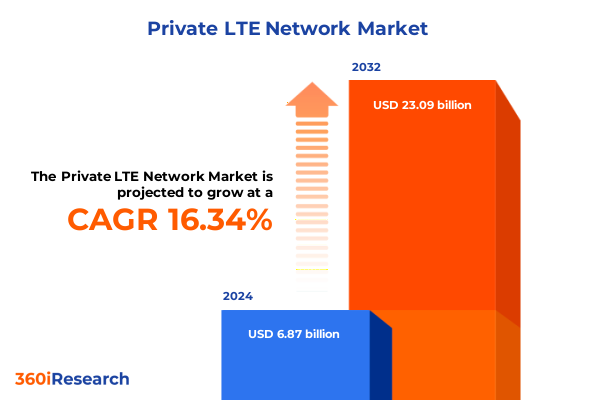

The Private LTE Network Market size was estimated at USD 8.00 billion in 2025 and expected to reach USD 9.23 billion in 2026, at a CAGR of 16.34% to reach USD 23.09 billion by 2032.

Discover How Private LTE Networks Redefine Connectivity by Delivering Secure, Reliable, and High-Performance Wireless Solutions for Enterprise Digital Transformation

Private LTE networks represent dedicated wireless solutions optimized for secure connectivity. Over the past few years, enterprises across manufacturing, energy, healthcare, and logistics have embraced this technology as a linchpin for mission-critical operations. By operating in licensed, shared, or unlicensed bands, organizations gain control, predictability, and robust security that public networks cannot match. Federated Wireless reports that manufacturing leads private wireless adoption with 352 deployments in Q1 2025, underscoring how CBRS-powered LTE is enabling robotics, automation, and predictive maintenance at scale. Moreover, data indicates that as of Q1 2025, more than half of private deployments continue to rely exclusively on LTE, reflecting its proven reliability and device ecosystem.

Transitioning from traditional Wi-Fi and wired infrastructures to private LTE requires a nuanced understanding of spectrum choices, equipment architectures, and integration pathways. This executive summary guides stakeholders through the core elements of the private LTE landscape, offering a concise yet comprehensive snapshot of technological innovations, policy dynamics, segmentation frameworks, and regional considerations shaping deployment strategies. As enterprises chart their connectivity roadmaps, this overview equips decision-makers with the insights needed to align business objectives with the evolving demands of Industry 4.0 and digital transformation initiatives. Continued collaboration among technology vendors, regulators, and end users will be critical to unlock the full potential of private LTE networks across diverse operational environments.

Unveiling the Technology and Industry Game-Changers That Are Reshaping the Private LTE Landscape for Digital Enterprises Everywhere

Private wireless infrastructure has emerged as one of the most exciting segments within the broader radio access network (RAN) market, with revenues ending 2024 more than 40 percent higher than initial projections. This surge has been driven by enterprises seeking deterministic performance, robust security, and assured quality of service for advanced use cases such as robotics, AR-enabled training, and smart manufacturing. As a result, vendors and systems integrators are redoubling efforts to develop end-to-end solutions that span core network elements, edge computing platforms, and specialized applications that reinforce private LTE’s role in digital transformation.

Simultaneously, the democratization of spectrum access is reshaping deployment strategies. The Citizens Broadband Radio Service (CBRS) band in the United States has catalyzed wide-area and campus-scale use cases, with 51.7 percent of private wireless deployments operating on LTE alone and 27.3 percent adopting 5G as enterprises plan for next-generation performance. At the same time, hardware decoupling trends are gaining momentum as tariffs drive cost uncertainty; suppliers are accelerating software-defined RAN and virtualized core platforms to offset up to 25 percent markups on traditional base stations, shifting investment toward network management and orchestration software. Together, these shifts are ushering in a new era of private LTE architecture defined by flexibility, scalability, and a seamless blend of connectivity and compute.

Analyzing the Complex Cumulative Effects of United States Tariffs Announced in 2025 on Private LTE Infrastructure Costs and Deployment Strategies

The landscape for private LTE has been significantly influenced by the United States’ tariff policies enacted in early 2025. In April, the administration introduced a blanket 10 percent tariff on imports from all trade partners, coupled with reciprocal measures targeting China at a total rate of 54 percent and the European Union at 20 percent. These tariffs have immediately elevated the cost of core telecom equipment, placing raw materials and sub-systems-including RF antennas, chipsets, and transport gear-under tighter financial pressure.

Consequently, private LTE hardware costs have experienced marked increases. Industry reports indicate that equipment markups of up to 25 percent are now common, directly impacting total cost of ownership for network operators. For smaller enterprises that rely on cost-effective deployments, these elevated prices pose significant barriers and may delay or restrict infrastructure rollouts. In parallel, established equipment suppliers are reevaluating supply chains, exploring production shifts to Southeast Asia and Mexico to mitigate the financial impact of U.S. trade measures.

Major telecom vendors have not been immune to these headwinds. In July 2025, Nokia lowered its 2025 profit guidance by €300 million, attributing €50 to €80 million of the shortfall to increased tariff expenses alongside currency fluctuations. These adjustments underscore the pervasive influence of trade policy on both vendor profitability and long-term investment strategies.

Looking ahead, enterprises and infrastructure providers must navigate this tariff-induced landscape through diversified sourcing strategies, strategic partnerships, and enhanced policy engagement. By pursuing a mix of regional manufacturing hubs and advocating for exemptions on mission-critical components, stakeholders can build more resilient supply chains and safeguard private LTE deployments against future regulatory volatility.

Revealing Critical Insights Across Components, Deployment Models, End-User Verticals, Application Types, and Service Offerings for Private LTE Market Segmentation

Understanding the private LTE market requires a nuanced segmentation framework that spans components, deployment models, vertical industries, application types, and service offerings. Within the component layer, hardware-comprising antennas, core equipment, and radio access network elements-forms the infrastructure backbone. Services then layer on consulting, deployment and installation, and support and maintenance functions, while software encompasses network management, security, and SLA management platforms. This tripartite view highlights the interplay between physical assets, professional expertise, and the software intelligence needed to achieve operational excellence.

Moving to deployment models, hosted, hybrid, and on-premise architectures each address unique organizational priorities, from rapid scalability in cloud environments to full operational autonomy in closed-loop private campuses. The end user segmentation further refines strategic focus by identifying priority industries-such as energy and utilities, government and defense, healthcare, manufacturing, and transportation and logistics-where demanding use cases drive tailored private LTE designs. Application-level differentiation-ranging from asset tracking and critical communications to IoT connectivity and video surveillance-reveals how specific technical requirements inform choices across spectrum, antenna placement, and network orchestration. Finally, service type classification-spanning managed and professional services-illuminates how ongoing maintenance, remote monitoring, consulting, system integration, and training offerings support the full lifecycle of private LTE investments. Collectively, this layered segmentation provides a comprehensive lens to evaluate competitive positioning, investment priorities, and go-to-market strategies without relegating insights to simple lists.

This comprehensive research report categorizes the Private LTE Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- End User Industry

- Application Type

Mapping Regional Dynamics in the Americas, Europe Middle East Africa, and Asia-Pacific to Illuminate Growth Patterns and Strategic Priorities for Private LTE Adoption

Regional dynamics are reshaping how organizations prioritize and execute private LTE deployments. In the Americas, the United States leads global adoption, a trend underscored by the GSA’s catalog of over 1,772 customer references for private mobile networks in Q1 2025-more than any other country. Manufacturing remains the top sector alongside education and mining, and while 5G trials proliferate, LTE is still dominant in operational use cases, reflecting a cautious transition toward next-generation technologies.

Across Europe, Middle East, and Africa, momentum is driven by stringent regulatory frameworks and a strong industrial base. Germany has emerged as a focal point for private 5G innovation, with the Federal Network Agency issuing dedicated spectrum licenses that enable pioneering projects in manufacturing and logistics. Major enterprises like Siemens and BASF are leveraging private networks to optimize automation and real-time analytics, while collaborative ventures with telecom operators ensure robust deployment support across the region.

In Asia-Pacific, rapid digitization across China, Japan, South Korea, and India fuels growth in both private LTE and 5G initiatives. Vehicle manufacturing, healthcare, and higher education institutions are at the forefront of CBRS and neutral host deployments, with SNS Telecom estimating that standalone 5G CBRS networks could approach $800 million in annual U.S. spending by 2027-a harbinger of the broader APAC market’s thirst for high-performance private wireless solutions. These regional variations underscore the importance of localized strategies that align spectrum policies, vendor ecosystems, and end-user priorities.

This comprehensive research report examines key regions that drive the evolution of the Private LTE Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Moves Driving Innovation, Partnerships, and Market Differentiation in the Private LTE Ecosystem

The private LTE ecosystem is anchored by a cadre of leading technology vendors, each bringing unique strengths to the table. Industry data indicates that Huawei, Nokia, and Ericsson currently top the list of private wireless RAN suppliers, leveraging their global scale and comprehensive portfolios to address diverse enterprise requirements. These organizations continue to expand their offerings, integrating edge computing capabilities and advanced network management software to deliver turnkey solutions for campus and wide-area deployments.

Beyond traditional equipment providers, hyperscalers and software specialists are reshaping the competitive landscape. Vendors increasingly partner with Amazon Web Services and Microsoft Azure to host virtualized RAN and core functions, decoupling network services from physical hardware and enabling subscription-based models that appeal to cost-conscious enterprises. New entrants like Celona are also gaining traction by offering integrated CBRS solutions that simplify spectrum access and network orchestration, while high-profile deployments-such as Tesla’s use of Ericsson gear to power private 5G networks in its global manufacturing facilities-highlight the growing collaboration between automotive OEMs and telecom vendors.

Collectively, these strategic moves illustrate how innovation, partnerships, and a shift toward software-centric architectures are driving differentiation in a rapidly evolving market. Organizations evaluating vendor options must consider not only technical capabilities and total cost of ownership but also the agility and roadmap alignment each provider brings to their private LTE journey.

This comprehensive research report delivers an in-depth overview of the principal market players in the Private LTE Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelleran NV

- Airspan Networks, Inc

- Amazon Web Services, Inc

- Athonet S.p.A

- Baicells Technologies, Inc

- Cisco Systems, Inc

- CommScope, Inc

- Druid Software Ltd

- Huawei Technologies Co. Ltd

- JMA Wireless, Inc

- Mavenir Systems, Inc

- NEC Corporation

- Nokia Corporation

- Qualcomm Technologies, Inc

- Redline Communications Inc

- Samsung Electronics Co. Ltd

- Sierra Wireless, Inc

- Telefonaktiebolaget LM Ericsson

- Telrad Networks Ltd

- ZTE Corporation

Actionable Recommendations to Guide Industry Leaders in Optimizing Private LTE Deployments, Overcoming Barriers, and Capitalizing on Emerging Opportunities

To navigate the evolving private LTE landscape, industry leaders should adopt a multi-pronged strategy that balances operational resilience with future-proof innovation. First, diversifying supply chains by incorporating alternative manufacturing hubs in Southeast Asia and Mexico will mitigate the financial impact of tariff volatility and strengthen procurement agility. Second, investing in software-defined network architectures and virtualization frameworks enables rapid feature updates and scalability without the need for extensive hardware refresh cycles.

Furthermore, forging partnerships with hyperscale cloud providers can streamline virtualization of RAN and core elements, fostering subscription-based models that align capex with opex objectives. Engaging in proactive policy advocacy through industry alliances ensures that mission-critical components receive exemptions from punitive tariffs, preserving cost efficiency for essential network deployments. Emphasizing modular deployment approaches-beginning with LTE and incrementally integrating 5G standalone capabilities-allows organizations to manage risk while capturing incremental value.

Finally, building internal expertise through targeted training and certification programs empowers teams to manage complex private LTE networks effectively. By combining strategic sourcing, agile architecture, policy engagement, and talent development, enterprise and vendor leaders can transform private LTE initiatives into sustainable competitive advantages that drive operational excellence and business growth.

Detailing the Rigorous Research Methodology Employed to Ensure Robust, Unbiased Insights into the Private LTE Market Landscape

This research leverages a rigorous methodology that integrates both primary and secondary data sources to deliver well-rounded insights into the private LTE market. Secondary research included a comprehensive review of industry reports, regulatory publications, and vendor whitepapers to map technology trends, tariff policies, and deployment case studies. Primary research consisted of in-depth interviews with telecom executives, network architects, system integrators, and end-user decision-makers across key verticals.

Quantitative data was triangulated by cross-referencing vendor shipment figures, spectrum auction outcomes, and deployment reference databases published by organizations such as the GSA Private Mobile Networks Special Interest Group. Qualitative analysis drew upon expert roundtables and advisory panels to interpret market drivers, barriers, and strategic imperatives. The segmentation framework was validated through statistical analysis of deployment characteristics, ensuring that component, deployment model, industry vertical, application type, and service type categorizations accurately reflect real-world implementations.

Throughout the process, strict data governance protocols and ethical research standards were observed to maintain objectivity and transparency. This approach ensures that the findings presented provide a reliable foundation for strategic planning, vendor selection, and investment decision-making within the private LTE ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Private LTE Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Private LTE Network Market, by Component

- Private LTE Network Market, by Deployment Model

- Private LTE Network Market, by End User Industry

- Private LTE Network Market, by Application Type

- Private LTE Network Market, by Region

- Private LTE Network Market, by Group

- Private LTE Network Market, by Country

- United States Private LTE Network Market

- China Private LTE Network Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the Key Findings and Strategic Implications That Executive Stakeholders Need to Navigate the Private LTE Market With Confidence

In summary, private LTE networks have emerged as critical enablers of digital transformation across industries that demand uncompromised reliability, security, and performance. Technological shifts-including the rise of CBRS in the United States and the acceleration of software-defined network architectures-are reshaping how enterprises design, deploy, and manage dedicated wireless infrastructure. Meanwhile, the introduction of 2025 tariffs has underscored the need for diversified supply chains and proactive policy engagement to protect project economics and vendor viability.

The multi-layered segmentation framework presented clarifies how component, deployment model, industry vertical, application type, and service type dimensions intersect to inform tailored strategy development. Regional insights reveal that the Americas lead in deployment scale, EMEA leverages regulatory support and industrial strength, and Asia-Pacific benefits from rapid digitization and neutral host innovations. Leading vendors, hyperscalers, and new entrants are vying for market leadership through collaborative ecosystems, software-centric offerings, and domain-specific solutions.

By synthesizing these findings, this executive summary equips stakeholders with the context and clarity needed to make informed decisions about private LTE investments. With strategic recommendations in hand, organizations can optimize deployment approaches, fortify supply chains, and unlock the full potential of dedicated wireless networks to drive operational excellence and sustainable competitive advantage.

Engage With Associate Director Ketan Rohom to Secure Exclusive Access to the Comprehensive Private LTE Market Research Report and Gain Competitive Advantage

By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, you gain exclusive access to the comprehensive Private LTE Network Market Research Report that delivers the in-depth analysis and strategic insights your organization needs to accelerate transformation. Reach out to arrange a personalized briefing that will walk you through critical findings, segmentation breakdowns, regional dynamics, and the impact of the 2025 tariff landscape. Engage with Ketan to secure your copy of the report and position your business at the forefront of private LTE innovation.

- How big is the Private LTE Network Market?

- What is the Private LTE Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?