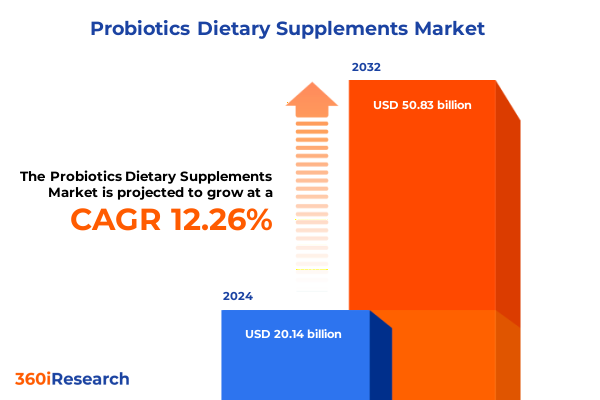

The Probiotics Dietary Supplements Market size was estimated at USD 22.50 billion in 2025 and expected to reach USD 25.15 billion in 2026, at a CAGR of 12.34% to reach USD 50.83 billion by 2032.

Unveiling the Evolving Probiotics Supplement Landscape Driven by Consumer Wellness Priorities and Technological Innovations Transforming Health Solutions

The probiotic dietary supplements sector has matured into a critical pillar of the broader functional nutrition landscape, propelled by heightened consumer awareness of gut health’s role in overall well-being. Once confined to niche health food stores, probiotic supplements are now a mainstream pillar of daily wellness routines, with individuals seeking both foundational and targeted benefits. As research underscores the gut microbiome’s influence on digestive balance, immune response, and even cognitive function, demand has shifted from general formulations toward specialized solutions backed by scientific validation.

Concurrently, technological advancements have democratized access to personalized health insights, enabling formulation developers to tailor strain combinations and delivery formats more precisely than ever before. Driven by a confluence of digital health platforms, emerging clinical evidence, and regulatory bodies clarifying strain-specific claims, manufacturers are moving beyond one-size-fits-all offerings. Meanwhile, distribution channels have multiplied, with e-commerce platforms complementing a resurgent focus on brick-and-mortar pharmacies and specialty retailers to enhance consumer convenience and trust.

Against this backdrop of informed consumers, evolving science, and diversified channels, industry stakeholders must align their innovation roadmaps and go-to-market strategies with the nuanced expectations of athletes, health-conscious individuals, and lifestyle-focused consumers. This introductory overview sets the stage for a deeper exploration of recent market shifts, regulatory headwinds, segmentation dynamics, and actionable imperatives shaping the future of probiotic supplements.

Unraveling Transformative Shifts in Probiotic Supplementation Fueled by Scientific Breakthroughs, Personalized Nutrition, and Regulatory Evolution

The probiotics industry is undergoing transformative changes as breakthroughs in microbiome science intersect with consumer demand for tailored nutrition. Cutting-edge delivery technologies, such as microencapsulation and time-release matrices, have enhanced strain viability through storage and digestion, enabling producers to make more precise efficacy claims. These innovations, coupled with advances in genomic sequencing, allow researchers to map strain-specific interactions with host physiology and develop formulations that address discrete health objectives, from gut-brain axis modulation to metabolic support.

Personalization has emerged as a powerful theme, with direct-to-consumer testing kits offering individualized microbiome profiles that inform product selection. This shift is fostering closer collaboration between laboratories, healthcare providers, and supplement manufacturers, streamlining the translation of clinical findings into consumer-ready products. At the same time, postbiotic compounds-metabolites produced by probiotic strains-are gaining attention for their stability and targeted functional benefits, prompting a wave of novel product launches.

Regulatory agencies worldwide are simultaneously refining guidelines to ensure transparency and safety across the sector. Strain identification, dosage substantiation, and health claim approvals have become more rigorous, raising the bar for market entrants while reassuring consumers of product integrity. The convergence of scientific progress, personalized nutrition pathways, and evolving regulatory frameworks is setting a new standard for innovation, with brands that can navigate these shifts poised to capture premium positioning in an increasingly discerning market.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Probiotic Supply Chains, Raw Material Sourcing, and Price Competitiveness

The introduction of new United States tariff measures in early 2025 has exerted a significant influence on the probiotic supplements supply chain, altering raw material sourcing strategies and cost structures across the industry. As import duties rose on key ingredients-ranging from freeze-dried bacterial strains to specialized encapsulation polymers-manufacturers faced the dual imperative of preserving profit margins and maintaining product accessibility for consumers. These pressures have accelerated efforts to localize critical processes, prompting strategic investments in domestic fermentation facilities and partnerships with regional ingredient providers.

In response, several companies have redesigned logistics networks to mitigate shipping costs and lead times, prioritizing bulk procurement agreements and onshore warehousing solutions. While some of these adjustments have led to incremental price increases at the point of sale, manufacturers have concurrently introduced value-added propositions-such as enhanced strain potency and extended shelf-life certifications-to justify revised pricing structures. Meanwhile, organizations with multi-region sourcing capabilities have navigated these tariff headwinds more smoothly, reallocating production volumes to facilities in tariff-exempt jurisdictions and leveraging trade agreements to secure preferential duty rates.

Looking forward, the landscape underscores the importance of supply chain resilience and agility. Producers that proactively diversify their supplier base, optimize inventory buffers, and engage in sophisticated tariff engineering are best positioned to weather ongoing trade fluctuations. As tariffs continue to shape cost competitiveness, strategic sourcing and adaptive distribution models will remain critical levers for sustaining growth and consumer trust in probiotic supplements.

Deriving Key Segmentation Insights from Product Forms, Strain Varieties, Formulation Strategies, Distribution Channels, Applications, and End-User Preferences

Probiotic supplement companies must navigate a spectrum of product formats to satisfy consumer preferences, with capsules remaining a reliable choice for convenience and dosage accuracy, powders appealing to those seeking customizable mixing options, and tablets offering stability benefits for multi-strain blends. Each format presents distinct manufacturing considerations, from moisture control in powder lines to compression technology for tablets, driving producers to refine processes and quality controls to uphold strain viability and ensure consistent performance.

On the strain front, Bifidobacterium and Lactobacillus species dominate as foundational organisms, supported by an upsurge in Streptococcus-based formulations that target niche applications such as upper respiratory tract support. Within formulation strategies, single-strain offerings appeal to consumers seeking targeted outcomes, while multi-strain combinations-structured as duo or triad matrices-address broader health objectives by leveraging strain synergy. This bifurcation has inspired a parallel development track for strain interaction research and blend optimization.

Distribution channels further differentiate market reach: traditional offline outlets such as pharmacies, specialty nutrition stores, and large-format supermarkets and hypermarkets provide essential clinical credibility and impulse purchase opportunities, whereas online retail platforms deliver personalized subscription models and direct consumer engagement. Across applications, digestive health continues to anchor demand, even as immune enhancement claims gain traction in response to heightened public health awareness. Finally, end-user segments reveal divergent motivations: athletes gravitate toward performance-oriented probiotic regimens, health-conscious individuals emphasize long-term maintenance, and lifestyle consumers prioritize convenience and aligned brand values. Together, these segmentation insights underscore the complex interplay of product characteristics, consumer behaviors, and channel strategies guiding market advancement.

This comprehensive research report categorizes the Probiotics Dietary Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Strain

- Formulation

- Distribution Channel

- Application

- End-user

Unearthing Pivotal Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets Shaping Local Probiotic Ecosystems

Regional dynamics in the probiotic supplements arena reflect distinct consumer priorities, regulatory landscapes, and distribution infrastructures. In the Americas, North American markets lead in consumer education and demand for clinically substantiated products, supported by well-established e-commerce logistics and robust pharmacy networks. Manufacturers in this region often emphasize advanced strain technologies and premium packaging, catering to an audience that values both scientific rigor and brand transparency.

Meanwhile, Europe, the Middle East, and Africa exhibit a mosaic of regulatory approaches, from stringent European Food Safety Authority protocols to emerging Gulf Cooperation Council frameworks. Brands operating in these areas balance compliance with local health authority guidelines while adapting formulations to meet diverse dietary norms and retail preferences. Multinational companies leverage regional offices to navigate labeling requirements and certification programs, ensuring product claims resonate with varied market sensibilities.

In the Asia-Pacific, traditional fermentation heritage intersects with rapid modern retail expansion. Domestic producers in East Asian markets benefit from longstanding cultural acceptance of probiotic-rich foods, enabling swift uptake of supplement innovations. Meanwhile, Southeast Asia and Australasia are experiencing surging demand driven by growing urban middle classes and the proliferation of health-focused e-commerce portals. Across the region, digital-first strategies and influencer partnerships are key to educating consumers and driving trial, underlining the importance of culturally attuned messaging and omnichannel engagement.

This comprehensive research report examines key regions that drive the evolution of the Probiotics Dietary Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Probiotic Industry Leaders and Emerging Innovators Transforming Product Development, Strategic Alliances, and Competitive Positioning

Industry leadership in the probiotics space is characterized by a combination of established global providers and agile newcomers focusing on disruptive innovation. Blue-chip firms leverage extensive R&D capabilities and large-scale manufacturing to deliver a breadth of strain offerings and distribution reach. These organizations often secure strategic alliances with academic institutions to validate new strain efficacy, while focusing on scalability and regulatory compliance to protect market share.

Conversely, emerging innovators are staking claims in specialized niches, harnessing proprietary microencapsulation technologies and digital health integrations to differentiate their portfolios. These dynamic entrants often pilot direct-to-consumer subscription models, employing data-driven feedback loops to refine formulation criteria and enhance consumer engagement. Venture-backed startups are also exploring novel delivery mechanisms-such as effervescent formats and chewable tablets-to capture lifestyle-driven segments.

The competitive landscape has witnessed a series of strategic mergers and acquisitions, as legacy players absorb nimble innovators to expand their strain libraries and digital capabilities. At the same time, partnerships with logistics providers and contract manufacturers are enabling companies of all sizes to optimize supply chain resilience. Ultimately, industry positioning hinges on the ability to merge scientific credibility with consumer-centric branding, ensuring that product differentiation is both substantiated by evidence and accessible through preferred retail channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Probiotics Dietary Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aenova Holding GmbH

- Archer Daniels Midland Company

- BASF SE

- BioGaia AB

- Chr. Hansen Holding A/S

- Custom Probiotics, Inc.

- DuPont de Nemours, Inc.

- Herbaland Naturals Inc.

- International Flavors & Fragrances, Inc.

- Koninklijke DSM N.V.

- Leucine Rich Bio Private Limited

- Lonza Group AG

- Nature's Bounty (NY) Inc.

- Nestlé S.A.

- NOW Health Group, Inc.

- NutriFlair by FINEST VITAMINS, LLC

- Optibac Probiotics by Wren Laboratories Ltd.

- Ora Organic Pvt Ltd

- Probi AB

- Probium by Dietary Pros, Inc.

- Procter & Gamble Company

- Reckitt Benckiser Group PLC

- Roquette Frères

- SC Nutra Limited

- Wellbeing Nutrition by NUTRITIONALAB PRIVATE LIMITED

- Yakult Honsha Co., Ltd.

Strategic Actionable Recommendations Empowering Industry Leaders to Leverage Innovation, Diversify Portfolios, and Navigate Regulatory and Trade Complexities

To thrive in a rapidly evolving probiotics market, industry leaders should prioritize a multifaceted innovation agenda that centers on expanding strain portfolios and deepening clinical validation. Investing in collaborative research with academic and clinical partners can accelerate the discovery of novel bacterial species and postbiotic metabolites, strengthening efficacy claims and fostering consumer trust. At the same time, companies must diversify product formats, integrating advanced delivery systems to address segment-specific preferences and dosage requirements.

Robust supply chain management is equally crucial. Organizations should diversify sourcing networks to mitigate exposure to future tariff fluctuations, while implementing real-time inventory analytics to optimize buffer stocks for high-demand SKUs. Engaging in strategic partnerships with regional manufacturers or exploring toll-manufacturing arrangements can also reduce lead times and enhance cost flexibility.

On the commercial front, reinforcing digital touchpoints will be vital for personalized marketing and subscription retention. Leveraging consumer data through privacy-compliant platforms can inform targeted messaging around digestive wellness and immune support, while education-driven content establishes brands as thought leaders. Meanwhile, strengthening relationships with brick-and-mortar retail partners through in-store activations and training programs for health professionals can bridge the gap between clinical endorsement and shelf presence.

Finally, proactive regulatory engagement and scenario planning will empower leaders to anticipate policy shifts and ensure agile compliance. By adopting these strategic imperatives, companies can navigate complexity, seize emerging opportunities, and secure long-term growth in the probiotic supplements landscape.

Outlining Robust Research Methodology Combining Primary Insights, Secondary Data, and Rigorous Validation for Probiotic Market Intelligence

This analysis integrates a structured research methodology combining primary and secondary data sources to deliver robust market intelligence. Primary research included in-depth interviews with senior executives from leading supplement manufacturers, third-party logistics providers, and key opinion leaders in nutrition and gastroenterology. These conversations illuminated current challenges in strain viability, tariff management, and consumer engagement, shaping the narrative around strategic priorities for industry stakeholders.

Secondary research encompassed a rigorous review of peer-reviewed journals, regulatory filings from major health authorities, and company disclosures on recent mergers, acquisitions, and product launches. This data set was augmented by analysis of trade policy documents and tariff schedules relevant to probiotic ingredients, ensuring a comprehensive understanding of cost pressures and supply chain dynamics.

To validate insights, data triangulation techniques were applied, cross-referencing primary feedback with quantitative metrics where available, such as import/export volumes and patent filings. A peer review panel comprising formulation scientists, regulatory specialists, and retail channel experts evaluated the findings to ensure accuracy and relevance. This multi-layered approach yields a verifiable, actionable perspective on the probiotics supplements market, providing stakeholders with confidence in the strategic guidance offered herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Probiotics Dietary Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Probiotics Dietary Supplements Market, by Product

- Probiotics Dietary Supplements Market, by Strain

- Probiotics Dietary Supplements Market, by Formulation

- Probiotics Dietary Supplements Market, by Distribution Channel

- Probiotics Dietary Supplements Market, by Application

- Probiotics Dietary Supplements Market, by End-user

- Probiotics Dietary Supplements Market, by Region

- Probiotics Dietary Supplements Market, by Group

- Probiotics Dietary Supplements Market, by Country

- United States Probiotics Dietary Supplements Market

- China Probiotics Dietary Supplements Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Strategic Conclusions Emphasizing Growth Opportunities, Risk Mitigation, and the Path Forward in the Probiotics Supplement Industry

The probiotics dietary supplements sector stands at a pivotal juncture, marked by scientific innovation, shifting consumer expectations, and evolving trade dynamics. Organizations that harness emerging delivery technologies, invest in targeted strain research, and navigate regulatory complexities with agility will secure a competitive edge. At the same time, companies must remain vigilant to supply chain vulnerabilities, leveraging diverse sourcing strategies to mitigate geopolitical and tariff-related risks.

Segmentation insights reveal that success hinges on a nuanced appreciation of product formats, strain synergies, channel optimization, application-specific formulations, and end-user motivations. Meanwhile, regional dynamics underscore the necessity of tailored approaches, from clinical positioning in North America to digital engagement models in Asia-Pacific and compliance-driven strategies in Europe, the Middle East, and Africa. Industry leaders and emerging challengers alike must balance scale with specialization, forging strategic alliances that amplify scientific credibility and logistical efficiency.

As the market continues to expand, the most resilient players will be those who integrate data-driven decision-making with innovation-led cultures, maintaining a clear line of sight from research labs to the consumer’s daily wellness regimen. By aligning operational excellence with forward-looking strategy, stakeholders can capitalize on growth opportunities, mitigate potential headwinds, and chart a sustainable path forward in the dynamic probiotics supplements landscape.

Empowering Stakeholders to Access In-Depth Probiotic Market Intelligence with Personalized Support and Guidance from Our Senior Sales and Marketing Leadership

To access the comprehensive analysis, case studies, and strategic tools covered in this executive summary and unlock a competitive advantage in the probiotics sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through tailored licensing options and demonstrate how the in-depth market intelligence contained in the full report can accelerate your growth plans and support informed decision-making. Seize this opportunity to equip your team with actionable data, expert commentary, and interactive dashboards that address your specific goals and challenges. Engage today to transform insights into measurable impact and stay at the forefront of the probiotic supplements industry.

- How big is the Probiotics Dietary Supplements Market?

- What is the Probiotics Dietary Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?