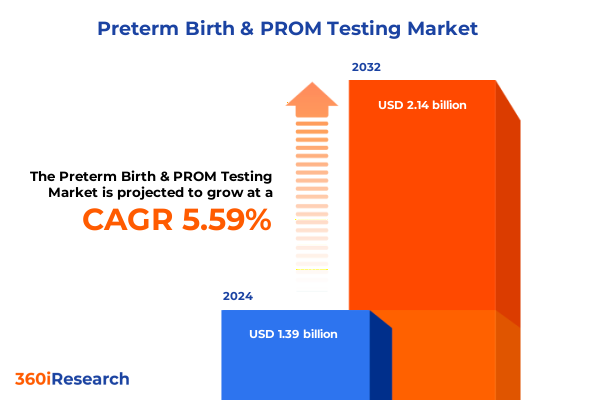

The Preterm Birth & PROM Testing Market size was estimated at USD 1.46 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 5.62% to reach USD 2.14 billion by 2032.

Understanding the Critical Global Health Challenge of Preterm Birth and Its Devastating Impact on Child Survival

Preterm birth, defined by the World Health Organization as childbirth before 37 completed weeks of gestation, represents a global health crisis that demands urgent attention. In 2020 alone, an estimated 13.4 million infants were born preterm, accounting for more than one in ten births and contributing to approximately 900,000 deaths in children under five years of age. Compelling evidence shows that three-quarters of these deaths could be prevented with existing, cost-effective interventions such as antenatal steroids and basic neonatal care. Yet, despite decades of progress in maternal and child health, preterm birth rates worldwide remain stubbornly high, ranging from 4 to 16 percent across regions.

Revolutionary Diagnostic Innovations and Telehealth Solutions Are Redefining Early Detection and Management of Preterm Birth

The landscape of preterm birth prevention and PROM diagnosis is undergoing transformative shifts fueled by cutting-edge technologies and telehealth integration. Recent breakthroughs in immunoassay development have introduced rapid, bedside tests like the AmniSure® ROM immunoassay, which detects placental alpha-microglobulin-1 with a sensitivity near 99 percent in under ten minutes. This innovation replaces invasive speculum exams, enabling prompt clinical decisions and reducing diagnostic uncertainty in preterm PROM scenarios. Moreover, first-generation blood tests such as Sera Prognostics’ PreTRM assay, though not yet FDA-approved, allow women to directly assess their preterm birth risk by measuring two key protein biomarkers between 18 and 21 weeks of gestation. This laboratory-developed test-achieving predictive accuracy above 90 percent-empowers clinicians to institute preventive interventions like progesterone and targeted monitoring to mitigate early labor outcomes.

Navigating the Ripple Effects of Layered U.S. Tariffs on Diagnostic Device Sourcing, Production Costs, and Supply Chain Resilience

In 2025, the accumulation of U.S. tariffs threatens to reshape the economics of diagnostic testing and medical device procurement. The recent U.S.-EU agreement introduces a 15 percent levy on European imports, with medical devices temporarily exempt to preserve critical care access, but this relief may not extend to emerging test kits requiring rapid adaptation in production and supply chains. Meanwhile, tariffs on medical devices from China, Mexico, and Canada remain in effect under the most recent measures, complicating sourcing strategies for diagnostic reagents and immunoassay consumables; these duties span 10 to 25 percent, with no broad exemptions granted to date, heightening cost pressures for manufacturers and providers. Layered on top are 25 percent tariffs on steel and aluminum derivative products, which directly impact equipment manufacturing and maintenance overheads in laboratory and point-of-care settings, leading some industry players to anticipate six-figure headwinds in 2025. The immediate consequence is a sharp turn toward near-shoring initiatives and dual sourcing agreements, yet forging new domestic partnerships requires time-during which supply delays and material shortages are likely to persist, potentially impeding timely diagnosis and treatment of PROM and preterm labor.

Deciphering How Diagnostic Instruments, Assay Kits, and Consumables Converge with End-User Needs and Clinical Applications

Insight into the diverse segments of preterm birth and PROM diagnostics reveals a multifaceted market shaped by product type, end users, and application. Instruments and equipment encompass automated ELISA analyzers, immunoassay platforms, and PCR systems-each requiring specialized maintenance and calibration in high-volume laboratories. Kits and assay kits span ELISA formats, PCR test panels, and rapid lateral-flow devices, offering tiered speed and sensitivity to suit clinical workflows from large hospitals to bedside testing. Reagents and consumables, including antibodies, culture media, and enzyme-based probes, form the lifeblood of continuous diagnostic throughput. End users range from ambulatory care settings that favor point-of-care immunoassays for swift decision-making, through diagnostic laboratories equipped for high-complexity PCR testing, to hospitals and clinics deploying multi-modal diagnostics and research institutes conducting translational studies. Across applications-diagnosis, monitoring, research use, and screening-test selection is determined by clinical urgency, resource availability, and the need for quantitative versus qualitative results, underscoring the importance of aligning product portfolios to evolving care pathways.

This comprehensive research report categorizes the Preterm Birth & PROM Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Biomarker

- End User

- Application

Examining Regional Variances in Regulatory Rigor, Healthcare Infrastructure, and Technology Adoption Across Major Global Markets

Regional considerations shape the deployment and adoption of preterm birth and PROM diagnostics across the Americas, Europe, the Middle East & Africa, and the Asia-Pacific. In the Americas, established regulatory pathways under the U.S. FDA and Health Canada facilitate rapid entry for innovative immunoassays, while reimbursement structures reward early intervention programs, fueling demand for high-accuracy biomarkers. Within Europe, Middle East & Africa, intricate CE-marking processes coexist with heterogeneous market access conditions; leading Scandinavian and Western European markets drive premium pricing for advanced PCR-based platforms, whereas emerging markets prioritize cost-effective lateral-flow tests. Asia-Pacific’s dynamic growth is powered by large patient volumes, expanding private healthcare networks, and government-sponsored digital health initiatives; countries like Japan and South Korea emphasize in-hospital automation, while Southeast Asia and Australia show accelerating uptake of point-of-care ultrasound AI solutions and remote monitoring services. Each region’s unique regulatory, economic, and healthcare infrastructure factors dictates tailored market entry strategies and localized partnerships.

This comprehensive research report examines key regions that drive the evolution of the Preterm Birth & PROM Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking How Major Players and Emerging Innovators Are Forging Partnerships and Advancing Cutting-Edge Test Solutions

Leading diagnostic and life science companies are intensifying their focus on preterm birth and PROM test development through strategic investments and alliances. Hologic has leveraged its clinical immunoassay expertise to optimize rapid cervical fluid tests and expand global distribution networks. Abbott Laboratories integrates automated analyzers with consumable streams, enhancing throughput in central laboratories. Qiagen’s proprietary PAMG-1 assays have gained traction in prenatal clinics, supported by data validating high negative predictive value. Smaller pioneers such as Sera Prognostics are advancing personalized risk stratification platforms for early biomarker detection, while Ultrasound AI applies patented machine learning algorithms to standard obstetric imaging, achieving predictive values above 90 percent for preterm birth outcomes. Collaborative ventures between diagnostic innovators and digital health firms are also proliferating, underscoring a broader ecosystem approach to comprehensive perinatal care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Preterm Birth & PROM Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- bioMérieux SA

- Danaher Corporation

- Eurofins Scientific SE

- Hologic, Inc.

- Qiagen N.V.

- Quidel Corporation

- Revvity, Inc.

- Rhomed S.p.A.

- Roche Diagnostics GmbH

- Sekisui Medical Co., Ltd.

- Sera Prognostics, Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Actionable Strategies for Diagnostic Innovators to Enhance Resilience, Drive Innovation, and Influence Policy in the Preterm Birth Arena

To remain competitive and drive value, industry leaders should prioritize several strategic imperatives. First, embracing hybrid diagnostic ecosystems that marry point-of-care immunoassays with central-lab automation will balance speed and accuracy while addressing diverse clinical use cases. Second, forging resilient supply chains through dual sourcing strategies and accelerated onshoring incentives can mitigate tariff-induced cost volatility. Third, investment in next-generation AI-driven ultrasound and predictive blood-based biomarkers will unlock personalized intervention pathways, reducing avoidable preterm births. Fourth, proactive engagement with policymakers and trade bodies to advocate for medical device tariff exemptions will safeguard affordability and access. Lastly, fostering public-private collaborations to expand virtual care and remote monitoring programs can enhance prenatal oversight, improve outcomes, and unlock new care delivery models.

Detailing the Rigorous Mixed-Methods Research Design, Data Sources, and Expert Engagements Underpinning This Diagnostic Market Analysis

This analysis draws on a multi-tiered research methodology combining comprehensive secondary literature reviews, regulatory filings, patent databases, and public health data, complemented by expert consultations across clinical, technical, and commercial domains. Secondary data sources included World Health Organization fact sheets, U.S. national vital statistics, peer-reviewed publications on PROM immunoassay performance, and reputable news outlets reporting on trade policy developments. Patent landscapes were examined via records from Ultrasound AI’s Preterm AI filings and related intellectual property disclosures. Qualitative insights were enriched through dialogues with obstetrics specialists, laboratory directors, and strategic sourcing executives, ensuring that emerging market trends, supply chain dynamics, and user preferences were contextualized. This rigorous approach underpins the analytical framework and segmentation models used to surface actionable intelligence for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Preterm Birth & PROM Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Preterm Birth & PROM Testing Market, by Product Type

- Preterm Birth & PROM Testing Market, by Technology

- Preterm Birth & PROM Testing Market, by Biomarker

- Preterm Birth & PROM Testing Market, by End User

- Preterm Birth & PROM Testing Market, by Application

- Preterm Birth & PROM Testing Market, by Region

- Preterm Birth & PROM Testing Market, by Group

- Preterm Birth & PROM Testing Market, by Country

- United States Preterm Birth & PROM Testing Market

- China Preterm Birth & PROM Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights on Balancing Innovation, Supply Chain Resilience, and Strategic Collaboration in the Evolving Perinatal Diagnostics Landscape

In sum, the preterm birth and PROM testing ecosystem stands at the cusp of remarkable transformation. Advances in immunoassay sensitivity, AI-derived imaging analytics, and remote monitoring platforms promise to enhance early detection and intervention, potentially averting thousands of neonatal complications. Concurrently, geopolitical trade tensions and evolving tariff regimes underscore the imperative for supply chain agility and cost stewardship. By integrating product innovation with strategic policy advocacy, diagnostic providers can navigate these headwinds while seizing growth opportunities. Stakeholders who align segmentation-driven offerings, regional market strategies, and technology partnerships will be best positioned to improve clinical outcomes and deliver value across the perinatal care continuum.

Elevate Your Strategy with a Direct Consultation to Unlock Exclusive Insights and Secure Your Customized Preterm Birth & PROM Testing Market Report

To secure comprehensive insights into preterm birth and PROM testing trends, market leaders and decision-makers are invited to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Drawing upon an extensive analysis of diagnostic innovations, regulatory shifts, supply chain dynamics, and end-user segmentation, Ketan can personalize a research package that aligns with your strategic objectives. His expertise will guide you through customized data sets, competitive benchmarking, and tailored forecasts that ensure actionable intelligence. Connect with Ketan to explore trial access options, schedule a detailed briefing, and discuss bespoke collaborations that will empower your organization to seize emerging opportunities and navigate industry challenges with confidence.

- How big is the Preterm Birth & PROM Testing Market?

- What is the Preterm Birth & PROM Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?