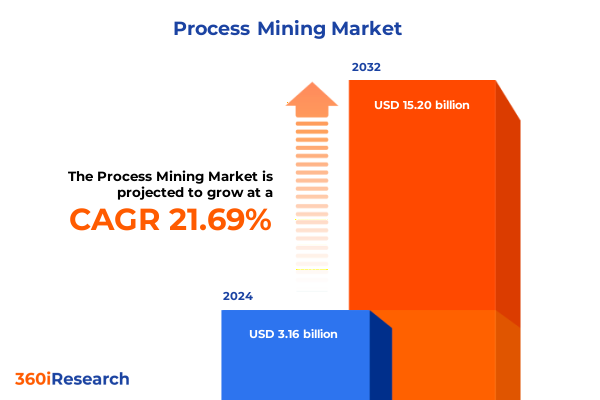

The Process Mining Market size was estimated at USD 3.82 billion in 2025 and expected to reach USD 4.64 billion in 2026, at a CAGR of 21.77% to reach USD 15.20 billion by 2032.

Unveiling the Transformative Power of Process Mining: Driving Operational Visibility, Efficiency, and Compliance Across Modern Enterprises

Process mining has rapidly emerged as a critical discipline for organizations seeking to unlock the hidden value within operational data. By applying advanced algorithms to event logs, enterprises gain unprecedented visibility into every facet of their end-to-end processes. This visibility empowers executives to pinpoint inefficiencies, ensure regulatory compliance, and drive continuous improvement across the value chain. As market complexity grows, process mining offers a systematic approach to deciphering the real behavior of business processes rather than relying on assumptions or manual audits.

This executive summary sets the stage for a holistic exploration of how process mining is reshaping operational paradigms. We begin with an overview of the core principles and emerging trends that define the technology’s transformative potential. Next, we delve into pivotal shifts occurring within the landscape, followed by an assessment of external factors, including trade policies, that influence adoption and deployment. Subsequently, we examine key segmentation insights that reveal where demand is strongest and uncover regional and vendor-specific dynamics. Finally, we present actionable recommendations and a concise conclusion that reinforces the strategic imperatives for leaders looking to harness process mining as a catalyst for sustainable competitive advantage.

Identifying Key Catalysts Reshaping the Process Mining Landscape: From AI-Driven Insights to Integration Ecosystems Revolutionizing Operational Excellence

The process mining landscape is witnessing a convergence of technological, organizational, and regulatory catalysts that are redefining how enterprises optimize workflows and manage risks. On the technological front, the infusion of artificial intelligence and machine learning is elevating process mining from descriptive analytics toward predictive and prescriptive capabilities. This shift enables organizations to not only identify bottlenecks but also anticipate deviations and recommend remedial actions before issues materialize. Concurrently, cloud-native architectures are accelerating deployment cycles and lowering barriers to entry for organizations of all sizes, making real-time process transparency more accessible than ever.

From an organizational perspective, leaders are increasingly adopting a data-centric culture, driving cross-functional collaboration and embedding analytics into decision-making processes. These cultural shifts are often supported by executive sponsorship and dedicated centers of excellence focused on process intelligence. Meanwhile, regulatory scrutiny around data governance and compliance continues to intensify, compelling businesses to adopt transparent, auditable process mining solutions to satisfy stringent reporting mandates. Altogether, these transformative shifts illustrate a landscape in which process mining is no longer a niche capability but a foundational component of enterprise digital strategy.

Analyzing the Multifaceted Impact of U.S. Tariffs in 2025 on Process Mining Adoption, Technology Procurement, and Cross-Border Data Exchange Dynamics

The imposition of new United States tariffs in 2025 has introduced a layer of complexity for enterprises evaluating process mining solutions and related services. Heightened duties on imported hardware and specialized software components have prompted organizations to reassess sourcing strategies for critical infrastructure, such as on-premises servers and proprietary analytics engines. As a result, some enterprises are accelerating their migration to cloud-based process mining platforms, which offer subscription-based models that mitigate upfront capital expenditure and tariff exposure.

However, tariffs also influence the total cost of ownership for professional services engagements, particularly where offshore labor and imported consulting tools are involved. Service providers have responded by adjusting their pricing structures and establishing regional delivery centers to absorb additional duties. Furthermore, cross-border data exchange has become more expensive, compelling organizations to optimize data residency and compliance architectures. In parallel, vendors are exploring localized partnerships to maintain cost competitiveness and reduce supply chain risks. Ultimately, the cumulative impact of these trade measures underscores the importance of flexible deployment strategies and diversified vendor ecosystems in navigating the evolving tariff environment.

Deep Dive into Component, Deployment Model, Organization Size, and Vertical Segmentation Insights Uncovering Diverse Drivers Influencing Process Mining Strategies

A nuanced understanding of market segmentation is essential for stakeholders seeking to align process mining investments with organizational priorities. When considering components, it becomes clear that managed services and professional services coexist with software offerings in driving adoption. Within professional services, a spectrum of consulting and advisory engagements delivers strategic roadmaps, while implementation and integration experts ensure seamless connectivity with existing enterprise resource planning and customer relationship management systems. Support and maintenance functions then sustain performance over time. Meanwhile, software solutions range from conformance checking modules that validate process adherence to discovery engines that reconstruct end-to-end workflows and enhancement tools that identify improvement opportunities.

Deployment models introduce another layer of differentiation, as cloud-based platforms leverage platform-as-a-service and software-as-a-service frameworks to deliver scalability and rapid adoption. Conversely, on-premises deployments utilize licensed or subscription models to provide organizations with direct control over data and infrastructure. Organizational size further shapes purchasing patterns: Fortune 500 companies harness process mining at scale, often through integrated enterprise-wide initiatives, while medium and small enterprises deploy targeted use cases that address specific pain points, such as invoice processing or customer onboarding. Industry verticals also inform solution design and rollout strategies. Financial institutions, including banking, capital markets, and insurance firms, prioritize compliance and auditability. Healthcare providers, biotech firms, and pharmaceutical companies emphasize patient safety and regulatory adherence. IT services, software vendors, and telecommunications operators focus on digital transformation and network optimization. Manufacturers in discrete and process environments seek defect reduction and throughput enhancement. Finally, consumer goods and retail organizations concentrate on supply chain visibility and customer experience improvements.

This comprehensive research report categorizes the Process Mining market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Industry Vertical

Navigating Regional Nuances in Process Mining: Unpacking Opportunities and Challenges Across the Americas, EMEA, and Asia-Pacific Economic Hubs

Regional dynamics play a pivotal role in shaping how organizations embrace process mining, with each economic zone presenting distinct opportunities and constraints. Across the Americas, the emphasis on operational efficiency and regulatory compliance drives robust demand for both cloud and on-premises solutions. Mature markets such as the United States and Canada tend to lead innovation, while Latin American enterprises demonstrate growing interest in managed services to compensate for limited in-house analytics capabilities.

In Europe, the Middle East, and Africa, stringent data protection regulations, including the General Data Protection Regulation, have elevated the importance of auditability and data sovereignty, steering enterprises toward platforms that offer granular access controls and local data centers. Collaboration between public sector entities and private organizations further accelerates adoption in compliance-driven verticals. Meanwhile, Asia-Pacific markets exhibit a varied landscape; developed economies like Japan and Australia invest heavily in advanced analytics, whereas emerging markets in Southeast Asia and South Asia leverage cloud-first strategies to overcome infrastructure limitations. Together, these regional insights highlight the need for solution providers to tailor deployment models, compliance features, and service offerings to the unique regulatory and technological maturity levels of each region.

This comprehensive research report examines key regions that drive the evolution of the Process Mining market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Process Mining Providers and Service Innovators: Strategic Differentiators and Competitive Positioning Shaping the Market

Leading vendors in the process mining ecosystem distinguish themselves through differentiated product capabilities, service portfolios, and strategic alliances. Established software providers emphasize platform extensibility, integrating process mining modules within broader analytics and business intelligence suites to deliver cohesive user experiences. Conversely, pure-play process mining companies focus on refining event log ingestion, algorithmic innovation, and domain-specific accelerators to expedite time to value.

Service organizations have also emerged as critical enablers, offering end-to-end engagements that combine strategic advisory, technical implementation, and ongoing optimization. Partnerships between technology vendors and global consulting firms are increasingly common, resulting in bundled propositions that streamline procurement and governance. Additionally, open-source initiatives and community-driven frameworks provide cost-effective alternatives for organizations with advanced in-house capabilities, fostering competitive pressure on commercial offerings and driving continuous improvement across the vendor landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Process Mining market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABBYY USA Software House, Inc.

- Appian Corporation

- Apromore Pty Ltd

- Celonis SE

- Cyclone Robotics

- International Business Machines Corporation

- Kofax, Inc.

- MEHRWERK GmbH

- Microsoft Corporation

- mindzie, inc.

- Minit s.r.o.

- Pegasystems Inc.

- QPR Software Oy

- SAP SE

- Shanghai EntropyHub Technology Co., Ltd. (Proxverse)

- Skan, Inc.

- Smart Process S.A. (UpFlux Process Mining)

- Software AG

- StereoLOGIC Ltd.

- UiPath Inc.

Actionable Strategic Imperatives for Industry Leaders to Harness Process Mining for Operational Agility, Cost Efficiency, and Sustained Competitive Advantage

For industry leaders aiming to capitalize on process mining, a clear strategic roadmap is essential. Begin by securing executive sponsorship and defining measurable objectives that align with broader digital transformation goals. Conduct a pilot in a high-impact operational area, such as order-to-cash or procure-to-pay, to establish proof of value and build organizational momentum. As you scale, invest in upskilling internal teams, establishing centers of excellence, and nurturing cross-functional collaboration between process owners, IT, and analytics specialists.

It is also advisable to adopt a hybrid deployment approach that combines cloud-native agility with on-premises control where required for compliance. Engage with multiple vendors to encourage competitive pricing and secure best-in-class capabilities. Maintain a focus on data governance, ensuring robust data quality and lineage to support reliable analytics. Finally, embed process mining insights within continuous improvement frameworks, leveraging iterative cycles of monitoring, analysis, and optimization to sustain momentum and drive long-term operational excellence.

Comprehensive Research Methodology Employed for Process Mining Analysis Incorporating Qualitative Interviews, Quantitative Surveys, and Data Triangulation Techniques

The research underpinning this analysis was conducted through a multi-dimensional methodology designed to ensure depth and rigor. Primary data collection involved structured interviews with C-level executives, process owners, and IT leaders to capture qualitative insights into strategic drivers, adoption barriers, and value realization patterns. Complementing this, quantitative surveys were administered across a diverse sample of organizations spanning multiple industries and geographies, enabling statistical validation of key trends and preferences.

Secondary research encompassed the systematic review of academic publications, industry whitepapers, regulatory filings, and vendor technical documentation. Data triangulation techniques were applied to reconcile divergent viewpoints and enhance reliability. All information was cross-verified with subject matter experts and market practitioners to identify emerging best practices and ensure the analysis reflects current realities. Finally, the report underwent multiple rounds of peer review to uphold stringent quality standards and maintain an impartial perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Process Mining market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Process Mining Market, by Component

- Process Mining Market, by Deployment Mode

- Process Mining Market, by Organization Size

- Process Mining Market, by Industry Vertical

- Process Mining Market, by Region

- Process Mining Market, by Group

- Process Mining Market, by Country

- United States Process Mining Market

- China Process Mining Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Strategic Implications: Concluding Reflections on Process Mining’s Role in Driving Enterprise Transformation

The convergence of advanced analytics, evolving regulatory landscapes, and strategic imperatives has elevated process mining from a niche capability to a cornerstone of enterprise transformation. Organizations that embrace its diagnostic, predictive, and prescriptive potential stand to gain not only in operational efficiency but also in risk mitigation and competitive differentiation. The insights presented throughout this summary underscore the importance of a holistic approach-one that integrates technology, talent, and governance-to realize the full promise of process mining.

As the market continues to mature, leaders must remain vigilant of emerging trends, including deeper AI integration, extended process intelligence platforms, and evolving compliance requirements. By applying the recommendations outlined herein and leveraging the segmentation and regional insights provided, decision-makers can chart a clear path toward data-driven excellence and secure a sustainable advantage in an increasingly dynamic business environment.

Secure Your Customized Process Mining Market Intelligence Report Today by Engaging with Ketan Rohom to Empower Data-Driven Decision Making

To access unrivaled insights and tailored analysis that can transform your organization’s operational intelligence, contact Ketan Rohom, Associate Director of Sales & Marketing, to procure the comprehensive market intelligence report on process mining. Engaging directly with Ketan ensures you receive a customized package aligned with your strategic objectives, complete with expert briefings and premium support that will accelerate your data-driven transformation journey.

Reach out to Ketan today to secure your authoritative guide to process mining innovation and position your enterprise at the forefront of process excellence.

- How big is the Process Mining Market?

- What is the Process Mining Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?