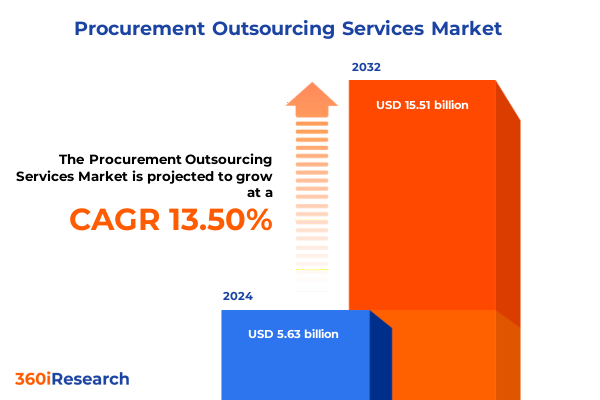

The Procurement Outsourcing Services Market size was estimated at USD 6.34 billion in 2025 and expected to reach USD 7.16 billion in 2026, at a CAGR of 13.62% to reach USD 15.51 billion by 2032.

Empowering Enterprises to Navigate Procurement Complexity Through Outsourced Expertise and Strategic Value-Driven Service Models

The modern procurement landscape demands agility, visibility, and strategic foresight in equal measure. Increasingly complex supplier ecosystems, evolving regulatory requirements, and pressure to reduce costs while driving innovation have converged to elevate procurement from a back-office function to a value-creating strategic partner. Forward-thinking organizations recognize that outsourcing core procurement activities can unlock specialized expertise, accelerate digital transformation, and establish robust frameworks for continuous improvement. This executive summary sets the stage by outlining the critical drivers, emerging trends, and key considerations that underpin successful procurement outsourcing engagements.

By highlighting foundational concepts and articulating the rationale behind the growing reliance on external service providers, this overview provides a clear context for subsequent deep dives. Stakeholders will gain clarity on how outsourcing can relieve internal resource constraints, enhance process efficiency, and enable procurement teams to focus on higher-value initiatives. Throughout, the narrative maintains a focus on practical relevance, equipping decision-makers with the insights necessary to navigate complexity, mitigate risks, and harness new opportunities for cost optimization and supplier innovation.

Uncovering Critical Market Disruptions and Technological Innovations Reshaping Procurement Outsourcing Service Delivery Across Industries

The procurement outsourcing market is in the midst of fundamental transformation driven by digital adoption and evolving business imperatives. Organizations are leveraging robotic process automation to streamline transactional workflows, while artificial intelligence and machine learning are being deployed for predictive spend analysis and risk monitoring. These technological advancements, coupled with heightened emphasis on sustainability and supplier diversity, are rewriting the rules of procurement service delivery and driving providers to expand their capabilities beyond traditional cost-arbitrage models.

At the same time, stakeholder expectations have shifted significantly. Procurement leaders now demand outcome-based engagement frameworks that align service provider incentives with business performance metrics. This shift is fostering the growth of hybrid engagement models that blend managed services with project-based and staff augmentation approaches, enabling buyers to flexibly scale resources. Moreover, the integration of cloud-based e-procurement suites with advanced analytics platforms is establishing new benchmarks for collaboration, transparency, and data-driven decision-making.

Evaluating the Far-Reaching Consequences of 2025 US Tariff Measures on Global Sourcing Strategies and Supplier Ecosystems

The reinstatement of tariffs by the United States in early 2025 has triggered widespread supply chain realignment and heightened cost pressures across both direct and indirect sourcing categories. Import duties on key raw materials and capital goods have compelled multinational enterprises to reassess supplier relationships and pivot toward regional nearshoring arrangements. As a result, procurement leaders are confronting the dual challenge of maintaining competitive pricing while safeguarding supply continuity.

In response, many organizations have broadened their scope of supplier risk management programs to include scenario planning for further trade policy shifts. This entails diversifying vendor portfolios, renegotiating contracts to include pass-through clauses for tariff fluctuations, and investing in supply chain control towers to enhance real-time visibility. These measures are design to deliver resilience and flexibility amid an uncertain trade environment, enabling procurement professionals to respond swiftly to policy changes and minimize downstream operational disruptions.

Illuminating Market Dynamics Through Nuanced Segmentation by Organization Scale Engagement Models Service Types and Industry Verticals

A nuanced understanding of market segments reveals strategic pathways for both service providers and buyers seeking to optimize procurement outcomes. Among large enterprises, the preference for outcome-based managed services underscores a commitment to performance accountability, while small and medium enterprises frequently favor time-and-materials arrangements to balance cost control with flexible resourcing. This divergence in organizational scale highlights the importance of tailored engagement models that align with internal capabilities and budgetary constraints.

The distinction between direct and indirect procurement is also driving specialization among service firms, with direct sourcing engagements increasingly focused on category expertise in areas such as raw materials and components, whereas indirect procurement offerings emphasize agile vendor on-boarding, contract compliance, and tail-spend rationalization. Meanwhile, contract management, strategic sourcing, and supplier management collectively represent critical pillars of service delivery, each demanding a distinct mix of analytical rigor, technology integration, and stakeholder collaboration. Within e-procurement deployments, functionality ranging from catalog management through purchase order automation and requisition workflows is being leveraged to accelerate transaction cycle times, while advanced spend analysis methods are enabling procurement teams to move from descriptive audits to predictive modeling and prescriptive recommendations. Across industry verticals, leading adopters leverage domain-specific insights in banking and financial services, energy, healthcare, information technology, manufacturing, and retail to tailor sourcing strategies that account for regulatory nuances, inventory dynamics, and demand variability.

This comprehensive research report categorizes the Procurement Outsourcing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Engagement Model

- Sourcing Type

- Service Type

- Industry Vertical

Delineating Regional Procurement Outsourcing Trends and Growth Drivers Across Americas EMEA and Asia-Pacific Markets

The Americas region continues to dominate in procurement outsourcing adoption, driven by the maturity of digital infrastructure and a robust ecosystem of service providers. North American corporations frequently serve as early adopters of outcome-based managed services, leveraging insights from detailed spend analytics to uncover cost reduction opportunities and align procurement objectives with broader operational goals. Latin America is experiencing a surge in interest for project-based engagements, particularly in sectors such as manufacturing and retail, where resource augmentation supports seasonal demand fluctuations.

In Europe, the Middle East, and Africa, regulatory compliance, sustainability mandates, and geopolitical considerations are shaping procurement priorities. European enterprises have intensified focus on supplier diversity and green procurement, prompting providers to embed environmental, social, and governance criteria into sourcing frameworks. The Middle East is witnessing investments in digital procurement platforms to support large-scale infrastructure programs, while Africa’s emerging markets are engaging in staff augmentation to build local capabilities and bridge talent gaps.

The Asia-Pacific region is characterized by rapid expansion in procurement outsourcing fueled by manufacturing hubs in Southeast Asia and technology centers in East Asia. Buyers are partnering with providers offering integrated service suites that encompass contract management, strategic category sourcing, and e-procurement platforms localized for multi-language and multi-currency requirements. This growth is complemented by rising demand for predictive spend analysis solutions to navigate volatile raw material prices and evolving regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Procurement Outsourcing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Differentiators and Strategic Positioning of Leading Procurement Outsourcing Providers in a Crowded Market

Leading procurement outsourcing firms are differentiating through a combination of deep domain expertise, advanced digital capabilities, and global delivery networks. Several players have expanded their managed services portfolios to include outcome-based offerings, aligning fees with cost savings, process optimization milestones, and supplier performance metrics. Others have forged strategic alliances with technology vendors to integrate artificial intelligence, robotic process automation, and blockchain into their service ecosystems, enabling greater transparency in supplier transactions and enhanced accuracy in spend categorization.

Moreover, companies with robust footprints across multiple regions are capitalizing on in-country delivery centers to provide localized support and regulatory compliance, while leveraging best practices from mature markets to accelerate deployments in emerging geographies. Talent management has become a front-and-center differentiator, with top-tier providers investing in upskilling programs, knowledge management platforms, and cross-functional centers of excellence to ensure continuity of expertise. Partnerships with niche consulting firms and academic institutions further reinforce thought leadership, enabling providers to deliver tailored insights on industry-specific procurement challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Procurement Outsourcing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.T. Kearney, Inc.

- Accenture plc

- Bain & Company

- Boston Consulting Group

- Capgemini SE

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Ernst & Young Global Limited

- Genpact Limited

- GEP Worldwide

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- KPMG International Limited

- McKinsey & Company

- PricewaterhouseCoopers International Limited

- Tata Consultancy Services Limited

- Wipro Limited

- WNS (Holdings) Limited

Driving Organizational Excellence with Targeted Strategic Actions to Maximize Value from Procurement Outsourcing Engagements

Industry leaders must adopt a structured approach to procurement outsourcing that aligns internal capabilities with external expertise and technological innovation. Embedding comprehensive governance frameworks at the contract inception stage ensures transparent roles, responsibilities, and performance metrics, enabling continuous alignment with business objectives. Concurrently, investing in digital integration through open APIs and cloud-native platforms facilitates seamless data exchange and real-time visibility into procurement processes.

Fostering a change-ready culture is equally critical, as internal stakeholders transition from transactional oversight to strategic partnership with service providers. Tailored training programs, cross-functional collaboration workshops, and leadership sponsorship can accelerate adoption and reinforce accountability. Furthermore, procurement executives should prioritize supplier collaboration frameworks that incentivize innovation, sustainability outcomes, and agility in response to market shifts.

Lastly, organizations can harness advanced analytics to detect emerging risks and uncover value capture opportunities throughout the procurement lifecycle. By instituting a continuous improvement mindset, companies can iteratively refine sourcing strategies, optimize service provider portfolios, and pivot rapidly in response to evolving regulatory and market conditions.

Detailing a Rigorous Approach to Gathering and Analyzing Data for Comprehensive Procurement Outsourcing Market Insights

This research integrates primary and secondary data collection methodologies to ensure comprehensive coverage of the procurement outsourcing landscape. Secondary research encompassed extensive review of industry publications, regulatory filings, and technology vendor releases to map market trends and service model evolution. Primary insights were gathered through structured interviews with procurement executives, service provider leaders, and domain experts, delivering granular perspectives on implementation challenges and emerging priorities.

Quantitative surveys were administered to a cross-section of end-user organizations, capturing data on engagement preferences, performance outcomes, and technology adoption levels. Responses were triangulated with publicly available case studies and financial reports to validate key findings. Segmentation analyses were conducted using statistical segmentation techniques to discern patterns across organization size, engagement model, sourcing type, service category, and industry vertical.

Quality assurance protocols were applied throughout, including double-blind data validation, consistency checks, and peer reviews by subject-matter experts. This multi-layered methodology underpins the credibility of the insights presented and ensures that recommendations reflect both broad market dynamics and nuanced buyer requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Procurement Outsourcing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Procurement Outsourcing Services Market, by Organization Size

- Procurement Outsourcing Services Market, by Engagement Model

- Procurement Outsourcing Services Market, by Sourcing Type

- Procurement Outsourcing Services Market, by Service Type

- Procurement Outsourcing Services Market, by Industry Vertical

- Procurement Outsourcing Services Market, by Region

- Procurement Outsourcing Services Market, by Group

- Procurement Outsourcing Services Market, by Country

- United States Procurement Outsourcing Services Market

- China Procurement Outsourcing Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Consolidating Key Findings to Reinforce the Strategic Imperative of Procurement Outsourcing in Achieving Operational Resilience and Cost Efficiency

In summary, procurement outsourcing has evolved from a tactical cost-reduction lever to a strategic enabler of organizational agility, innovation, and resilience. Technology integration, outcome-based engagement models, and advanced analytics are driving service providers to expand capabilities and deepen value propositions. Concurrently, evolving regulatory frameworks and geopolitical shifts are compelling buyers to adopt more sophisticated risk management and supplier diversification strategies.

By leveraging the segmentation insights, regional dynamics, and competitive landscapes outlined in this report, business leaders can make informed decisions about partnership structures, governance models, and technology investments. The actionable recommendations provided serve as a roadmap for aligning procurement outsourcing strategies with broader business priorities, enabling sustained operational efficiency and accelerated time to value. As enterprises navigate an increasingly complex environment, the strategic imperative of outsourcing procurement functions will only grow in significance, underscoring the need for data-driven approaches and adaptive partnership models.

Engage with Ketan Rohom for Tailored Insights and Seamless Access to the Complete Procurement Outsourcing Market Research Report

Engaging with Ketan Rohom opens the door to a personalized exploration of procurement outsourcing strategies tailored to your organization’s unique requirements. As an experienced Associate Director specializing in sales and marketing, Ketan combines market expertise with actionable guidance to ensure clarity on the scope, depth, and applications of the full report. By connecting directly, you gain access to comprehensive analysis, bespoke briefings, and support in translating insights into operational improvements. Reach out to schedule a detailed walkthrough, explore sample findings, and discuss how this research can empower informed decision-making within your procurement functions. Take this opportunity to deepen your understanding, address specific pain points, and drive sustainable value through data-driven sourcing strategies with Ketan Rohom’s support

- How big is the Procurement Outsourcing Services Market?

- What is the Procurement Outsourcing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?