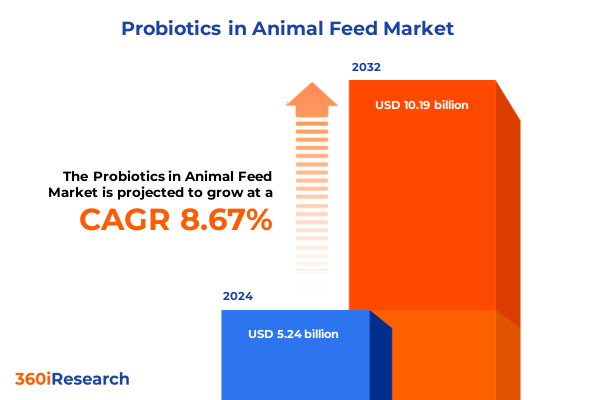

The Probiotics in Animal Feed Market size was estimated at USD 5.67 billion in 2025 and expected to reach USD 6.15 billion in 2026, at a CAGR of 8.72% to reach USD 10.19 billion by 2032.

Unveiling the Revolutionary Role of Probiotics in Animal Feed and Their Contribution to Sustainable Livestock and Aquaculture Performance

Over the past decade, the integration of probiotic supplements into animal nutrition has transitioned from a niche practice to a cornerstone of sustainable livestock management. Driven by mounting regulatory pressures to reduce antibiotic use and growing consumer demand for naturally enhanced animal products, probiotics have gained prominence as essential agents for promoting gut health, bolstering immune function, and optimizing nutrient absorption across diverse animal species.

As innovative research continues to unveil strain-specific benefits, including improved weight gain efficiency in poultry and enhanced digestive stability in aquaculture, industry participants are recognizing probiotics as strategic tools that reinforce animal welfare while aligning with ethical production mandates. Consequently, feed formulators, producers, and end-users alike are increasingly integrating probiotic solutions into their operational frameworks to drive productivity, ensure regulatory compliance, and meet evolving market expectations. This report sets the stage for understanding these critical dynamics and their implications for decision-makers throughout the animal feed value chain.

Transformative Market Dynamics and Technological Advancements Reshaping the Animal Feed Probiotics Landscape for Future Growth

The landscape of animal feed probiotics has undergone significant shifts propelled by technological advancements, scientific discoveries, and shifting stakeholder priorities. Firstly, precision fermentation techniques have enabled the development of next-generation probiotic strains with enhanced stability and targeted efficacy, thereby expanding the scope of application from conventional poultry and swine diets to specialized aquaculture and ruminant formulations.

Moreover, artificial intelligence-driven strain selection and predictive modeling are streamlining R&D processes, facilitating the rapid identification of microbial candidates that deliver consistent performance under diverse environmental conditions. Alongside these innovations, strategic collaborations between feed producers and biotech firms are reshaping supply chains, ushering in vertically integrated models that reduce time-to-market and bolster quality assurance. Collectively, these transformative trends are redefining competitive benchmarks, elevating the standard for efficacy, and laying the groundwork for sustained expansion in the probiotics segment.

Evaluating the Complex Cumulative Impact of 2025 United States Tariffs on Probiotic Ingredient Supply Chains and Cost Structures

In 2025, the United States introduced a series of tariff adjustments targeting key probiotic raw materials imported for animal feed applications. These measures have generated ripple effects throughout the supply chain, compelling feed manufacturers to reassess procurement strategies and cost structures. Initially, elevated import duties on select probiotic ingredients have increased landed costs, prompting formulators to explore alternative sourcing from domestic biotech producers.

Furthermore, the cumulative effect of tariff realignments has intensified negotiations between suppliers and distributors, as stakeholders seek to mitigate margin compression without compromising product quality. In response, some feed mills have engaged in forward-contracting arrangements to lock in pricing, while others have invested in localized production capacity to circumvent import dependencies. As a result, the evolving tariff landscape is driving strategic recalibrations that underline the importance of supply chain agility and diversified ingredient portfolios within the probiotics industry.

Comprehensive Segmentation Insights Revealing Animal Type Strain Form Application and Distribution Channel Dynamics in Probiotics Feed Market

Examining the market through the lens of multiple segmentation criteria reveals nuanced opportunities and challenges that vary by animal category, microbial strain, product form, application modality, and distribution pathway. When considering animal type, the market spans from aquaculture-encompassing fish, shrimp, and mollusks-to companion animals such as cats and dogs, as well as conventional livestock including poultry, swine, and ruminants. Each segment exhibits distinct performance drivers, with ruminant formulations focusing on fiber-degrading strains for dairy and beef cattle and poultry diets prioritizing pathogen inhibition and growth promotion.

Strain selection further delineates market potential, as probiotic providers leverage Bacillus, Bifidobacterium, Enterococcus, Lactobacillus, and Saccharomyces species to address species-specific gut ecology requirements. Within these genera, targeted variants like L. acidophilus for monogastric animals and B. subtilis for broad-spectrum resilience underscore the importance of precision in strain deployment. Meanwhile, the choice between granule, liquid, or powder formulations-each available in specialized sub-forms such as emulsions, suspensions, freeze-dried, or spray-dried formats-enables tailored integration into feed pellets, mash, premixes fortified with minerals or vitamins, and water-based delivery systems. Distribution channels similarly impact market access, with direct sales, feed mill partnerships, and digital commerce platforms offering distinct value propositions based on scale, service level, and regional reach.

This comprehensive research report categorizes the Probiotics in Animal Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Strain

- Form

- Product Form

- Application

Critical Regional Insights Highlighting Differentiated Demand Patterns and Growth Drivers Across Americas EMEA and Asia-Pacific Markets

Geographically, the Americas continue to exhibit robust uptake of probiotic solutions, driven by stringent antibiotic reduction policies and progressive sustainability frameworks in the United States, Canada, and Brazil. In contrast, the Europe, Middle East & Africa region balances rigorous regulatory oversight with increasing investments in precision feed technologies, catalyzing growth opportunities across dairy herds in Germany and poultry producers in the GCC nations.

Shifting focus to Asia-Pacific, rapid intensification of aquaculture operations in China, Vietnam, and India-coupled with rising consumer demand for protein-has accelerated probiotic adoption to manage disease risk and enhance feed conversion ratios. Likewise, emerging markets in Southeast Asia are leveraging regional production hubs to develop cost-effective, locally tailored probiotic blends. Taken together, these regional trends underscore the importance of contextualizing market strategies based on policy environment, production scale, and regional innovation ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Probiotics in Animal Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Player Profiles and Strategic Initiatives Driving Competitive Advantage in the Global Animal Feed Probiotics Market

The competitive landscape features a mix of established life science corporations and agile biotech innovators, each pursuing distinct strategic initiatives to capture market share. Leading players are emphasizing product differentiation through the development of proprietary strains, investing in clinical trials to substantiate health claims, and expanding manufacturing footprints to ensure supply stability.

Additionally, partnerships and joint ventures between feed ingredient specialists and genomic research firms are emerging as pivotal to accessing novel microbial solutions. Simultaneously, contract manufacturing organizations are forming alliances with probiotic developers to optimize production scalability and regulatory compliance. This multifaceted competitive dynamic underscores the significance of strategic positioning, collaborative innovation, and operational excellence as brands vie for differentiation in an increasingly sophisticated animal feed probiotics market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Probiotics in Animal Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Agri Ltd.

- Adisseo France SAS

- Alltech, Inc.

- Archer-Daniels-Midland Company

- Asahi Group Holdings, Ltd.

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- DuPont de Nemours, Inc.

- Elanco Animal Health

- Evonik Industries AG

- Kemin Industries, Inc.

- Kerry Group PLC

- Koninklijke DSM N.V.

- Lallemand Inc.

- Novozymes

- Nutreco N.V.

- Ohly GmbH

- Olmix Group

- Perdue Farms Inc.

- Phibro Animal Health Corporation

- Phileo by Lesaffre

- Provita Eurotech Limited

- Purina Mills, LLC

- VETANCO S.A.

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Probiotic Trends and Navigate Market Complexities Effectively

To capitalize on evolving market dynamics, industry leaders should prioritize strategic investments in proprietary strain development and validation studies that demonstrate clear performance outcomes. By fostering collaborative research partnerships with academic institutions and leveraging digital tools for in-field monitoring, organizations can enhance product credibility and drive greater adoption among end-users.

Moreover, diversifying supply chains to include domestic production and alternative raw material sources will bolster resilience against tariff volatility and logistical disruptions. At the same time, embracing omnichannel distribution strategies-integrating direct sales efforts with feed mill collaborations and targeted digital outreach-will enable more effective market penetration. By adopting these actionable recommendations, stakeholders can position themselves at the forefront of innovation while safeguarding operational continuity and maximizing long-term value creation.

Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation to Ensure Market Intelligence Accuracy

This research employs a robust methodology combining primary interviews with feed formulators, probiotic manufacturers, and subject matter experts, alongside extensive secondary data analysis of peer-reviewed publications and industry reports. Qualitative insights were validated through cross-referenced commentary from regional distributors and end-user surveys, ensuring comprehensive coverage of market perspectives.

Quantitative data points were triangulated using multiple independent sources to minimize bias and reinforce the integrity of findings. Additionally, proprietary analytics tools were utilized to track strain performance metrics and distribution channel activity over time. Collectively, these methodological pillars underpin the accuracy and reliability of our market intelligence, providing stakeholders with a clear, evidence-driven foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Probiotics in Animal Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Probiotics in Animal Feed Market, by Animal Type

- Probiotics in Animal Feed Market, by Strain

- Probiotics in Animal Feed Market, by Form

- Probiotics in Animal Feed Market, by Product Form

- Probiotics in Animal Feed Market, by Application

- Probiotics in Animal Feed Market, by Region

- Probiotics in Animal Feed Market, by Group

- Probiotics in Animal Feed Market, by Country

- United States Probiotics in Animal Feed Market

- China Probiotics in Animal Feed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Conclusive Insights Underscoring the Strategic Imperatives and Future Outlook for Probiotics in Animal Feed Across Diverse Market Segments

In summary, probiotics have established themselves as pivotal components in modern animal feed strategies, offering sustainable solutions to enhance animal health and productivity. The convergence of technological breakthroughs, regulatory shifts, and evolving consumer expectations has created an environment ripe for continued innovation and expansion across all animal segments.

Looking ahead, the industry’s ability to navigate tariff landscapes, optimize strain efficacy, and address regional market nuances will define competitive success. By synthesizing comprehensive segmentation insights, regional analyses, and strategic recommendations, this executive summary provides a cohesive blueprint for stakeholders seeking to harness the transformative potential of probiotics in animal nutrition.

Engage Directly with Ketan Rohom to Access Tailored Animal Feed Probiotics Research and Strategic Market Intelligence

We invite industry stakeholders to engage directly with Ketan Rohom, the Associate Director of Sales & Marketing, to explore tailored market research solutions that align with your strategic objectives. His expertise in the animal feed probiotics sector ensures that you receive personalized guidance on leveraging our comprehensive data to make informed business decisions.

By connecting with Ketan Rohom, you will gain early access to in-depth insights, specialized trend analyses, and customized advisory services designed to support your organization’s growth ambitions. Secure your competitive advantage today by partnering with an expert who understands the nuances of probiotics in animal feed.

- How big is the Probiotics in Animal Feed Market?

- What is the Probiotics in Animal Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?