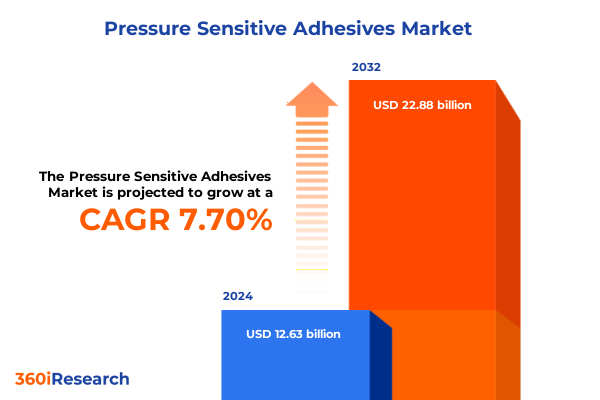

The Pressure Sensitive Adhesives Market size was estimated at USD 13.59 billion in 2025 and expected to reach USD 14.54 billion in 2026, at a CAGR of 7.72% to reach USD 22.88 billion by 2032.

Discover the critical role of pressure sensitive adhesives in modern manufacturing and how evolving market forces are reshaping application opportunities

In today’s fast-evolving manufacturing and consumer goods sectors, pressure sensitive adhesives have emerged as indispensable enablers of product functionality and design innovation. From sleek automotive interiors to advanced medical devices, the seamless integration of adhesive technologies underpins performance, safety, and user experience. As end users increasingly demand lightweight assemblies, enhanced durability, and accelerated production cycles, the adhesives industry is called upon to deliver solutions that balance cost efficiency with technical excellence.

This dynamic environment is further shaped by regulatory pressures on environmental compliance and sustainability objectives, compelling manufacturers to adopt greener chemistries and reduce volatile organic compounds. Meanwhile, advancements in digital printing and precision dispensing have expanded the range of feasible applications, empowering product designers to push the boundaries of form and function. Against this backdrop of regulatory and technological change, market participants must cultivate agility and foresight to seize emerging opportunities.

As a result, industry stakeholders are re-evaluating traditional supply chains and process workflows, forging strategic partnerships and investing in research and development to differentiate their offering. This introduction sets the stage for a deeper exploration of the transformative shifts, policy impacts, and strategic imperatives that will define the next phase of growth and innovation in the pressure sensitive adhesives landscape.

Unveiling the pivotal technological innovations and evolving consumer demands that are catalyzing unprecedented transformations across the adhesive industry landscape

The advent of novel polymer chemistries and digital fabrication techniques has irrevocably altered the pressure sensitive adhesives landscape, driving a rapid cycle of product innovation. Bio-based acrylics and silicone systems, for instance, are responding to sustainable sourcing mandates while delivering performance parity with traditional formulations. At the same time, advancements in hot melt technologies are enabling solvent-free processes that lower energy consumption and operational complexity.

Simultaneously, end user trends such as miniaturization in electronics and microfluidics in medical devices have engendered the need for ultra-thin, precision-applied adhesive layers. This demand is prompting suppliers to develop transfer tape solutions and linerless formats that facilitate high-speed automated application with minimal material waste. Transitioning from batch application methods to continuous roll-to-roll processes further illustrates how innovation is redefining efficiencies across production lines.

Moreover, the rise of customization in packaging and labeling has elevated the importance of low-temperature tack development and quick-curing formulas. Adaptations like UV-curable adhesives are gaining traction in industries where rapid assembly and immediate handling strength are paramount. As such, transformative shifts in materials science and manufacturing technology are unlocking new performance thresholds, fostering heightened competition and setting the stage for next-generation adhesive solutions.

Analyzing the comprehensive repercussions of United States tariff adjustments in 2025 on supply chains, raw material sourcing, and strategic positioning across the adhesives sector

The implementation of revised United States tariff measures in early 2025 has introduced complex variables into raw material procurement and cost structuring. Import duties on key monomers and polymer additives have exerted upward pressure on supply chain expenses, compelling downstream manufacturers to reassess supplier portfolios. Domestic producers with vertically integrated operations have gained relative advantage by buffering volatility and enabling more predictable input pricing.

These tariff-related shifts have also prompted a strategic reorientation toward alternative sourcing regions, with some companies exploring partnerships in Southeast Asia and the Middle East to diversify risk. Concurrently, negotiations for long-term supply agreements have become more prevalent, reflecting an industry-wide emphasis on securing continuity of critical feedstocks. This realignment has underscored the importance of supply chain resilience as a core competency for leading adhesive manufacturers.

In response, manufacturers are investing in process innovations to offset cost pressures, such as adopting energy-efficient polymerization reactors and leveraging real-time analytics to optimize batch yields. Consequently, the cumulative impact of the 2025 tariff landscape has catalyzed a renewed focus on operational excellence, driving both incremental improvements in productivity and longer-term strategic shifts in procurement and production models.

Gaining an in-depth understanding of market segmentation dynamics by product, technology, application, end user, and format to inform targeted growth strategies across industries

Acrylic chemistries continue to dominate the pressure sensitive adhesives field by delivering versatile performance attributes, while rubber-based systems offer cost-effective solutions for high-volume applications. Silicone adhesives, prized for their thermal stability and biocompatibility, are carving out specialized niches in sectors demanding extreme environmental resistance. Within technology platforms, hot melt formulations provide rapid set times and low solvent usage, whereas solvent-based adhesives maintain strong substrate compatibility and water-based systems deliver environmental compliance benefits.

Applications span the automotive industry’s requirements for durable bonding in lightweight assemblies, building and construction’s demand for sealants and mounting tapes, and the electronics sector’s need for precise thermal management solutions. In labels and tapes, rapid tack development and clarity are paramount for branding initiatives, while medical applications emphasize biocompatibility and clean removal properties. From an end user standpoint, the consumer goods arena values design flexibility and speed to market, healthcare prioritizes sterilization compatibility, and packaging focuses on tamper evidence and shelf appeal.

Format innovations such as film adhesives offer uniform coverage for laminating processes, linerless options minimize material waste and logistics costs, roll-to-roll systems enable high-throughput processing, and transfer tapes facilitate precision application without the need for carrier liners. This multifaceted segmentation landscape highlights the importance of aligning product development and commercialization strategies with nuanced performance and operational requirements across diverse market segments.

This comprehensive research report categorizes the Pressure Sensitive Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Format

- End User Industry

Exploring regional dynamics across Americas, EMEA, and Asia-Pacific to uncover unique growth drivers, regulatory influences, and competitive landscapes shaping adhesive markets

In the Americas, strong demand for lightweight bonding solutions in the automotive and aerospace sectors is driving innovation focused on high-strength acrylic systems. North American manufacturers are investing in regional production capacity to address lead time concerns and capitalize on nearshoring trends. Latin American markets, meanwhile, are embracing water-based adhesive technologies to align with tightening environmental regulations and growing packaging activities.

Within Europe, Middle East and Africa, regulatory frameworks such as the European Union’s REACH program are shaping formulation choices toward low-emission and bio-based materials. This regulatory rigor is fostering widespread adoption of solvent-free hot melt adhesives and silicone alternatives for high-temperature applications. In the Middle East, booming construction projects are fueling demand for tape and mounting solutions, while Africa is gradually expanding its medical and consumer goods sectors, creating new opportunities for specialized adhesive applications.

Asia-Pacific remains a hotbed of adhesives innovation, with robust growth in electronics manufacturing driving advances in precision dispensing and linerless tape formats. China and India continue to scale production, benefiting from localized raw material availability and cost efficiencies. At the same time, sustainable product offerings are gaining traction across the region, reflecting both consumer environmental awareness and government mandates for reduced carbon footprints. These diverse regional dynamics underscore the necessity for geographically tailored strategies to maximize market penetration and share.

This comprehensive research report examines key regions that drive the evolution of the Pressure Sensitive Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the strategic initiatives, collaborative ventures, and competitive differentiators driving leading companies to excel and innovate within the pressure sensitive adhesives market

Leading players are prioritizing strategic partnerships and acquisitions to expand technological capabilities and extend geographic reach. Collaborative R&D initiatives with chemical suppliers and end user industries are accelerating the development of next-generation adhesive chemistries, particularly in the realms of bio-based and low-VOC formulations. In parallel, investments in capacity expansions and modernized production facilities are enhancing throughput and enabling adaptive manufacturing.

Several tier-one companies are differentiating their offerings through digital integration, deploying sensor-equipped dispensing systems and data-driven service models to provide customers with real-time process insights and predictive maintenance support. This shift towards bundled product-and-service solutions is redefining value propositions, enabling suppliers to move beyond commodity pricing pressure. Meanwhile, niche innovators are gaining recognition by addressing specialized applications in medical and electronics segments, where performance specifications are exacting and regulatory hurdles are stringent.

Competitive positioning is further influenced by sustainability credentials and supply chain transparency, with top firms publishing detailed lifecycle assessments and engaging in circular economy initiatives. This holistic approach to product stewardship is resonating with environmentally conscious customers and strengthening brand equity in highly regulated markets. Collectively, these strategic moves illustrate how companies are recalibrating their capabilities to meet evolving customer expectations and stay ahead in a crowded competitive field.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pressure Sensitive Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Avery Dennison Corporation

- Berry Global Group Inc.

- Bostik SA

- Dow Inc.

- Eastman Chemical Company

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Intertape Polymer Group Inc.

- LINTEC Corporation

- Lohmann GmbH & Co. KG

- Master Bond Inc.

- Nitto Denko Corporation

- Pidilite Industries Limited

- Saint-Gobain S.A.

- Scapa Group plc

- Sika AG

- Tesa SE

- Wacker Chemie AG

Delivering strategic guidance and prioritized action plans to empower industry leaders to capitalize on emerging trends, mitigate risks, and drive sustainable growth in adhesives

To thrive amid ongoing supply chain complexities and regulatory pressures, industry leaders should prioritize the development of adaptable manufacturing platforms that can quickly switch between chemistries and formats. Implementing modular production lines and leveraging advanced process controls will enable rapid response to shifts in material availability and customer specifications. In doing so, companies can minimize downtime and maintain consistent product quality.

Furthermore, forging deeper integration with key end user segments through co-development agreements will align product roadmaps with evolving application requirements. This customer-centric approach should be supported by proactive regulatory intelligence gathering to anticipate policy changes and adjust product formulations accordingly. As sustainability continues to ascend as a competitive differentiator, investing in bio-based monomers and closed-loop recycling programs will bolster both compliance and brand reputation.

Finally, embracing digitalization across the value chain-from supplier portals to smart dispensing systems-will unlock data-driven insights that inform strategic decisions and support value-added service offerings. By combining technological innovation with targeted partnership models and operational flexibility, industry leaders can position themselves to capture emerging opportunities, mitigate risk exposure, and drive sustained growth in the rapidly evolving adhesives sector.

Detailing the rigorous research framework, data collection techniques, and analytical methodologies employed to ensure accuracy and depth in market intelligence findings

The research underpinning this analysis draws upon a rigorous combination of primary interviews with industry executives, engineers, and procurement specialists, alongside secondary sources including peer-reviewed journals, technical white papers, and regulatory filings. Site visits to manufacturing facilities and technical centers provided firsthand insights into production methodologies and emerging process innovations. This direct engagement ensured a deep understanding of operational constraints and strategic priorities across key market participants.

Secondary data collection involved systematic reviews of publicly available environmental regulations, trade association reports, and patent databases to track shifts in formulation trends and intellectual property developments. Quality checks were performed via triangulation of data points from multiple sources, ensuring consistency and reliability. Advanced analytical tools were applied to evaluate thematic patterns and derive strategic implications without relying on numerical market sizing or forecasting models.

Throughout this methodology, emphasis was placed on maintaining objectivity and reducing bias by engaging a balanced cross-section of stakeholders across product types, technologies, and regions. Ethical research practices were observed in all primary and secondary activities, and confidentiality agreements were honoured to protect proprietary information. This comprehensive approach provides the foundation for robust, actionable insights tailored to the nuanced landscape of pressure sensitive adhesives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pressure Sensitive Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pressure Sensitive Adhesives Market, by Product Type

- Pressure Sensitive Adhesives Market, by Technology

- Pressure Sensitive Adhesives Market, by Format

- Pressure Sensitive Adhesives Market, by End User Industry

- Pressure Sensitive Adhesives Market, by Region

- Pressure Sensitive Adhesives Market, by Group

- Pressure Sensitive Adhesives Market, by Country

- United States Pressure Sensitive Adhesives Market

- China Pressure Sensitive Adhesives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing the critical insights and strategic imperatives that industry stakeholders should embrace to navigate market complexities and unlock adhesive sector potential

Pressure sensitive adhesives are poised at an inflection point where technological innovation, regulatory evolution, and global trade dynamics converge to redefine competitive benchmarks. Stakeholders equipped with a nuanced understanding of segmentation nuances, regional peculiarities, and tariff influences will be best positioned to leverage emerging opportunities. Strategic agility in sourcing, formulation, and production will serve as a critical enabler of resilience and growth.

Sustainability imperatives continue to drive material science breakthroughs and process optimization, reshaping what defines premium performance in adhesive applications. As industry leaders harness digital integration and collaborative partnerships, the lines between product and service are blurring, ushering in new business models that emphasize end-to-end value creation. Ultimately, the companies that anticipate shifts, invest in adaptable capabilities, and align their offerings with customer-driven performance metrics will emerge as the next generation of market frontrunners.

The insights presented here underscore the importance of a holistic strategic lens-one that balances technical innovation with regulatory prudence and operational excellence. By internalizing these imperatives and translating them into decisive action, stakeholders can navigate complexity with confidence and unlock the full potential of the pressure sensitive adhesives sector.

Engage with Ketan Rohom to secure tailored strategic insights and unlock the full potential of your adhesives business

Don’t miss the opportunity to gain a competitive edge in the dynamic pressure sensitive adhesives arena by accessing the full breadth of insights and strategic guidance available through our comprehensive research report. Engage directly with Ketan Rohom, whose extensive experience in sales and marketing can provide you with personalized support to address your pressing challenges and aspirations. Secure an expert consultation to explore custom solutions, deepen your understanding of market intricacies, and tailor a growth roadmap that aligns with your organizational objectives. Act now to equip your team with actionable intelligence and position your company to navigate evolving market conditions with confidence and precision

- How big is the Pressure Sensitive Adhesives Market?

- What is the Pressure Sensitive Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?