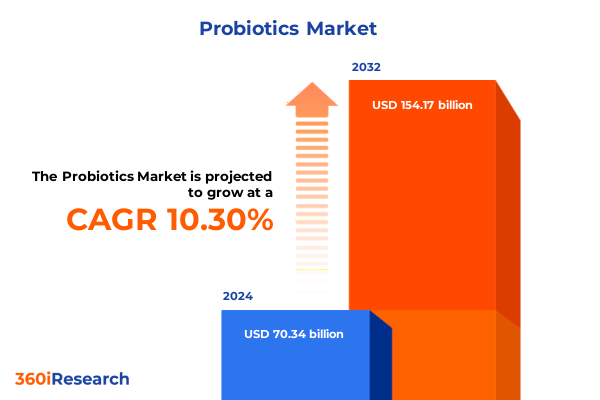

The Probiotics Market size was estimated at USD 77.20 billion in 2025 and expected to reach USD 84.85 billion in 2026, at a CAGR of 10.38% to reach USD 154.17 billion by 2032.

Setting the Context for a Dynamic Probiotic Ecosystem Driven by Scientific Advances, Consumer Demand, and Regulatory Evolution Worldwide

The global probiotic landscape is undergoing a remarkable evolution fueled by accelerating scientific discoveries, shifting consumer preferences, and an increasingly complex regulatory environment. At its core, probiotics have transitioned from a niche niche supplement category to a mainstream pillar of preventive health and functional nutrition. This transformation reflects both a heightened awareness of the gut-brain axis and growing evidence of microbiome modulatory benefits across diverse health domains. As research continues to uncover novel strains and delivery technologies, the market is poised for sustained innovation and broadening application areas.

In parallel, consumer behavior is transforming as end users demand transparent labeling, clinically substantiated claims, and personalized solutions aligned with holistic wellness goals. Millennials and aging demographics alike are embracing probiotics as part of daily routines spanning dietary supplements, fortified foods, and personal care regimens. Consequently, manufacturers and ingredient suppliers are increasingly prioritizing collaborative research partnerships, advanced encapsulation techniques, and digital health integration to better meet evolving expectations.

Against this backdrop, the executive summary highlights how recent shifts in trade policy, segmentation trends, and regional growth drivers converge to reshape competitive dynamics. It underscores the strategic imperatives for industry stakeholders to navigate evolving supply chain complexities, leverage differentiated product portfolios, and capitalize on emerging market niches. By examining key drivers, segmentation insights, and actionable recommendations, this report equips decision-makers with the knowledge to chart a successful path in the rapidly maturing probiotic market.

Unveiling the Paradigm Shifts Revolutionizing Probiotic Applications and Consumer Adoption in Today’s Health and Wellness Landscape

Over the past five years, the probiotic sector has witnessed paradigm-shifting developments that are redefining both supply and demand dynamics. First, technological breakthroughs in strain discovery and delivery platforms have enabled higher viability, targeted release, and enhanced functional benefits. Microencapsulation, next-generation sequencing for strain characterization, and synbiotic formulations pairing probiotics with prebiotics exemplify how innovation is elevating product efficacy and consumer trust.

Meanwhile, broader wellness trends are fostering rapid adoption across non-traditional categories such as skincare, oral care, and animal nutrition. External to traditional digestive health claims, probiotics are now marketed for skin barrier fortification, oral microbiome balance, and livestock growth promotion. This expanded scope has attracted cross-industry collaborations with cosmetic formulators, pet food producers, and dairy players, illustrating how probiotics are weaving into diverse value chains.

Concurrently, digital transformation is enhancing consumer engagement through telehealth consultations, personalized health apps, and direct-to-consumer subscription models. Data-driven insights on individual microbiome profiles are informing tailored recommendations, fostering deeper brand loyalty, and supporting premium pricing. As these transformative shifts continue to gain momentum, the competitive landscape is being recalibrated by agile players that can marry scientific rigor with nimble go-to-market strategies.

Examining the Comprehensive Effects of Newly Implemented United States Tariffs on Probiotic Ingredients and Supply Chain Economics

In 2025, newly implemented United States tariffs on select probiotic ingredients and related raw materials have introduced notable pressures on import costs and supply chain resilience. While the specific duty increases vary by ingredient classification, the overall impact has been a recalibration of sourcing strategies and cost-pass-through decisions. Manufacturers reliant on imported bacterial and yeast strains are actively exploring nearshoring and domestic cultivation partnerships to alleviate tariff burdens.

These adjustments have prompted ingredient suppliers and finished-goods producers to reassess long-term agreements, diversify incumbent suppliers across multiple geographies, and invest in in-house fermentation capacity. Moreover, the tariffs have accelerated industry conversations around improving logistical efficiency, from optimizing cold-chain transport to renegotiating bulk shipping terms. As a result, some cost pressures have been offset through operational improvements, though margin compression remains a key consideration.

Looking ahead, companies are monitoring potential extensions or corrective measures from trade authorities, while stakeholders engage with regulatory bodies to advocate for tariff relief or targeted exemptions. Overall, the 2025 tariff landscape has underscored the necessity for proactive risk management and supply chain transparency. Those organizations capable of swiftly adapting to evolving trade conditions will be best positioned to sustain product affordability and market agility.

Decoding Probiotic Market Diversity through Product Types, Sources, Applications, End Users, and Distribution Pathways Insights

An in-depth look at market segmentation reveals a multifaceted ecosystem shaped by distinct product categories, sources, applications, end-user groups, and channels. In the product realm, the dominance of dietary supplements manifests across capsules, powders, and tablets, each offering tailored convenience and dosage precision, while the food and beverage sphere spans both dairy and non-dairy vehicles to address diverse dietary preferences. Beyond ingestible forms, personal care products harness probiotic science for haircare and skincare benefits, marrying microbiome balance with beauty routines.

Diverging at the source level, bacterial strains remain the cornerstone of most formulations, although yeast-based probiotics are gaining traction for unique functional attributes and stability advantages. Application-wise, digestive and immune health continue to command the largest share of interest, yet oral and urogenital health niches are expanding, driven by targeted research and specialized formulations.

Finally, the segmentation by end user bifurcates into human and animal nutrition, illustrating how probiotic efficacy transcends species boundaries, while distribution channels oscillate between traditional brick-and-mortar outlets and rapidly growing online platforms. Understanding these intersecting segmentation dimensions enables stakeholders to tailor portfolios, optimize marketing strategies, and uncover high-value opportunities in both established and emerging submarkets.

This comprehensive research report categorizes the Probiotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Application

- End-User

- Distribution Channel

Mapping Regional Probiotic Trends and Growth Drivers across the Americas, Europe Middle East Africa, and Asia Pacific Spheres

Regionally, the Americas lead in probiotic adoption through well-established dietary supplement markets and advanced regulatory frameworks that support health claim substantiation. Within this region, the United States remains a central hub for innovation and research partnerships, while Canada and Latin America show increasing acceptance of functional foods and animal nutrition applications. As consumer education deepens, North America is evolving into a launchpad for novel formulations and digital health integrations.

Across Europe, the Middle East, and Africa, regulatory heterogeneity shapes market entry strategies and claim positioning. The European Union continues to enforce stringent safety and efficacy requirements, encouraging manufacturers to invest in robust clinical studies. In contrast, Middle Eastern and North African markets are characterized by high growth potential in dairy, non-dairy beverages, and personalized nutraceuticals, driven by rising health awareness and disposable incomes.

In the Asia-Pacific region, exponential growth stems from expanding middle-class populations and traditional fermentation heritage. Countries such as Japan and South Korea blend longstanding cultural appreciation for fermented foods with modern probiotic science, while emerging markets like India and Southeast Asia are rapidly adopting capsules and functional beverages. The convergence of urban lifestyle changes and digital retail channels is propelling the region to the forefront of global probiotic demand.

This comprehensive research report examines key regions that drive the evolution of the Probiotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Moves and Competitive Positioning of Leading Global Probiotic Manufacturers and Innovators Charting Growth

Leading probiotic companies are differentiating through strategic alliances, pipeline expansions, and M&A activity aimed at securing proprietary strains and broadening application reach. Some key players have invested heavily in in-house fermentation and formulation capabilities to enhance supply control and protect intellectual property. Others have forged partnerships with academic institutions and biotech startups to accelerate the development of next-generation strains targeting specific health endpoints.

In parallel, contract manufacturing organizations specializing in microbial cultures are scaling capacity to meet surging demand, emphasizing quality management systems and traceability. Private equity and venture investors are taking note, funneling capital into innovative brands that demonstrate strong consumer traction and scientific backing. Meanwhile, major consumer goods conglomerates are increasingly acquiring niche probiotic specialists to integrate microbiome benefits into their existing portfolios, signaling the strategic importance of probiotics in broader health and wellness roadmaps.

Ultimately, the competitive environment is coalescing around differentiated capabilities in research, production agility, and go-to-market excellence. Companies that can harmonize these elements while preserving brand credibility and regulatory compliance will be positioned as front-runners in the evolving probiotic sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Probiotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech, Inc.

- Archer Daniels Midland Company

- Arla Foods, Inc.

- Asahi Group Holdings, Ltd.

- Bio Armor Developpement S.A.R.L. by The Kersia Group

- BioCC LLC

- BioGaia AB

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Greentech

- Kerry Group PLC

- Lallemand Inc.

- Land O'lakes, Inc.

- Lesaffre & CIE

- Lifeway Foods, Inc.

- MITUSHI BIOPHARMA

- Morinaga Milk Industry Co., Ltd.

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Nestlé S.A.

- Novozymes A/S

- Probi AB

- Probiotical SpA

- Provita Eurotech Limited

- Reckitt Benckiser Group plc

- Roelmi HPC

- Royal DSM N.V.

- Sabinsa Corporation

- Schouw & Co.

- Synbio Tech Inc.

- Yakult Honsha Co., Ltd.

Crafting Targeted Strategies for Industry Leaders to Navigate Shifting Probiotic Demands, Regulatory Changes, and Supply Chain Complexities

To sustain momentum and capitalize on emerging opportunities, industry leaders should adopt a multipronged approach that blends scientific rigor with operational agility. First, investing in proprietary strain research and validated clinical studies will reinforce product claims and build consumer trust. Complementing this, establishing or expanding domestic cultivation and manufacturing partnerships can mitigate tariff-related risks and reduce lead times.

Second, companies should tailor product portfolios to address underpenetrated application areas such as oral and urogenital health, leveraging specialty formulations and targeted delivery systems. Strategic collaboration with healthcare professionals and specialized marketing campaigns will be essential to educate end users and differentiate offerings. Third, embracing digital platforms for personalized consumer engagement-from microbiome profiling apps to subscription-based replenishment models-will foster loyalty and enable premium positioning.

Finally, regional strategies must account for regulatory diversity and consumer behaviors, with dedicated market entry plans for North America, EMEA, and Asia-Pacific focused on relevant distribution channels and cultural nuances. By integrating these recommendations, leaders can build resilient supply chains, strengthen brand equity, and capture high-value segments in the dynamic probiotic market.

Outlining a Robust Mixed Methods Framework Combining Primary Interviews, Secondary Data Synthesis, and Validation for Probiotic Market Intelligence

The research methodology underpinning this report combines qualitative and quantitative approaches to ensure comprehensive market coverage and robust insights. Primary research includes in-depth interviews with executives across manufacturing, retail, research institutions, and ingredient suppliers, capturing firsthand perspectives on trends, challenges, and strategic priorities. These interviews were systematically coded and analyzed to identify recurring themes and emergent opportunities.

Secondary research sources encompass scientific journals, regulatory filings, patent databases, and proprietary trade publications, yielding context on strain innovations, product launches, and shifting policy environments. Market mapping exercises and supply chain analyses were conducted to trace ingredient flows, tariff implications, and distribution channel evolution. Data triangulation techniques were employed to validate findings and reconcile discrepancies among sources.

The combination of these methods ensures that the report delivers nuanced, multi-dimensional intelligence. Analytical frameworks such as SWOT analyses, Porter’s Five Forces assessments, and segmentation matrices were applied to distill actionable insights. Rigor and transparency in methodology bolster confidence in the conclusions, making this report a reliable reference for strategic decision-making in the probiotic sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Probiotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Probiotics Market, by Product Type

- Probiotics Market, by Source

- Probiotics Market, by Application

- Probiotics Market, by End-User

- Probiotics Market, by Distribution Channel

- Probiotics Market, by Region

- Probiotics Market, by Group

- Probiotics Market, by Country

- United States Probiotics Market

- China Probiotics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Highlighting Core Market Drivers, Challenges, and Strategic Opportunities Shaping the Future of Probiotics Worldwide

In conclusion, the probiotic market stands at a strategic inflection point, where scientific breakthroughs, evolving trade policies, and consumer sophistication intersect to create both opportunities and challenges. Advanced strain technologies and delivery systems are unlocking new health applications, while regional market dynamics and tariff considerations are reshaping supply chain and cost structures. At the same time, segmentation diversity across product types, sources, applications, end users, and distribution channels underscores the need for tailored strategies and deep market understanding.

Companies that prioritize integrated research investments, flexible manufacturing models, and digitally enabled consumer engagement will emerge as market leaders. Likewise, proactive risk management around tariffs and regulatory compliance will be critical to safeguarding margins and ensuring continuity of supply. By embracing the recommendations outlined herein and leveraging robust market intelligence, stakeholders can navigate the complex probiotic landscape and capitalize on the next wave of growth opportunities.

This executive summary serves as a strategic compass, highlighting the most impactful trends and actionable insights to guide decision-makers toward sustainable success. The full report provides detailed analyses, case studies, and granular segmentation data to support informed, confident strategic planning in the rapidly maturing probiotic industry.

Engage with Our Expert Team Today to Secure Comprehensive Probiotic Market Intelligence and Empower Your Strategic Growth Initiatives

To explore the full breadth of probiotic market insights and equip your organization with actionable strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure the definitive industry report. Engaging with Ketan will provide personalized guidance on how the latest data, competitive intelligence, and strategic recommendations can be applied to your unique business needs. Connect directly with the sales and marketing lead to discuss tailored research packages, enterprise licensing options, and consulting add-ons designed to accelerate time-to-value. Don’t miss this opportunity to gain a competitive edge by leveraging the only comprehensive resource focused on scientific advancements, tariff impacts, segmentation nuances, and regional dynamics of the probiotic sector. Start the conversation today and transform insights into informed decisions that drive growth and profitability.

- How big is the Probiotics Market?

- What is the Probiotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?