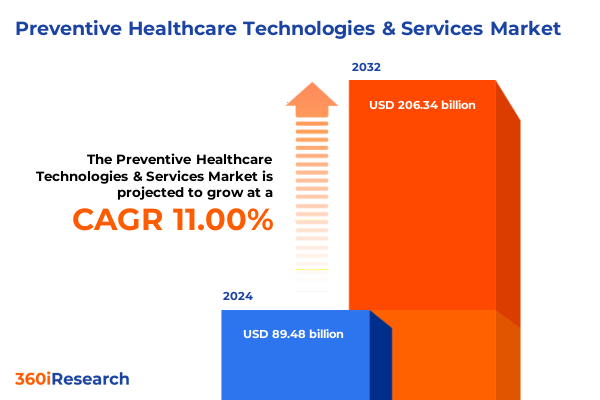

The Preventive Healthcare Technologies & Services Market size was estimated at USD 99.45 billion in 2025 and expected to reach USD 110.54 billion in 2026, at a CAGR of 10.98% to reach USD 206.34 billion by 2032.

Pioneering the Future of Preventive Healthcare Technologies to Empower Proactive Patient Outcomes and Drive Industry Innovation

Preventive healthcare technology stands at a pivotal moment where innovation converges with the urgent need to shift from reactive to proactive care. Recent advances in genetic screening, digital monitoring tools, and AI-driven risk assessment platforms have collectively created a robust infrastructure that empowers both clinicians and individuals to anticipate health challenges before they manifest. As healthcare systems grapple with rising chronic disease burdens and aging populations, the integration of these technologies is no longer optional but essential to sustainable care delivery and cost management.

Through the lens of patient-centric design and data-driven insights, preventive healthcare is evolving from episodic interventions to continuous health stewardship. This transformation is underpinned by a broad ecosystem of testing services, lifestyle coaching, telehealth platforms, and immunization programs, all working together to deliver personalized pathways to wellness. By embracing these solutions, stakeholders can not only reduce long-term treatment costs but also enhance patient engagement and outcomes, setting a new standard for healthcare quality and efficiency.

Navigating Disruption in Healthcare Delivery Channels and Technologies Redefining Preventive Care in an Era of Rapid Digital Transformation

Preventive healthcare is undergoing a seismic shift driven by the convergence of artificial intelligence, digital connectivity, and precision medicine. AI-based predictive models now analyze vast datasets from genetic profiles, wearable sensors, and electronic health records to identify individuals at elevated disease risk, enabling timely interventions. Simultaneously, teleconsultation and mobile clinic deployments have extended reach into underserved communities, breaking down geographical barriers and democratizing access to preventive services.

Moreover, the mainstream adoption of lifestyle management platforms-ranging from remote fitness coaching to nutritional counseling-has redefined patient engagement by addressing health behaviors at their root. Genomic testing services for carrier screening and hereditary cancer mutations complement these efforts by enabling hyper-personalized preventive plans. Together, these dynamics are propelling the preventive care landscape toward a more holistic, integrated model, where early detection and continuous health optimization become both the starting point and the hallmark of modern healthcare delivery.

Assessing the Far-Reaching Consequences of Recent United States Tariff Policies on the Preventive Healthcare Value Chain and Stakeholder Dynamics

In 2025, the introduction and adjustment of United States tariffs on imported medical equipment, diagnostic reagents, and related components have reverberated across the preventive healthcare market. Manufacturers of genetic testing kits and predictive analytics platforms have faced elevated input costs for reagents sourced overseas, prompting strategic shifts in supply chain configurations and procurement strategies. As a result, some domestic laboratories have accelerated efforts to localize production, reducing exposure to cross-border tariff volatility and strengthening operational resilience.

Concurrently, the pricing pressure induced by tariffs has incentivized strategic partnerships between biotech firms and equipment providers to co-develop cost-optimized solutions. Collaborative frameworks, such as joint manufacturing ventures and shared distribution networks, have emerged as pragmatic responses to mitigate margin erosion. Although these dynamics initially challenged market participants, they have ultimately catalyzed innovation in lean production methods and modular diagnostic technologies, laying the groundwork for a more agile preventive healthcare ecosystem that can adapt quickly to policy shifts.

Uncovering Key Growth Drivers and Innovation Potential Across Diverse Service Models Shaping Preventive Healthcare Market Segments

As the preventive healthcare market diversifies, the interplay between service offerings and patient demands reveals shifting priorities. Genetic testing services have expanded beyond carrier and hereditary cancer testing to encompass pharmacogenomic insights that inform medication regimens, illustrating the fusion of diagnostics and personalized medicine. Meanwhile, predictive analytics powered by AI-based models and risk assessment tools have gained traction among payers and providers seeking to preempt high-cost chronic conditions, demonstrating the market’s pivot toward data-centric prevention.

Lifestyle management platforms now blend fitness coaching, nutritional counseling, and stress management into cohesive digital ecosystems, reflecting consumer appetite for holistic wellness solutions. Preventive screening services, from cardiovascular and diabetes screening to osteoporosis assessments, are increasingly bundled with seasonal and workplace vaccination programs to deliver one-stop preventive care packages. These integrated models underscore a broader segmentation trend: services that deliver end-to-end prevention, from early detection through continuous health monitoring and immunization, are outpacing standalone solutions.

This comprehensive research report categorizes the Preventive Healthcare Technologies & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Delivery Mode

- End User

- Application

Analyzing Regional Variations and Strategic Opportunities Across the Americas EMEA and Asia-Pacific Preventive Healthcare Landscapes

Regional dynamics shape how preventive healthcare technologies gain traction and scale. In the Americas, established reimbursement frameworks and major private payers foster early adoption of advanced screening tools and genetic tests. This environment has catalyzed partnerships between diagnostic laboratories and digital health startups, driving rapid rollout of home-based self-administered services alongside in-person clinic diagnostics. Meanwhile, public–private initiatives in North America have accelerated mobile clinics and pop-up immunization campaigns, enhancing preventive coverage in rural and underserved urban areas.

Across Europe, the Middle East, and Africa, heterogeneous regulatory landscapes drive a dual-speed market. Western European countries leverage strong healthcare infrastructure and integrated electronic health records to support sophisticated AI-driven risk stratification programs. In contrast, some Middle Eastern and African markets prioritize workplace vaccination and basic cardiovascular screening as foundational preventive interventions. In both cases, virtual teleconsultation and app-based monitoring have emerged as key enablers for reaching remote populations.

The Asia-Pacific region exhibits one of the fastest growth trajectories, propelled by government-led preventive health initiatives, rising chronic disease awareness, and expanding digital penetration. Countries such as Japan and South Korea lead in precision genetic testing deployment, while emerging Southeast Asian markets embrace mobile clinics and app-based telehealth to overcome resource constraints. As a result, cross-border collaborations and technology transfers are shaping a dynamic APAC preventive care landscape that balances innovation with scalability.

This comprehensive research report examines key regions that drive the evolution of the Preventive Healthcare Technologies & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Driving Competitive Dynamics in Preventive Healthcare Technologies and Services

Industry leaders and emerging players alike are driving competitive dynamics through differentiated offerings and strategic alliances. Global healthcare giants have expanded their preventive portfolios via acquisitions of niche genomics firms and investments in AI startups, reinforcing vertical integration from data analytics to service delivery. Meanwhile, mid-sized companies specializing in teleconsultation platforms and remote monitoring devices have carved out distinct market positions by emphasizing user experience and interoperable ecosystems.

At the same time, emerging players in the pharmacogenomics space are forging partnerships with academic research centers to validate novel biomarkers, highlighting the role of collaboration in accelerating clinical adoption. Mobile clinic operators are also innovating by deploying bus-based screening units equipped with point-of-care diagnostic tools, targeting high-traffic community locations to maximize preventive reach. Furthermore, vaccine manufacturers are broadening their offerings to include workplace and travel immunization services, reflecting a shift toward more personalized and context-sensitive preventive solutions. Together, these strategies illustrate how competitive advantage increasingly depends on the ability to integrate technology, data, and service delivery seamlessly.

This comprehensive research report delivers an in-depth overview of the principal market players in the Preventive Healthcare Technologies & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AliveCor, Inc.

- Alphabet Inc.

- Apple Inc.

- Becton, Dickinson and Company

- Danaher Corporation

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd.

- Garmin Ltd.

- General Electric Company

- Illumina, Inc.

- Johnson & Johnson

- Koninklijke Philips N.V.

- Laboratory Corporation of America Holdings

- Medtronic plc

- Noom, Inc.

- Omada Health, Inc.

- OMRON Healthcare Co., Ltd.

- Quest Diagnostics Incorporated

- ResMed Inc.

- Siemens Healthineers AG

- Teladoc Health, Inc.

- Thermo Fisher Scientific Inc.

- Virgin Pulse, LLC

- Virta Health Corp.

Strategic Imperatives and Actionable Pathways for Industry Leaders to Optimize Preventive Healthcare Outcomes and Strengthen Market Position

Industry leaders should pursue an integrated platform strategy that unites genetic testing, predictive analytics, and lifestyle management under a seamless user interface, thereby elevating patient engagement and adherence. Concurrently, diversifying supply chains and forging regional manufacturing partnerships can mitigate risks associated with regulatory changes and trade policies, ensuring uninterrupted access to critical diagnostic inputs.

Moreover, organizations must cultivate data-sharing agreements with payers and providers to optimize risk stratification models and demonstrate value through real-world evidence. In parallel, expanding mobile clinic deployments and teleconsultation channels can drive penetration in hard-to-reach demographics, while targeted vaccination programs can leverage workplace and community partnerships to boost immunization rates. By investing in interoperability frameworks and standardized data protocols, industry leaders can unlock the full potential of integrated preventive care, cementing their market position as trusted partners in proactive health management.

Ensuring Rigor and Reproducibility Through a Robust Methodological Framework Underpinning Preventive Healthcare Research Insights

This report’s findings derive from a comprehensive research framework combining extensive secondary research with qualitative primary engagements. The secondary phase incorporated the review of peer-reviewed journals, industry white papers, and regulatory filings to map the technological, economic, and policy drivers shaping preventive healthcare. Parallel to this, high-level interviews with executives across diagnostics laboratories, technology vendors, payers, and regulatory bodies provided nuanced perspectives on market dynamics.

In the primary phase, structured interviews and surveys captured insights from over 50 stakeholders, ensuring representation across all major service segments and geographic regions. Data triangulation techniques were applied to validate qualitative inputs against market signals, while proprietary data models facilitated thematic synthesis. Rigorous quality checks, including cross-verification with public health databases and expert panels, underpin the credibility of the conclusions and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Preventive Healthcare Technologies & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Preventive Healthcare Technologies & Services Market, by Service

- Preventive Healthcare Technologies & Services Market, by Delivery Mode

- Preventive Healthcare Technologies & Services Market, by End User

- Preventive Healthcare Technologies & Services Market, by Application

- Preventive Healthcare Technologies & Services Market, by Region

- Preventive Healthcare Technologies & Services Market, by Group

- Preventive Healthcare Technologies & Services Market, by Country

- United States Preventive Healthcare Technologies & Services Market

- China Preventive Healthcare Technologies & Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3657 ]

Summarizing Insights and Future Outlook to Guide Stakeholders in Shaping the Next Generation of Preventive Healthcare Solutions

The trajectory of preventive healthcare technologies and services underscores a fundamental shift toward personalized, data-driven care. Innovations in genetic testing, AI-based predictive modeling, and integrated lifestyle interventions are converging to create holistic preventive ecosystems that deliver measurable health outcomes. As stakeholders navigate policy shifts, such as the recent tariff adjustments, agility and collaboration will determine success in an increasingly competitive landscape.

Looking forward, the most impactful breakthroughs will emerge at the intersection of precision medicine and digital connectivity. Organizations that harness interoperable data platforms, invest in decentralized delivery models, and sustain strategic partnerships across the value chain will lead the next wave of preventive healthcare innovation. Ultimately, the imperative is clear: proactive, patient-centric prevention represents the cornerstone of a sustainable, future-ready healthcare system.

Unlock Comprehensive Preventive Healthcare Market Intelligence and Accelerate Strategic Decision-Making by Engaging with Ketan Rohom Today

To explore how tailored insights can accelerate your strategic initiatives in the preventive healthcare space, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the report’s depth and help unlock the data-driven intelligence your organization needs to stay ahead. Engage with expertise that combines rigorous research methodology and real-world perspectives to ensure you deploy the most effective preventive solutions in an increasingly complex healthcare ecosystem.

- How big is the Preventive Healthcare Technologies & Services Market?

- What is the Preventive Healthcare Technologies & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?