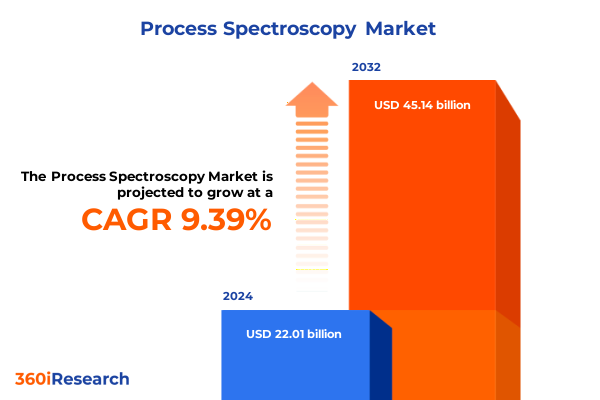

The Process Spectroscopy Market size was estimated at USD 23.96 billion in 2025 and expected to reach USD 26.09 billion in 2026, at a CAGR of 9.46% to reach USD 45.14 billion by 2032.

Exploring the Impact of Process Spectroscopy on Quality Control Precision and Throughput Optimization in Manufacturing and Process Industries

The burgeoning importance of process spectroscopy in modern industries reflects a paradigm shift toward data-driven quality control and real-time decision making. From petroleum refineries to pharmaceutical manufacturing sites, the ability to continuously monitor chemical compositions and detect trace impurities has evolved into an operational imperative. Companies can now capture spectral information at multiple stages of production, transforming previously reactive quality checks into proactive control strategies that enhance throughput and reduce waste.

In this context, process spectroscopy has transcended its traditional laboratory confines, emerging as a core pillar in digital transformation initiatives. By integrating spectroscopic sensors with advanced analytics platforms, organizations unlock new levels of transparency across their operations. This seamless flow of high-frequency data supports predictive maintenance, tighter regulatory compliance, and rapid identification of deviations, all of which contribute to significant cost efficiencies.

As pressure mounts to meet stringent environmental standards and satisfy sustainability mandates, spectroscopy techniques such as near infrared and ultraviolet-visible analysis offer noninvasive, solvent-free surveillance. These approaches minimize hazards while delivering precise insights into molecular structures. With artificial intelligence and machine learning algorithms maturing, the next frontier lies in harnessing complex spectral datasets to forecast product quality, optimize resource utilization, and enable closed-loop control systems that redefine how industrial processes are orchestrated.

Uncovering the Revolutionary Shifts in Process Spectroscopy Technology That Are Redefining Industrial Analytics and Enabling Predictive Operational Control

Recent innovations in optical hardware, cloud-native analytics, and miniaturized sensor technologies are rapidly expanding the boundaries of process spectroscopy. Spectrometer designs now integrate novel detector materials, enabling broader spectral ranges and heightened sensitivity to trace-level analytes. At the same time, modular analyzer systems are becoming more compact and rugged, widening their applicability to field and remote installations where traditional laboratory instruments were impractical.

Underpinning these hardware advancements are transformative leaps in software intelligence. Smarter calibration assistance tools and real-time remote monitoring platforms are empowering users to adapt spectral models on the fly, accommodating raw material variations and process drift without extensive manual intervention. These capabilities reduce downtime and expedite deployment, fostering agile, just-in-time quality management.

Simultaneously, emerging analytical paradigms such as multivariate curve resolution and chemometric modeling are unlocking deeper interpretive layers of spectroscopic data. By correlating spectral signatures with key performance attributes, organizations can predict product efficacy, shelf life, or hazardous byproduct formation before issues arise. The convergence of atomic, molecular, and mass-based approaches further enriches the analytical toolkit, granting unprecedented visibility into elemental composition and molecular fingerprinting. This fusion of cross-technology insights is reshaping how engineers design, monitor, and optimize complex chemical and biological processes.

Assessing the Comprehensive Effects of United States Tariff Policies on Process Spectroscopy Suppliers, Supply Chains, and Pricing Structures in 2025

The implementation of elevated tariffs on spectroscopic equipment and ancillary components by the United States in early 2025 has introduced new cost and supply chain considerations for manufacturers and end users alike. Components imported from key global suppliers now carry additional duties, compelling organizations to reassess sourcing strategies and negotiate more aggressively on total landed cost. These added import charges reverberate across the value chain, influencing capital budgeting decisions and elongating procurement cycles.

Faced with this environment, equipment providers have reevaluated their production footprints, with some accelerating nearshoring efforts to mitigate tariff impacts and maintain competitive pricing. Others have pursued strategic partnerships with domestic component vendors to localize critical subsystems, thus circumventing cross-border duties. This shift toward a hybrid global–local supply network not only addresses immediate economic pressures but also enhances supply resilience against future policy changes.

At the user level, calibration services and consumables that rely on tariff-impacted imports have witnessed incremental cost increases. Maintenance contracts now account for potential duty fluctuations, incorporating dynamic pricing clauses to balance risk. Overall, the tariff regime has catalyzed a more diversified supplier ecosystem, where long-term value is assessed not solely by unit pricing but by the robustness of delivery commitments, technical support infrastructure, and the flexibility to adapt to evolving trade regulations.

Deriving Strategic Intelligence from Component, Technology, Functional Usage, and End-User Segmentation to Guide Spectroscopy Adoption and Custom Solutions

A closer look at market segmentation reveals critical levers shaping buyer behavior and technology adoption. When examining the component breakdown, end users demonstrate a growing preference for integrated hardware suites that blend analyzers, detectors, and spectrometers into unified platforms. To complement these instruments, comprehensive services offerings encompass installation and maintenance, technical support, and training and consulting engagements that ensure rapid system uptime and extend lifecycle performance. Meanwhile, software layers dedicated to calibration assistance and remote monitoring are increasingly valued for their ability to deliver continuous data quality assurance and enable centralized oversight of distributed assets.

Equally consequential is the choice of technology type. Atomic spectroscopy retains its appeal for trace elemental analysis, especially in applications where regulatory traceability is paramount. Molecular spectroscopy solutions, spanning Fourier-transform infrared, near infrared, nuclear magnetic resonance, Raman, and ultraviolet-visible techniques, each carve distinct niches-from rapid moisture quantification to structural elucidation of organic compounds. Mass spectroscopy continues to consolidate its role in high-resolution, untargeted profiling of complex mixtures, addressing research and quality assurance mandates with unparalleled specificity.

Functional usage further delineates opportunity spaces. Inspection and monitoring functions prioritize rapid spectral acquisition and minimal sample preparation, often driving demand for portable or in-line analyzer configurations. Quality assurance workflows hinge on high reproducibility and validated methods to satisfy accreditation requirements, favoring robust, certified instrumentation. Conversely, research and development applications exploit the full analytical breadth of mass and molecular platforms, leveraging advanced data processing to unravel novel chemistries and accelerate product innovation.

Finally, end-user domains such as academics and research laboratories underscore the importance of specialized modules for biomedical investigations and material science exploration. Chemical and petrochemical plants focus on composition identification, hydrocarbon analysis, and pollutant detection under stringent safety protocols. Environmental testing facilities require versatile spectroscopic approaches for air quality monitoring, soil analysis, and water quality assessment, each demanding different spectral regimes and sensitivity thresholds. The food and beverage industry balances nutritional analysis, quality assurance, and spoilage detection in high-throughput production yards, while pharmaceutical and biotechnology firms leverage drug development, formulation analysis, and protein characterization to drive regulatory approvals and pipeline expansion.

This comprehensive research report categorizes the Process Spectroscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Functional Usage

- End-User

Highlighting Regional Variations in Process Spectroscopy Demand, Regulatory Drivers, and Operational Priorities across the Americas, EMEA, and Asia-Pacific Domains

Regional dynamics shape process spectroscopy adoption in distinctive ways, reflecting variations in regulatory frameworks, industrial maturity, and investment ecosystems. In the Americas, a combination of stringent environmental mandates and robust petrochemical infrastructure has driven widespread adoption of inline analyzers for continuous process monitoring. North American refineries and food production facilities have integrated near infrared and ultraviolet-visible modules into their control loops, while Latin American mining operations prioritize ruggedized spectrometers that can withstand extreme field conditions.

Within Europe, Middle East, and Africa, regulatory drivers such as the European Union’s REACH guidelines and air quality standards have elevated the role of molecular and atomic spectroscopy in compliance testing. Advanced manufacturing hubs in Germany and the Nordics are pioneering digital twin frameworks that rely on high-fidelity spectral data to optimize energy consumption. Simultaneously, Middle Eastern chemical complexes and African agro-processing ventures are investing in portable Raman and handheld near infrared devices to support localized quality inspection and drive supply chain transparency.

Asia-Pacific presents a tapestry of adoption scenarios. In Japan and South Korea, semiconductor fabrication and pharmaceutical R&D heavily rely on mass spectroscopy and nuclear magnetic resonance platforms to meet the highest purity benchmarks. Chinese industrial conglomerates continue expanding capacity for petrochemical and battery manufacturing, embedding inline spectroscopy for real-time analytics. Meanwhile, Australia’s mining sector leverages Raman and Fourier-transform infrared tools for mineral identification, and India’s fast-growing biotechnology industry is integrating remote monitoring software to connect distributed research sites under centralized oversight.

This comprehensive research report examines key regions that drive the evolution of the Process Spectroscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Dynamics and Innovation Trajectories of Leading Process Spectroscopy Providers to Unveil Growth Strategies and Collaborative Ecosystems

The competitive landscape of process spectroscopy features established instrument manufacturers alongside emerging analytics software providers and service specialists. Leading hardware vendors are intensifying R&D investments to deliver next-generation spectrometers with higher throughput and broader spectral coverage. These incumbents leverage long-standing customer relationships to bundle hardware with proprietary calibration and maintenance services, reinforcing switching costs and deepening technical collaboration.

Concurrently, agile software firms are carving out niche positions by offering cloud-enabled platforms that aggregate spectral data across multiple sites. Their solutions emphasize ease of integration with enterprise resource planning and distributed control systems, enabling centralized oversight of compliance reporting and performance benchmarking. By partnering with hardware makers, these software firms extend instrument lifecycles and unlock recurring revenue streams through subscription models.

In the service domain, specialized consultancies provide custom method development, regulatory auditing, and advanced chemometric modeling. They differentiate by embedding automation capabilities into spectral workflows, reducing manual interpretation and accelerating time to actionable insights. This trend has spurred alliances between service providers and instrument OEMs, creating comprehensive solutions that span from system installation and operator training to ongoing remote support.

Strategic partnerships and acquisitions are also reshaping market dynamics. Hardware leaders are acquiring analytics startups to bolster their software portfolios, while cloud-native disruptors are joining with application-specific instrument integrators to deliver turnkey, industry-focused spectroscopy solutions. These collaborations underscore a broader movement toward integrated ecosystems where hardware, software, and services converge to address the full lifecycle needs of spectroscopic applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Process Spectroscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Analytik Jena GmbH + Co. KG

- Anton Paar GmbH

- Avantes BV

- Bruker Corporation

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Hitachi High‑Tech Corporation

- Hitachi, Ltd.

- IRsweep Holding

- JEOL Ltd.

- Kaiser Optical Systems, Inc.

- Kett Electric Laboratory, Inc.

- Malvern Panalytical Ltd.

- Metrohm AG

- MKS Instruments, Inc.

- Sartorius AG

- Schneider Electric SE

- Siemens AG

- Teledyne Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Timegate Instruments, Ltd.

- VIAVI Solutions Inc.

- WITec GmbH

- Yokogawa Electric Corporation

Empowering Industry Leaders with Targeted Strategies and Tactical Roadmaps to Capitalize on Spectroscopy Innovations and Enhance Operational Resilience

Industry leaders can accelerate their spectroscopy initiatives by prioritizing modular architectures that allow seamless upgrades of analyzers, detectors, and spectrometers as technologies evolve. By adopting open data standards and interoperable software frameworks, organizations avoid vendor lock-in and facilitate cross-platform analytics, enhancing operational agility and future-proofing their investments. This approach also enables integration of calibration assistance and remote monitoring modules, ensuring continuous alignment between spectral models and real-world process variations.

To strengthen supply chain resilience in the wake of tariff fluctuations, companies should cultivate a diversified supplier base that includes both domestic and international partners. Negotiating long-term service agreements with adjustable terms can mitigate duty risks while securing rapid response support. Embedding predictive maintenance algorithms within technical support contracts will further reduce unplanned downtime, transforming service engagements into value-generating assets rather than cost centers.

Developing internal competency in chemometric modeling and multivariate analysis is equally vital. Training and consulting services should be aligned with specific use cases-whether in-line moisture content analysis, pollutant detection in emissions, or protein structure elucidation-allowing organizations to leverage spectroscopy data for strategic decision making. Establishing center-of-excellence teams that bridge operations, quality, and R&D functions will foster cross-disciplinary collaboration and accelerate innovation cycles.

Finally, executives should explore collaborative research arrangements with academic institutions and specialized service providers to co-develop application-tailored methodologies. These partnerships can yield custom spectral libraries and validated analytical protocols, creating competitive differentiation and expediting regulatory approvals.

Outlining Rigorous Qualitative and Quantitative Approaches Underpinning Comprehensive Process Spectroscopy Market Analysis to Ensure Data Integrity

Our research methodology combines in-depth primary interviews with engineers, quality managers, and procurement leaders across key end users, including petrochemical, pharmaceutical, food and beverage, and environmental testing sectors. These qualitative engagements uncover firsthand insights into technology selection criteria, service expectations, and regional adoption barriers. To complement these perspectives, we conduct extensive secondary research, analyzing technical whitepapers, industrial standards frameworks, and regulatory guidelines to map the evolving compliance landscape.

Quantitative data is gathered through structured surveys and market activity tracking, focusing on equipment deployment rates, software subscription uptake, and service contract volumes across the Americas, EMEA, and Asia-Pacific. Advanced data triangulation techniques reconcile self-reported insights with supplier shipment statistics and trade databases, ensuring balanced representation and minimizing potential bias from individual sources.

We apply rigorous validation protocols, cross-referencing information from multiple stakeholders and auditing findings against publicly available disclosures and relevant patent filings. Chemometric modeling approaches underpin our technology assessments, enabling objective comparison of spectroscopic methods based on sensitivity, speed, and application scope. The combined qualitative and quantitative analysis is synthesized into comprehensive segmentation matrices, illuminating where component, technology, functional, and end-user categories intersect to shape market demand.

This multi-layered methodological framework ensures our insights are grounded in empirical evidence and reflect the nuanced realities of process spectroscopy adoption, delivering reliable guidance for strategic planning and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Process Spectroscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Process Spectroscopy Market, by Component

- Process Spectroscopy Market, by Technology Type

- Process Spectroscopy Market, by Functional Usage

- Process Spectroscopy Market, by End-User

- Process Spectroscopy Market, by Region

- Process Spectroscopy Market, by Group

- Process Spectroscopy Market, by Country

- United States Process Spectroscopy Market

- China Process Spectroscopy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Key Insights and Strategic Implications of Current Process Spectroscopy Trends to Equip Decision-Makers for Future Industry Challenges

By synthesizing the transformative shifts in hardware, software, and service paradigms with the real-world implications of evolving trade policies, this executive summary paints a comprehensive picture of the current process spectroscopy landscape. Segmentation analysis clarifies how component choices, technology types, and functional applications converge to meet the unique demands of different end-user domains, from academia to heavy industry.

Regional insights further highlight that no single strategy fits all markets; leaders must tailor their approaches to local regulatory pressures, infrastructure maturity, and supply chain conditions. Meanwhile, competitive intelligence underscores the growing importance of integrated ecosystems in which hardware innovators, software developers, and service specialists collaborate to deliver turnkey solutions.

Actionable recommendations emphasize the need for modular architectures, supplier diversification, and in-house analytics capability building. These imperatives, combined with targeted partnerships and shared research initiatives, position organizations to harness spectroscopy innovations for enhanced quality, efficiency, and compliance.

As process spectroscopy continues to mature, decision-makers will increasingly rely on data-driven methodologies and cross-disciplinary expertise. By leveraging the insights and strategic imperatives outlined here, stakeholders can navigate industry headwinds, capitalize on emerging opportunities, and sustainably scale their spectroscopy investments to address future challenges.

Connect with Ketan Rohom to Secure Exclusive Insights and Drive Growth through Comprehensive Process Spectroscopy Market Intelligence Purchase

To explore exclusive insights and detailed strategic guidance on process spectroscopy, reach out to Ketan Rohom for direct consultation and to secure the full research report. As Associate Director of Sales & Marketing, he can arrange tailored demonstrations of how the findings apply to your unique operational needs and help you identify the most impactful technologies and partnerships.

Engaging with Ketan ensures you obtain prioritized access to in-depth analysis of market drivers, segmentation dynamics, regional trends, and competitive landscapes. His expertise in translating complex data into actionable roadmaps will empower your organization to leverage process spectroscopy for enhanced quality control, operational resiliency, and innovation acceleration.

Contact Ketan to discuss licensing options, enterprise access, or customized research add-ons that align with your strategic objectives. His guidance will enable you to turn insights into decisive strategies, securing your advantage in an evolving industry environment.

- How big is the Process Spectroscopy Market?

- What is the Process Spectroscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?