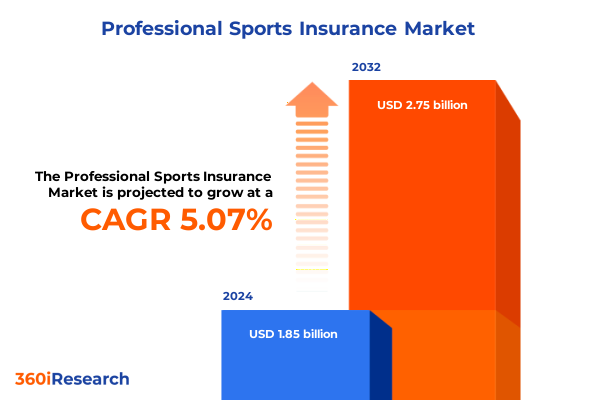

The Professional Sports Insurance Market size was estimated at USD 1.88 billion in 2025 and expected to reach USD 2.00 billion in 2026, at a CAGR of 5.50% to reach USD 2.75 billion by 2032.

Positioning Professional Sports Insurance as the Foundational Shield Against Escalating Liability Exposures and Complexities in Modern Athletic Endeavors

Professional sports insurance delivers essential financial protection that safeguards athletes, teams, and event organizers against an array of complex liabilities and injury risks. As the global sports ecosystem has matured into a multi-billion-dollar industry, insurers have developed specialized policies that address everything from career-ending injuries to event cancellations; these solutions now underpin the commercial viability of leagues, tournaments, and sponsorship agreements. In recent years, heightened visibility of athlete welfare and intensified media scrutiny of injury outcomes have driven decision-makers to adopt robust risk management frameworks that integrate insurance as a cornerstone of operational planning.

Moreover, the market has evolved in response to a series of external dynamics that are reshaping coverage needs and underwriting models. The increasing financial stakes of professional sports events underscore the necessity for policies that blend traditional accident and liability coverage with advanced features such as income protection and rehabilitation support. At the same time, the rising frequency of severe injuries and sharply escalating legal judgments related to equipment failures and on-field incidents have catalyzed a more nuanced approach to policy design. Consequently, insurers are now tasked with balancing comprehensive protection with cost-effective premium structures that meet stakeholder expectations for both performance and value.

Uncovering the Transformative Technological and Demographic Shifts Redefining Risk Assessment and Policy Innovation in Sports Insurance

The professional sports insurance industry is experiencing a profound shift driven by technological advancements that empower underwriters with real-time data and predictive insights. Wearable devices now collect biometric indicators during training and competition, enabling insurers to calibrate premiums dynamically and encourage proactive risk mitigation through personalized feedback loops. This integration of health wearables and machine learning algorithms has unlocked a new era of precision underwriting, where policy terms can adjust in response to an athlete’s evolving risk profile.

Simultaneously, telemedicine platforms have emerged as critical enablers of rapid injury assessment and claims processing, reducing the time between incident and care coordination. Virtual consultations and digital triage tools not only accelerate treatment timelines but also yield detailed data that inform future policy parameters. Insurers who have incorporated these remote diagnostic solutions report significant improvements in claim accuracy and customer satisfaction, highlighting the competitive advantage of technology-enabled service models.

Furthermore, demographic and participation trends are challenging conventional product structures. The growing representation of female and non-binary athletes has spurred demand for tailored income protection and health coverage that accounts for diverse career spans and physiological considerations. In parallel, the rise of digital insurers offering fully online policy customization is prompting legacy providers to pursue strategic alliances with insurtech startups. These collaborations aim to deliver agile platforms that support real-time policy adjustments, fostering a more responsive and customer-centric sports insurance ecosystem.

Analyzing the Cumulative Consequences of 2025 United States Tariffs on Equipment Costs and Coverage Dynamics in Professional Sports Insurance

In 2025, an expanded wave of U.S. tariffs targeting imported sportswear components, safety gear, and rehabilitation equipment has created new cost pressures across the professional sports insurance value chain. Many high-performance protective products are subject to baseline duties that range from 4% to 30% under the Harmonized Tariff Schedule, with additional levies of up to 46% on select goods originating from targeted regions. These surcharges have translated into higher replacement and maintenance expenses, compelling insurers to reevaluate coverage parameters tied to equipment damage and loss.

Insurers have responded to these cost headwinds by adjusting premium structures and policy terms, often introducing equipment-related deductibles and co-insurance components to offset tariff-driven input price volatility. Some carriers have secured volume agreements with domestic manufacturers to stabilize supply costs, while others are exploring self-insurance arrangements for high-value assets. Concurrently, tariff-induced inflation has catalyzed investment in the development of locally sourced alternatives, with insurers offering premium credits and risk-sharing incentives to policyholders who adopt qualifying domestic products. These collective measures illustrate how the industry is navigating regulatory disruptions to preserve both coverage breadth and financial resilience.

Gleaning Critical Insights from Multi-Dimensional Segmentation Revealing Distinct Coverage Needs Across Sports, Policies, and Stakeholder Roles

The sports insurance landscape reveals distinct coverage dynamics when viewed through the lens of sport type segmentation. Baseball organizations, for example, emphasize equipment damage and player liability coverage due to frequent bat-and-ball interactions, whereas football insurers prioritize high-value accident injury protection given the sport’s collision intensity. Golf and tennis participants typically seek policies that focus on participant liability and property damage, reflecting the lower incidence of catastrophic loss but the need to safeguard venue infrastructure and expensive gear.

Coverage type segmentation further illuminates market nuances. Accident injury protection-encompassing medical expenses, permanent disability, and total disability benefits-is a cornerstone offering that addresses the immediate financial fallout of biomechanical injuries. Event cancellation coverage safeguards organizers against revenue losses stemming from financial default, non-appearance, and weather-related interruptions. Product and public liability clauses manage third-party claims, while participant liability and property damage components extend protection to event venues and equipment manufacturers.

When segmented by insured party, athletes-including coaches, officials, and players-require specialized income protection and career-end policies, whereas league and tournament organizers focus on broad-scale event liability and cancellation insurance. Sponsors, whether corporate or individual, lean toward contractual liability and reputational risk safeguards. Teams and organizations, ranging from amateur clubs to professional franchises, demand integrated solutions that consolidate accident, liability, and property damage coverage into unified policy packages.

The distribution channel profile underscores diverse acquisition preferences. Captive and independent agents serve as trusted intermediaries for bespoke program design, while brokers and risk advisors facilitate complex, multi-line placements. Direct sales channels enable insurers to streamline standard policy offerings, and online platforms have emerged as key conduits for rapid quotes, policy customization, and self-service management.

Finally, policy duration segmentation reveals a bifurcated market. Long-term coverage, whether annual or multi-year, appeals to stakeholders seeking continuity and predictable premium commitments, whereas short-term season-pass and single-event policies cater to episodic competition schedules and one-off tournaments.

This comprehensive research report categorizes the Professional Sports Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sport Type

- Coverage Type

- Policy Duration

- Insured Party Type

- Distribution Channel

Dissecting Regional Dynamics and Demand Patterns Shaping the Professional Sports Insurance Market in Americas, EMEA, and Asia-Pacific

The Americas region commands a dominant position in professional sports insurance, driven by the high concentration of premier leagues in North America and Latin America’s expanding tournament calendar. The presence of major franchises in baseball, basketball, and football has spurred advanced product innovation and sophisticated risk management solutions, reinforcing the region’s role as an early adopter of telemedicine integrations and technology-driven underwriting.

In Europe, the Middle East, and Africa, diverse event portfolios ranging from global tennis majors to emerging football tournaments have shaped a robust demand for event cancellation and general liability coverage. Regulatory frameworks in EMEA often mandate minimum insurance thresholds, which has elevated compliance-driven procurement and strengthened partnerships between insurers and local governing bodies. At the same time, high-value sponsorship agreements in Europe’s top leagues have amplified the need for bespoke liability and reputational risk solutions.

Asia-Pacific stands out as the fastest-growing market segment, fueled by government-backed sports initiatives, infrastructure investments, and the emergence of professional leagues in basketball, cricket, and tennis. As participation rates rise across amateur and professional tiers, insurers are customizing products to address unique regional risk profiles, including weather-related event disruptions and athlete wellness programs. Digital distribution channels and telehealth capabilities are particularly resonant in this region, where mobile connectivity underpins rapid policy access and claims processing.

This comprehensive research report examines key regions that drive the evolution of the Professional Sports Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Insurers’ Strategic Moves and Innovation Pathways Driving Competitive Differentiation in Professional Sports Insurance

Leading insurers are strategically differentiating their sports insurance portfolios through targeted product innovations and partnerships. Allianz has capitalized on market demand for holistic athlete welfare by launching an integrated plan that couples career-ending injury protection with mental health support and rehabilitation services in North America and Europe. Chubb has introduced a specialized liability product for the burgeoning e-sports sector, addressing unique risks such as event disruption and cyber liabilities. AXA’s entry into the amateur team space with a customizable accident policy underscores the importance of affordable, flexible solutions for grassroots programs. Meanwhile, Zurich’s advanced event cancellation offering leverages predictive analytics to quantify weather-related risks for major tournaments, and MetLife’s disability coverage designed for high-risk adventure sports highlights the growing need for niche protection across diverse athletic disciplines.

These competitive maneuvers reflect a broader industry pattern: carriers are investing in data partnerships and insurtech collaborations to drive underwriting precision, accelerate claim settlements, and enhance customer engagement. By embedding digital advisory tools and risk mitigation services into their platforms, insurers aim to deepen relationships with policyholders and capture incremental revenue from value-added offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Professional Sports Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- American International Group, Inc.

- Aon plc

- Beazley plc

- Berkshire Hathaway Specialty Insurance

- Chubb Limited

- CNA Financial Corporation

- Great American Insurance Group

- Hiscox Ltd

- Liberty Mutual Insurance Company

- Lloyd's of London

- Markel Group Inc.

- Marsh & McLennan Companies, Inc.

- Munich Reinsurance Company

- Nationwide Mutual Insurance Company

- Philadelphia Insurance Companies

- ProSight Global, Inc.

- State Farm Mutual Automobile Insurance Company

- Swiss Re Ltd.

- The Hartford Financial Services Group, Inc.

- Travelers Companies, Inc.

- Zurich Insurance Group AG

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Fortify Market Positioning and Accelerate Product Innovation

Industry leaders should prioritize investments in advanced risk analytics and wearable technology integrations to deliver dynamic, usage-based premium models that incentivize proactive injury prevention. Cultivating alliances with domestic equipment manufacturers and rehabilitation solution providers can mitigate cost pressures stemming from tariffs while unlocking co-branded value propositions. Strengthening telemedicine and virtual care frameworks is likewise critical, as expedited medical assessments and digital claim adjudication drive both customer satisfaction and loss control.

In addition, insurers are encouraged to architect modular product suites that allow policyholders-from individual athletes to large leagues-to tailor coverage components across accident injury, liability, and property damage segments. Regional product customization, informed by localized risk data and regulatory requirements, will further support market penetration and compliance. Finally, organizations must fortify digital distribution capabilities through enhanced broker portals, self-service platforms, and mobile applications to reduce friction in policy acquisition and renewal cycles.

Elucidating the Rigorous Research Methodology Underpinning Comprehensive Professional Sports Insurance Market Analysis

This analysis is grounded in a rigorous research methodology that blends primary and secondary data sources. Primary research involved structured interviews and surveys with underwriters, risk managers, equipment manufacturers, and sports governing bodies to capture firsthand insights into evolving coverage needs and operational challenges. Secondary research encompassed a comprehensive review of industry publications, regulatory filings, harmonized tariff schedules, and market intelligence databases to establish a robust contextual framework.

Data triangulation techniques were employed to validate findings, reconcile divergent perspectives, and ensure the reliability of trend narratives. Quantitative data points, such as tariff rate schedules and participation metrics, were cross-referenced with qualitative insights derived from expert consultations. Additionally, a systematic content analysis of policy documentation and claims adjudication procedures informed the examination of coverage structures and underwriting adaptations. This methodological approach ensures that the conclusions and recommendations presented herein rest on a foundation of empirical rigor and industry relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Professional Sports Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Professional Sports Insurance Market, by Sport Type

- Professional Sports Insurance Market, by Coverage Type

- Professional Sports Insurance Market, by Policy Duration

- Professional Sports Insurance Market, by Insured Party Type

- Professional Sports Insurance Market, by Distribution Channel

- Professional Sports Insurance Market, by Region

- Professional Sports Insurance Market, by Group

- Professional Sports Insurance Market, by Country

- United States Professional Sports Insurance Market

- China Professional Sports Insurance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Core Insights and Emerging Opportunities to Navigate the Future Landscape of Professional Sports Insurance with Confidence

The evolving professional sports insurance landscape reflects a dynamic interplay of technological innovation, regulatory influences, and shifting stakeholder demographics. As tariffs reshape equipment cost structures and digital platforms accelerate service delivery, insurers must adopt agile underwriting frameworks that accommodate rapid change. Segmentation analysis underscores the importance of tailoring coverage solutions to sport type, insured party, and policy duration, while regional insights highlight the divergent risk profiles and regulatory demands across the Americas, EMEA, and Asia-Pacific.

Looking ahead, the convergence of predictive analytics, telemedicine, and domestic manufacturing partnerships will continue to redefine policy design and claims management. Industry leaders who implement the strategic imperatives outlined here are well-positioned to enhance operational resilience, drive customer loyalty, and capitalize on emerging growth opportunities. By maintaining a relentless focus on innovation and collaboration, insurers can secure their role as indispensable partners in safeguarding athletes and the ecosystems that support them.

Take the Next Step Today by Engaging with Ketan Rohom for Tailored Sales and Marketing Support to Secure Your Comprehensive Market Research Report

Seize this opportunity to gain an unparalleled competitive edge by securing the comprehensive market research report on professional sports insurance. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, empowers you to tailor your acquisition to meet strategic objectives and organizational priorities, ensuring you access the precise insights and data critical to informed decision-making and growth acceleration. Reach out today to transform your understanding of risk dynamics and position your organization for success in the evolving landscape of professional sports insurance.

- How big is the Professional Sports Insurance Market?

- What is the Professional Sports Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?