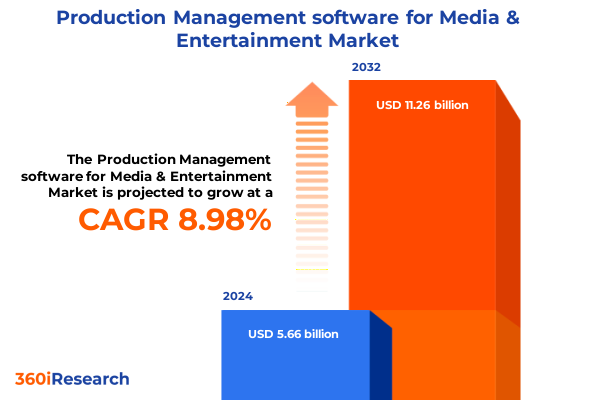

The Production Management software for Media & Entertainment Market size was estimated at USD 6.13 billion in 2025 and expected to reach USD 6.66 billion in 2026, at a CAGR of 9.06% to reach USD 11.26 billion by 2032.

Unveiling the Future of Media & Entertainment Production Management with Cutting-Edge Software Solutions Driving Operational Excellence

Production management software has emerged as a cornerstone for media and entertainment organizations seeking to orchestrate complex workflows, streamline asset lifecycles, and foster seamless collaboration across geographically dispersed teams. Historically, studios relied on manual processes, disparate spreadsheets, and siloed communication channels to manage budgets, schedules, and creative assets. However, the accelerating pace of content creation-driven by streaming services, emerging platforms, and evolving audience expectations-has exposed the limitations of traditional approaches, spurring a shift toward integrated digital solutions.

Today’s leading production management platforms unify critical functions such as asset management, budget tracking, resource allocation, and compliance reporting into a centralized environment. By providing real-time visibility into project status, financial performance, and resource utilization, these software solutions enable stakeholders to make data-driven decisions, minimize operational bottlenecks, and maintain creative momentum. This transformation aligns with broader industry imperatives highlighted in the 2024 media and entertainment outlook, where convergence of gaming, streaming, and social content intersects with rising production costs and demand for premium experiences.

As the industry contends with escalating complexity-from multi-platform distribution to global co-productions-production management software serves as both a strategic enabler and a competitive differentiator. It empowers leaders to optimize investments, enhance cross-functional collaboration, and deliver high-quality content on time and within budget. In this executive summary, we explore the transformative shifts shaping the landscape, assess the cumulative impact of recent U.S. tariffs on operational costs, and uncover key segmentation, regional, and company-specific insights that will inform strategic decision-making for media and entertainment executives.

Navigating the Paradigm Shifts Redefining Media & Entertainment Production Workflows Amid Digital Transformation and Hybrid Collaboration Demands

The media and entertainment industry is undergoing a paradigm shift powered by digital transformation, advanced analytics, and artificial intelligence. Content creators and production houses are increasingly embracing cloud-native architectures and hybrid deployment models to achieve scalability and flexibility in response to fluctuating project demands. Multicloud strategies enable teams to leverage geographically distributed resources, ensuring that high-resolution footage and visual effects pipelines remain performant and secure across diverse locations. This momentum is underscored by the rapid adoption of generative AI tools that streamline tasks like script ideation, metadata tagging, and automated rough-cut editing, marking a departure from manual-intensive workflows.

Concurrently, collaborative ecosystems are maturing to support real-time communication, version control, and stakeholder feedback. Integration of communication platforms with project scheduling and asset tracking modules is eroding traditional silos between production, post-production, and distribution teams. Advanced compliance and reporting features have also risen in prominence, driven by regulatory requirements and the growing emphasis on intellectual property protection in a borderless content economy. These shifts reflect a broader industry trend toward end-to-end, data-driven orchestration, where the convergence of AI, cloud, and collaborative capabilities redefines the principles of efficiency, agility, and creative innovation within media and entertainment production workflows.

Assessing the Far-Reaching Consequences of Recent United States Tariff Measures on Media & Entertainment Production Management Operations

Over the first half of 2025, U.S. tariff policies have introduced new layers of complexity for media and entertainment companies that depend on imported hardware and equipment. Tariffs on electronics, semiconductors, and display components have led to immediate cost increases for data center infrastructure, editing workstations, and audiovisual gear. These elevated hardware expenses ripple through production pipelines, compelling software vendors and integrators to recalibrate pricing models and supply chain strategies to maintain margins and service levels.

The administration’s measures have also targeted specific categories critical to production operations, such as high-performance GPUs and storage arrays that underpin rendering farms and collaborative review systems. Despite ongoing negotiations that seek to ease certain levies, the prevailing uncertainty drives organizations to hedge against further escalations by stockpiling key components or diversifying procurement across regional suppliers. Early evidence from integrator communities indicates an average pass-through rate of nearly 80% for tariff-induced cost increases, which directly impacts capital expenditure budgets for hardware refreshes and expansion projects.

In this environment, production management software providers face a dual challenge: absorbing some of these additional costs to preserve client relationships while advising on infrastructure optimization to mitigate long-term financial risks. Such advisory services range from identifying cloud-based rendering alternatives to recommending scalable SaaS solutions that reduce dependence on on-premises hardware. Understanding the cumulative impact of U.S. tariffs is therefore essential for stakeholders aiming to navigate volatility, sustain operational continuity, and safeguard the creative agility that defines modern media and entertainment production.

Unlocking Critical Perspectives through Segmenting Production Management Software by Functionality, Deployment, Media Type, Company Scale and End-User Roles

Dissecting the production management software market through multiple lenses reveals distinctive value propositions and adoption dynamics. When examining functionality, asset management capabilities form the foundational layer, enabling centralized storage, version control, and metadata governance for rich media assets. Concurrently, budgeting and cost-tracking modules integrate with financial systems to provide granular visibility into project expenditures, while resource allocation tools ensure that personnel, equipment, and facilities are optimally deployed. Content planning and distribution functions address the need for streamlined delivery pipelines, and risk management features safeguard compliance and intellectual property integrity. Collaboration and communication modules bridge creative and technical teams, accelerating feedback loops and decision-making.

Category segmentation delineates deployment preferences among installed on-premises solutions, open-source frameworks, and SaaS offerings. While established studios may favor installed or hybrid configurations to maintain control over proprietary workflows, nimble post-production houses and emerging content creators often embrace SaaS models for their rapid deployment, predictable costs, and built-in security provisions. Media type segmentation underscores divergent priorities between digital content producers-who demand cloud scalability and microservice architectures-and traditional film and television production companies that value deep integrations with desktop editing platforms and legacy infrastructure.

Deployment models further differentiate market offerings, with cloud-based solutions championing flexibility, global accessibility, and continuous updates, whereas on-premises deployments appeal to organizations with stringent data sovereignty, latency, or customization requirements. Company size segmentation highlights how large enterprises leverage enterprise-grade platforms with advanced reporting and governance, while small and medium enterprises gravitate toward modular, cost-effective suites that can scale as production demands evolve. Finally, end-user segmentation illuminates the tailored workflows for content creators, post-production houses, production companies, and studios-each requiring specialized interfaces, reporting dashboards, and integration touchpoints to drive creative ideation, operational oversight, and strategic alignment.

This comprehensive research report categorizes the Production Management software for Media & Entertainment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Workflow Phase

- Production Type

- Pricing Model

- Access Platform

- Application

- End-User

- Organization Size

- Deployment

Identifying Strategic Opportunities and Challenges across the Americas, Europe Middle East & Africa and Asia-Pacific Film and Television Software Markets

The Americas continue to exhibit robust demand for production management software, driven by North American studios’ push to optimize content pipelines for streaming platforms and global distribution. Regional cloud infrastructure investments and favorable regulatory environments have accelerated SaaS adoption, while Latin American production hubs are emerging as cost-efficient co-production destinations, prompting software providers to offer localized language support and multiregional data residency options. In Europe, Middle East & Africa, the fragmentation of regulatory frameworks-from EU data protection directives to localized incentive schemes-has spurred demand for flexible deployment models that can adapt to varying compliance standards. Regional content funding initiatives and cross-border co-productions further require sophisticated rights management and royalty tracking capabilities to ensure transparent financial reporting.

Asia-Pacific stands out as a high-growth region, bolstered by booming digital entertainment ecosystems in markets such as India, South Korea, and Southeast Asia. Local studios and broadcasters are investing heavily in virtual production, game streaming, and short-form digital content, creating opportunities for production management software that integrates with regional virtual studio workflows and mobile-first distribution channels. Providers that offer multicloud support, AI-driven localization, and integration with popular regional editing suites are well-positioned to capture this dynamic market. Across all regions, the convergence of content creation, distribution, and monetization underscores the need for unified platforms that can address diverse regulatory, linguistic, and operational requirements while delivering consistent user experiences.

This comprehensive research report examines key regions that drive the evolution of the Production Management software for Media & Entertainment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Providing a Detailed Examination of Leading Technology Providers Shaping the Production Management Software Landscape in Media & Entertainment

Leading technology providers are advancing production management software by embedding AI-driven automation, expanded integration ecosystems, and enhanced security controls. Autodesk’s ShotGrid platform exemplifies this trend by offering real-time tracking of project assets, flexible API integrations, and automated review workflows that accelerate feedback cycles in large, distributed teams. Similarly, ftrack Studio has matured into a comprehensive post-production management suite, combining timeline planning, team collaboration, and progress analytics designed for VFX and animation pipelines. Celtx continues to cater to small and mid-sized creative teams with an intuitive, browser-based interface that unifies scriptwriting, budgeting, and scheduling, while StudioBinder focuses on call sheets, storyboards, and shot lists that seamlessly integrate with traditional filmmaking practices.

In parallel, established creative software vendors such as Adobe are embedding production tracking features directly into their editing suites, leveraging machine learning to automate tasks like speech-to-text transcription, shot detection, and color matching. Niche specialists like farmerswife emphasize resource scheduling and financial reporting, addressing the needs of large broadcasting entities and rental operations, whereas newcomers such as CETA Software provide end-to-end bidding, scheduling, billing, and reporting modules infused with time-tracking portals for artists and crew members. Collectively, these companies are redefining the competitive landscape by offering tailored solutions that balance deep industry integrations, cloud scalability, and user-centric workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Production Management software for Media & Entertainment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquia, Inc.

- Adobe Inc.

- AiqZon Technologies Pvt Ltd

- Amazon Web Services, Inc.

- Arvato SE

- Atlassian Corporation

- Autodesk, Inc.

- Avid Technology, Inc.

- Bassam Infotech

- BlinkBid Software, LLC

- Cast & Crew LLC

- Celtx Inc. by Backlight.co

- Cognizant Technology Solutions Corporation

- DALET

- Deskera Singapore Pte. Ltd.

- Dramatify AB

- Elinext Softtech Sp. z o.o.

- Entertainment Partners

- FilmTrack, Inc.

- Filmustage Inc.

- Google LLC by Alphabet Inc.

- GoVisually (Clockwork Studio Pty Ltd.)

- International Business Machines Corporation

- ITRex Group

- Jungle Software

- Kaltura, Inc.

- Krock.io

- Microsoft Corporation

- OCTOPUS Newsroom, S.r.o.

- Open Text Corporation

- Oracle Corporation

- SAP SE

- SHIFT Media Holdings, Inc. by EditShare

- Silverline by Mphasis Corporation

- Slack Technologies, LLC by Salesforce, Inc.

- Sony Group Corporation

- StudioBinder Inc.

- TeamViewer SE

- Toon Boom Animation Inc.

- ValueCoders

- VSN, S.L

- Workday, Inc.

- Wrapbook

- Yamdu

Empowering Industry Leaders with Tactical Strategies to Enhance Adoption, Optimize Investments, and Drive Growth in Media & Entertainment Production Management

Industry leaders should begin by auditing existing production workflows to identify inefficiencies and opportunities for automation. By mapping current processes-ranging from asset intake to final delivery-they can establish clear objectives for software deployment that align with organizational goals and creative priorities. It is imperative to engage cross-functional stakeholders early, ensuring that IT, finance, creative, and compliance teams coalesce around a unified vision that balances innovation with governance.

Next, organizations are advised to adopt a phased implementation approach, starting with pilot projects that target high-impact use cases such as remote collaboration, automated asset tagging, or integrated budgeting. These pilots should incorporate key performance indicators that measure time savings, error reduction, and financial transparency. Success metrics will not only validate the business case for broader rollouts but also reveal customization requirements and integration touchpoints with existing systems like ERP, PAM, or MAM platforms.

Further, decision-makers should negotiate scalable licensing models-favoring subscription-based or usage-based pricing-to accommodate fluctuating production volumes and evolving feature needs. Vendors’ professional services teams can be leveraged to accelerate onboarding, provide training, and ensure that best practices are embedded within organizational processes. Finally, industry leaders must remain vigilant of emerging regulatory and trade developments, adapting procurement and deployment strategies to mitigate risks associated with hardware tariffs, data sovereignty, and evolving content rights frameworks.

Explaining the Rigorous Multidimensional Research Framework Underpinning the Analysis of Production Management Software Trends and Market Dynamics

This analysis draws upon a rigorous research framework that integrates primary and secondary data sources, expert interviews, and comparative vendor assessments. Secondary research included an extensive review of industry publications, white papers, and regulatory filings to capture macroeconomic trends, technology adoption patterns, and tariff policy developments. Primary research comprised structured interviews with senior executives at production studios, post-production houses, and software vendors, supplemented by surveys that probed deployment preferences, functionality priorities, and budgeting considerations.

Vendor assessments were conducted using a standardized scoring rubric that evaluated criteria such as integration capabilities, AI-driven features, deployment flexibility, and security controls. To ensure validity and reliability, findings were triangulated by cross-referencing market insights with publicly available case studies and anonymized customer feedback. Geopolitical and regulatory factors, including U.S. tariff measures and regional data compliance mandates, were incorporated through scenario analysis to gauge potential impacts on infrastructure costs and deployment strategies. This multidimensional approach ensures that the conclusions and recommendations presented herein are both comprehensive and actionable for decision-makers across the media and entertainment sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Production Management software for Media & Entertainment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Production Management software for Media & Entertainment Market, by Workflow Phase

- Production Management software for Media & Entertainment Market, by Production Type

- Production Management software for Media & Entertainment Market, by Pricing Model

- Production Management software for Media & Entertainment Market, by Access Platform

- Production Management software for Media & Entertainment Market, by Application

- Production Management software for Media & Entertainment Market, by End-User

- Production Management software for Media & Entertainment Market, by Organization Size

- Production Management software for Media & Entertainment Market, by Deployment

- Production Management software for Media & Entertainment Market, by Region

- Production Management software for Media & Entertainment Market, by Group

- Production Management software for Media & Entertainment Market, by Country

- United States Production Management software for Media & Entertainment Market

- China Production Management software for Media & Entertainment Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3180 ]

Concluding Perspectives on Harnessing Advanced Production Management Software to Bolster Efficiency Resilience and Creative Excellence in Media & Entertainment

In an era defined by rapid technological change and intensifying content competition, production management software stands as a critical pillar for operational resilience and creative excellence. The convergence of AI capabilities, cloud infrastructure, and real-time collaboration tools is reshaping how studios, post-production houses, and content creators plan, execute, and deliver projects. At the same time, external factors such as tariff policies and regional compliance requirements are exerting new pressures on resource allocation and infrastructure investments.

By embracing segmented strategies-tailoring software selections based on functionality needs, deployment preferences, and company size-organizations can optimize for agility, cost efficiency, and strategic alignment. Regional insights highlight the importance of localized capabilities and multicloud support, while company-specific analyses underscore the evolving competitive landscape shaped by vendors embedding AI and automation into core workflows.

Ultimately, success will favor those who adopt a holistic, data-driven approach: leveraging comprehensive vendor evaluations, piloting targeted use cases, and continuously refining processes in response to emerging business and regulatory signals. Through informed decision-making and purposeful technology adoption, media and entertainment organizations can not only navigate current challenges but also unlock new avenues for creativity, collaboration, and growth.

Connect with Ketan Rohom to Secure Exclusive Access to the Definitive Production Management Software Market Research Report for Media & Entertainment

If you’re ready to leverage advanced insights and tailored strategies that will empower your organization to excel in an increasingly competitive media and entertainment landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through the comprehensive findings of our in-depth report, demonstrate how the critical insights apply to your specific challenges, and customize a package that meets your unique requirements. Connect with Ketan today to secure exclusive access to the definitive production management software market research report and position your company at the forefront of innovation and operational excellence.

- How big is the Production Management software for Media & Entertainment Market?

- What is the Production Management software for Media & Entertainment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?