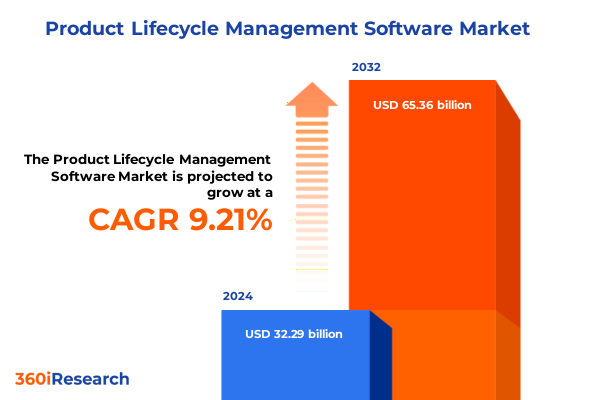

The Product Lifecycle Management Software Market size was estimated at USD 35.30 billion in 2025 and expected to reach USD 38.62 billion in 2026, at a CAGR of 9.19% to reach USD 65.36 billion by 2032.

Elevate Innovation and Operational Excellence by Harnessing Product Lifecycle Management as Your Strategic Enterprise Backbone

In today’s rapidly evolving technological landscape, organizations are under immense pressure to deliver innovative products faster while simultaneously optimizing costs and ensuring compliance. Product Lifecycle Management software serves as the strategic backbone for achieving these goals by orchestrating the complex interplay between ideation, design, manufacturing, and after-sales support. By centralizing data, standardizing processes, and enabling seamless collaboration across multidisciplinary teams, PLM empowers companies to reduce time to market, mitigate risks, and sustain competitive advantage. The imperative for such a unified system has never been more critical, as market entrants leverage digital technologies to disrupt traditional product value chains and raise the bar for quality, customization, and sustainability.

As enterprises navigate digital transformation journeys, the role of PLM extends beyond mere data management. Forward-thinking organizations view PLM platforms as platforms for driving continuous innovation, embedding intelligence through analytics and artificial intelligence, and integrating with complementary systems such as ERP, CRM, and MES. This shift elevates PLM from a back-office enabler to a strategic driver of business outcomes, positioning it at the heart of corporate decision-making and cross-functional alignment. In this executive summary, we will outline the pivotal trends reshaping the PLM environment, examine the implications of recent trade policies, unpack key market segmentation and regional dynamics, highlight leading company strategies, and propose actionable recommendations to guide industry leaders toward sustainable growth and resilience.

Harness the Power of AI, Digital Twin Models, and Cloud-Native Architectures to Revolutionize Product Lifecycle Management Beyond Traditional Boundaries

The PLM landscape is undergoing a profound transformation driven by advancements in digital technologies, shifting customer expectations, and evolving regulatory demands. Machine learning algorithms now analyze vast repositories of product data to identify design anomalies, forecast maintenance requirements, and recommend performance improvements. Concurrently, the proliferation of Internet of Things devices throughout manufacturing lines and in-field products generates real-time telemetry, enabling digital twin models that mirror physical assets and simulate various operational scenarios. These innovations foster predictive decision-making, optimize resource utilization, and accelerate design iterations, fundamentally altering how products are conceived and managed.

Moreover, the expanding adoption of cloud-native architectures has lowered barriers to entry, enabling organizations of all sizes to access enterprise-grade PLM capabilities without the need for significant upfront infrastructure investments. Combined with open APIs and low-code integration platforms, cloud PLM solutions facilitate seamless data exchange with CAD systems, ERP suites, and supplier portals. This interoperability is essential for orchestrating end-to-end workflows across geographically dispersed teams and multi-tier supply chains. At the same time, heightened focus on sustainability and circular economy principles is driving PLM tools to incorporate environmental impact assessments, materials traceability, and end-of-life planning functionalities. These transformative shifts create a new paradigm for product development and management, where agility, collaboration, and eco-conscious design converge.

Analyze How 2025 US Tariffs on Raw Materials and Electronics Are Reshaping Supply Chain Strategies and Elevating PLM as a Resilience Tool

In 2025, the United States implemented a series of tariffs targeting key raw materials and electronic components integral to manufacturing processes, affecting imports of steel, aluminum, semiconductor wafers, and specialized alloys. These trade measures have introduced cost pressures across the value chain, compelling OEMs and tier-level suppliers to reevaluate sourcing strategies, renegotiate supplier agreements, and explore domestic production alternatives. As a result, procurement teams are increasingly leveraging PLM systems to centralize supplier intelligence, track material compliance data, and conduct scenario analyses for multi-sourcing strategies. This heightened focus on supply chain resilience is reshaping PLM roadmaps and feature priorities.

Furthermore, tariffs have amplified volatility in materials costs, leading to shifting bill of materials (BOM) configurations and continuous reengineering to maintain margin targets. Organizations with robust PLM platforms can dynamically update BOM structures, perform impact assessments on upstream and downstream processes, and maintain traceability for regulatory reporting. In contrast, companies relying on fragmented legacy solutions face data silos and slow cycle times, undermining their ability to respond swiftly to tariff-driven disruptions. Consequently, PLM adoption in industries most exposed to the tariffs, such as automotive, aerospace & defense, and medical devices, is accelerating as manufacturers seek to harness integrated data environments for end-to-end visibility and rapid decision-making.

Uncover Nuanced Adoption Patterns Across Services, Core Modules, Deployment Models, Application Use Cases, Industry Verticals, and Enterprise Tiers

Examining market dynamics through the lens of component segmentation reveals distinct adoption patterns for services and software offerings. Services, spanning both consulting and support & maintenance engagements, are critical for customizing deployments, driving user adoption, and ensuring ongoing system optimization. Meanwhile, software revenue is propelled by demand for analytics tools that deliver actionable insights, core PLM modules that manage product records and workflows, and integration modules that bridge disparate systems. Transitioning to cloud or on-premises deployment models further delineates buyer preferences: companies prioritizing rapid scalability and lower total cost of ownership embrace cloud solutions, whereas those emphasizing data sovereignty and deep customization continue to invest in on-premises installations.

From an application standpoint, leading organizations deploy PLM across change management processes to govern engineering revisions, design collaboration environments to streamline co-authoring among global stakeholders, product data management hubs to centralize CAD files and documentation, and quality management workflows with modules for product quality planning and supplier quality management. Sectoral differences are pronounced, with aerospace & defense and automotive prioritizing rigorous compliance and traceability, industrial manufacturing focusing on configurability and throughput optimization, and medical device manufacturers demanding stringent validation and audit trails. Finally, organization size plays a role in solution scope and funding models: large enterprises commit to enterprise-wide PLM suites with multi-year roadmaps, whereas small and medium enterprises often opt for modular implementations that address critical use cases and enable phased expansion.

This comprehensive research report categorizes the Product Lifecycle Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Industry

- Organization Size

- Application

Explore Distinct Drivers and Adoption Rates Across the Americas, Europe Middle East & Africa, and Asia-Pacific PLM Ecosystems

Regional dynamics in the PLM market underscore divergent growth drivers and maturity levels across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, advanced manufacturing hubs and a robust startup ecosystem fuel demand for cloud-delivered PLM solutions that accelerate innovation cycles and support distributed design teams. North America’s well-established regulatory frameworks and strong technology infrastructure foster early adoption of digital twin and analytics capabilities, while Latin American manufacturers gradually adopt PLM to address quality and compliance challenges as they scale into global supply chains.

Across Europe Middle East & Africa, stringent environmental regulations and sustainability targets propel investments in PLM features for lifecycle assessment, materials traceability, and circularity planning. The region’s emphasis on Industry 4.0 integration drives collaboration between PLM vendors and automation specialists to deliver end-to-end digital factory solutions. In the Middle East, government-led diversification initiatives stimulate demand for PLM in aerospace, defence, and oil & gas sectors. Meanwhile, Asia-Pacific is characterized by rapid industrialization, cost-sensitive procurement, and a surge in local software development. China, Japan, South Korea, and India represent large, mature markets with a mix of on-premises and cloud engagements, whereas emerging Southeast Asian economies are increasingly looking to SaaS-based PLM to leapfrog legacy constraints.

This comprehensive research report examines key regions that drive the evolution of the Product Lifecycle Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluate How Leading PLM Vendors Are Innovating with AI, Ecosystem Partnerships, and Outcome-Based Service Models to Capture Market Leadership

Leading vendors continue to differentiate themselves through strategic investments in AI, ecosystem partnerships, and industry-specific templates. One prominent provider has deepened its cloud infrastructure footprint and introduced low-code workflow builders to enable rapid configuration by business users, while another has prioritized open standards and partner-led integrations to support flexible multi-vendor environments. A third notable company has launched advanced generative AI capabilities for automated design optimization and service parts forecasting, addressing critical pain points in product innovation and aftermarket support.

Beyond technology, these key players are expanding their global service networks and forging alliances with system integrators, engineering consultancies, and OEMs to accelerate deployment success. Several have established centers of excellence dedicated to sustainability, digital twin methodologies, and advanced analytics to showcase best practices and guide customer implementations. This growing emphasis on outcome-based pricing and consumption models signals a shift toward value-driven engagements, aligning vendor incentives with customer success metrics such as cycle time reduction, quality improvements, and lifecycle cost savings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Product Lifecycle Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altair Engineering Inc

- ANSYS Inc

- Aras Corporation

- Arena Solutions

- Autodesk Inc

- Bamboo Rose Inc

- Bentley Systems Inc

- Centric Software

- Dassault Systèmes SE

- Duro Labs

- Hexagon AB

- IBM Corporation

- Infor Inc

- Jama Software

- Omnify Software

- OpenBOM

- Oracle Corporation

- ProdPad

- Propel Software

- PTC Inc

- SAP SE

- Siemens AG

- Upchain Inc

- Wrike

Drive Strategic Value by Embracing Cloud Migration, AI-Driven Analytics, Modular Architectures, and Collaborative Ecosystem Strategies

To capitalize on emerging PLM opportunities and navigate market uncertainties, industry leaders should prioritize strategic initiatives that balance innovation with operational discipline. First, they must accelerate cloud adoption by developing clear migration roadmaps that account for data governance, security protocols, and integration requirements, thus ensuring a seamless transition without disrupting mission-critical workflows. Second, they should integrate AI-powered analytics across the product lifecycle to derive predictive insights on design performance, supply chain risks, and maintenance needs, enabling proactive decision-making and resource optimization.

Third, strengthening supplier collaboration through shared digital platforms will enhance visibility into upstream processes, support multi-sourcing strategies, and facilitate joint quality improvement initiatives. Fourth, organizations should modularize their PLM architectures to accommodate evolving use cases and emerging technologies without incurring prohibitive customization costs. Fifth, investing in change management and user training programs will drive consistent adoption, minimize resistance, and embed PLM as a core competency. Finally, business leaders must embed resilience into their product strategies by conducting regular tariff impact assessments, diversifying regional manufacturing footprint, and incorporating scenario planning capabilities within the PLM framework.

Integrate Primary Executive Interviews, Quantitative Surveys, and Comprehensive Secondary Research to Deliver Balanced and Actionable PLM Market Insights

This study employs a rigorous multi-stage research methodology that integrates both primary and secondary data sources to ensure comprehensive and balanced insights. The secondary research phase involved reviewing company reports, regulatory filings, trade publications, and technical whitepapers to establish baseline understanding of market drivers, technology trends, and policy developments. Patent databases and academic journals were also consulted to identify emerging innovations in AI, digital twin, and sustainability modules.

Primary research consisted of structured interviews with over 50 senior executives, including PLM product managers, IT directors, supply chain leads, and manufacturing engineers across diverse industries and geographies. These discussions provided qualitative perspectives on adoption challenges, feature priorities, and investment drivers. Quantitative surveys complemented the interviews, gathering data on deployment preferences, application use cases, and vendor satisfaction levels. The findings were corroborated through triangulation, whereby multiple data points were cross-validated to ensure accuracy and mitigate bias. Finally, the insights were synthesized and reviewed by industry experts to validate assumptions and refine strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Product Lifecycle Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Product Lifecycle Management Software Market, by Component

- Product Lifecycle Management Software Market, by Deployment

- Product Lifecycle Management Software Market, by Industry

- Product Lifecycle Management Software Market, by Organization Size

- Product Lifecycle Management Software Market, by Application

- Product Lifecycle Management Software Market, by Region

- Product Lifecycle Management Software Market, by Group

- Product Lifecycle Management Software Market, by Country

- United States Product Lifecycle Management Software Market

- China Product Lifecycle Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesize Strategic Drivers and Contextual Dynamics to Reinforce Product Lifecycle Management as a Core Catalyst for Growth and Resilience

The convergence of digital transformation drivers, policy changes, and evolving customer demands underscores the critical role of advanced PLM solutions in fostering innovation and operational resilience. Organizations that embrace integrated platforms capable of managing complex product lifecycles, incorporating AI analytics, and adapting to shifting supply chain dynamics will secure a sustainable competitive edge. Segment-specific requirements, whether in aerospace & defense with stringent compliance or in medical devices with exacting quality standards, necessitate tailored PLM strategies that align technology investments with business objectives.

Regional nuances further highlight the need for localized approach, as regulatory frameworks, infrastructure maturity, and cost sensitivities influence solution adoption. By understanding these multifaceted dynamics, industry leaders can craft roadmaps that span cloud migration, modular architecture, and collaborative supplier networks. Ultimately, PLM is no longer a back-office system but a strategic enabler that orchestrates people, processes, and technologies to deliver superior products at lower total cost of ownership. Adopting the actionable recommendations outlined herein will equip organizations to navigate uncertainties, capture emerging opportunities, and drive continuous product excellence.

Unlock Transformative Product Lifecycle Management Insights by Engaging with Ketan Rohom for Your Comprehensive Market Research Report

For a deeper exploration of how these insights translate into tangible value for your organization, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through the report’s comprehensive findings, help you identify the most relevant strategies for your specific challenges, and ensure you maximize the return on your investment. Don’t miss the opportunity to equip your leadership team with the actionable intelligence and expert guidance needed to accelerate product innovation, optimize operational efficiency, and enhance resilience against market disruptions. Contact Ketan Rohom today to secure your copy of the market research report and begin transforming the way you approach product lifecycle management.

- How big is the Product Lifecycle Management Software Market?

- What is the Product Lifecycle Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?