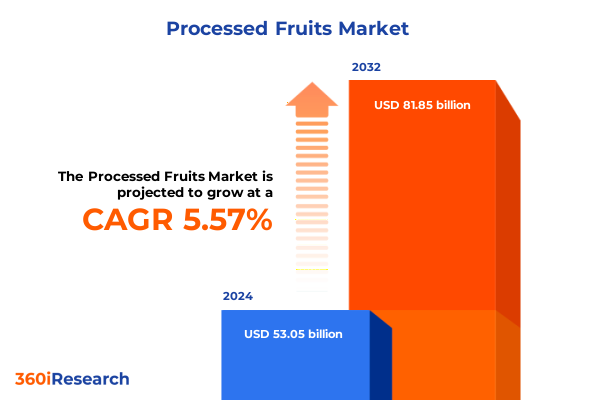

The Processed Fruits Market size was estimated at USD 56.04 billion in 2025 and expected to reach USD 59.27 billion in 2026, at a CAGR of 5.56% to reach USD 81.85 billion by 2032.

Unveiling the critical landscape of processed fruits industry dynamics driven by evolving consumer appetites and global supply chain complexities

The processed fruits industry operates at the intersection of consumer demand for convenience, nutritional preferences, and technological advances in food preservation. Over recent years, evolving lifestyles have driven a growing appetite for ready-to-use fruit products that deliver both flavor and functionality. This trend has been reinforced by heightened interest in health and wellness, prompting manufacturers to innovate across textures, formats, and ingredient profiles. In addition, climate variability and global supply chain complexities have challenged traditional sourcing models, compelling companies to adopt more agile procurement strategies. As a result, the sector is witnessing a dynamic realignment of production priorities.

In parallel, regulatory frameworks have grown more stringent in response to food safety concerns and environmental sustainability goals. Producers are increasingly tasked with ensuring traceability from farm to fork, while simultaneously reducing carbon footprints and water usage. This regulatory momentum is reshaping formulation processes, driving the adoption of natural preservation techniques and cleaner label solutions. Consequently, industry participants are investing in advanced processing equipment and digital monitoring systems to maintain quality and compliance.

Looking ahead, these converging forces-consumer-driven innovation, supply chain resilience initiatives, and regulatory pressures-form the bedrock of the processed fruits market. By understanding the interplay of these elements, stakeholders can better navigate emerging opportunities and anticipate potential risks. This introduction sets the stage for a comprehensive exploration of transformative shifts, tariff impacts, segmentation nuances, regional dynamics, leading companies, actionable recommendations, and methodology.

Exploring transformative shifts redefining processed fruit sector through innovation sustainability integration and digital enablement across supply chains

The processed fruits sector has reached an inflection point where innovation, sustainability, and digital transformation are converging to redefine market boundaries. On the innovation front, manufacturers are leveraging novel extraction methods and enzyme treatments to enhance flavor retention and nutritional integrity. At the same time, sustainability has become a core pillar of strategic roadmaps. Companies are exploring circular economy approaches by repurposing byproducts, reducing food waste, and securing eco-friendly packaging alternatives. These initiatives not only address consumer expectations but also align with corporate social responsibility commitments.

Digital enablement is further accelerating this transformation. Advanced analytics and the Internet of Things are empowering real-time monitoring of processing lines, enabling predictive maintenance and minimizing downtime. Blockchain technology is gaining traction as a tool for enhancing transparency and traceability, reassuring both regulators and end-users about product provenance. Moreover, e-commerce platforms and direct-to-consumer models are reshaping distribution strategies, offering brands new avenues to connect with niche segments and curate personalized offerings.

Together, these paradigm shifts are erasing traditional boundaries between raw produce and value-added products. They are fostering horizontal collaborations among technology providers, agricultural cooperatives, and brand owners. As the industry evolves, leaders must embrace an integrated approach to innovation, weaving together technological advances, sustainability imperatives, and customer-centric strategies to capture growth in this rapidly changing landscape.

Assessing the cumulative impact of United States tariff measures in 2025 on processed fruits trade flows supply resilience and pricing structures

Throughout 2025, the imposition of new and elevated tariffs by the United States has introduced significant challenges for the processed fruits trade. In early April, a baseline 10% duty on all imports came into effect, fluctuating by country under a dynamic tiered structure that placed as much as a 34% levy on Chinese products and a 20% rate on EU-origin shipments. Within months, targeted tariffs further disrupted key supply corridors: a 50% duty on Brazilian citrus products was scheduled for August 1, driving forecasts of tightened orange juice sourcing given that Brazil supplies over 40% of U.S. imports.

These cumulative measures have elevated landed costs for multiple processed fruit categories, from concentrated apple and grape juices to dried berries and essential fruit oils. In particular, Chinese apple juice concentrate, which accounts for roughly two-thirds of U.S. market needs, saw input prices surge under a combined 34% tariff, incentivizing buyers to explore alternative origins or reformulate blends to maintain competitive pricing. Concurrently, the sudden reintroduction of out-of-quota tariffs on nuts and berries increased raw material expenses, prompting manufacturers to reassess long-term supply agreements.

Moreover, the tariff environment has heightened supply chain volatility. Importers initially absorbed incremental duties to protect downstream relationships; however, increased logistical complexity and inflationary pressures are now cascading to distribution partners and retail channels, eroding margin stability. In response, several companies have accelerated nearshoring initiatives and diversified procurement portfolios, seeking to balance cost mitigation against reliability. As the policy landscape continues to evolve, stakeholders are closely monitoring legal challenges and bilateral negotiations that could recalibrate duties further.

Decoding segmentation insights revealing how product portfolios packaging formats channels and end user preferences shape the processed fruits market dynamics

A nuanced understanding of market segmentation is imperative to navigate the processed fruits landscape effectively. When examining the market through product type lenses, canned fruits continue to anchor mainstream consumption, offering affordability and shelf stability, while frozen fruits are gaining traction for smoothie bases and premium snacking formats. Dried fruits benefit from the wellness wave, with on-the-go appeal, and jams and jellies maintain relevance through both traditional breakfast applications and innovative dessert pairings. Meanwhile, purees and concentrates underpin beverage and bakery formulations, and sauces and compotes deliver artisanal textures that cater to upscale culinary trends.

Packaging type considerations reveal that traditional formats such as glass jars and metal cans remain integral for their recyclability and tamper-evident properties. However, pouches are rapidly capturing mindshare, prized for their lightweight, flexible structure and reduced carbon footprint in transportation. Plastic containers persist as a cost-efficient option for bulk and retail-ready offerings, and cartons are emerging in niche segments that value renewable fiber content and easy recyclability.

Distribution channel insights underscore the resilience of supermarkets and hypermarkets as primary outlets, bolstered by widespread distribution networks. Online retail is making significant inroads, leveraging convenience and direct engagement with health-conscious consumers. Convenience stores deliver impulse-driven sales through smaller pack sizes, and foodservice operators, spanning quick service and full-service establishments, consistently integrate processed fruit components into menu innovations. This multifaceted segmentation matrix provides a strategic compass, allowing stakeholders to tailor product development, distribution, and marketing tactics to the most dynamic and profitable subsectors.

This comprehensive research report categorizes the Processed Fruits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Distribution Channel

- End User

Recognizing key regional insights illustrating diverse processed fruits market drivers and strategic opportunities across Americas EMEA and Asia Pacific geographies

Regional dynamics underscore the heterogeneity of the processed fruits sector across global markets. In the Americas, robust agricultural output in North and South America underpins a steady supply of raw fruit, particularly citrus in Brazil and berries in the United States. Proximity to production zones confers logistical advantages, yet domestic players are also adapting to rising transportation costs and labor constraints in field operations. Regulatory alignment under trade agreements, such as USMCA, continues to facilitate cross-border flows of processed fruit ingredients, but recent tariff escalations have injected uncertainty into procurement strategies.

Across Europe, the Middle East, and Africa, consumer preferences are leaning towards clean label and organic-certified processed fruit products. European regulatory frameworks emphasize nutrition labeling and environmental stewardship, driving investments in eco-friendly processing technologies. Meanwhile, burgeoning demand in the Middle Eastern and North African regions is fueled by rising disposable incomes and evolving dietary habits. However, fragmented distribution infrastructures often necessitate tailored approaches, balancing centralized production with localized repackaging to meet unique market requirements.

In the Asia-Pacific realm, rapid urbanization and digital commerce penetration are catalyzing growth for processed fruit offerings. Markets such as China, India, Japan, and Southeast Asia display divergent consumption patterns: China’s appetite for fruit juice concentrates remains high, driven by beverage giants, while India shows a growing taste for fruit preserves and compotes in premium retail segments. The region grapples with logistical bottlenecks and variable refrigeration infrastructure, compelling manufacturers to optimize shelf-stable formats and invest in cold chain enhancements. These region-specific forces shape differentiated trajectories and strategic imperatives for stakeholders operating across these diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Processed Fruits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies shaping the processed fruits domain through strategic collaborations product innovations and operational excellence initiatives

Key industry players are actively shaping the processed fruits ecosystem through strategic partnerships, innovative product portfolios, and operational excellence initiatives. Some organizations are forging alliances with agricultural cooperatives to secure year-round fruit supplies while minimizing exposure to seasonal volatility. Others are entering joint ventures with technology firms to deploy advanced processing equipment that improves yield and reduces energy consumption. Product innovation remains a central focus, with several leading manufacturers introducing fruit-based ingredients designed for high-protein snacks, plant-based dairy alternatives, and functional beverages.

Furthermore, sustainability commitments are influencing capital allocations and corporate strategies. Major companies are pledging to reduce greenhouse gas emissions, adopt renewable energy sources in their processing facilities, and transition to post-consumer recycled materials in packaging. At the same time, efficiency gains are being realized through streamlined logistics and performance management systems, which enhance throughput while preserving fruit quality. The emphasis on end-to-end traceability is driving investments in digital platforms that integrate farm-level data with real-time processing metrics, ensuring transparency for both business partners and consumers.

These coordinated efforts among top-tier participants are intensifying competitive dynamics and raising the bar for new entrants. As leading entities continue to refine their value propositions, mid-size and emerging firms are leveraging niche positioning in areas such as organic offerings, exotic fruit blends, and customized ingredient solutions. Collectively, these diverse initiatives are defining the competitive landscape and setting the stage for the next wave of market evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Processed Fruits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrana Group

- Alfa Laval

- B&G Foods

- Bonduelle

- Brothers International Food Holdings, LLC

- Chiquita Brands International

- Conagra Brands

- Dole Food Company

- Fresh Del Monte Produce

- General Mills

- Greenyard

- JBT Corporation

- Mondelez International

- Nestlé S.A.

- Olam International

- PepsiCo

- SunOpta

- SVZ International B.V.

- The Kraft Heinz Company

- Tyson Foods

Formulating actionable recommendations for industry leaders to optimize operational resilience innovation portfolios and strategic partnerships in processed fruits

To thrive in the increasingly complex processed fruits environment, industry leaders must pursue multi-dimensional strategies that balance innovation with operational resilience. First, investing in agile supply networks will enable rapid responses to tariff fluctuations and climate-driven harvest variances. By diversifying sourcing portfolios and cultivating relationships across multiple geographies, organizations can mitigate concentration risks and secure consistent raw material flows.

Second, embedding sustainability into core processes enhances brand reputation and meets escalating regulatory requirements. Companies should explore circular economy models, such as repurposing fruit byproducts for nutraceutical applications, to maximize resource efficiency. Simultaneously, adopting renewable energy solutions within processing operations can lower carbon footprints and yield long-term cost savings.

Third, embracing digital transformation across the value chain is non-negotiable. Advanced analytics can optimize yield and quality control, while blockchain-enabled traceability offers proof of provenance. Digital commerce channels also provide direct access to end users, facilitating personalized offerings and consumer feedback loops that drive iterative product enhancements.

Finally, fostering cross-sector partnerships-linking ingredient suppliers with technology providers, logistics specialists, and foodservice operators-can unlock new market openings and accelerate time to market. By orchestrating these collaborative networks, companies can co-create novel solutions, share risks, and capitalize on collective expertise. This holistic approach will be critical for sustaining competitive advantage and capturing growth in the evolving processed fruits landscape.

Detailing rigorous research methodology underpinning the processed fruits market analysis through data triangulation expert insights and multi source validation

This analysis rests on a robust research methodology designed to deliver comprehensive and reliable insights into the processed fruits market. Primary inputs were gathered through in-depth interviews with senior executives representing leading fruit processors, agricultural cooperatives, packaging innovators, and supply chain specialists. These discussions provided first-hand perspectives on operational challenges, innovation priorities, and future strategic imperatives.

Complementing the primary research, extensive secondary data collection involved reviewing industry journals, regulatory filings, and corporate sustainability reports. Publicly available trade data and export-import records were analyzed to contextualize tariff impacts and trade flow variations. Proprietary databases and technology vendor whitepapers offered granular details on processing equipment adoption, packaging breakthroughs, and digital solution benchmarks.

To ensure accuracy and consistency, the research employed data triangulation techniques, cross-validating findings from multiple sources. Quantitative insights were corroborated against qualitative feedback, while regional experts vetted assumptions related to logistics, regulatory frameworks, and consumer preferences. The final outputs underwent rigorous peer review by internal analysts specializing in the agriculture and food processing sectors, guaranteeing methodological integrity and relevance.

This systematic approach ensures that the resulting analysis is both actionable and aligned with the realities of stakeholders across the processed fruits value chain, offering a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Processed Fruits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Processed Fruits Market, by Product Type

- Processed Fruits Market, by Packaging Type

- Processed Fruits Market, by Distribution Channel

- Processed Fruits Market, by End User

- Processed Fruits Market, by Region

- Processed Fruits Market, by Group

- Processed Fruits Market, by Country

- United States Processed Fruits Market

- China Processed Fruits Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing compelling conclusions on the processed fruits market trajectory emphasizing critical factors driving evolution and competitive positioning strategies

In conclusion, the processed fruits industry is navigating a period of profound transformation driven by consumer demands for healthful convenience, sustainability mandates, and a shifting trade policy landscape. The integration of advanced technologies, from precision processing to digital traceability, is reshaping operational models and enabling manufacturers to deliver differentiated products with enhanced nutritional profiles and minimized environmental impact.

Simultaneously, the 2025 tariff measures have introduced new cost pressures and sourcing complexities, underscoring the importance of diversified supply strategies and agile procurement frameworks. As regional dynamics continue to diverge, with each geography presenting unique logistical and regulatory contexts, stakeholders must tailor their approaches to align with market-specific drivers and consumer preferences.

Successful navigation of this evolving landscape requires an orchestrated focus on innovation, sustainability, and strategic partnerships. Leading companies that invest in efficient processing technologies, sustainable sourcing, and digital integration will be best positioned to capture emerging opportunities and maintain competitive advantage. Moreover, mid-size and niche players can thrive by leveraging specialized product portfolios and agile business models that address under-served segments.

Overall, the convergence of these factors is heralding a new era for processed fruits, where resilience and adaptability will define market leadership. By aligning strategic priorities with industry shifts, stakeholders can unlock value and drive sustainable growth across the global processed fruits sector.

Engaging with Ketan Rohom for a personalized consultation to unlock deep processed fruits market intelligence and acquire the comprehensive industry report

Ready to elevate your strategic understanding of the processed fruits landscape and gain unparalleled market intelligence insights? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to schedule a personalized consultation. By connecting with Ketan, you can explore tailored solutions that address your organization’s unique needs and unlock the comprehensive market research report. Engage with his expertise in market trends, competitive dynamics, and actionable recommendations that will empower your decisions. Don’t miss this opportunity to leverage deep analysis and drive growth in the rapidly evolving processed fruits industry. Contact Ketan today to secure your copy of the full report and take the next step toward informed strategic planning and sustainable success

- How big is the Processed Fruits Market?

- What is the Processed Fruits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?