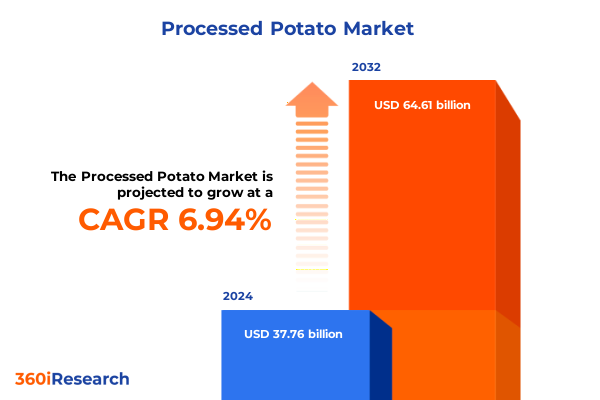

The Processed Potato Market size was estimated at USD 40.37 billion in 2025 and expected to reach USD 42.88 billion in 2026, at a CAGR of 6.95% to reach USD 64.61 billion by 2032.

Unlocking the Power of Potatoes: Unveiling the Processed Potato Market’s Evolution Consumer Drivers And Strategic Imperatives Shaping Future Growth

The processed potato market is undergoing a period of unprecedented transformation, driven by shifting consumer preferences and evolving supply chain dynamics. With rising demand for convenience-driven meal solutions, industry stakeholders are investing heavily in innovations that cater to health-conscious and time-pressed consumers. From the resurgence of air-fried fries to premium chilled offerings, new product formats are redefining perceptions of processed potatoes and expanding the category’s appeal beyond traditional fast-food channels.

In parallel, the sector is grappling with external pressures including climatic variability, logistical bottlenecks, and fluctuating raw material costs. These challenges have prompted manufacturers to adopt more agile sourcing strategies and integrate advanced throughput technologies in processing facilities. As value chain optimization takes center stage, collaboration among growers, processors, distributors, and retailers is becoming increasingly essential to ensure consistent quality, reduce waste, and maintain margin resiliency.

Against this backdrop of opportunity and complexity, this executive summary provides a foundational overview of key market dynamics, structural shifts, and actionable insights. It sets the stage for a deeper exploration of tariff impacts, segmentation nuances, regional trajectories, competitive benchmarks, and strategic recommendations aimed at guiding decision-makers through an evolving landscape.

How Technological Advancements Health Trends And Sustainability Practices Are Transforming The Processed Potato Industry

The processed potato industry is experiencing transformative shifts as health and sustainability converge with technological innovation to redefine product standards and consumer expectations. Nutrient-retention processing techniques, such as steam-based blanching and low-temperature dehydration, are gaining traction, enabling brands to position their offerings as wholesome alternatives without compromising on convenience or taste. Meanwhile, plant-based and gluten-free formulations continue to diversify product portfolios, attracting niche cohorts with specific dietary requirements.

On the supply chain front, digitalization is accelerating end-to-end visibility and traceability. Blockchain platforms and IoT-enabled sensors are being deployed to monitor crop conditions, track lot movements, and optimize inventory management. This level of transparency boosts consumer trust and enhances recall efficiency, while predictive analytics drive proactive decision-making for procurement, production scheduling, and demand forecasting.

Sustainability also emerges as a central pillar, with circular economy practices taking root at multiple nodes of the value chain. Processors are repurposing peel and pulp residuals for animal feed, biogas generation, or high-value fiber extracts, thereby reducing waste and unlocking new revenue streams. These combined shifts underscore a new era in the processed potato market, characterized by resilient, responsible, and consumer-centric models that promise sustained growth.

Assessing The Cumulative Impact Of The 2025 United States Tariff Adjustments On Processed Potato Supply Chains And Pricing Dynamics

In 2025, recent tariff adjustments imposed by the United States government have introduced a new layer of complexity for both importers and domestic producers of processed potatoes. By varying duties across product categories, policymakers aim to safeguard local agriculture while balancing consumer access to competitively priced goods. These tariff measures, while intended to protect growers, have had cascading effects on raw material procurement costs, production economics, and retail pricing strategies.

Importers of dehydrated flakes and powdered formulations have faced higher landed costs, prompting many to explore alternative sourcing from regions with preferential trade agreements or lower production overheads. This shift has fostered new alliances between U.S. distributors and overseas producers in Latin America and Europe, albeit at the expense of extended lead times and logistics expenses. Concurrently, domestic processors cultivating chilled and frozen formats have benefitted from reduced competition in specific niches, enabling them to reclaim shelf space and negotiate stronger terms with major retail chains.

However, the uneven application of tariff rates across product types has introduced distortions in supply chain negotiations. Stakeholders are increasingly leveraging tariff classification expertise and advanced duty-drawback mechanisms to mitigate incremental cost burdens. As these adaptive strategies become more sophisticated, market participants able to navigate the tariff landscape with agility are securing a competitive edge.

Exploring The Distinct Trajectories Of Chilled Dehydrated And Frozen Processed Potato Segments Across End Market Applications

Diving into the nuances of product segmentation reveals distinct growth trajectories across chilled, dehydrated, and frozen processed potatoes. Chilled offerings, anchored by premium chilled fries, are resonating with on-the-go consumers seeking fresh-tasting solutions and minimal preparation time. This segment is drawing innovation in packaging formats designed for convenience and extended shelf life, catering to both home cooks and food service operators aiming to reduce kitchen labor.

In the dehydrated realm, flakes, granules, and powder are experiencing a resurgence as formulators leverage these versatile ingredients for applications ranging from soups and sauces to snack coatings. Enhanced functionality in rehydration performance and clean-label positioning have propelled private-label and specialty snack manufacturers to incorporate dehydrated potatoes into value-added products.

Frozen formats encompassing crinkle cut, classic fries, sticks, and wedges continue to dominate quick-service and retail channels, fueled by consistent quality and ease of preparation. Crinkle cuts are capturing share among premium casual dining establishments, while wedges are increasingly spotlighted in menu innovation at institutional canteens. Across distribution channels like convenience stores, online retail platforms, and supermarket and hypermarket chains, consumers are gravitating toward formats that seamlessly integrate with both at-home entertaining and digital fulfillment models.

The bifurcation between food service and retail applications further underscores divergent purchasing behaviors. Quick service restaurants prioritize high-throughput frozen solutions with standardized yield metrics, institutional canteens demand bulk chilled or frozen formats optimized for batch cooking, and retail shoppers exhibit growing preference for portion-controlled chilled and gourmet dehydrated offerings that align with home meal kits.

This comprehensive research report categorizes the Processed Potato market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

Unveiling Regional Demand Patterns And Strategic Imperatives In The Americas Europe Middle East Africa And Asia Pacific Markets

Regional insights illuminate divergent demand patterns and strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific landscapes. In the Americas, robust consumption of classic frozen fries is driving capacity expansions among established processors, while cold-chain investments are facilitating growth in chilled offerings. Shifts toward healthier snacking and indulgent comfort foods coalesce to create a dynamic environment for new product development, particularly within premium casual dining and retail meal solutions.

The Europe, Middle East & Africa region presents a mosaic of regulatory environments and culinary traditions. Western Europe is leading in sustainability certifications and clean-label dehydrated formats, with processors collaborating on cross-border supply frameworks. In contrast, the Middle East is prioritizing frozen and chilled imports to meet rapid urbanization demands, while African markets are emerging as both production hubs and nascent consumer bases where cost competitiveness and shelf stability are paramount.

Across Asia-Pacific, rising disposable incomes and evolving eating habits are catalyzing demand for convenient frozen snacks and chilled ready meals. Government initiatives targeting agricultural modernization are enhancing yield consistency, supporting processors in countries such as China and India to scale up dehydrated and frozen proposition capacities. Simultaneously, e-commerce proliferation is reshaping distribution paradigms, amplifying the importance of rapid fulfillment and localized inventory strategies.

This comprehensive research report examines key regions that drive the evolution of the Processed Potato market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Leading Processed Potato Manufacturers Are Leveraging Innovation Sustainability And Strategic Partnerships To Secure Market Leadership

Key players in the processed potato ecosystem are steering innovation, capacity, and sustainability agendas to fortify market leadership. Global icon McCain Foods has intensified its investment in carbon-neutral processing facilities, pioneering water-reduction technologies and bioenergy integration to minimize environmental footprint. Its focus on product diversification, especially in chilled solutions and specialty dehydrated ingredients, is broadening its appeal across retail and food service segments.

Lamb Weston continues to build on its frozen-crinkle-cut heritage by expanding global footprint through strategic acquisitions and joint ventures. The company’s advanced logistics platforms and proprietary yield-optimization software enable consistent performance across varying end-use scenarios. Meanwhile, J.R. Simplot Company is leveraging its upstream farming capabilities to introduce high-amylose potato varieties, enhancing textural attributes and functional performance for both dehydrated and frozen formats.

Regional champions such as Agristo in Europe are capitalizing on traceability and origin-specific propositions to meet growing demand for clean-label dehydrated products. In the Asia-Pacific arena, local manufacturers are partnering with technology providers to deploy modular processing units that optimize throughput and reduce capital intensity. Collectively, these companies are redefining competitive benchmarks through agile manufacturing, targeted R&D, and sustainability-driven value chain integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Processed Potato market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agristo NV

- Albert Fisher Group

- Alexia Foods

- Ardo N.V.

- Aviko B.V.

- Bart's Potato Company

- Bonduelle Group

- Cascadian Farm Organic

- Cavendish Farms

- Farm Frites International B.V.

- Findus Group

- Green Giant

- Greenyard NV

- Himalaya Food International Ltd.

- Iglo Group

- J.R. Simplot Company

- Lamb Weston Holdings Inc.

- McCain Foods Limited

- Nature's Promise

- Nomad Foods Limited

- Picard Surgelés

- Pinguin Lutosa

- The Kraft Heinz Company

- Trader Joe's Company

- Waitrose Limited

Driving Growth By Integrating Advanced Analytics Product Innovation And Sustainability To Navigate Supply Chain Complexities

Industry leaders should prioritize a strategic balance between product innovation and operational agility to thrive in the evolving landscape. By embedding advanced analytics into supply chain management, organizations can anticipate raw material cost fluctuations, optimize logistics, and align production schedules with real-time demand signals. This foresight-driven approach will be critical for mitigating risks associated with tariff volatility and climatic disruptions.

In parallel, crafting differentiated value propositions through functional and indulgent attributes will foster stronger consumer loyalty. Harnessing consumer insights to develop nutrient-retentive chilled formats and versatile dehydrated solutions can unlock new categories and premium positioning opportunities. Additionally, deepening collaborations with food service operators and e-commerce platforms can accelerate market penetration and drive incremental volume through co-branded offerings and digital promotions.

Sustainability must also be elevated from a compliance checkbox to a core value driver. Implementing circular economy initiatives that repurpose byproducts and reduce water and energy usage will generate cost savings and resonate with environmentally conscious consumers. Leaders who integrate sustainability metrics into executive performance targets and supplier scorecards will reinforce accountability and enhance brand equity in a rapidly evolving regulatory environment.

Delivering Robust Insights Through Comprehensive Primary Interviews Secondary Data Analysis And Advanced Scenario Modeling Techniques

This analysis synthesizes qualitative and quantitative inputs gathered through a rigorous multi-stage research framework. Primary research included in-depth interviews with senior executives across the value chain-spanning growers, processors, distributors, and key food service operators. These discussions provided firsthand perspectives on operational challenges, investment priorities, and innovation pipelines.

Secondary research encompassed a thorough review of industry publications, peer-reviewed journals, government trade filings, and financial disclosures. Trade data on tariff classifications, import-export flows, and commodity price indices were examined to assess the impact of the 2025 United States duties on processed potato economics. Complementary datasets on consumer dietary trends, packaging innovations, and sustainability benchmarks were integrated to contextualize product segmentation and regional performance.

Analytical techniques included scenario modeling of tariff cost pass-through, comparative benchmarking of company capabilities, and cross-sectional analysis of distribution channel dynamics. Triangulation of primary and secondary findings ensured the robustness of insights, while executive dialogues validated strategic recommendations. This methodology underscores a commitment to accuracy, relevance, and actionable intelligence for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Processed Potato market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Processed Potato Market, by Product Type

- Processed Potato Market, by Distribution Channel

- Processed Potato Market, by Application

- Processed Potato Market, by Region

- Processed Potato Market, by Group

- Processed Potato Market, by Country

- United States Processed Potato Market

- China Processed Potato Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Positioning For Success In A Pivotal Era Of Consumer Innovation Supply Chain Resilience And Sustainable Growth

The processed potato market stands at a pivotal juncture where consumer-driven innovation, supply chain resilience, and sustainability imperatives converge to shape future trajectories. With tariff landscapes shifting and distribution channels fragmenting, industry participants must adopt a dynamic mindset-combining predictive analytics, collaborative sourcing, and differentiated product development-to maintain competitive advantage.

Segmentation analysis demonstrates that chilled formats are capturing health-conscious and convenience-driven demand, dehydrated products are unlocking versatile ingredient applications, and frozen offerings remain foundational to quick-service and retail portfolios. Regional variations in regulatory frameworks, consumption patterns, and infrastructure maturity call for localized strategies that respect cultural tastes while leveraging global best practices.

Leading companies are already embedding sustainability and digital technologies to enhance efficiency, traceability, and brand equity, while emerging players are nimble enough to capitalize on niche opportunities. In this context, success will favor those who can seamlessly integrate market intelligence with innovation roadmaps, supply chain adaptability, and stakeholder partnerships. The path forward is clear: embrace transformation, anticipate disruptions, and deliver differentiated value at every node of the value chain.

Reach Out to Ketan Rohom Associate Director Sales And Marketing To Secure Your Exclusive Processed Potato Market Research Report

To delve deeper into these transformative insights, Ketan Rohom, Associate Director, Sales & Marketing is ready to guide you through tailored solutions and strategic pathways. Engage directly to explore comprehensive data, unlock proprietary analyses, and leverage actionable intelligence that will empower your organization to navigate market complexities with confidence. Reach out today to secure your copy of the detailed processed potato market research report and position your business at the forefront of innovation, sustainability, and profitability.

- How big is the Processed Potato Market?

- What is the Processed Potato Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?