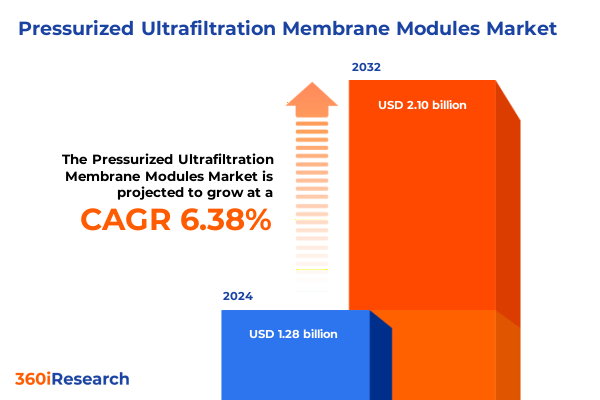

The Pressurized Ultrafiltration Membrane Modules Market size was estimated at USD 1.59 billion in 2025 and expected to reach USD 1.73 billion in 2026, at a CAGR of 8.11% to reach USD 2.76 billion by 2032.

Pivotal Role of Pressurized Ultrafiltration Membrane Modules in Meeting Global Sustainability and Regulatory Water Treatment Demands

Pressurized ultrafiltration membrane modules have emerged as a cornerstone in industrial and municipal water treatment processes, providing a reliable barrier against suspended solids, pathogens, and colloids. With growing regulatory mandates for effluent quality and an increasing focus on resource conservation, these modules enable operators across chemical processing, food and beverage, pharmaceuticals and biotechnology, and water and wastewater treatment to achieve stringent performance targets with minimized footprint and energy consumption. According to an industry analysis, the integration of advanced ultrafiltration modules with Internet of Things-enabled monitoring systems is enhancing operational efficiency and predictive maintenance, signaling a new era of digital water infrastructure optimization

How Advanced Technologies and Sustainability Imperatives Are Redefining the Ultrafiltration Membrane Module Landscape for Water and Industrial Processes

The ultrafiltration landscape is undergoing transformative shifts as emerging technologies converge with sustainability imperatives. The integration of artificial intelligence and machine learning algorithms into membrane systems is empowering operators to forecast fouling events accurately and optimize cleaning cycles, thereby extending module lifespan and reducing unplanned downtime. Simultaneously, IoT-connected sensors embedded within module housings are enabling real-time data acquisition on flow rates, transmembrane pressures, and water quality parameters. This digital transformation supports remote monitoring and automated controls, driving continuous process improvements and unlocking new levels of scalability and responsiveness.

In parallel, material science innovations such as hybrid ceramic composites and reinforced polymer blends are enhancing flux rates and chemical resistance, allowing modules to tackle more challenging feed streams with heightened throughput. Regulatory drivers aimed at curbing industrial effluents and promoting circular economy principles are pushing end users to adopt hybrid treatment trains–combining ultrafiltration with biological and advanced oxidation processes–to meet zero-liquid discharge targets. Furthermore, the convergence of renewable energy sources, including solar-powered membrane filtration systems, underscores a collective industry move to decarbonize water treatment operations, reduce energy footprints, and achieve broader environmental goals. Emerging autonomous cleaning robots and digital twins are poised to further streamline maintenance routines and provide virtual testing grounds for system modifications, cementing ultrafiltration’s role at the forefront of Industry 4.0 innovations.

Evaluating the Far-Reaching Consequences of the 2025 United States Tariff Actions on the Pressurized Ultrafiltration Membrane Module Supply Chain and Costs

In early 2025, the United States government introduced a series of reciprocal and targeted tariffs that have significantly reshaped the cost structure and supply chain dynamics for ultrafiltration membrane modules. On April 2, a baseline global tariff of 10% was enacted on imports from most countries, excluding China, while Chinese-origin products were subject to an initial 125% tariff, rapidly escalating to 145% in response to bilateral trade measures. These prohibitive duties disrupted existing procurement strategies for water treatment chemicals, membrane modules, and ancillary equipment, compelling many end users to reassess supplier portfolios and absorb higher input costs.

During a 90-day postponement window for non-Chinese imports, a subset of products including pharmaceutical membranes and select active ingredients remained exempt, yet key ultrafiltration components such as high-pressure polymeric and ceramic membranes were fully tariffed. Concurrently, water and wastewater treatment entities faced capital project cost overruns as municipal and industrial budgets, previously calibrated under pre-tariff assumptions, ballooned when priced with an added 25% levy on steels, chemicals, and membrane skids imported for infrastructure upgrades.

Operational costs have surged as utilities contend with higher replacement part prices and elevated expenditures on consumables. Some contractors resorted to stockpiling critical membrane elements and spares in late 2024 to hedge against impending costs, while others pivoted to regional sourcing hubs in Mexico and the EU to partially mitigate the tariff burden. Yet, the pervasive nature of the tariffs-spanning steel pressure vessels to precision polymer membranes-has limited entirely tariff-free alternatives. U.S. producers and OEMs have begun expanding domestic assembly lines and forging co-manufacturing agreements to capitalize on tariff exemptions for domestic content, but capacity constraints and longer lead times temper the short-term relief available in a market grappling with heightened protectionism.

Unveiling Critical Insights Across Application, Material, Configuration, Industry, Capacity, Sales Channel, and Module Type Segments in Ultrafiltration Markets

The ultrafiltration membrane module market exhibits nuanced variations when viewed through multiple segmentation lenses. Across applications, chemical processing facilities leverage modules for catalyst recovery and effluent polishing, food and beverage operations integrate specialized membranes for beverage production, brewing, and dairy processing, and pharmaceutical and biotechnology plants depend on bioprocessing and drug manufacturing separation protocols. Industrial wastewater, municipal wastewater, and potable water treatment scenarios further diversify water and wastewater treatment uses, each demanding unique membrane characteristics and system configurations.

Material selection also plays a crucial role, with cellulose acetate enduring in legacy installations, while high-performance polymers such as polyethersulfone, polysulfone, and polyvinylidene fluoride gain traction for their fouling resistance and mechanical strength. Configuration choices range from hollow fiber constructs, optimizing surface area in compact footprints, to spiral wound assemblies favored for ease of scale-up, plate and frame setups offering simplified cleaning, and tubular modules servicing high-solids streams.

End-use industry distinctions reveal industrial sectors spanning chemical, food and beverage, petrochemical, and pharmaceutical applications, in contrast to municipal infrastructure projects and residential point-of-use systems. System capacities vary from small-scale units below 100 cubic meters per day to high-volume installations exceeding 500 cubic meters per day, while module sales channels include direct manufacturer engagements, distributor partnerships, and burgeoning online platforms. Lastly, module types-standardized for cost efficiency or customized by OEMs and private labelers-provide tailored solutions, balancing performance requirements against installation and lifecycle objectives.

This comprehensive research report categorizes the Pressurized Ultrafiltration Membrane Modules market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Membrane Material

- Configuration

- Capacity

- Module Type

- Application

- End-Use Industry

- Sales Channel

Regional Dynamics Shaping Pressurized Ultrafiltration Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

The Americas region, led by the United States, is characterized by substantial municipal and industrial capital expenditure programs aimed at upgrading aging water treatment plants and pipeline infrastructure. Federal initiatives under the Bipartisan Infrastructure Law have injected billions into municipal water and wastewater projects, driving demand for ultrafiltration modules capable of ensuring compliance with tightening effluent and drinking water standards. Canada’s focus on advanced RO-UF hybrids for remote communities further stimulates market activity, with private and public utilities seeking robust, low-maintenance solutions to address widespread network rehabilitation efforts.

In Europe, Middle East & Africa, stringent regulatory frameworks around discharge limits and circular economy mandates are prompting accelerated adoption of ultrafiltration in both municipal and industrial applications. Regulatory instruments such as the EU’s Industrial Emissions Directive and regional water reuse targets in the Middle East are compelling operators to integrate membrane trains for tertiary treatment, while African nations lean on public-private partnerships to deploy modular UF systems for potable reuse and sanitation improvements.

Asia-Pacific is emerging as the fastest-growing ultrafiltration market, fueled by rapid urbanization, rising industrial water demands, and acute water scarcity. Countries such as China and India are investing heavily in desalination pretreatment and industrial wastewater recycling to support manufacturing hubs, while Southeast Asian governments roll out rural water supply programs using compact pressurized UF modules. Across the region, cost-competitive local membrane producers and aggressive government subsidy schemes are expanding deployment beyond traditional municipal users into food processing, pharmaceuticals, and semiconductor applications.

This comprehensive research report examines key regions that drive the evolution of the Pressurized Ultrafiltration Membrane Modules market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ultrafiltration Module Manufacturers and Innovators Driving Product Development, Digital Tools, and Strategic Partnerships in 2025

Leading ultrafiltration module manufacturers are intensifying their focus on innovation, digital enablement, and strategic partnerships to maintain competitive differentiation. DuPont has recently unveiled WAVE PRO, an online ultrafiltration modeling tool that guides system designers through complex treatment scenarios and integrates economic and process simulations for drinking water, industrial utility, and desalination applications. Additionally, DuPont’s Multibore PRO membranes, featuring an advanced 19-capillary geometry, have redefined PES in-out performance by amplifying surface area within reduced module counts, enhancing sustainability and installation efficiency.

Toray Industries has introduced a high-removal ultrafiltration membrane engineered to reduce downstream reverse osmosis loading, directly lowering CO₂ emissions by over 30% in hybrid UF-RO plants focused on wastewater reuse. Koch Membrane Systems expanded its hollow fiber portfolio with the MegaPure line, designed for high-solids industrial and tertiary applications, incorporating reinforced fibers and single-potting cartridges to minimize downtime, chemical usage, and total cost of ownership.

Consolidation in the water sector has also impacted the competitive landscape. Xylem’s acquisition of Evoqua in 2023 created a unified water technology powerhouse offering Memcor ultrafiltration systems for diverse applications, while Veolia’s merger with SUEZ in 2021 established a global champion with enhanced membrane and modular treatment capabilities across municipal and industrial domains. These strategic alignments underscore an industry trend toward integrated solution portfolios and broader geographic reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pressurized Ultrafiltration Membrane Modules market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aguapuro Equipments

- Aquabrane Water Technologies

- Asahi Kasei Corporation

- Danaher Corporation

- DuPont de Nemours, Inc.

- Evoqua Water Technologies LLC

- Hongtek Filtration

- Hydramem

- Hydranautics

- Ion Exchange

- Koch Membrane Systems, Inc.

- Korgen

- MANN+HUMMEL

- MS Membrane-Solutions

- Nitto Denko Corporation

- Pentair plc

- SUEZ S.A.

- Synder Filtration

- TEAM Hi-Tec Equipment Pvt Ltd

- Tianjin Morui Environment Technology Co., Ltd.

- Toray Industries, Inc.

- Xpert Water Technology

Strategic Actions for Industry Leaders to Navigate Trade Disruptions, Boost Resilience, and Capitalize on Emerging Ultrafiltration Opportunities

To navigate the complexities of a tariff-shocked supply chain and capitalize on emergent market opportunities, industry leaders should expand domestic fabrication capabilities and pursue co-manufacturing agreements within tariff-exempt regions to secure consistent module availability. Leveraging regional assembly hubs can reduce lead times and mitigate the impact of import duties on critical components.

Further, building resilient sourcing frameworks-such as dual-supplier arrangements across North America, Europe, and Asia Pacific-will diversify procurement risk and enhance bargaining power against volatile trade policies. Engaging in long-term supply contracts with performance-linked clauses can stabilize pricing and secure priority allocations for membrane elements and housing assemblies under constrained supply conditions.

Investing in digital twins, AI-driven monitoring platforms, and predictive maintenance capabilities will unlock operational efficiencies, reduce total cost of ownership, and reinforce proactive asset management strategies. By integrating intelligent controls and remote performance analytics, operators can optimize cleaning cycles, extend membrane longevity, and enhance overall system reliability under varied feedwater conditions.

Finally, proactive participation in industry consortia and policy advocacy groups is critical to shaping equitable trade measures, securing tariff exemptions for essential materials, and informing regulatory frameworks that balance domestic manufacturing incentives with global supply interdependencies.

Robust Research Methodology Employing Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Comprehensive Market Insights

This research employed a multi-tiered methodology combining primary and secondary data gathering to ensure robust and unbiased market insights. Primary research involved in-depth interviews with C-level executives, R&D leaders, and operations managers across membrane module OEMs, system integrators, and end-user organizations to capture firsthand perspectives on technology adoption, supply chain challenges, and strategic priorities.

Secondary sources included published company press releases, white papers, government trade notices, and industry journals to validate primary findings and provide context on regulatory developments, tariff measures, and capital investment trends. Quantitative data were triangulated against multiple datasets to minimize estimation variances and bolster analytical accuracy.

An expert panel comprising water treatment veterans and membrane technology specialists reviewed interim findings to calibrate assumptions and refine segmentation frameworks. Statistical tools were leveraged for trend analysis, cross-sectional comparisons, and scenario modeling, culminating in a comprehensive report that balances granular detail with actionable strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pressurized Ultrafiltration Membrane Modules market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pressurized Ultrafiltration Membrane Modules Market, by Membrane Material

- Pressurized Ultrafiltration Membrane Modules Market, by Configuration

- Pressurized Ultrafiltration Membrane Modules Market, by Capacity

- Pressurized Ultrafiltration Membrane Modules Market, by Module Type

- Pressurized Ultrafiltration Membrane Modules Market, by Application

- Pressurized Ultrafiltration Membrane Modules Market, by End-Use Industry

- Pressurized Ultrafiltration Membrane Modules Market, by Sales Channel

- Pressurized Ultrafiltration Membrane Modules Market, by Region

- Pressurized Ultrafiltration Membrane Modules Market, by Group

- Pressurized Ultrafiltration Membrane Modules Market, by Country

- United States Pressurized Ultrafiltration Membrane Modules Market

- China Pressurized Ultrafiltration Membrane Modules Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Concluding Perspectives on Ultrafiltration Membrane Module Market Dynamics, Strategic Imperatives, and the Path Forward for Industry Stakeholders

The pressing need for clean water, coupled with stringent environmental regulations and aging infrastructure, has elevated pressurized ultrafiltration membrane modules to a critical solution in both municipal and industrial settings. Rapid advancements in digital monitoring, material innovation, and modular design are reshaping system capabilities, enabling operators to address evolving water quality challenges with greater agility and efficiency.

However, the imposition of significant tariffs in 2025 has introduced supply chain complexities and cost pressures that necessitate strategic realignments in sourcing, production, and partnership models. By leveraging diversified procurement strategies, domestic manufacturing initiatives, and digital optimization tools, stakeholders can mitigate tariff impacts and sustain the momentum of ultrafiltration adoption across key regions.

As industry leaders chart their path forward, embracing collaborative innovation-through co-development alliances, policy advocacy, and technology integrations-will be pivotal. The convergence of sustainability imperatives, digital transformation, and global trade dynamics presents both challenges and opportunities for the ultrafiltration market. Navigating this intricate landscape requires a balanced approach that aligns operational resilience with strategic foresight, ultimately driving value for organizations and contributing to broader water security objectives.

Engage with Associate Director of Sales & Marketing Ketan Rohom to Access the In-Depth Pressurized Ultrafiltration Membrane Modules Market Research Report

To acquire the full market research report on Pressurized Ultrafiltration Membrane Modules and harness actionable insights for your organization, reach out to Ketan Rohom. As an Associate Director of Sales & Marketing, Ketan can guide you through tailored solutions, provide detailed report overviews, and facilitate seamless access to the comprehensive analysis essential for strategic decision-making. Engage with Ketan today to ensure your team stays ahead in a rapidly evolving ultrafiltration landscape and unlock the competitive advantages embedded within our research.

- How big is the Pressurized Ultrafiltration Membrane Modules Market?

- What is the Pressurized Ultrafiltration Membrane Modules Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?