyre technologies that can deliver consistent performance, reduced noise, and enhanced efficiency. As a result, research and development efforts are intensifying to refine press-on systems, optimize bonding agents, and integrate sensor technologies that provide real-time condition monitoring and predictive maintenance capabilities.

In parallel, eco-friendly imperatives and regulatory pressures are driving a shift toward sustainable materials and circular supply chains within the press-on tyre segment. Manufacturers are exploring bio-based adhesives and recyclable liners to minimize environmental impact while ensuring that product lifecycle performance meets stringent safety norms. This evolving paradigm underscores the importance of cross-industry collaboration, bringing together polymer scientists, adhesive specialists, and vehicle OEMs to co-innovate solutions that address both performance benchmarks and sustainability targets. As these core drivers continue to reshape the market, stakeholders who strategically align their development roadmaps and distribution models can capture new growth avenues and establish thought leadership in a dynamic, highly competitive environment.

Navigating Pivotal Transformations Reshaping the Press-On Tyre Industry from Electrification Imperatives to Advanced Manufacturing and Digital Distribution Models

The press-on tyre industry is undergoing pivotal transformations driven by technological breakthroughs and shifting supply chain paradigms. Electrification initiatives are prompting the development of low-rolling-resistance bonding systems that preserve energy efficiency while accommodating higher torque demands. Concurrently, additive manufacturing techniques are enabling rapid prototyping of liner geometries that improve adhesive spread and uniform pressure distribution, resulting in enhanced ride comfort and tyre longevity. These advancements are complemented by digital supply chain platforms that offer end-to-end visibility, connecting raw material suppliers, adhesive producers, and aftermarket distributors through real-time inventory tracking and predictive replenishment algorithms.

Furthermore, consumer engagement is evolving as digital retail channels proliferate and virtual fitment solutions emerge. Interactive online configurators now allow end users to visualize press-on tyre assemblies on their vehicles, select compatible liners by vehicle type, and schedule on-site fitting services. This trend toward digital-physical integration reduces lead times and creates seamless user experiences, reinforcing the strategic importance of robust e-commerce capabilities. In response, forward-looking tyre manufacturers are forging partnerships with technology providers and logistic specialists to offer integrated platforms that streamline ordering, warehousing, and installation scheduling. These transformative shifts establish a foundation for sustained innovation and heightened market responsiveness within the press-on tyre segment.

Examining Cumulative Effects of New United States Tariffs on Press-On Tyre Supply Chains Production Costs and Market Access in 2025

In 2025, the United States implemented a series of cumulative tariffs on imported tyre components and raw materials, significantly affecting cost structures across the press-on tyre segment. These tariffs have elevated the price of specialized adhesives, reinforcing fibers, and rubber compounds, compelling manufacturers to reassess supplier portfolios and negotiate new terms. As cost pressures mount, many firms are shifting to diversified sourcing strategies, establishing partnerships with domestic producers of natural and synthetic rubber to mitigate tariff volatility. Simultaneously, the need to maintain competitive end-user pricing has accelerated investments in lean manufacturing practices and advanced quality controls to maximize yield and minimize waste during the lamination process.

These policy changes have also spurred a renewed emphasis on nearshoring and regional production hubs to reduce lead times and transportation expenses. By relocating critical stages of the assembly process closer to key markets, manufacturers can offset tariff impacts while preserving margin integrity. However, the transition entails capital expenditures for facility upgrades and workforce retraining, underscoring the importance of collaborative ventures between tyre producers, material suppliers, and regional economic development agencies. Moving forward, the cumulative effect of these tariffs will continue to influence competitive positioning, prompting industry participants to refine cost models, accelerate process innovations, and cultivate resilient supply chain networks.

Uncovering Strategic Segmentation Insights Across Product Material Application Distribution Sales Channel and Rim Size Drivers for Press-On Tyres

A nuanced understanding of product segmentation reveals that the press-on tyre market spans a diverse array of performance categories tailored to specific driving scenarios. Within the all-season domain, touring configurations prioritize longevity and ride comfort, while performance variants deliver enhanced handling across wet and dry conditions. All-terrain offerings diverge into highway-focused compounds designed for fuel efficiency and off-road formulations engineered for traction on unpaved surfaces. Run-flat systems present subcategories of self-supported liners, auxiliary-supported kits, and hybrid designs that strike different balances between weight and emergency mobility. Summer product lines further bifurcate into ultra-high-performance assemblies for sports applications and touring versions for everyday driving, while winter tyres split into studded and non-studded options to optimize safety on icy and snow-covered roads.

Equally critical is material segmentation, which spans composite liners with reinforced or non-reinforced architectures, prime and reclaimed natural rubber formulations, and synthetic compounds based on butadiene, EPDM, and styrene-butadiene rubber. Each material subset imparts unique adhesion, durability, and temperature tolerance characteristics. Application segmentation dissects end-user demand across heavy and light commercial vehicles, off-road and on-road motorcycles, and passenger vehicle variants including cars, crossovers, and SUVs. Distribution channels encompass traditional outlets such as dealers, service centers, and wholesalers alongside online platforms via company websites and third-party marketplaces. Sales channel segmentation differentiates direct engagements through proprietary channels and fleet contracts from indirect partnerships with distributors and retailers. Lastly, rim size considerations range from 13–15 inch assemblies divided into 13–14 and 14–15 inch brackets, through 16–18 inch classes split into 16–17 and 17–18 inch tiers, to 19+ inch wheels segmented into 19–20 and 21+ inch categories. This multilayered segmentation framework enables precise targeting of product innovation and marketing initiatives.

This comprehensive research report categorizes the Press-On Tyres market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Material

- Rim Size

- Application

- Distribution Channel

Exploring Regional Nuances in Press-On Tyre Adoption and Distribution across the Americas EMEA and Asia-Pacific Markets

Regional dynamics profoundly influence the development and deployment of press-on tyre solutions. In the Americas, a mature aftermarket ecosystem combined with progressive infrastructure standards fuels demand for advanced press-on offerings that enhance uptime and reduce maintenance complexity. North American fleets, in particular, prioritize rapid fitment services and mobile warranty support, driving growth in on-site installation networks and partnerships between tyre producers and service providers. Latin American markets are witnessing an uptick in off-road press-on applications, as agricultural and mining sectors seek robust rubber compounds and liner systems capable of withstanding extreme terrain and heavy load cycles.

In Europe, Middle East & Africa, regulatory frameworks emphasizing environmental sustainability and safety are catalyzing the adoption of recyclable liners and eco-adhesives. Western European countries are early adopters of advanced press-on technologies, with fleet operators requiring seamless OBD integration for tyre-monitoring systems. Meanwhile, in the Middle East, high ambient temperatures and challenging desert environments are prompting material innovation, while African markets are gradually embracing aftermarket services as infrastructure projects expand. Across Asia-Pacific, robust automotive production hubs in East Asia and the rising popularity of two-wheeler mobility in Southeast Asia spur diversified demand. In China and India, the confluence of expanding light-vehicle ownership and developing fleet logistics creates a lucrative environment for both mass-market and premium press-on tyre solutions. These regional variations underscore the need for tailored product roadmaps and distribution strategies.

This comprehensive research report examines key regions that drive the evolution of the Press-On Tyres market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Industry Players Driving Competitive Innovation Partnerships and Strategic Growth in the Press-On Tyre Sector

The competitive landscape of the press-on tyre sector is characterized by established tyre manufacturers forging strategic alliances and pioneering new solutions. Leading global suppliers are investing heavily in R&D to optimize adhesive chemistries and liner materials, partnering with chemical producers for customized polymer blends that enhance bond strength under variable temperature cycles. Strategic collaborations between tyre OEMs and technology firms are also emerging, integrating sensor packages into press-on assemblies to enable seamless connectivity with vehicle telematics systems and predictive maintenance platforms.

Furthermore, mid-sized specialists are carving out niches by focusing on high-value segments such as off-road and motorsport applications, emphasizing lightweight composite liners and rapid replacement protocols. Several players are expanding their geographic footprints through joint ventures and licensing agreements, particularly in high-growth regions like Southeast Asia and Latin America. This trend illustrates a dual focus on market diversification and capability expansion, allowing companies to address both fleet and consumer end users effectively. As competition intensifies, the ability to leverage proprietary technologies and cross-industry partnerships will distinguish market leaders and accelerate the adoption of next-generation press-on tyre solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Press-On Tyres market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accel Tire Group, LLC

- Addo India Tyres

- Affix Cold Tread Co.

- Bremels Rubbers

- Bridgestone Corporation

- Compagnie Générale des Établissements Michelin SCA

- Continental AG

- Eastman Industries Limited

- Emerald Tyre Manufacturers Limited

- Gandhi Tyres

- Industrial Rubber Company

- Load Solid Tyres Pvt Ltd

- Maciej Material Handling

- Marangoni S.p.A.

- Mel Services

- Om Sagar Engineering Pvt Ltd

- Pirelli & C. S.p.A.

- Potento Lift Stack Equipments

- Sterling Solid Tyres (P) Ltd

- Sun-Tyre & Wheel Systems

- Technoflex Rubber Products

- The Goodyear Tire & Rubber Company

- The Yokohama Rubber Co., Ltd.

- Treadcraft Canada Inc.

- TreadStone Systems A/S

Implementing Strategic Initiatives to Capitalize on Emerging Press-On Tyre Opportunities and Strengthen Competitive Positioning Globally

To capitalize on evolving market opportunities, industry leaders should prioritize investments in adhesive and liner innovation that align with electrification trends and stringent regulatory requirements. Enhancing collaboration with electric vehicle OEMs can yield bespoke press-on systems calibrated for high-torque launch profiles and low-noise operation. Additionally, expanding digital distribution capabilities through direct-to-consumer portals and mobile service offerings will deepen customer engagement and facilitate data-driven service models. By integrating predictive maintenance features and warranty tracking into online platforms, manufacturers can foster loyalty and create recurring revenue streams.

Moreover, supply chain resilience must become a strategic imperative. Diversifying raw material sources and establishing regional assembly hubs will mitigate tariff impacts and logistical disruptions. Leaders should also explore circular economy initiatives, partnering with end-of-life tyre processors to reclaim liners and adhesives for remanufacturing. Finally, robust training programs for service network partners can ensure consistent installation quality and protect brand reputation. By executing these targeted strategies, press-on tyre companies can strengthen their competitive positioning and capture value in both mature and emerging markets.

Detailing Rigorous Methodological Framework Employing Primary and Secondary Research Techniques for In-Depth Press-On Tyre Market Analysis

This analysis is underpinned by a robust methodological framework combining primary and secondary research techniques. Primary insights were obtained through in-depth interviews with key executives at tyre manufacturers, adhesive suppliers, fleet operators, and end-user service networks. These discussions informed qualitative perspectives on product innovation priorities, supply chain strategies, and emerging application requirements. Secondary sources, including industry publications, regulatory filings, and peer-reviewed journals, were systematically reviewed to validate technological trends and competitive developments.

Quantitative data collection involved compiling global patent filings, trade statistics, and customs records to map tariff impacts and material flow patterns. A triangulation approach ensured data integrity, cross-referencing survey findings with historical industry performance metrics and public financial disclosures. The segmentation framework was developed through iterative workshops with subject matter experts, aligning product, material, application, distribution, sales channel, and rim size categories to reflect real-world market needs. This comprehensive methodology supports the credibility of the insights presented and offers stakeholders a transparent view of research processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Press-On Tyres market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Press-On Tyres Market, by Product

- Press-On Tyres Market, by Material

- Press-On Tyres Market, by Rim Size

- Press-On Tyres Market, by Application

- Press-On Tyres Market, by Distribution Channel

- Press-On Tyres Market, by Region

- Press-On Tyres Market, by Group

- Press-On Tyres Market, by Country

- United States Press-On Tyres Market

- China Press-On Tyres Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Critical Findings to Illuminate Future Directions and Strategic Imperatives for Stakeholders in the Press-On Tyre Ecosystem

In synthesizing the findings, it is evident that the press-on tyre industry is at a crossroads defined by material innovations, digital transformation, and policy shifts. The convergence of electrification demands, advanced manufacturing capabilities, and evolving consumer preferences highlights a landscape ripe for strategic differentiation. Tariff headwinds in the United States underscore the necessity for resilient supply chains and regional production footprints, while segmentation insights offer a roadmap for targeted product development across diverse application scenarios.

Regional dynamics further emphasize the importance of localized strategies that cater to specific environmental and regulatory contexts. Competitive trajectories indicate that collaboration and proprietary technology integration will serve as key differentiators, compelling stakeholders to forge cross-industry partnerships and invest in value-added services. As the press-on tyre market continues to mature, organizations that proactively adapt to these multifaceted drivers and implement the actionable recommendations outlined will be well-positioned to lead the next wave of growth and innovation.

Engage with Ketan Rohom to Access Comprehensive Press-On Tyre Market Intelligence and Drive Informed Strategic Decision Making Today

To explore a deeper understanding of the press-on tyre market and unlock actionable insights for strategic growth, schedule a personalized briefing with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in navigating complex industry dynamics and tailoring data-driven recommendations ensures that your organization will gain the competitive intelligence necessary to optimize product portfolios, streamline supply chains, and capitalize on emerging opportunities. Reach out to Ketan Rohom today to secure access to the comprehensive market research report and partner with a knowledgeable advisor committed to accelerating your success in the rapidly evolving press-on tyre ecosystem.

- How big is the Press-On Tyres Market?

- What is the Press-On Tyres Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?