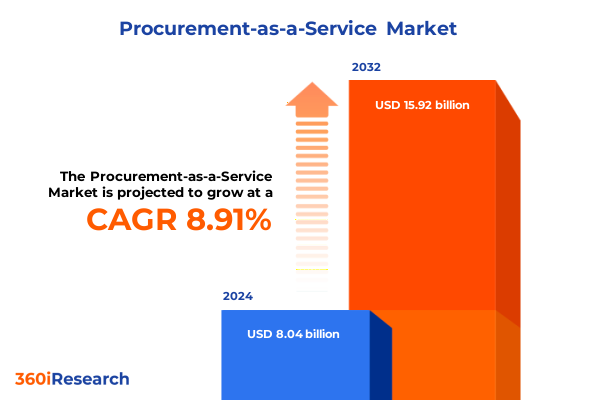

The Procurement-as-a-Service Market size was estimated at USD 8.72 billion in 2025 and expected to reach USD 9.46 billion in 2026, at a CAGR of 8.97% to reach USD 15.92 billion by 2032.

Unveiling the Strategic Imperative of Procurement-as-a-Service in the Era of Digital Transformation and Global Market Volatility

Procurement-as-a-Service has emerged as a transformative model that redefines how organizations manage sourcing and supplier relationships in an increasingly complex business environment. By shifting from traditional, in-house procurement functions to specialized service providers, enterprises harness deep domain expertise, advanced technology platforms, and scalable resources. This evolution not only drives cost efficiencies but also enhances strategic agility, allowing companies to pivot swiftly in response to market disruptions and evolving customer expectations. In the face of global volatility, procurement-as-a-service offers a compelling avenue for achieving operational excellence without the burden of heavy capital investments and lengthy implementation cycles.

As organizations embrace procurement-as-a-service, they tap into a rich ecosystem of digital tools powered by artificial intelligence and machine learning, enabling more precise spend analysis and supplier risk assessments. Providers continuously refine their offerings through partnerships and best-practice methodologies, positioning procurement as a proactive driver of innovation rather than a reactive cost center. Ultimately, this approach empowers businesses to elevate procurement from tactical transaction management to a strategic function that fuels competitive differentiation and long-term value creation.

Embracing Digital Innovation and Sustainable Practices as Procurement Evolves into a Strategic Value Driver Across Industries

The procurement-as-a-service landscape is witnessing profound shifts as organizations integrate cutting-edge technologies and reconfigure supplier ecosystems to meet dynamic business requirements. Cloud-based procurement platforms are gaining traction, offering real-time data visibility and seamless collaboration across geographically dispersed teams. Automation of routine tasks-from purchase order creation to invoice reconciliation-is liberating procurement professionals to focus on high-value activities such as category strategy and supplier innovation. These technological advances are complemented by outcome-driven contracting models that align supplier incentives with measurable business results, fostering partnerships grounded in mutual growth and shared risk.

In parallel, sustainability and ethical sourcing have surged to the forefront of procurement agendas, with enterprises embedding Environmental, Social, and Governance (ESG) criteria into supplier evaluations. Companies now assess carbon footprints, labor practices, and governance frameworks to ensure supply chain resilience and brand reputation. This emphasis on responsible sourcing not only addresses regulatory demands but also resonates with stakeholders and consumers who prioritize transparency and ethical stewardship. Together, these transformative shifts are converging to elevate procurement-as-a-service from a cost management tool to a strategic enabler of innovation, resilience, and sustainable growth.

Assessing the Far-reaching Financial and Operational Consequences of Elevated U.S. Tariffs on Modern Procurement Strategies in 2025

The imposition of elevated U.S. tariffs in 2025 has exerted significant pressure on procurement strategies, reshaping cost structures and supplier decisions across sectors. Average U.S. import tariffs soared to approximately 15%, marking their highest level since the 1940s and compelling companies to revisit sourcing networks and total cost assessments. Retailers, for instance, faced immediate inventory challenges when new duties prompted accelerated imports that ultimately exceeded demand, leading to increased discounting pressures and profit margin erosion, as evidenced by a recent case where a global apparel brand saw its annual gross profit shrink by nearly €80 million due to tariff impacts.

Manufacturers and logistics-intensive enterprises have similarly absorbed substantial tariff burdens. Despite initial assertions that foreign suppliers would bear most duties, U.S. importers increasingly find themselves shouldering these costs to maintain market competitiveness, with some firms reporting second-quarter tariff expenses exceeding $1 billion. As a result, procurement leaders are diversifying supplier bases, exploring nearshoring options, and incorporating tariff scenario planning into their forecasting models. This cumulative impact underscores the necessity for agile procurement frameworks capable of navigating policy volatility while safeguarding operational continuity and financial performance.

Decoding Market Dynamics Through Offering, Deployment, Procurement Type, Organization Size, and Industry-Based Procurement Segmentation Lenses

Market segmentation reveals the varied dimensions through which procurement-as-a-service providers tailor solutions to client needs. Offering-driven services encompass category management capabilities that optimize sourcing strategies, contract negotiation expertise that secures favorable terms, and spend analysis and management frameworks that deliver transparency into expenditure patterns. Strategic sourcing engagements dive deep into market dynamics to unlock value, supplier management programs ensure robust relationship governance, and transactional procurement operations handle day-to-day purchasing activities with efficiency and compliance.

Deployment modalities further differentiate the market, with cloud-based procurement platforms leading adoption due to their scalability and remote accessibility, enhanced by hybrid cloud configurations that blend on-premise control with public and private cloud flexibility. Conversely, traditional on-premise solutions continue to serve organizations with stringent data residency and security requirements, offering full infrastructure ownership and customization.

Procurement type segmentation highlights distinct approaches for direct procurement, which secures raw materials and goods essential for production, and indirect procurement, which manages ancillary services and operational supplies. Each category demands specialized processes and supplier networks, driving service providers to develop targeted capabilities.

Organizational size also frames procurement-as-a-service offerings, ranging from comprehensive, multi-country programs suited for large enterprises to streamlined packages designed for medium and small enterprises seeking rapid deployment and cost predictability. Tailored service tiers address varying budget constraints, internal resource levels, and strategic priorities across the enterprise spectrum.

The industry Dimension shapes solution design, with Banking, Financial Services, and Insurance firms prioritizing compliance and risk controls; Healthcare organizations focussing on regulated product sourcing and patient safety; IT and Telecom companies demanding agile technology procurement and vendor integration; Manufacturing enterprises concentrating on just-in-time inventory and component quality; and Retail businesses balancing cost, speed, and customer-driven assortment planning. By aligning segmentation axes with client-specific drivers, procurement-as-a-service providers deliver nuanced, high-impact solutions.

This comprehensive research report categorizes the Procurement-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Deployment Type

- Procurement Type

- Organization Size

- Industry

Exploring Regional Procurement-as-a-Service Opportunities Across Americas, Europe Middle East & Africa, and the Asia-Pacific Growth Corridors

Regional analysis underscores the diverse adoption patterns and growth enablers for procurement-as-a-service across global markets. In the Americas, advanced enterprises leverage mature cloud ecosystems and robust technology investments to accelerate procurement transformation, with North American firms leading in AI-driven spend analytics adoption. Latin American organizations, while contending with economic and regulatory fluctuations, increasingly engage service providers to bolster supply chain resilience and streamline cross-border transactions.

Europe, the Middle East, and Africa display pronounced interest in ethical and sustainable procurement, shaped by stringent ESG regulations and eco-labeling mandates. European Union members are pioneering supplier diversity initiatives, and regulatory frameworks such as the Corporate Sustainability Due Diligence Directive propel procurement functions to integrate social and environmental risk assessments. Meanwhile, Middle Eastern and African markets are witnessing gradual digital procurement uptake, often through regional partnerships that localize global best practices to address infrastructure and talent gaps.

In the Asia-Pacific region, rapid industrialization and burgeoning e-commerce ecosystems drive demand for scalable procurement-as-a-service models. Organizations in markets such as China, India, and Southeast Asia adopt cloud-native procurement platforms to manage complex, high-volume sourcing activities. Meanwhile, regional trade agreements and free trade zones catalyze cross-border supplier networks, prompting service providers to embed multi-currency and multi-language capabilities within their offerings. Collectively, these regional dynamics highlight the necessity for providers to adapt service delivery models to local market nuances while maintaining global standards of performance and compliance.

This comprehensive research report examines key regions that drive the evolution of the Procurement-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Innovation Trajectories of Leading Procurement-as-a-Service Providers Shaping Market Excellence

Leading players in the procurement-as-a-service arena are actively enhancing their platforms and expanding service portfolios to maintain competitive advantage. Prominent technology-focused providers are integrating advanced analytics modules powered by artificial intelligence to deliver predictive insights on spend anomalies and supplier performance. These capabilities enable clients to proactively address cost overruns and supply risks before they materialize, strengthening procurement’s strategic influence.

Simultaneously, established consulting and outsourcing firms are forging alliances and executing targeted acquisitions to deepen domain expertise in vertical industries such as life sciences and automotive. By combining proprietary technology stacks with specialized knowledge in regulatory compliance and global trade policies, these companies offer differentiated, end-to-end procurement solutions. Strategic investments in user experience design further drive higher adoption rates, ensuring that digital procurement tools resonate with business stakeholders and deliver measurable outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Procurement-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Aegis Limited

- Basware Corporation

- Capgemini SE

- Corbus LLC

- Coupa Software Inc.

- Genpact Limited

- GEP Worldwide

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Ivalua Inc.

- JAGGAER Inc.

- Oracle Corporation

- SAP SE

- Simfoni Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Total IT Global Ltd.

- Tradeshift ApS

- Wipro Limited

- Xchanging Services Limited

- Zycus Inc.

Empowering Procurement Leadership with Actionable Strategies to Navigate Disruption, Drive Collaboration, and Sustain Competitive Advantage

Industry leaders seeking to unlock the full potential of procurement-as-a-service should prioritize the adoption of unified digital platforms that seamlessly integrate spend analytics, supplier risk management, and contract lifecycle functionalities. By consolidating disparate procurement processes within a single ecosystem, organizations can achieve greater transparency, reduce manual handoffs, and accelerate cycle times. This foundational step should be complemented by establishing cross-functional governance councils that align procurement objectives with finance, operations, and sustainability teams, ensuring a holistic view of organizational goals.

In parallel, procurement executives must cultivate outcome-based supplier partnerships that tie compensation and performance incentives to measurable metrics such as delivery lead times, quality benchmarks, and innovation contributions. Structuring agreements around shared objectives fosters deeper collaboration and drives continuous improvement across supplier networks. Additionally, developing a robust talent framework-emphasizing digital literacy, strategic sourcing expertise, and change management skills-will empower procurement teams to maximize the benefits of service-based delivery models.

Finally, embedding dynamic risk management practices is essential in today’s volatile environment. Procurement leaders should leverage real-time market intelligence and scenario planning tools to anticipate tariff shifts, geopolitical disruptions, and commodity price fluctuations. By modeling multiple supply chain scenarios and maintaining a diversified supplier portfolio, organizations can mitigate downside risks and sustain operational continuity amid evolving global conditions.

Detailing a Robust Mixed-Methodology Framework Integrating Secondary Research, Expert Interviews, and Quantitative Analysis for Comprehensive Insights

This research employed a rigorous mixed-methodology approach to ensure comprehensive and reliable insights. Secondary research involved systematic analysis of industry publications, government trade reports, and reputable business journals to identify key trends shaping the procurement-as-a-service market. Sources included peer-reviewed studies, regulatory filings, and market intelligence reports, providing a solid foundation for quantitative modeling and contextual analysis.

Primary data collection was conducted through in-depth interviews with senior procurement executives, CPOs, and supply chain leaders across diverse industry verticals. These conversations offered nuanced perspectives on adoption drivers, service provider selection criteria, and best-practice implementation strategies. Supplementing qualitative inputs, a structured survey of procurement professionals captured benchmark metrics on cost savings, process efficiencies, and risk mitigation outcomes. Data triangulation techniques were applied to reconcile findings, validate hypotheses, and enhance the overall robustness of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Procurement-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Procurement-as-a-Service Market, by Offering

- Procurement-as-a-Service Market, by Deployment Type

- Procurement-as-a-Service Market, by Procurement Type

- Procurement-as-a-Service Market, by Organization Size

- Procurement-as-a-Service Market, by Industry

- Procurement-as-a-Service Market, by Region

- Procurement-as-a-Service Market, by Group

- Procurement-as-a-Service Market, by Country

- United States Procurement-as-a-Service Market

- China Procurement-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate the Evolution of Procurement-as-a-Service and Its Role in Shaping Future Business Resilience

The evolution of procurement-as-a-service signals a profound shift in how organizations approach sourcing, supplier management, and operational resilience. By embracing digital platforms, automation, and outcome-based engagement models, enterprises transform procurement from a tactical function into a strategic enabler that drives innovation, cost optimization, and sustainability. Segmentation analyses underscore the importance of tailored offerings based on client size, industry requirements, and deployment preferences, while regional insights reveal distinct market dynamics that inform service delivery models.

As global supply chains face increasing uncertainty-from policy-driven tariff fluctuations to evolving ESG mandates-procurement-as-a-service providers are poised to deliver the agility and expertise necessary to navigate these complexities. The combination of advanced analytics, strategic partnerships, and deep domain knowledge equips CPOs and procurement leaders with the tools to anticipate disruptions, align supplier ecosystems with corporate objectives, and create measurable business impact. This report’s findings offer a roadmap for organizations seeking to harness procurement-as-a-service as a catalyst for sustained competitive advantage in an ever-changing global marketplace.

Engage with Associate Director Ketan Rohom to Secure Your Comprehensive Procurement-as-a-Service Market Research Report for Strategic Advantage

To gain an in-depth understanding of emerging procurement-as-a-service dynamics, strategic vendor landscapes, and actionable insights tailored to your organization’s goals, reach out to Associate Director, Sales & Marketing Ketan Rohom. Engaging with Ketan will enable you to secure the comprehensive market research report that illuminates critical trends, segmentation analyses, and regional outlooks essential for making informed procurement investments and driving sustainable competitive advantage.

- How big is the Procurement-as-a-Service Market?

- What is the Procurement-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?