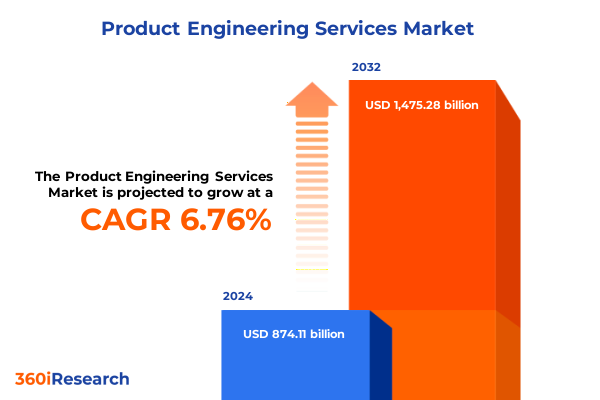

The Product Engineering Services Market size was estimated at USD 930.10 billion in 2025 and expected to reach USD 990.67 billion in 2026, at a CAGR of 6.81% to reach USD 1,475.28 billion by 2032.

Shaping the Future of Product Engineering Services Through Innovation, Strategic Excellence, and Adaptive Solutions in an Evolving Technological Ecosystem

The accelerating pace of technological innovation is redefining the boundaries of product engineering services, compelling organizations to embrace novel approaches that unlock value at every stage of the product lifecycle. As firms strive to maintain relevance amid digital disruption, they are investing more heavily in integrated solutions that encompass design, development, testing, and post-market support. This integrative mindset is driven by an overarching imperative to compress time-to-market while simultaneously elevating product quality and user experience. Consequently, service providers are re-architecting their capabilities to respond with agility to shifting customer demands, regulatory changes, and supply chain pressures.

Against this backdrop, the product engineering services sector is witnessing a convergence of multiple disciplines, including mechanical engineering, embedded software development, and user interface design. This confluence of expertise underscores the growing complexity of modern products, which increasingly meld hardware, firmware, and cloud-enabled intelligence. As a result, organizations are forging cross-functional teams that can navigate these multifaceted requirements with both technical precision and strategic vision. In turn, this collaborative ethos is catalyzing the emergence of end-to-end solutions that streamline workflows and reduce organizational silos.

Looking forward, the introduction of advanced digital platforms and automation tools is set to further transform service delivery models. By harnessing data-driven insights and predictive analytics, providers can anticipate maintenance issues, accelerate iteration cycles, and personalize offerings at scale. This shift marks a critical evolution from traditional project-centric engagements to outcome-oriented partnerships, wherein clients and providers co-innovate to achieve strategic differentiation. With these dynamics in play, a reimagined ecosystem is taking shape-one characterized by fluid collaboration, continuous improvement, and a relentless focus on customer success.

Navigating Disruptive Paradigm Shifts in Product Engineering Services Driven by Digitalization, Automation, and Customer-Centric Innovation in 2025

The landscape of product engineering services is undergoing transformative shifts propelled by three interrelated forces: digitalization, automation, and customer-centric innovation. First, digitalization is dissolving traditional boundaries between design and manufacturing as virtual prototyping and model-based systems engineering gain prominence. Firms are now able to simulate complex scenarios, optimize performance in a virtual environment, and iterate designs with unprecedented speed and precision. This digital thread not only streamlines development but also lays the foundation for continuous monitoring and improvement long after a product reaches the market.

Moreover, the integration of automation technologies such as robotics and automated testing platforms is enhancing both efficiency and reliability. Automated test benches and robotic assembly lines reduce manual errors, shorten feedback loops, and enable service providers to meet stringent quality and compliance requirements. As a result, clients benefit from consistent performance metrics and accelerated validation cycles, leading to faster regulatory approvals and smoother product launches.

In parallel, customer-centric innovation is reshaping value propositions across industries. Service providers are embedding user experience design directly into engineering workflows, ensuring that end products resonate deeply with target audiences. By leveraging user behavior data, sentiment analysis, and usability testing, teams can refine product features to align with evolving market expectations. Consequently, organizations are moving beyond functional specifications to embrace holistic experiences that drive brand loyalty and long-term revenue growth.

These transformative shifts are not occurring in isolation. Rather, they reinforce one another to create a dynamic ecosystem in which differentiated value is co-created through fluid partnerships. As digitalization, automation, and customer focus converge, the next generation of product engineering services will deliver smarter, more adaptable solutions that unlock new opportunities and redefine competitive advantage.

Understanding the Aggregate Implications of Newly Enacted United States Tariffs on Product Engineering Services Supply Chains and Cost Structures in 2025

The United States’ tariff policy in 2025 has introduced a complex set of challenges for the product engineering services sector, affecting cost structures, supply chains, and strategic sourcing decisions. Heightened duties on imported components have compelled engineering teams to reassess supplier networks and consider onshore alternatives to mitigate exposure. In many cases, this has accelerated the adoption of nearshore partnerships and domestic manufacturing to ensure continuity and control over critical subsystems. At the same time, higher input costs are prompting closer collaboration between clients and service providers to identify design optimizations that reduce material usage and improve manufacturability.

Furthermore, the ripple effects of tariff adjustments have been felt across the embedded software development and hardware segments. Providers are now investing in localized research and development facilities to offset tariff burdens and streamline regulatory compliance. These investments not only address immediate cost pressures but also establish a stronger presence in key regional markets. Simultaneously, organizations are exploring advanced supply chain visibility tools and predictive analytics to anticipate disruptions and stabilize inventory levels.

In response to the evolving tariff landscape, many clients are renegotiating master service agreements to share risks and rewards more equitably. This collaborative ethos fosters joint roadmaps for cost management and innovation, ensuring that product roadmaps remain viable despite external headwinds. As a result, the cumulative impact of the 2025 tariff framework has served as a catalyst for greater resilience, driving service providers and clients to adopt more agile, localized, and data-driven approaches to product engineering engagement.

Unveiling Strategic Insights into Service Delivery, Engagement Models, Outsourcing Approaches, Organizational Dimensions, and Industry Applications

The market for product engineering services can be understood by examining the nuanced ways in which organizations consume and deliver specialized functions. From product deployment to support and maintenance, each service tier plays a pivotal role in the product lifecycle. Product designing encompasses both CAD modeling and user interface design, laying the groundwork for a seamless blend of mechanical precision and intuitive user experiences. Once a design is solidified, product development takes center stage, drawing on embedded software expertise alongside hardware engineering to translate concepts into functional prototypes.

Equally important are the phases of product testing and redesigning. Rigorous validation protocols ensure that both performance and safety criteria are met, while re-engineering efforts refine designs in response to test insights. This iterative loop not only elevates product reliability but also accelerates time to market. Finally, support and maintenance services provide ongoing value, enabling clients to optimize fielded products, address warranty issues, and implement enhancements in line with user feedback.

Turning to the manner in which these services are delivered, nearshore, offshore, and onshore engagement models each present distinct advantages. Nearshore services strike a balance between cost efficiency and cultural alignment, enabling real-time collaboration adjusted to regional time zones. Offshore models deliver labor arbitrage and scale, while onshore services offer proximity, stronger IP protection, and simplified logistics. Each model can be tailored to the complexity and sensitivity of the engagement at hand.

When evaluating outsourcing relationships, the distinction between component engineering, consulting-only services, and end-to-end product engineering defines the degree of integration and accountability assumed by the provider. Component engineering offers targeted expertise on discrete subsystems, while consulting engagements focus on strategy and process optimization. In contrast, end-to-end product engineering partners shoulder comprehensive responsibility across stages of the product lifecycle, creating a turnkey solution for clients seeking a single point of accountability.

The size of the client organization also influences engagement dynamics. Large enterprises often command broad, multi-jurisdictional mandates with robust governance structures, whereas small and medium-sized enterprises pursue more agile, focused initiatives. Ultimately, industry context-from aerospace and defense to consumer electronics and healthcare-further defines technical and regulatory complexities, driving providers to cultivate domain-specific competencies and compliance frameworks.

This comprehensive research report categorizes the Product Engineering Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Engagement Model

- Outsourcing Type

- Organization Size

- Industry

Exploring Regional Dynamics and Growth Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific Within Product Engineering Services

Regional dynamics exert a profound influence on the evolution of product engineering services, as geographic markets exhibit varying regulatory environments, talent pools, and ecosystem maturity. In the Americas, for instance, the proliferation of advanced manufacturing hubs and a well-established regulatory landscape have encouraged robust collaborations between universities, technology startups, and tier-one suppliers. This synergy has fueled innovation in sectors such as industrial equipment, medical devices, and automotive software, driving a focus on modular platforms and sustainable design practices.

Across Europe, the Middle East, and Africa, service providers are navigating a rich tapestry of regulatory standards and market demands. European clients, in particular, emphasize stringent compliance with environmental directives and data privacy mandates, prompting investments in secure design workflows and lifecycle traceability. Meanwhile, emerging markets in the Middle East and Africa are experiencing accelerated digital adoption, creating opportunities for rapid entry through modular, cloud-enabled offerings that address core infrastructural challenges.

In the Asia-Pacific region, the convergence of high-volume manufacturing capabilities and growing R&D investments is reshaping competitive dynamics. Countries with established manufacturing ecosystems are upgrading toward smart factories and Industry 4.0 frameworks, while developing economies are becoming hotspots for embedded software talent and electronics assembly. These diverse trajectories underscore the importance of flexible delivery models, as service providers tailor solutions that leverage local cost efficiencies, talent strengths, and regulatory incentives. Ultimately, regional insights inform strategic decisions around talent sourcing, facility placement, and technology investments, enabling clients to optimize global footprints for both performance and risk mitigation.

This comprehensive research report examines key regions that drive the evolution of the Product Engineering Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players in Product Engineering Services Highlighting Their Core Competencies, Partnerships, and Market Strategies

Leading participants in product engineering services are distinguished by their ability to blend technical depth with strategic foresight. Innovators with a strong presence in CAD modeling and embedded software have forged partnerships with major technology vendors, enabling them to co-develop platforms that streamline digital twins and virtual commissioning. These collaborative models reduce integration friction and accelerate client adoption of next-generation design methodologies.

Strategic alliances are also shaping the competitive landscape, as service providers partner with startups specializing in artificial intelligence and machine learning to embed predictive maintenance and quality analytics directly into the engineering workflow. This fusion of capabilities enhances design validation and field performance monitoring, delivering measurable uptime improvements for critical equipment.

Moreover, organizations that excel in end-to-end product engineering have expanded their portfolios through targeted acquisitions and talent reinforcements, positioning themselves to manage complex, regulated markets such as medical devices and aerospace systems. By integrating specialized consulting practices with scaled delivery centers, these players can drive standardized governance frameworks while retaining the agility required for bespoke innovation.

In addition to traditional leaders, smaller niche providers are gaining traction by focusing on high-value microspecialties. Whether it be hardware platform optimization for electric vehicles or user interface prototyping for wearable health monitors, these agile firms leverage deep domain expertise to deliver differentiated solutions. Their specialized focus often yields rapid deployments and high customer satisfaction scores, establishing them as preferred partners for clients with mission-critical requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Product Engineering Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Akkodis Group AG by The Adecco Group

- Alfanar Group

- Algoscale Technologies, Inc.

- Alten Group

- Arrow Electronics, Inc.

- Assystem S.A.

- Calsoft Inc.

- Capgemini SE

- CloudMoyo, Inc.

- Cognizant Technology Solutions Corporation

- Damco Solutions

- DXC Technology Company

- EPAM Systems, Inc.

- Genpact

- Hakuna Matata Solutions Private Limited

- Happiest Minds Technologies Limited

- HCL Technologies Limited

- Hinduja Tech Limited

- Infinite Computer Solutions Inc.

- Infosys Limited

- Intellectsoft LLC

- International Business Machines Corporation

- ITC Infotech India Ltd.

- Mphasis Limited

- NeST Digital Pvt Ltd.

- Nous Infosystems Private Ltd.

- Producement

- Quest Global Services Pte. Ltd.

- Ranosys Technologies Private Limited

- Robert Bosch GmbH

- Safran S.A.

- Salesforce, Inc.

- SAP SE

- Sapphire Software Solutions

- Segula Technologies

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Terasol Technologies Pvt. Ltd.

- ThinkPalm Technologies Pvt. Ltd.

- TransformHub

- Vee Technologies Private Limited by Sona Valliappa Group

- Wipro Ltd.

- Xoriant Corporation, Inc.

Delivering Tactical and Strategic Recommendations to Empower Industry Leaders to Drive Innovation, Optimize Operations, and Enhance Competitive Advantage

To thrive amidst evolving market pressures and escalate value delivery, industry leaders should adopt a multifaceted approach grounded in technology convergence, talent empowerment, and ecosystem collaboration. First, investing in unified digital platforms that bridge design, development, and testing workflows will reduce latency in decision making and foster cross-disciplinary innovation. Such platforms not only synchronize data across engineering functions but also support advanced simulation and predictive analytics capabilities.

Furthermore, cultivating a culture of continuous learning is paramount. Organizations must balance the recruitment of specialized engineering talent with the upskilling of existing teams in areas such as embedded AI, cloud-native architectures, and user experience research. By establishing dedicated centers of excellence and leveraging apprenticeship models, firms can maintain a pipeline of skills that aligns with emerging technological trends.

In parallel, forging strategic alliances with technology vendors, academic institutions, and niche innovators will accelerate access to cutting-edge methodologies and domain knowledge. These collaborations should be structured around joint innovation roadmaps with clear performance metrics and shared investment models. Doing so reduces time-to-value and expands the scope for value co-creation across the product lifecycle.

Lastly, embedding sustainability and resilience into engineering processes will yield competitive differentiation. Leaders can achieve this by integrating life-cycle assessments into early design phases, optimizing material usage, and establishing circular economy principles for hardware components. In an environment where regulatory scrutiny and stakeholder expectations continue to mount, such proactive measures will safeguard market access and reinforce brand reputation.

Detailing the Rigorous Research Methodology Combining Primary Insights, Secondary Data Analysis, and Statistical Validation Techniques to Ensure Credibility

The insights presented in this summary are grounded in a robust research methodology that combines primary and secondary data sources with rigorous analytical frameworks. Primary insights were obtained through in-depth interviews and structured surveys with senior executives, engineering leaders, and procurement specialists across a broad spectrum of industries. These engagements provided firsthand perspectives on emerging priorities, strategic challenges, and technology adoption trajectories.

Secondary data were drawn from reputable industry publications, regulatory filings, and patent analyses to establish contextual understanding of market dynamics and innovation pipelines. Publicly available white papers and technical standards were also reviewed to validate the compliance and quality benchmarks cited during primary research.

To ensure the credibility of findings, data were subjected to statistical validation techniques, including triangulation across independent sources and consistency checks through regression analysis. The research team employed scenario planning workshops and cross-sector benchmarking sessions to test assumptions and stress-test strategic hypotheses under varying market conditions.

The integration of qualitative and quantitative approaches underpins the reliability of the insights and recommendations. This layered methodology enables a holistic view of the product engineering services landscape, ensuring that strategic guidance is both empirically grounded and forward-looking.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Product Engineering Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Product Engineering Services Market, by Service

- Product Engineering Services Market, by Engagement Model

- Product Engineering Services Market, by Outsourcing Type

- Product Engineering Services Market, by Organization Size

- Product Engineering Services Market, by Industry

- Product Engineering Services Market, by Region

- Product Engineering Services Market, by Group

- Product Engineering Services Market, by Country

- United States Product Engineering Services Market

- China Product Engineering Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Findings and Reflecting on Industry Evolution, Strategic Imperatives, and Future Outlook for Product Engineering Services in a Dynamic Market

This executive summary has illuminated the critical forces redefining product engineering services, from tariff-induced supply chain adaptations to the convergence of digital design and automation. Strategic segmentation and regional analyses have underscored how service models, outsourcing approaches, and geographic footprints shape competitive positioning. Furthermore, leading companies have demonstrated the power of partnerships and specialized expertise in driving innovation and operational excellence.

Ultimately, the synthesis of these insights reveals a market characterized by increasing complexity and opportunity. As organizations navigate emerging regulatory requirements, talent constraints, and shifting customer expectations, strategic agility and collaborative ecosystems will define success. By embracing integrated digital platforms, fostering cross-functional teams, and aligning innovation with sustainability imperatives, stakeholders can unlock new levels of performance and resilience.

Looking ahead, those who act decisively on these imperatives will secure a competitive edge in an environment where speed, quality, and customer experience converge. This conclusion reinforces the importance of leveraging comprehensive market insights to make informed decisions that drive long-term value creation in the realm of product engineering services.

Contact Ketan Rohom to access in-depth product engineering insights and strengthen your competitive edge by acquiring the market research report

We appreciate your interest in gaining a comprehensive understanding of the transformative forces shaping product engineering services. To unlock unparalleled insights tailored to your organization’s strategic objectives, you are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Through this dialogue, you will gain access to expert guidance that illuminates emerging trends, operational best practices, and competitive benchmarks. By acquiring the market research report, you stand to strengthen your decision-making process, optimize investment priorities, and elevate your competitive positioning in an increasingly dynamic environment. Engage with Ketan Rohom today to leverage these insights and chart a course toward sustained innovation and growth in the realm of product engineering services.

- How big is the Product Engineering Services Market?

- What is the Product Engineering Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?