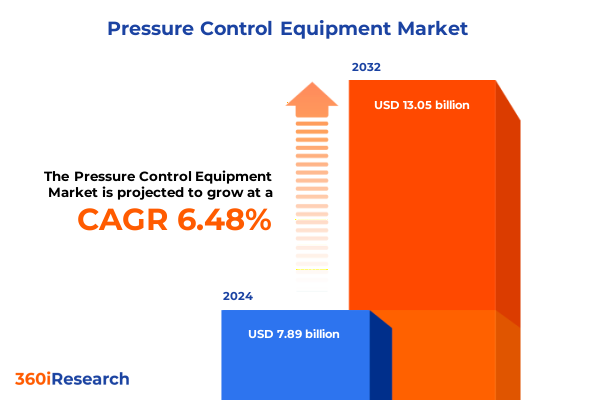

The Pressure Control Equipment Market size was estimated at USD 8.41 billion in 2025 and expected to reach USD 8.91 billion in 2026, at a CAGR of 6.47% to reach USD 13.05 billion by 2032.

Exploring the Vital Backbone of Industrial Safety and Efficiency with Pressure Control Technologies Across Today’s Complex Operational Environments

Pressure control equipment, encompassing valves, regulators, and chokes, serves as the unseen backbone of countless industrial processes where precise flow and pressure management is critical. In sectors such as oil and gas, manufacturing, energy, and mining, these devices uphold operational integrity by ensuring that pressurized fluids and gases adhere to stringent safety and performance criteria. Without robust pressure control systems, complex operations run the risk of catastrophic failures, regulatory non-compliance, and costly downtime.

The evolution of pressure control technologies has been shaped by the dual demands of digitalization and sustainability. Modern systems leverage advanced sensors and Internet of Things connectivity to monitor performance in real time, enabling remote diagnostics and automated adjustments that reduce unplanned stoppages and enhance asset utilization. Concurrently, rising environmental standards and energy-efficiency mandates have driven innovations in low-leakage and energy-saving actuation mechanisms. As a result, manufacturers today offer solutions that not only deliver precise control but also contribute to corporate sustainability goals, underlining the strategic importance of pressure control equipment in achieving operational excellence.

Unraveling the Technological, Regulatory, and Market Dynamics Redefining the Future Trajectory of Pressure Control Equipment Innovations

The landscape of pressure control equipment is undergoing a fundamental transformation, driven by converging forces that reshape both product design and industry strategy. At the forefront, digital automation has accelerated the adoption of smart valves and regulators that integrate artificial intelligence for predictive maintenance, enabling asset managers to forecast component wear and schedule interventions before failures occur. This shift from reactive to proactive maintenance not only mitigates operational risk but also optimizes lifecycle costs, reinforcing the business case for intelligent pressure management solutions.

Meanwhile, escalating environmental and safety regulations worldwide have prompted manufacturers to innovate around energy-efficient actuation and low-emission designs. The demand for equipment that meets stringent ISO, ASME, and API standards has never been higher, compelling suppliers to deploy advanced materials and sealing technologies that reduce leakage and enhance durability under harsh service conditions. These developments underscore the pivotal role of regulatory frameworks in steering product roadmaps.

Another emergent trend is supply chain resilience. Recent fluctuations in global steel and aluminum availability, compounded by geopolitical trade tensions, have led end-users to diversify sourcing strategies and build buffer inventories. In parallel, industry consolidation through mergers and acquisitions is gaining momentum, as leading firms seek to broaden their portfolios and geographic reach. Notable transactions include Honeywell’s acquisition of Sundyne to enrich its downstream pump and compressor offerings and the all-stock merger of Chart Industries and Flowserve to form a formidable industrial process technologies platform. Taken together, these transformative shifts signal a new era of innovation, compliance, and strategic positioning in the pressure control equipment arena.

Assessing the Far-Reaching Consequences of Expanded U.S. Steel and Aluminum Tariffs on Pressure Control Equipment Manufacturing Costs and Supply Chain Strategies

In early 2025, the United States reinstated and expanded Section 232 tariffs on imported steel and aluminum, a decision with significant downstream implications for pressure control equipment manufacturers. President Trump’s February proclamation restored a uniform 25 percent duty on steel and elevated aluminum tariffs to 25 percent by closing alternative exemption agreements that had previously mitigated import levies. Shortly thereafter, a subsequent proclamation increased tariffs on both metals to 50 percent effective June 4, 2025, as part of a broader effort to protect domestic steel and aluminum producers from global excess capacity.

These heightened duties have directly influenced raw material costs for valve and regulator fabricators, as steel and aluminum content in pressure control devices now attracts steeper import levies. Manufacturers have faced immediate financial pressure to absorb increased input prices or pass them through the supply chain, prompting renegotiation of supplier contracts and redesign of components to optimize material usage. At the same time, the exclusion process for derivative steel articles was suspended in March 2025, extending tariffs to a wider range of finished and downstream products and further complicating procurement strategies within the industry.

As a result, pressure control equipment suppliers have accelerated their efforts to localize production, develop alternative alloy formulations, and refine bill-of-materials specifications to contain cost impacts. While these measures mitigate short-term tariff burdens, they also catalyze longer-term supply chain realignment and innovation in material science-trends that will define competitive advantage in a persistently uncertain trade environment.

Delving into Valve, Actuation, Material, Operation, and End-Industry Segmentation to Reveal Tailored Insights Driving Strategic Product Development

The pressure control equipment market is analyzed through multiple segmentation lenses, each revealing unique performance drivers and application priorities. Valve types encompass a diverse range, from ball valves prized for their bi-directional shutoff and compact footprint to globe valves favored for throttling control, as well as gate valves, diaphragm valves, and check valves that serve critical isolation or backflow prevention roles. By dissecting these type-specific requirements, suppliers can tailor design enhancements-such as advanced seat coatings or optimized flow paths-to meet the stringent demands of each application.

Actuation modality delineates another critical axis, with electric, pneumatic, hydraulic, and manual actuation options addressing distinct operational imperatives. Electric actuators, for instance, enable precise positioner control and integration with SCADA systems, while pneumatic and hydraulic drives offer rapid response and high torque in challenging environments. Manual systems remain indispensable for fail-safe or backup scenarios, ensuring human-intervened operation when automated controls are unavailable.

Material composition further shapes product performance under extreme service conditions. Alloy steel variants deliver high-strength and corrosion resistance, carbon steel remains a cost-effective solution for general service, and stainless steel provides superior corrosion protection in aggressive chemical or marine environments. Matching material selection to media compatibility and pressure-temperature ratings is a foundational step in guaranteeing reliability and lifecycle value.

Operational mode bifurcates solutions into automatic and manual categories, reflecting the growing emphasis on remote and autonomous functionality. Automatic systems with embedded sensors and control logic streamline workflows and support predictive maintenance, whereas manual modes continue to underpin safety-critical interventions. Together, these operational distinctions guide procurement teams in balancing digital capabilities with regulatory compliance and human-machine interfaces.

Finally, end-industry segmentation illuminates the diverse operational landscapes that demand pressure control solutions. Within chemical processing, the petrochemical and specialty chemical sub-segments impose exacting purity and corrosion-resistance requirements. The oil and gas domain spans upstream exploration, midstream transport, and downstream refining, each with unique pressure-control challenges tied to high-pressure risers or flare gas management. Pharmaceuticals call for hygienic valve designs that meet FDA and cGMP standards, while power generation draws on nuclear, renewable, and thermal segments, emphasizing high-integrity safety valves. Water and wastewater treatment applications demand robust, low-fouling equipment for continuous service under variable flow and debris conditions. By overlaying these segmentation insights, industry stakeholders can refine product roadmaps and prioritize R&D investments for maximum impact.

This comprehensive research report categorizes the Pressure Control Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Valve Type

- Actuation Type

- Material Type

- Operation Mode

- End Industry

Examining How Distinct Growth Drivers and Regulatory Landscapes Shape Demand for Pressure Control Assets in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the competitive landscape for pressure control equipment. In the Americas, robust oil and gas activity-driven by shale gas and LNG exports-continues to spur demand for high-pressure valves and control systems, particularly in the Gulf Coast region where petrochemical and natural gas processing infrastructure has expanded. Concurrently, stringent U.S. environmental regulations and safety standards incentivize the upgrade of aging assets, leading to a wave of retrofits that require sophisticated pressure management solutions. North American manufacturers are therefore emphasizing product reliability and aftermarket service excellence to capitalize on this steady replacement cycle.

Across Europe, the Middle East, and Africa, operators face a dual mandate of modernizing legacy infrastructure while navigating geopolitical trade tensions and fiscal constraints. In Europe, a €250 billion shortfall in grid investment underscores the urgent need for resilient pressure control assets that can support renewable energy integration and grid stability. Meanwhile, in the Middle East, ambitious petrochemical and desalination projects demand valves that deliver consistent performance under extreme heat and corrosive conditions. African markets are characterized by rising municipal and industrial water treatment capacity, driving growth in robust diaphragm and control valve applications.

The Asia-Pacific region remains the fastest-growing frontier for pressure control technologies, fueled by rapid industrialization, expanding refining capacity, and large-scale infrastructure investments. Countries such as China and India are prioritizing new petrochemical complexes and power plants, while Southeast Asia’s water and wastewater sector advances under sustainability initiatives. Regional manufacturers benefit from proximity to key raw material sources and cost-competitive production, yet they also face intensifying competition from global OEMs. As a result, providers in Asia-Pacific focus on scalable, modular solutions and local service networks to address diverse regulatory regimes and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the Pressure Control Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Strategic Acquisitions, Divestitures, and Mergers Are Reshaping the Competitive Positions of Pressure Control Market Leaders

Leading industry participants are actively repositioning themselves to meet evolving customer needs and capitalize on sectoral shifts. Honeywell’s acquisition of Sundyne in a $2.16 billion transaction exemplifies how technology-driven diversification bolsters aftermarket services and digital integration. The addition of Sundyne’s specialized pumps and compressors enhances Honeywell’s ability to offer end-to-end flow solutions under its Forge IoT platform, deepening customer relationships in refining and petrochemicals.

Similarly, Crane’s agreement to purchase Baker Hughes’ Precision Sensors and Instrumentation unit for $1.15 billion underscores an emphasis on high-margin, engineered products. This divestiture and subsequent acquisition realignment allows Crane to strengthen its pressure sensing and calibration portfolio, while Baker Hughes streamlines its focus on core energy transition technologies.

The merger of Chart Industries and Flowserve into a $19 billion combined entity creates a powerhouse in industrial process technologies, harnessing complementary strengths in flow management and thermal systems. By uniting after-market services that comprise over 40 percent of their revenue, the merged firm is positioned to deliver integrated solutions and achieve substantial cost synergies across procurement and operations.

Meanwhile, Georg Fischer’s acquisition of VAG-Group solidifies its infrastructure flow solutions leadership by adding critical water utility valve capabilities. This transaction not only expands GF’s footprint in Europe and the Middle East but also aligns with a broader strategic shift toward sustainable water management technologies and resilient urban infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pressure Control Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Baker Hughes Company

- Bosch Rexroth AG

- Bray International, Inc.

- Circor International, Inc.

- Crane Co.

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Festo SE & Co. KG

- Flowserve Corporation

- IMI plc

- Metso Outotec Corporation

- Parker Hannifin Corporation

- Richards Industries, Inc.

- Rotork plc

- Schlumberger Limited

- SMC Corporation

- Spirax-Sarco Engineering plc

- Swagelok Company

- Velan Inc.

- Watts Water Technologies, Inc.

- Weir Group PLC

Implementing Digital Intelligence, Sustainable Materials, Agile Supply Chains, and Service-Oriented Models to Strengthen Market Leadership

Industry leaders should integrate digital and sustainability imperatives to maintain competitive advantage. First, embedding advanced analytics and AI-driven diagnostic tools within pressure control solutions will enable predictive maintenance models that reduce unplanned stoppages by anticipating component wear factors. Collaborative pilots with end-users can validate performance gains and build proof points for broader deployments.

Second, prioritizing low-carbon material innovations and energy-efficient actuation systems will address tightening emissions regulations and customer sustainability goals. Investing in R&D partnerships with material science centers can accelerate development of advanced alloys and coatings that combine corrosion resistance with reduced weight and lower environmental impact.

Third, diversifying supply chains through near-shoring and multi-sourcing strategies will mitigate tariff exposure and raw material volatility. Establishing localized manufacturing hubs with standardized modular designs ensures regulatory compliance while enhancing agility in responding to regional demand spikes.

Finally, expanding aftermarket service networks and digital customer platforms will deepen recurring revenue streams and foster long-term customer loyalty. Offering outcome-based service contracts and real-time performance dashboards transforms traditional product-centric models into value-driven partnerships, reinforcing market resilience.

Outlining a Robust Blend of Authoritative Secondary Sources and In-Depth Expert Interviews to Ensure Comprehensive and Reliable Market Insights

This research combines both secondary and primary methodologies to ensure comprehensive coverage and rigorous validation. Secondary research involved a detailed review of government trade proclamations, regulatory filings, and credible industry publications to map tariff developments and regulatory trends. Publicly available company press releases and reputable news outlets provided insights into M&A activity, strategic partnerships, and technological breakthroughs.

Primary research comprised structured interviews with industry experts, engineering leads, and procurement managers within key end markets. These discussions yielded qualitative perspectives on product performance criteria, regional operational priorities, and anticipated technology adoption timelines. Input from technical specialists was triangulated with market data to refine segmentation frameworks and validate emerging trends.

Quantitative analysis employed contextual triangulation, aligning disparate data points from governmental sources, public financial disclosures, and expert interviews. This multi-sourced approach ensures that the findings accurately reflect both macroeconomic drivers and on-the-ground operational realities across diverse geographies and application domains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pressure Control Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pressure Control Equipment Market, by Valve Type

- Pressure Control Equipment Market, by Actuation Type

- Pressure Control Equipment Market, by Material Type

- Pressure Control Equipment Market, by Operation Mode

- Pressure Control Equipment Market, by End Industry

- Pressure Control Equipment Market, by Region

- Pressure Control Equipment Market, by Group

- Pressure Control Equipment Market, by Country

- United States Pressure Control Equipment Market

- China Pressure Control Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Distilling Insights on Digital Transformation, Regulatory Forces, and Strategic Realignment to Guide Sustainable Growth in Pressure Control Markets

The pressure control equipment market stands at the nexus of digital transformation, regulatory evolution, and strategic realignment. Cutting-edge smart valve technologies and AI-powered analytics are shifting maintenance paradigms, while sustainability mandates drive material and efficiency innovations. Concurrently, renewed U.S. tariffs on steel and aluminum have catalyzed supply chain realignment and local production initiatives.

Regional disparities underscore the importance of tailored strategies: the Americas leverage robust energy sector investment, EMEA grapples with infrastructure modernization and grid resilience, and Asia-Pacific capitalizes on rapid industrial growth and cost-competitive production. Major industry participants are responding through targeted acquisitions, mergers, and divestitures, reconfiguring their portfolios to deliver integrated flow and pressure management solutions.

Moving forward, organizations that embrace digital intelligence, sustainable materials, adaptive supply chains, and service-oriented business models will secure a decisive advantage. By aligning technological innovation with customer outcomes and regional priorities, pressure control equipment providers can navigate the evolving landscape and drive sustained growth.

Unlock Comprehensive Pressure Control Equipment Intelligence to Empower Strategic Decision-Making Across Your Organization

Ready to elevate your competitive advantage with authoritative insights on the pressure control equipment market? Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the comprehensive report and unlock the strategic intelligence your organization needs. Reach out today to secure your copy, gain unparalleled visibility into industry dynamics, and chart a course for informed decision-making and growth.

- How big is the Pressure Control Equipment Market?

- What is the Pressure Control Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?