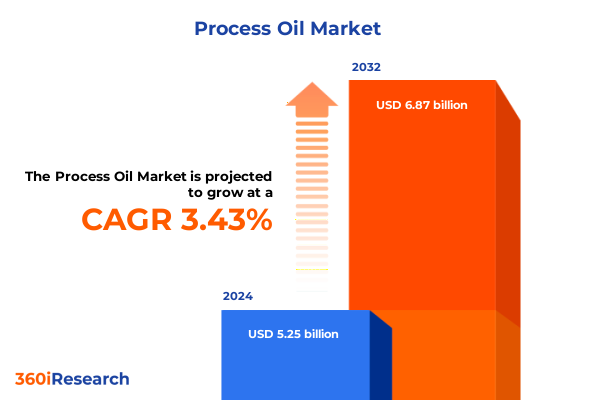

The Process Oil Market size was estimated at USD 5.06 billion in 2025 and expected to reach USD 5.35 billion in 2026, at a CAGR of 6.13% to reach USD 7.67 billion by 2032.

Unveiling the Crucial Role of Process Oils in Modern Industrial Operations and the Key Drivers Propelling Their Rapidly Expanding Market Dynamics

Process oils serve as the lifeblood of numerous industrial operations, providing essential functions that range from lubrication and heat dissipation to formulation enhancements and material processing. As foundational components in industries such as metalworking, rubber manufacturing, hydraulic systems, and electrical utilities, these oils contribute significantly to operational efficiency, equipment longevity, and overall productivity. Recent years have seen an intensified focus on optimizing process oil performance characteristics, driven by rising maintenance costs, stricter environmental regulations, and the growing demand for high-purity formulations. Consequently, stakeholders across supply chains-from base oil producers to end-users-are recalibrating their strategies to balance cost-effectiveness with evolving regulatory and performance requirements.

Moreover, the process oil landscape is being reshaped by converging trends such as sustainability mandates, technological advancements in formulation science, and the integration of digital monitoring tools. These shifts are creating both challenges and opportunities; manufacturers are investing in research and development to introduce bio-based alternatives and tailor-made blends, while buyers are increasingly prioritizing suppliers who can deliver consistent quality and regulatory compliance. As we embark on an in-depth exploration of transformative shifts, tariff impacts, segmentation dynamics, and regional behaviors, this introduction sets the stage for a comprehensive understanding of how process oils underpin industrial progress and why strategic positioning in this market is more critical than ever.

Navigating Transformative Shifts in the Process Oil Landscape Driven by Technological Advancements, Sustainability Imperatives, and Evolving Regulatory Frameworks

In recent years, the process oil sector has undergone transformative changes propelled by breakthroughs in formulation technologies, heightened environmental scrutiny, and shifting end-user demands. Advancements in additive packages and molecular engineering techniques have enabled manufacturers to develop process oils with targeted thermal stability, improved viscosity profiles, and enhanced oxidative resistance. Simultaneously, the global push toward circular economy principles is steering the industry toward renewable feedstocks and rigorous lifecycle assessments, prompting a wave of product innovations in bio-based and synthetic oils.

Alongside technological innovation, regulatory landscapes are evolving with greater stringency on emissions, waste handling, and chemical disclosures. These policy shifts are compelling companies to adapt their supply chains, invest in cleaner production processes, and seek certifications that validate environmental performance. At the same time, digitalization tools-from predictive maintenance algorithms to real-time viscosity monitoring sensors-are being integrated into process oil applications, empowering operators to optimize usage patterns and reduce unplanned downtime. Consequently, the interplay between innovation, regulation, and digital transformation is redefining competitive baselines, creating a dynamic environment where agility and sustainability are paramount.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Process Oil Supply Chains, Pricing Structures, and Competitive Positioning in Domestic Markets

The introduction of new United States tariffs on select process oil grades in 2025 has triggered ripple effects throughout global supply chains, affecting procurement costs, supplier negotiations, and market competition. By imposing an additional levy on imported base oils and specialty blends, these measures have prompted domestic buyers to reevaluate sourcing strategies, intensify negotiations with local producers, and explore alternative feedstocks. In turn, suppliers have responded by adjusting price lists, exploring tariff mitigation through free trade agreements, and diversifying into adjacent markets to offset volume fluctuations.

As tariffs reshape cost structures, downstream industries-such as automotive component manufacturing and rubber compounding-are encountering shifts in operating expenses and raw material availability. To mitigate these disruptions, many organizations are forging strategic partnerships with regional base oil producers or investing in on-site blending facilities to enhance supply stability. Furthermore, the changing tariff landscape has incentivized a more robust analysis of total landed cost, encompassing factors such as transportation, duties, and inventory carrying expenses. Ultimately, the 2025 tariff adjustments have catalyzed a more resilient and cost-conscious ecosystem, compelling stakeholders to innovate in procurement, logistics, and formulation strategies.

Deciphering Key Market Segmentation Insights Through Application, Product Type, Viscosity Grade, and Source Dimensions to Illuminate Growth Opportunities

Analyzing process oil market segmentation across application, product type, viscosity grade, and source reveals nuanced insights into end-user priorities and formulation requirements. In terms of application, hydraulic oil stands out for its performance in both closed and open circuit systems, demanding high film strength and thermal stability, while metalworking fluids address the needs of cutting fluids-divided into high speed and low speed categories-as well as drawing oils, grinding fluids, and milling oils. Rubber processing encompasses both industrial rubber manufacturing and tire compounding, each segment pressing suppliers for tailor-made oil blends that optimize extrusion and vulcanization processes. Transformer oils, whether mineral or vegetable derived, underscore the critical balance between dielectric properties and oxidation resistance in power distribution equipment.

Turning to product type, the market spans bright stock-available in additive treated and untreated variants-for use in high-viscosity applications, complemented by clarified sludge oil, extracted oil, and slurry oil, each chosen for specific cost-performance trade-offs. Viscosity grade segmentation further refines selection, with options like 1000 SUS and 150 SUS serving heavy-duty lubrication needs, and 500 SUS formulations tailored for operations where high temperature stability and standard temperature performance are critical. Finally, source-based categorization differentiates bio-based oils sourced from animal fat and vegetable oil from conventional mineral oils, as well as advanced synthetics such as ester-based products and polyalphaolefin oils, the latter of which are distinguished by high-performance and standard-performance grades. This multi-dimensional segmentation framework equips suppliers and end-users with the precision needed to match oil characteristics to application demands, driving both operational efficiency and product innovation.

This comprehensive research report categorizes the Process Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Function

- Viscosity Grade

- Application

- End-Use Industry

- Sales Channel

Uncovering Strategic Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Process Oil Market Hotspots

A regional perspective on the process oil market highlights divergent growth trajectories and strategic imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, robust investment in automotive and construction sectors underpins steady demand for hydraulic and metalworking oils, while the shale revolution continues to support growth in onshore lubrication and process fluids. Meanwhile, companies are leveraging regional trade agreements to optimize cross-border supply chains and mitigate tariff-related cost pressures.

Within Europe Middle East & Africa, stringent environmental standards and decarbonization targets are driving the adoption of bio-based and synthetic oil alternatives, prompting suppliers to secure certifications and invest in research centers to stay ahead of regulatory curves. In parallel, the Middle East’s petrochemical infrastructure and Africa’s industrialization initiatives present opportunities for capacity expansion and joint ventures in both feedstock production and oil blending.

Turning to the Asia-Pacific region, rapid industrialization in emerging markets and a booming automotive aftermarket segment are fueling demand for high-performance process oils. Manufacturers in this region are increasingly focused on localizing production to reduce lead times, while international players are forging alliances with regional distributors to broaden market access. Collectively, these regional dynamics underscore the importance of tailored strategies that align product development, supply chain configurations, and regulatory compliance with distinct market drivers.

This comprehensive research report examines key regions that drive the evolution of the Process Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Process Oil Industry Players and Revealing Their Strategic Initiatives, Partnerships, and Innovation Trajectories Shaping Market Outcomes

Leading process oil producers are advancing diverse strategic initiatives to capture market share, enhance product portfolios, and fortify supply chain resilience. Major integrated energy companies are leveraging their upstream feedstock capabilities to secure cost-advantaged base oils, while specialty chemical firms are investing in advanced additive chemistries to differentiate performance characteristics. Collaboration between multinational corporations and regional blending facilities is becoming increasingly prevalent, enabling customized formulations that address localized demand patterns and regulatory requirements.

In parallel, several key players have established global research hubs focused on next-generation formulations-encompassing bio-based, low-viscosity, and ultra-high-temperature-resistant oils-to meet evolving end-user specifications. Strategic partnerships with equipment OEMs are also on the rise, facilitating co-development of application-specific fluid solutions and integrated monitoring systems. Moreover, mergers and acquisitions activity underscores an industry-wide emphasis on portfolio diversification, with companies seeking to broaden their reach into complementary segments such as specialty lubricants and functional fluids. By closely monitoring competitor moves, collaboration trends, and innovation pipelines, market participants can anticipate shifts in bargaining power and pinpoint opportunities for strategic differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Process Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Exxon Mobil Corporation

- Shell PLC

- Sinopec Group

- Nynas AB

- Chevron Corporation

- TotalEnergies SE

- PetroChina Company Limited

- Repsol, S.A.

- Idemitsu Kosan Co., Ltd.

- Phillips 66 Company

- Adinath Chemicals

- Apar Industries Limited

- Behran Oil Company

- Cross Oil

- EaglePetrochem.com, Inc.

- Eni Deutschland GmbH

- Ergon Inc.

- Farabi Petrochemicals Company

- GP Petroleums Ltd.

- H&R Group

- Hindustan Petroleum Corporation Limited

- Iranol

- Japan Sun Oil Company, Ltd.

- Lodha Chem

- ORLEN Unipetrol Slovakia s.r.o.

- Panama Petrochem Ltd.

- PJSC LUKOIL

- Shree Sai Chemicals

- Taurus Petroleums Pvt. Ltd.

- Vinayak Oil

- Witmans Industries Pvt. Ltd.

Crafting Actionable Strategic Recommendations for Industry Leaders to Navigate Market Volatility, Drive Innovation, and Capitalize on Emerging Trends

Industry leaders can proactively navigate market volatility by first aligning innovation investments with end-user performance priorities and sustainability goals. By fostering cross-functional collaboration between R&D and supply chain teams, organizations can accelerate the development of bio-based and synthetic blends that comply with tightening regulatory frameworks while delivering superior operational efficiencies. Concurrently, companies should expand collaboration with digital technology providers to integrate real-time monitoring and predictive analytics into service offerings, thereby strengthening customer value propositions and fostering long-term partnerships.

To mitigate tariff-related pressures, it is essential to establish diversified sourcing networks that incorporate both domestic and global suppliers, leveraging strategic trade agreements and onshore blending capabilities. Additionally, firms should pursue targeted mergers or alliances to unlock scale economies in raw material procurement and distribution. Equally important is the cultivation of agile pricing models that reflect total delivered cost considerations, enabling transparent dialogue with end-users and reinforcing trust. Ultimately, by embracing a holistic approach that unites sustainability, digitalization, and strategic supply chain management, industry leaders can secure competitive advantage and drive resilient, profitable growth.

Detailing a Rigorous Multi-Stage Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Validation Protocols

The research methodology underpinning this analysis integrates rigorous primary and secondary data collection processes to ensure reliability and depth. Primary research was conducted through comprehensive interviews with industry stakeholders, including process oil producers, equipment OEMs, regulatory bodies, and end-user organizations, facilitating first-hand insights into market dynamics, regulatory drivers, and technological adoption patterns. Secondary research encompassed a thorough review of public filings, technical whitepapers, patent databases, and trade association publications, augmented by analysis of regulatory frameworks and sustainability standards across key regions.

Quantitative data was validated via cross-comparison of manufacturer disclosures, industry association statistics, and proprietary databases, employing both top-down and bottom-up approaches to confirm consistency and identify anomalous trends. Qualitative insights were further enriched through expert panel workshops, enabling scenario modeling and stress-testing of tariff impact hypotheses. This multi-stage methodology ensures a comprehensive, triangulated perspective on process oil market evolution, offering stakeholders a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Process Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Process Oil Market, by Product Type

- Process Oil Market, by Source

- Process Oil Market, by Function

- Process Oil Market, by Viscosity Grade

- Process Oil Market, by Application

- Process Oil Market, by End-Use Industry

- Process Oil Market, by Sales Channel

- Process Oil Market, by Region

- Process Oil Market, by Group

- Process Oil Market, by Country

- United States Process Oil Market

- China Process Oil Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Drawing Strategic Conclusions on Process Oil Market Dynamics to Guide Future Investment, Operational Excellence, and Long-Term Competitive Success

This executive summary synthesizes the critical drivers, regional behaviors, and competitive strategies shaping the process oil market, underscoring the sector’s dynamic interplay between technical innovation, regulatory compliance, and economic pressures. As tariffs, sustainability imperatives, and digital transformations continue to influence supply chain configurations and end-user preferences, stakeholders must adopt integrated, data-driven approaches to maintain operational resilience and market relevance.

By leveraging granular segmentation insights across applications, product types, viscosity grades, and sources, alongside targeted regional strategies, organizations can identify high-opportunity niches and optimize resource allocation. Strategic partnerships, coupled with investment in advanced formulation technologies and digital analytics, will serve as catalysts for performance differentiation and long-term growth. In summary, a proactive, holistic strategy that aligns innovation, sustainability, and agile supply chain management will be essential for market leaders seeking to capitalize on emerging opportunities and mitigate evolving risks in the global process oil landscape.

Engage with Ketan Rohom to Unlock Comprehensive Process Oil Market Insights and Propel Informed Decision-Making with a Customized Research Report Offering

To access the full market research report and benefit from deep-dive analysis, detailed segmentation insights, and actionable strategies, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the report’s structure, customization options, and pricing details, ensuring you receive a solution tailored to your strategic objectives. This collaboration will empower your organization to harness critical intelligence on process oil market dynamics, regulatory impacts, and emerging opportunities across all major regions. Engage today to secure competitive advantage and drive sustainable growth in your process oil initiatives.

- How big is the Process Oil Market?

- What is the Process Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?