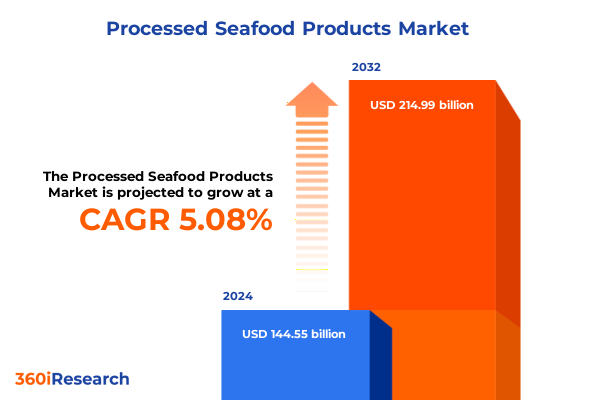

The Processed Seafood Products Market size was estimated at USD 154.10 billion in 2025 and expected to reach USD 165.00 billion in 2026, at a CAGR of 7.20% to reach USD 250.74 billion by 2032.

Exploring the Dynamic Processed Seafood Products Market: Unveiling Core Drivers and Emerging Trends Reshaping Global Consumption Patterns

Processed seafood products have evolved into essential components of modern diets, merging convenience with culinary diversity and nutritional value. Consumers seek reliable and versatile options that integrate seamlessly into fast-paced lifestyles, driving producers to refine processing techniques and packaging solutions. As global urbanization accelerates, the role of shelf-stable and frozen seafood offerings has become more prominent, bridging the gap between tradition and contemporary demand.

Supply chain resilience and quality assurance stand at the forefront of industry priorities. Organizations are optimizing cold chain logistics and adopting traceability protocols to maintain product integrity from harvest to consumption. Meanwhile, evolving regulatory frameworks around food safety and sustainability certifications compel manufacturers to innovate responsibly. This growing emphasis on accountability fosters consumer trust and differentiates leading brands in an increasingly competitive environment.

This executive summary presents an in-depth exploration of current market dynamics and strategic considerations shaping the processed seafood sector. By examining transformational shifts, tariff implications, segmentation intelligence, and regional outlooks, the report aims to equip stakeholders with a holistic perspective. Subsequent sections will reveal actionable insights and evidence-based recommendations to guide decision-making in a landscape defined by rapid change and heightened consumer expectations.

Identifying the Major Transformative Shifts Driving Innovation, Sustainability Initiatives, and Consumer Expectations in the Processed Seafood Landscape

The processed seafood landscape is undergoing profound transformation driven by a convergence of technological advancements, sustainability mandates, and shifting consumer values. On the innovation front, cutting-edge processing equipment and automation have streamlined production workflows, enabling manufacturers to scale operations while maintaining rigorous quality controls. Concurrently, next-generation packaging solutions are enhancing product freshness and reducing environmental impact through biodegradable and recyclable materials.

Sustainability has emerged as a pivotal force, compelling companies to integrate responsible sourcing practices and pursue certification schemes that resonate with eco-conscious consumers. Traceability platforms powered by blockchain and IoT tracking are becoming commonplace, providing end-to-end transparency and reinforcing brand credibility. At the same time, a growing demand for convenience and health-oriented options has stimulated portfolio diversification, with ready-to-eat meals, protein-rich snacks, and functional seafood formulations gaining traction.

In parallel, digital commerce channels are reshaping distribution strategies, enabling niche players to reach targeted demographics and fostering direct engagement through subscription services and curated offerings. This multi-channel approach underscores the need for agility, as organizations must navigate an increasingly fragmented retail ecosystem while ensuring consistent brand experiences across physical and online touchpoints.

Examining the Cumulative Effects of 2025 United States Tariffs on Raw Inputs, Cost Structures, and Sourcing Strategies in Processed Seafood Products

United States tariffs implemented in 2025 have redefined cost structures and procurement strategies within the processed seafood sector. Heightened duties on key commodity imports have increased landed costs, prompting companies to explore alternative sourcing hubs and renegotiate supplier agreements. This recalibration of supply chains has introduced both operational challenges and strategic opportunities for market participants.

Manufacturers have responded by diversifying their raw material portfolios, identifying lower‐cost origins while preserving quality standards. Regionally focused partnerships have emerged, incentivizing investment in processing facilities closer to new source locations. These shifts have also encouraged collaboration with local cooperatives and cold chain operators to mitigate transit risks and maintain product consistency under the revised tariff regime.

Despite increased input costs, some brands have leveraged tariff-induced constraints as a catalyst for improving internal efficiencies. Lean manufacturing methodologies and process digitization initiatives have been fast-tracked to offset margin pressures. By refining production schedules, optimizing batch sizes, and deploying predictive maintenance systems, forward-looking organizations are enhancing throughput and safeguarding profitability in a higher-cost operating environment.

Unveiling Key Segmentation Insights That Reveal Distinct Consumer Behaviors, Distribution Patterns, and Product Preferences Across Multiple Market Categories

A nuanced analysis of market segmentation reveals distinctive patterns across seafood types, product categories, packaging formats, distribution channels, and end‐user profiles. Within the seafood type spectrum, staples such as crabs, fish, molluscs, roe, shrimps, and tuna each exhibit unique consumption drivers and margin dynamics. Differentiation in processing requirements and flavor profiles further influences portfolio positioning.

When assessed through the lens of product form, canned seafood, dried seafood, fish meal, frozen seafood, pickled seafood, smoked seafood, and surimi occupy specialized niches that cater to both traditional recipes and emerging meal solutions. The interplay between shelf life and nutritional retention determines appeal among various consumer cohorts. Packaging formats span bags & pouches, bottles & cans, and pods, each offering trade-offs between convenience, portion control, and sustainability objectives.

Distribution channel analysis underscores a dual focus on offline retail outlets-encompassing convenience stores and supermarkets-and a surging online retail presence. Brick-and-mortar locations continue to drive impulse purchases and brand discovery, while e-commerce platforms facilitate subscription models and direct-to-consumer engagement. End-user segmentation highlights contrasting needs: commercial operators such as hotels and restaurants prioritize consistency and bulk procurement, whereas retail consumers seek convenience, variety, and transparency in sourcing.

This comprehensive research report categorizes the Processed Seafood Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Packaging Type

- Processing Technique

- Product Form

- Distribution Channel

- End User

Highlighting Key Regional Insights That Showcase Market Dynamics, Consumer Trends, and Strategic Opportunities Across Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics illustrate differentiated growth trajectories and strategic priorities in the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, evolving regulatory landscapes and robust retail infrastructures support continual expansion of value-added seafood offerings. Domestic producers are investing heavily in automation and cold chain upgrades to capitalize on stable demand and proximity to key consumption centers.

In Europe, Middle East & Africa, stringent sustainability standards and traceability requirements are accelerating the adoption of certified products. Collaborative initiatives between governments, NGOs, and private sector partners are fostering responsible fishing practices, particularly in coastal economies where seafood production underpins community livelihoods. Retailers in this region emphasize clean labels and origin transparency to meet discerning consumer preferences.

Asia-Pacific remains a powerhouse of both supply and consumption, driven by longstanding culinary traditions and rapid modernization of distribution networks. Emerging digital marketplaces and last-mile delivery infrastructures are enabling greater market penetration for processed seafood. Meanwhile, rising disposable incomes and urbanization trends are supporting premium product launches, such as artisanal smoked varieties and ready-to-heat meal kits that reflect regional flavor profiles.

This comprehensive research report examines key regions that drive the evolution of the Processed Seafood Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Leading Companies Are Driving Growth Through Innovation, Mergers, Sustainability, and Strategic Partnerships in Processed Seafood

Leading companies in the processed seafood arena are differentiating through a combination of product innovation, strategic acquisitions, and sustainability pledges. Major global brands are targeting niche segments with high-margin offerings like gourmet smoked fillets and functional seafood snacks enriched with omega-3 and protein blends. Such innovations are often supported by dedicated R&D centers that prototype novel formulations and advanced preservation methods.

At the same time, several industry players are engaging in bolt-on acquisitions to bolster their geographic footprint and expand processing capacity. Vertical integration strategies are under way, enabling tighter control over quality assurance and cost management across the supply chain. Collaborative ventures with technology startups are also gaining momentum, particularly those that leverage blockchain for traceability or AI-driven analytics for demand forecasting.

Furthermore, sustainability commitments have become integral to corporate positioning. Many organizations have set ambitious targets for reducing greenhouse gas emissions, achieving zero-waste operations, and sourcing from Marine Stewardship Council-certified fisheries. Public reporting on progress and third-party validations have emerged as critical tools for building consumer confidence and differentiating in crowded marketplaces.

This comprehensive research report delivers an in-depth overview of the principal market players in the Processed Seafood Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abad Fisheries Private Limited

- Austevoll Seafood ASA

- BAADER Global SE

- BMR Industries Private Limited

- Channel Fish Processing Company

- China National Fishery Corporation

- Dongwon Industries Co.

- Empresas AquaChile S.A. by Agrosuper S.A.

- GEA Group AG

- High Liner Foods Incorporated

- John Bean Technologies Ltd.

- Kroma A/S

- Kyokuyo Co., Ltd.

- Labeyrie Fine Foods PLC

- Maruha Nichiro Corporation

- Mitsubishi Corporation

- Mowi ASA

- Nippon Suisan Kaisha, Ltd.

- Nissui Corporation

- Nomad Foods Limited

- ORC Fishing by TGI Group

- Pacific Sea Food Company, Inc.

- Sajo Industries Co., Ltd.

- Silver Bay Seafoods, LLC

- Thai Union Group PCL

Delivering Actionable Strategic Recommendations That Empower Industry Leaders to Navigate Supply Chain Challenges and Consumer Expectations in Processed Seafood

Industry leaders are encouraged to cultivate agile supply chains by establishing multi-source procurement frameworks and fostering deeper collaboration with logistics partners. Embedding advanced analytics within inventory management systems will enable real-time visibility and proactive mitigation of disruptions. Simultaneously, investing in eco-friendly packaging innovations and aligning with circular economy principles can bolster brand reputation and reduce environmental liabilities.

To satisfy evolving consumer palates, organizations should expand product portfolios with value-added meal solutions and functional offerings that address health and wellness trends. Tailored marketing campaigns leveraging digital channels can amplify product launches and facilitate direct feedback loops. Establishing consumer loyalty programs that reward sustainable choices will further enhance engagement and support premium pricing initiatives.

Strategic partnerships with technology providers-particularly in areas of traceability and e-commerce platforms-can accelerate digital transformation efforts. Collaborative R&D consortia with academic institutions and industry associations may unlock breakthroughs in processing efficiency and ingredient innovation. By integrating these initiatives within a cohesive roadmap, industry stakeholders can secure competitive advantage and drive sustainable growth.

Outlining the Comprehensive Research Methodology That Integrates Primary Interviews, Secondary Data Sources, and Quantitative Analysis for Processed Seafood

The research methodology underpinning this analysis combines qualitative and quantitative techniques to ensure comprehensive coverage and robust insights. Primary data were gathered through in-depth interviews with senior executives, category managers, and technical experts across key processing and retail organizations. These conversations provided nuanced perspectives on operational challenges, technology adoption, and strategic outlooks.

Secondary data sources included industry trade journals, regulatory filings, and proprietary databases that track import/export flows, certification registrations, and patent filings. Data triangulation was employed to validate emerging trends and reconcile varying viewpoints. Quantitative modeling techniques, such as scenario analysis and sensitivity testing, were applied to assess the impact of tariff changes, consumer shifts, and supply chain disruptions on operational performance.

Segmentation and regional analyses were developed through a structured framework that layers seafood type, product form, packaging format, distribution channel, and end-user categories. This multi-dimensional approach allowed for the identification of high-growth niches and risk factors unique to each market segment. Continuous peer review and validation workshops ensured methodological rigor and minimized bias throughout the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Processed Seafood Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Processed Seafood Products Market, by Product Category

- Processed Seafood Products Market, by Packaging Type

- Processed Seafood Products Market, by Processing Technique

- Processed Seafood Products Market, by Product Form

- Processed Seafood Products Market, by Distribution Channel

- Processed Seafood Products Market, by End User

- Processed Seafood Products Market, by Region

- Processed Seafood Products Market, by Group

- Processed Seafood Products Market, by Country

- United States Processed Seafood Products Market

- China Processed Seafood Products Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing Key Findings and Strategic Imperatives That Define the Current State and Future Trajectory of Processed Seafood Products in Global Markets

This executive summary has illuminated the complex interplay of innovation, regulatory dynamics, and market forces shaping the processed seafood industry today. Transformative shifts in supply chain digitalization and sustainability have converged with evolving consumer preferences to redefine competitive parameters and growth pathways. Tariff adjustments in 2025 have acted as a catalyst for sourcing diversification and operational efficiency pursuits.

Segmentation insights reveal that distinctive preferences across seafood types, product categories, and packaging formats are creating pockets of opportunity for targeted value propositions. Regional dynamics vary significantly, with the Americas focusing on automation investments, EMEA leading traceability mandates, and Asia-Pacific driving demand through digital commerce expansion. Major companies are responding with a blend of product innovation, strategic partnerships, and sustainability commitments to secure market leadership.

Looking ahead, stakeholders must remain vigilant to evolving macro-economic conditions and technological disruptions. A proactive strategy anchored in agile supply chains, consumer-centric innovation, and transparent sustainability practices will be paramount. The collective ability to adapt and collaborate will determine which organizations emerge as the next generation of industry frontrunners.

Driving Growth and Collaboration Through Personalized Consultation with Ketan Rohom: Acquire the Definitive Processed Seafood Market Research Report Today

Engaging with industry experts is the most efficient way to leverage comprehensive insights and translate high-level analysis into concrete strategies. Ketan Rohom offers personalized consultation sessions that delve into the nuances of supply chain optimization, consumer trend monitoring, and competitive benchmarking. By collaborating directly, organizations can align their strategic objectives with real-time market intelligence and tailor solutions to address pressing business challenges.

Investing in a full market research report ensures access to proprietary data sets, in-depth case studies, and scenario planning frameworks. This extensive resource empowers decision-makers to evaluate growth opportunities with confidence and minimize risk exposure. Reach out to schedule a one-on-one consultation with Ketan Rohom to explore customized research deliverables and secure early access to extension modules that focus on emerging sub-segments and technological innovations.

- How big is the Processed Seafood Products Market?

- What is the Processed Seafood Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?