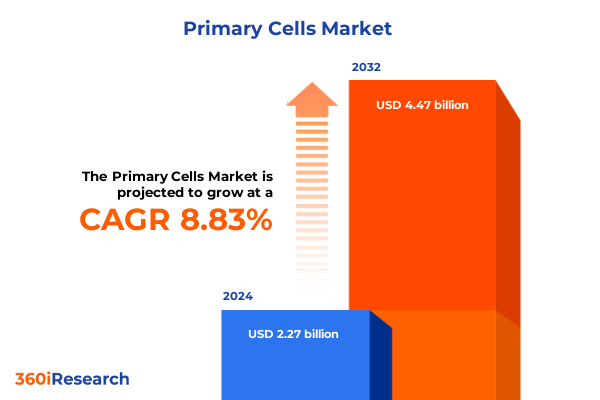

The Primary Cells Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.63 billion in 2026, at a CAGR of 8.99% to reach USD 4.47 billion by 2032.

Exploring the Dynamic Evolution and Fundamental Importance of Primary Cells to Illuminate Market Opportunities and Drive Innovative Scientific Advancements

Primary cells have become indispensable tools in modern biomedical research, serving as the crucial bridge between theoretical investigation and real-world application. Their inherent ability to replicate in vivo physiology makes them the gold standard for studies ranging from drug efficacy screening to disease modeling. As research institutions and commercial enterprises seek increasingly reliable data, the demand for primary cells has surged, driven by the promise of enhanced translational value and predictive accuracy. Understanding this evolution requires a deep dive into the principles that govern primary cell behavior, the technological breakthroughs fueling their expansion, and the diverse applications that continue to redefine scientific boundaries.

This executive summary sets the stage for an in-depth exploration of the primary cell landscape. The following sections will chart transformative shifts shaping the industry, analyze the impact of recent U.S. tariffs, and unpack the nuanced insights revealed by segmentation studies. Together, these analyses will highlight the interplay between market dynamics and research innovation, offering stakeholders a clear line of sight into emerging trends. By aligning strategic planning with the latest developments in primary cell science, organizations can position themselves at the forefront of discovery and therapeutic advancement.

Unveiling the Wave of Technological and Regulatory Transformations Reshaping How Primary Cells Drive Research and Commercial Innovation

In recent years, the primary cell landscape has undergone seismic transformations, driven by advances in cell culture technology and an ever-expanding array of applications. Three-dimensional culture systems, for instance, have revolutionized the way researchers recreate in vivo conditions, enabling more physiologically relevant models. Scaffold-based and scaffold-free approaches now facilitate complex tissue engineering applications, accelerating progress in regenerative medicine and organoid research. Meanwhile, improvements in two-dimensional culture remain indispensable for high-throughput screening platforms, reinforcing the critical bond between traditional and cutting-edge methodologies.

Concurrently, the cell processing pipeline has witnessed remarkable enhancements. Cryopreservation methods, including controlled rate freezing and vitrification, have significantly increased long-term cell viability, while hypothermic storage solutions offer flexible options for short-term transport. These preservation techniques are not only optimizing logistics but also safeguarding precious cell phenotypes, ensuring that end users-from academic labs to contract research organizations-receive consistent, high-quality materials.

On the regulatory front, the push toward standardized protocols has catalyzed a wave of harmonization efforts. Stakeholders are actively collaborating to establish best-practice guidelines, which promise to reduce variability and accelerate inter-laboratory reproducibility. As a result, the industry is poised for a new era of interoperability, where seamless integration of primary cell products into diverse research workflows will become the norm rather than the exception.

Analyzing the Far-Reaching Consequences of 2025 U.S. Tariffs on Primary Cell Supply Chains, Procurement Behaviors, and Collaborative Industry Strategies

The imposition of U.S. tariffs on imported primary cell products in early 2025 has introduced a new variable to an already complex market equation. By targeting key inputs such as specialized reagents, media, and instruments sourced from global suppliers, these measures have prompted supply chain recalibrations and cost reassessments across the value chain. Domestic manufacturers have responded by investing in localized production capabilities, aiming to mitigate supply disruptions and dampen the volatility introduced by fluctuating import duties.

Customers have naturally adjusted their procurement strategies, placing greater emphasis on vendor partnerships that offer stability and end-to-end support. Meanwhile, service providers have diversified their offerings-custom service solutions now encompass on-site technical assistance and streamlined logistics, ensuring uninterrupted research operations even as tariff-induced price fluctuations persist. The result is a marketplace that values resilience and adaptability as highly as quality and innovation.

Although it is still early to measure the long-term effects of these duties, preliminary indicators suggest a shift toward more collaborative business models. Suppliers and end users are increasingly forging strategic alliances to co-invest in domestic manufacturing infrastructure. Such partnerships not only address immediate tariff challenges but also lay the groundwork for sustained growth in an environment where geopolitical factors exert growing influence on research supply chains.

Unraveling the Intricate Tapestry of Product, Application, and End User Requirements That Define Divergent Supplier Success Pathways

Diving into segmentation reveals nuanced dynamics that transcend broad market generalizations. When considering product type, consumables and accessories maintain their status as foundational elements for every laboratory workflow, yet demand patterns vary significantly between instruments and media reagents versus specialized services. Custom service models are gaining traction among organizations with unique assay requirements, whereas standard services excel at delivering cost-effective, high-throughput workflows. This duality underscores the need for suppliers to tailor their portfolios in alignment with the evolving priorities of end users.

Applications paint an equally complex portrait. Basic research laboratories continue to fuel steady demand as they explore fundamental biological processes, but the momentum in drug discovery has accelerated markedly. Advances in regenerative medicine and toxicology testing have emerged as high-value frontiers, each demanding distinct cell types and culture methodologies. Successfully navigating these divergent needs hinges on an in-depth understanding of how application-specific pressures shape procurement criteria, from throughput and scalability to compliance and data fidelity.

End users themselves embody a spectrum of organizational structures-from academic and research centers with stringent reproducibility standards to contract research organizations that prioritize turnaround times and regulatory alignment. Hospitals and diagnostic labs, meanwhile, are increasingly integrating primary cell assays into clinical workflows for biomarker discovery and personalized medicine applications. Pharmaceutical and biotechnology companies represent the zenith of complexity, requiring turnkey solutions that span products, protocols, and technical expertise. Such varied user profiles demand that suppliers maintain fluid strategies capable of addressing disparate requirements.

This comprehensive research report categorizes the Primary Cells market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Cell Type

- Technology

- Preservation Method

- Application

- End User

Deciphering How Distinct Economic, Regulatory, and Infrastructure Forces Shape Primary Cell Market Behaviors Across the Americas, EMEA, and Asia-Pacific

Regional dynamics further nuance the market narrative. In the Americas, well-established research infrastructures and robust funding mechanisms have traditionally anchored demand. Recent investments in domestic cell manufacturing and preservation technologies have strengthened the local ecosystem, enabling faster adoption of advanced culture systems. There is a palpable shift toward vertically integrated solutions as top academic institutions and biopharma players seek to streamline workflows from cell procurement through analysis.

Europe, Middle East & Africa exhibit a different set of drivers. Regulatory harmonization across the European Union has fostered a collaborative research environment, but pockets of growth in Middle Eastern markets are fueled by government-sponsored life sciences initiatives. Africa remains an emerging frontier, with nascent demand for primary cell products tied to academic expansion and localized capacity building. Together, these subregions reflect a complex mosaic where regulatory, economic, and infrastructural variables coalesce to shape unique growth trajectories.

Asia-Pacific stands out for its rapid commercialization efforts and strong manufacturing base. Leading economies in this region have made strategic investments in biotechnology clusters, creating synergies between academic research, contract services, and bioprocessing facilities. The rising prominence of personalized medicine and cell therapy development in countries like Japan, South Korea, and China underscores the region’s potential as both a supplier and consumer of advanced primary cell solutions.

This comprehensive research report examines key regions that drive the evolution of the Primary Cells market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Life Sciences Giants and Agile Innovators Are Competing and Collaborating to Redefine Primary Cell Markets

The competitive landscape is anchored by a mix of global conglomerates and specialized players, each bringing unique capabilities to the table. Major life sciences organizations continue to invest heavily in portfolio expansion, leveraging their cross-platform expertise to offer integrated solutions that encompass consumables, instruments, media, reagents, and tailored services. Their scale and breadth enable them to pursue large-scale collaborations with pharmaceutical giants and government research bodies, cementing their leadership positions.

At the same time, niche innovators are carving out valuable spaces by focusing on high-precision offerings. Companies specializing in advanced three-dimensional culture systems and next-generation preservation methods are capturing attention for their ability to address complex biological questions. Complementary service providers-whether delivering bespoke assay development or rapid-response logistics-are differentiating themselves through customer-centric models and technology-driven operational efficiencies.

These diverse competitive strategies underscore a marketplace defined by both consolidation and fragmentation. As larger players seek inorganic growth through mergers and acquisitions, specialized firms are forging partnerships and developing proprietary platforms. The resulting ecosystem is rich with opportunity for collaboration, strategic differentiation, and the co-creation of next-generation primary cell applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Primary Cells market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Type Culture Collection

- BioIVT LLC

- Cell Applications, Inc.

- Lonza Group AG

- Merck KGaA

- PromoCell GmbH

- ScienCell Research Laboratories, Inc.

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- Zen-Bio, Inc.

Implementing a Multifaceted Growth Blueprint That Combines Service Modularity, Digital Integration, and Sustainability to Achieve Market Leadership

Industry leaders and emerging market entrants alike must adopt a multifaceted strategy to thrive. First, investing in modular service offerings-ranging from turnkey sample preparation to end-to-end assay development-will cater to customers’ increasing demand for flexibility and scalability. Strategic partnerships with regional distributors and contract research organizations can reinforce supply chain resilience, particularly in tariff-affected markets. Simultaneously, co-development agreements with academic centers will accelerate innovation pipelines while sharing risk.

Enhancing digital integration represents another critical lever. Deploying cloud-based tracking systems for cell provenance and integrating data analytics platforms will not only improve quality control but also generate actionable insights that can inform product road maps. In parallel, companies should prioritize regulatory engagement, collaborating with standards bodies to shape harmonized guidelines and stay ahead of compliance shifts.

Finally, embracing sustainability initiatives-such as eco-friendly consumables and energy-efficient storage solutions-will meet growing environmental expectations and differentiate brands in a crowded field. By weaving these approaches into cohesive go-to-market frameworks, companies can unlock new revenue streams and solidify their positions as trusted partners in the global primary cell ecosystem.

Presenting a Comprehensive Mixed-Methods Approach That Integrates Primary Interviews, Secondary Analysis, and Advanced Data Analytics to Ensure Rigor and Accuracy

This report’s findings are grounded in a rigorous research methodology that blends primary and secondary analyses. Over the course of several months, in-depth interviews were conducted with senior executives, laboratory directors, and technical specialists across academia, contract research organizations, and pharmaceutical companies. These conversations provided firsthand perspectives on evolving requirements, procurement challenges, and future trends.

Secondary research encompassed the review of peer-reviewed literature, regulatory publications, proprietary company documents, and publicly available data. This multi-source validation approach enabled comprehensive triangulation, ensuring that disruptive technologies, tariff impacts, and regional dynamics were accurately characterized. Quantitative and qualitative findings were cross-checked through iterative workshops and expert panels to refine insights and eliminate biases.

The study also leveraged advanced data analytics tools to identify patterns in supplier performance, application adoption rates, and geographic growth vectors. By integrating machine learning algorithms with human expertise, the methodology offers a robust framework for tracking market transitions and forecasting potential inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Primary Cells market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Primary Cells Market, by Product Type

- Primary Cells Market, by Cell Type

- Primary Cells Market, by Technology

- Primary Cells Market, by Preservation Method

- Primary Cells Market, by Application

- Primary Cells Market, by End User

- Primary Cells Market, by Region

- Primary Cells Market, by Group

- Primary Cells Market, by Country

- United States Primary Cells Market

- China Primary Cells Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing How Agility, Strategic Partnership, and Innovation Are Critical to Capitalizing on the Evolving Primary Cell Market Landscape

As primary cell applications continue to expand across research and industrial landscapes, stakeholders must navigate an increasingly dynamic environment. The convergence of technological breakthroughs, tariff-driven supply chain adjustments, and regional market nuances underscores the importance of agility and strategic foresight. By synthesizing insights from segmentation, competition, and regional analyses, organizations can make informed decisions that align with both current demands and future opportunities.

The path forward will favor those who invest in adaptive service models, digital ecosystems, and collaborative innovation platforms. As standardization efforts gain momentum, the ability to deliver consistent, high-quality primary cell products will become a key differentiator. Ultimately, success in this market will hinge on forging partnerships that blend scientific expertise with operational excellence, ensuring that the full promise of primary cells is realized in everything from basic research to life-changing therapeutics.

Take decisive action to secure unparalleled primary cell market intelligence through a direct consultation with our Sales & Marketing leadership

Unlock the full potential of your primary cells investment by connecting with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to acquire the definitive market research report that will shape your strategic roadmap

- How big is the Primary Cells Market?

- What is the Primary Cells Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?