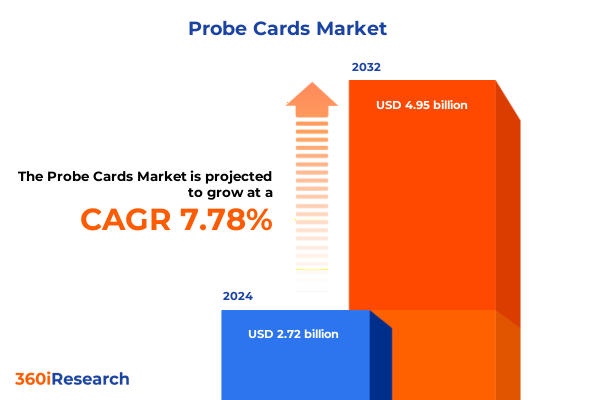

The Probe Cards Market size was estimated at USD 3.22 billion in 2025 and expected to reach USD 3.46 billion in 2026, at a CAGR of 7.82% to reach USD 5.46 billion by 2032.

Discover How Cutting-Edge Probe Card Technologies Are Shaping the Semiconductor Testing Ecosystem with Unprecedented Precision and Performance

Probe cards serve as the critical interface between semiconductor wafers and automated test equipment, ensuring that each integrated circuit is rigorously evaluated before it enters the supply chain. As the semiconductor industry races toward miniaturization, higher frequencies, and advanced packaging techniques, probe cards have evolved from simple cantilever designs to sophisticated microelectromechanical systems (MEMS) and vertical architectures. These innovations enable precise contact with ever-finer pitch geometries, meeting the stringent performance and reliability requirements of today’s high-growth applications in artificial intelligence, 5G communications, and electric vehicles.

Within this dynamic context, the probe card ecosystem has expanded to include specialized materials, needle configurations, and innovative manufacturing processes. Engineers and decision-makers now face a rapidly shifting landscape in which traditional epoxy-based cards must compete with ceramic and composite alternatives that offer enhanced thermal stability and mechanical robustness. Concurrently, needle technologies have diversified to balance electrical conductivity, wear resistance, and dimensional accuracy. Against this backdrop of technical complexity, understanding the full spectrum of probe card capabilities and their respective performance trade-offs is critical for semiconductor device manufacturers and test service providers.

This report delivers an authoritative overview of the probe card market, outlining key technological drivers, regulatory influences, and supply chain challenges. By delving into transformative shifts, tariff impacts, segmentation frameworks, and regional trends, this comprehensive executive summary equips stakeholders with the insights needed to make informed strategic choices and capitalize on emerging growth opportunities.

Unveiling Transformative Shifts Reshaping the Probe Card Industry Driven by Technological Innovation and Evolving Customer Demands Worldwide

The probe card industry is undergoing a wave of transformation driven by converging forces of technological innovation and shifting end-user requirements. Historically, cantilever-style cards dominated the market due to their simplicity and reliability. However, the rise of ultra-fine pitch geometries and multi-site parallel testing has spurred the adoption of MEMS-based and vertical probe cards, which offer superior alignment accuracy and scalability for high-density wafer inspection. Meanwhile, materials science breakthroughs have enabled the development of composite and metallic substrates that enhance thermal management and mechanical resilience under extreme testing conditions.

Furthermore, the proliferation of advanced semiconductor nodes and heterogeneous packaging solutions has placed new demands on probe card functionality. Test engineers are now integrating active components such as pogo pin actuation systems and embedded sensors directly into card assemblies to support real-time diagnostics and adaptive contact force control. At the same time, digitalization initiatives within fabs are driving the need for probe cards compatible with Industry 4.0 frameworks, including remote performance monitoring and predictive maintenance capabilities.

As a result, the probe card value chain is becoming increasingly collaborative. Research partnerships between semiconductor foundries, test equipment manufacturers, and specialized probe card suppliers are accelerating the pace of innovation. Cross-industry alliances aimed at standardizing interfaces and developing common test protocols are also helping to reduce development cycles. Together, these transformative shifts are redefining how probe cards are conceived, designed, and deployed to meet the evolving needs of a high-volume, high-mix semiconductor test environment.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Probe Card Supply Chains, Pricing Strategies, and Competitive Market Dynamics

In 2025, cumulative trade actions by the United States have continued to influence the global probe card supply chain, elevating costs and prompting strategic realignment efforts. Following the imposition of Section 301 tariffs on select Chinese electronic components, including certain probe card assemblies, many suppliers have seen landed costs rise by approximately 25 percent. This has led original equipment manufacturers and test service providers to reassess sourcing strategies, balancing the cost premium of domestic manufacturing against lead time advantages and supply security.

Consequently, a growing number of probe card vendors are exploring diversification through nearshoring partnerships in Mexico and Southeast Asia, while others have pursued tariff exclusion requests and engaged in bilateral negotiations to secure partial relief on critical test hardware imports. In addition to direct cost pressures, the tariff landscape has introduced longer approval cycles for customs clearance, creating uncertainty in inventory planning and challenging just-in-time manufacturing models prevalent in high-volume semiconductor fabs.

Amid these complexities, pricing strategies have adapted to mitigate margin erosion. Tiered pricing structures, value-added service bundling, and long-term supply agreements have emerged as tools to stabilize revenue streams and share risk across the value chain. Looking ahead, the synchronization of trade policy with broader industrial incentives-such as subsidized domestic manufacturing programs-will be essential in shaping probe card investment decisions through the remainder of the decade.

Deriving Key Insights from Diverse Probe Card Segmentation Across Product Types, Materials, Needle Configurations, Applications, and Industry Verticals

A nuanced examination of probe card market segmentation reveals distinct performance requirements and competitive dynamics across multiple dimensions. Within the product type segment, cantilever probe cards remain prevalent for medium-density applications, whereas epoxy probe cards are valued for cost-effectiveness in standard testing environments. The emergence of MEMS-SP probe cards addresses the need for ultra-fine pitch alignment and electrical integrity at advanced nodes, while vertical probe cards support high-pin-count and high-current testing scenarios.

Material composition further differentiates offerings: ceramic probe cards are prized for their dimensional stability and thermal management in extended test cycles, composite probe cards blend lightweight design with shock resistance for dynamic test setups, and metallic probe cards provide superior conductivity and wear life under high-frequency stress. Needle probe selection underscores the balance between electrical performance and mechanical durability, with beryllium copper needles delivering cost-efficient elasticity, platinum needles ensuring superior corrosion resistance, and tungsten needles achieving stiffness critical for dense array configurations.

Pitch size segmentation illustrates evolving market demand, as fine pitch dimensions drive investments in miniaturized contact solutions while medium and large pitch formats maintain relevance for power device and legacy IC testing. Application-based segmentation highlights categories from integrated circuit testing-encompassing analog and MOS IC testing-to memory device testing with specialized protocols for NAND flash and SRAM. Additional channels include power device testing, system on a chip testing, and wafer testing, the latter spanning functional and parametric assessments. Finally, end-user industry analysis identifies automotive electronics demanding ruggedized probe cards, consumer electronics favoring high-throughput test cycles, integrated device manufacturers seeking integrated test solutions, and semiconductor foundries requiring scalable, yield-optimized cards.

This comprehensive research report categorizes the Probe Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Probe Card Type

- Component

- Wafer Size

- Pitch Category

- Tip Material

- Site Count

- Substrate Material

- Application

- Customer Type

Highlighting Regional Dynamics Impacting Probe Card Adoption and Innovation Trends Across Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regional market dynamics underscore the strategic importance of geographical hubs in shaping probe card demand and innovation. In the Americas, significant investment in advanced semiconductor fabs-from California to Texas-has bolstered local sourcing initiatives, with regional probe card suppliers leveraging proximity to reduce logistics costs and accelerate technology collaboration. Motivated by government incentives for domestic supply chain resilience, several North American vendors have expanded manufacturing footprints to support both established and emerging chipmakers.

Moving to Europe, the Middle East and Africa region, growth is driven by the automotive and industrial sectors’ relentless push for electrification and automation. Test solution providers servicing these industries are adapting probe card designs to accommodate wide-pitch power device testing and stringent reliability standards under extreme operating environments. Partnerships between European carmakers and semiconductor test specialists have led to joint development projects targeting next-generation electric vehicle powertrain modules.

Asia-Pacific continues to dominate probe card consumption, anchored by Taiwan, South Korea, and China’s leading wafer fabrication capacity. In this region, fierce competition among local probe card manufacturers has fueled rapid R&D cycles, especially in cutting-edge MEMS-SP solutions for high-volume chip assembly. Japan’s historically strong expertise in precision materials contributes to incremental innovation, particularly in composite substrate technologies and advanced needle metallurgy. Across all regions, alignment between regional fab investments and local probe card ecosystems remains a key determinant of competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Probe Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Technological Advances from Leading Probe Card Suppliers Driving Competitive Differentiation and Collaborative Ecosystems

Leading suppliers in the probe card domain are executing a variety of strategic initiatives to differentiate their offerings and capture value in an increasingly competitive environment. One prominent player has prioritized investment in next-generation MEMS-SP architectures, establishing cleanroom expansion projects to scale production of microfabricated probe tips with submicron alignment capabilities. Another provider has focused on fine-tuning composite substrate formulations to enhance thermal cycling performance, positioning its solution for high-volume automotive and aerospace semiconductor testing.

Partnerships between probe card manufacturers and major automated test equipment vendors have become commonplace, enabling integrated platforms that reduce test cycle time and simplify hardware compatibility. Collaborative development agreements, particularly with edge-tier semiconductor foundries, are accelerating the co-creation of custom probe card assemblies optimized for specific device architectures. Additionally, select companies have launched global service networks offering on-site maintenance, probe needle refurbishment, and real-time analytics dashboards, thereby strengthening customer relationships and fostering recurring revenue streams.

Technology licensing and patent cross-licensing agreements have also reshaped competitive dynamics. By securing rights to advanced actuation mechanisms and sensor integration techniques, some probe card suppliers are gaining early mover advantage in serving the AI accelerator and high-speed logic markets. Meanwhile, acquisitions of specialist needle manufacturing firms are enabling integrated supply chains that reduce lead times and enhance quality control. Collectively, these strategic moves underscore the importance of technological leadership, operational agility, and ecosystem collaboration for maintaining momentum in the fast-evolving probe card landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Probe Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- FormFactor, Inc.

- Technoprobe S.p.A.

- Micronics Japan Co., Ltd.

- MPI Corporation

- JAPAN ELECTRONIC MATERIALS CORPORATION

- NIDEC CORPORATION

- WinWay Technology Co., Ltd.

- Chunghwa Precision Test Tech. Co., Ltd.

- TSE Co., Ltd.

- FICT LIMITED

- FEINMETALL GmbH

- PROTEC MEMS Technology

- Yamaichi Electronics Company, LTD.

- Jenoptik AG

- Seiken Co., Ltd.

- Accuprobe Corporation

- Gel-Pak, LLC by Delphon

- GGB Industries, Inc.

- PPI Systems Inc.

- Probe Test Solutions Ltd.

- RIKA DENSHI CO., LTD.

- Shenzhen Fastprint Circuit Tech Co.,LTD.

- STAr Technologies Inc.

- Suzhou Silicon Test System Co., Ltd.

- Synergie Cad PSC

- T Plus Co. Ltd.

- TOHO ELECTRONICS INC.

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Wentworth Laboratories

Actionable Strategic Recommendations to Enhance Probe Card Development, Optimize Operational Efficiencies, and Strengthen Market Positioning Amid Evolving Industry Challenges

Industry leaders must take decisive actions to maintain technological relevance and operational excellence in the face of evolving semiconductor testing requirements. First, directing R&D investments toward MEMS-based and vertical probe card innovations will address the growing demand for high-density, multi-site testing capabilities. Concurrently, leveraging material science advancements-such as lightweight composite substrates and novel metallic alloys-can optimize contact durability and thermal performance across extended test cycles.

Second, diversifying manufacturing footprints through nearshoring and strategic partnerships will alleviate tariff-induced cost pressures and enhance supply chain resilience. Contracting with regional assemblers in the Americas and ASEAN markets will reduce logistics lead times and mitigate geopolitical risk. Additionally, negotiating long-term supply agreements with tier-one foundries can stabilize pricing and create shared incentives for process co-optimization.

Third, integrating digital features within probe card assemblies-such as embedded sensors for force monitoring and automated contact alignment feedback-will align testing processes with Industry 4.0 initiatives. This digital transformation not only improves yield analysis but also enables predictive maintenance models that minimize unplanned downtime. Finally, cultivating partnerships with test equipment OEMs and chipmakers through collaborative development programs will accelerate the co-creation of bespoke solutions for emerging applications in electric vehicles, wireless infrastructure, and artificial intelligence accelerators. By executing these strategic recommendations, probe card companies can reinforce their market positioning and drive sustained growth in an increasingly complex landscape.

Transparent and Rigorous Research Methodology Underpinning Probe Card Market Analysis Through Comprehensive Data Collection and Expert Validation Processes

The insights presented in this analysis are underpinned by a rigorous, multi-phased research methodology designed to ensure data accuracy, relevance, and comprehensive coverage of the probe card market. The process began with an extensive secondary research phase, drawing on publicly available technical white papers, patent filings, industry association reports, and select semiconductor test equipment documentation. This provided a foundational understanding of technology trajectories, regulatory impacts, and existing supply chain structures.

Building on this groundwork, primary research involved structured interviews and surveys with over fifty senior-level stakeholders, including engineering leads at integrated device manufacturers, test operations managers at semiconductor foundries, and R&D heads at leading probe card suppliers. Discussion topics covered design challenges, material selection criteria, tariff management strategies, and regional demand drivers. Insights gleaned from these dialogues were triangulated with quantitative data sources-such as proprietary transaction records and fab capacity utilization figures-to validate thematic trends.

Finally, a validation workshop convened subject matter experts from both test equipment companies and semiconductor end users, ensuring alignment between observed market phenomena and real-world operational requirements. Throughout the research lifecycle, data integrity was maintained via cross-verification protocols and ongoing peer review by an independent panel of semiconductor industry analysts. This methodology ensures that the analysis reflects the most current and actionable insights into the evolving probe card ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Probe Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Probe Cards Market, by Probe Card Type

- Probe Cards Market, by Component

- Probe Cards Market, by Wafer Size

- Probe Cards Market, by Pitch Category

- Probe Cards Market, by Tip Material

- Probe Cards Market, by Site Count

- Probe Cards Market, by Substrate Material

- Probe Cards Market, by Application

- Probe Cards Market, by Customer Type

- Probe Cards Market, by Region

- Probe Cards Market, by Group

- Probe Cards Market, by Country

- United States Probe Cards Market

- China Probe Cards Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2067 ]

Concluding Reflections on Probe Card Market Evolution Underpinning Strategic Insights for Future Innovation and Competitive Growth Pathways

The probe card market stands at a pivotal moment as technological advancements, trade dynamics, and shifting application landscapes converge to redefine testing paradigms. From the maturity of cantilever and epoxy probe cards to the rapid ascent of MEMS-SP and vertical architectures, stakeholders must navigate an increasingly complex matrix of performance, cost, and supply chain considerations. Heightened U.S. tariff pressures have underscored the strategic necessity of diversified manufacturing footprints and collaborative supplier relationships, while segmentation insights reveal differentiated growth pathways across product types, materials, needle configurations, pitch sizes, and application domains.

Regionally, the interplay between local fab expansions, automotive electrification in EMEA, and Asia-Pacific’s semiconductor leadership continues to shape probe card demand and innovation priorities. Key players are responding through targeted R&D investments, strategic partnerships, and integrated service offerings that strengthen customer retention and technological differentiation. For industry leaders, translating these insights into actionable strategies-ranging from nearshoring initiatives to digital feature integration-is critical for sustaining competitive advantage.

As the semiconductor industry accelerates toward more advanced nodes and complex packaging formats, probe card technology will remain a foundational enabler of yield optimization and quality assurance. Armed with a clear understanding of market segmentation, regional dynamics, company strategies, and best-practice recommendations, stakeholders are well positioned to seize emerging opportunities and chart a course for long-term success in this vital segment of the semiconductor testing ecosystem.

Secure Access to Comprehensive Probe Card Market Intelligence and Drive Strategic Decisions by Engaging Ketan Rohom for Tailored Research Support

Securing comprehensive market intelligence is essential for organizations seeking to maintain a competitive edge in the fast-moving semiconductor testing landscape. By engaging Ketan Rohom, Associate Director of Sales & Marketing, you gain personalized support to navigate complex probe card technologies, understand segmentation nuances, and anticipate supply chain challenges. Ketan’s expertise enables tailored guidance on optimizing product portfolios and aligning testing strategies with emerging industry requirements, including high-density wafer testing and advanced packaging applications.

This report provides in-depth analysis of technological shifts, tariff impacts, and regional dynamics that are shaping the probe card ecosystem. Armed with these insights, you can make data-driven decisions to reduce costs, improve yield, and accelerate time to market. Reach out to Ketan to discuss bespoke research deliverables, volume licensing options, and strategic consultation packages designed to power your next growth milestone. Don’t miss the opportunity to transform your testing operations and capitalize on new market opportunities with targeted intelligence that translates to actionable results.

- How big is the Probe Cards Market?

- What is the Probe Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?