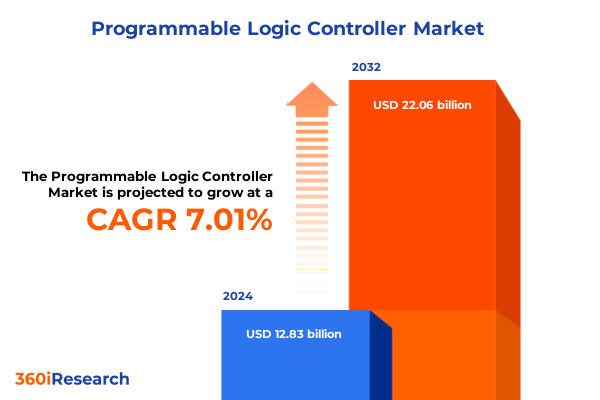

The Programmable Logic Controller Market size was estimated at USD 13.68 billion in 2025 and expected to reach USD 14.60 billion in 2026, at a CAGR of 7.06% to reach USD 22.06 billion by 2032.

Envisioning the Role of Next-Generation Programmable Logic Controllers in Driving Industrial Automation and Operational Resilience in Dynamic Environments

In an era defined by accelerated industrial transformation, programmable logic controllers have emerged as the backbone of digital enterprises striving for both efficiency and flexibility. Organizations across diverse sectors are integrating advanced control systems to streamline production workflows, respond rapidly to shifting market demands, and safeguard operations against unforeseen disruptions. As the sophistication of manufacturing processes continues to deepen, the role of programmable logic controllers has transcended traditional control functions, evolving into intelligent hubs that harmonize operational technology with information technology.

Amid the convergence of robotics, cloud computing, and the Internet of Things, stakeholders are placing growing emphasis on systems that can deliver real-time data insights and adaptive performance. This shift underscores the critical importance of next-generation controllers designed with scalable architectures, modular upgrades, and embedded connectivity. For decision-makers and engineering leaders, understanding these developments is essential to charting a path toward resilient, future-proof infrastructure. Consequently, this report aims to frame the overarching forces redefining the programmable logic controller landscape and to equip executives with the contextual knowledge needed to drive informed strategies.

Navigating the Convergence of Edge Computing, Artificial Intelligence, and Cybersecurity Protocols Reshaping the Programmable Logic Controller Ecosystem

Over recent years, the programmable logic controller market has been reshaped by several transformative trends that are altering both design paradigms and implementation strategies. Foremost among these is the emergence of edge computing architectures that bring decentralized processing power directly to the factory floor, thereby minimizing latency and enabling autonomous decision-making within time-critical applications. Alongside this, artificial intelligence algorithms are being embedded into controller firmware, empowering systems to optimize performance and anticipate maintenance needs through predictive analytics.

Equally significant is the heightened focus on cybersecurity protocols tailored specifically for industrial environments. With increased interconnectivity, controllers have become potential vectors for cyber threats, prompting the integration of secure boot mechanisms, encrypted communication channels, and real-time threat monitoring. At the same time, wireless PLC technologies have matured to support flexible deployment models, reducing cabling constraints and facilitating rapid system expansions. When viewed collectively, these advances signal a pivotal inflection point: programmable logic controllers are no longer isolated islands of automation but foundational elements of a connected, intelligent ecosystem.

Examining How Implemented United States Tariff Regulations in 2025 Influence Supply Chains, Manufacturing Costs, and Strategic Sourcing Decisions in Automation

In 2025, a series of tariff adjustments implemented by the United States have reverberated throughout global supply chains, with direct implications for programmable logic controller manufacturers and end users alike. Components such as processors, interface modules, and specialized I/O boards sourced from impacted countries have experienced upward pressure on landed costs. This dynamic has compelled many original equipment manufacturers to reassess supplier relationships and explore alternative procurement channels to mitigate cost volatility.

Moreover, the cumulative effect of these tariffs has accelerated conversations around nearshoring and the diversification of manufacturing footprints. Organizations are increasingly investigating partnerships with domestic and allied producers to reduce exposure to cross-border trade uncertainties. Simultaneously, engineering teams are prioritizing design flexibility to accommodate component substitutions without compromising system integrity. Within this context, purchasing strategies have become more agile; decision-makers are balancing the pursuit of cost efficiencies against the imperative to maintain supply continuity. Looking ahead, the ongoing recalibration of sourcing paradigms underscores the importance of strategic foresight and supply chain resilience for stakeholders in the programmable logic controller arena.

Unveiling Segmentation Insights Across Product Types, Service Offerings, Technological Modalities, and Industry-Specific Applications Driving Market Dynamics

When evaluating programmable logic controller offerings through the lens of product type, compact designs have gained traction in applications demanding space efficiency, whereas modular configurations appeal to operations seeking scalable expansion capabilities. Rack-mounted systems continue to serve high-capacity installations that require centralized monitoring and ease of maintenance. In parallel, a spectrum of service and software solutions complements hardware investments: integration services facilitate seamless system deployment, ongoing maintenance services protect uptime, and specialized training ensures operational proficiency. On the software front, integrated programming environments streamline development workflows, PC-based PLCs offer flexible access for remote diagnostics, and standalone software packages support off-line testing and validation.

Technological segmentation further reveals the rising adoption of wireless PLCs, which enable flexible layouts and reduce cabling complexity, alongside traditional wired solutions prized for their determinism in mission-critical settings. Power supply considerations also differentiate the market: controllers equipped with switched-mode power supplies (SMPS) at 230 VAC cater to heavy industrial networks, while those operating on 24 VDC without SMPS serve compact and mobile automation modules. Size classifications-from nano-scale devices suited to micro-automation tasks to very large controllers deployed in extensive infrastructure-illustrate the adaptability of PLCs across footprint requirements. Deployment modes span from cloud-based systems offering centralized analytics and remote monitoring to on-premise installations delivering maximal control sovereignty. End user industries such as automotive leverage assembly line automation, quality control systems, and robotic applications; food and beverage operations capitalize on bottling processes, packaging automation, and precise temperature regulation; oil and gas firms integrate drilling automation, pipeline management, and refinery control systems; and pharmaceutical manufacturers depend on handling solutions, manufacturing automation, and rigorous quality assurance protocols to maintain compliance.

This comprehensive research report categorizes the Programmable Logic Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Offering

- Technology

- Power Supply

- Size

- Deployment Mode

- End User Industry

Assessing Regional Market Characteristics and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Automation Sectors

Across the Americas, manufacturers are accelerating investments in digital automation to support reshoring initiatives and enhance supply chain robustness. North American automotive and pharmaceutical sectors continue to drive demand for integrated control platforms, prioritizing systems that offer seamless interoperability with enterprise resource planning and manufacturing execution systems. Meanwhile, in Latin America, industrial modernization efforts are creating incremental opportunities for scalable PLC solutions, particularly in light of regional infrastructure upgrades.

In Europe, Middle East, and Africa, a convergence of regulatory mandates and sustainability goals is shaping automation strategies. Manufacturers are adopting energy-monitoring modules and advanced process controls to comply with emissions standards and reduce carbon footprints. Rising interest in smart grid integration has also spurred collaboration between utilities and industrial end users to deploy PLC-based demand response solutions. The Middle East’s expanding petrochemical facilities and Africa’s mining sector modernization further underscore the demand for robust control architectures.

In Asia-Pacific, robust government incentives for smart manufacturing and Industry 4.0 adoption are driving widespread PLC implementation across diverse markets. Industrial giants in East Asia continue to push for high-precision automation, while Southeast Asian countries are embracing cost-effective wireless control platforms to support small and medium-sized enterprises. The region’s rapid urbanization and infrastructure development ensure that demand for both entry-level and advanced programmable logic controllers remains strong.

This comprehensive research report examines key regions that drive the evolution of the Programmable Logic Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning, Innovation Portfolios, and Competitive Collaboration Patterns Among Leading Programmable Logic Controller Providers

Leading programmable logic controller providers have adopted distinct strategic approaches to capture market opportunities. Some have prioritized the expansion of modular controller architectures, enabling rapid scaling through plug-and-play I/O and processor units. Others have deepened integration between PLC hardware and specialized software suites, driving stickiness through unified development environments and lifecycle management tools. Partnerships with cloud service providers have emerged as a common thread, positioning these firms to offer hybrid on-premise and cloud-native solutions tailored to customers’ digital transformation roadmaps.

Innovation portfolios reveal a pronounced emphasis on edge analytics and AI-driven diagnostics, with companies racing to embed machine learning capabilities directly into control units. Concurrently, joint ventures and strategic acquisitions are facilitating access to complementary technologies such as cybersecurity platforms and industrial networking components. Cross-collaboration with robotics and sensor manufacturers has also intensified, reflecting a broader industry shift toward holistic automation ecosystems rather than standalone controller offerings. This strategic diversification underscores how top-tier vendors are reinforcing their competitive moats by delivering end-to-end value chains, from device layer to enterprise management applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Programmable Logic Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Micro Controls, Inc.

- Anaheim Automation, Inc.

- Beckhoff Automation Group

- Crouzet Groupe

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- Graco Inc.

- Hitachi, Ltd.

- Honeywell International Inc.

- IDEC Corporation

- Infineon Technologies AG

- Intel Corporation

- Keyence Corporation

- Mitsubishi Electric Corporation

- Murata Manufacturing Co., Ltd.

- OMRON Corporation

- Opto 22

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- STMicroelectronics N.V.

- Toshiba Corporation

- Unitronics (1989) (R”G) Ltd.

- UpKeep Technologies, Inc.

- Yokogawa Electric Corporation

Empowering Industry Leaders with Targeted Strategies for Optimization, Digital Integration, and Resilient Supply Chain Management in Automation Environments

To capitalize on accelerating automation trends, industry leaders should prioritize the development of flexible supply chain frameworks that incorporate dual-sourcing and localized manufacturing partnerships. By diversifying component procurement across domestic and allied regions, organizations can safeguard against tariff-induced cost fluctuations and geopolitical disruptions. Simultaneously, investing in cybersecurity frameworks designed for operational technology will be imperative to protect critical control infrastructure from evolving threat vectors.

On the technology front, enterprise stakeholders should explore the deployment of edge-AI capabilities to enable real-time process optimization, predictive maintenance, and adaptive control strategies. Coupling these advances with robust training programs will ensure that workforce competencies align with the demands of increasingly intelligent automation platforms. In addition, fostering strategic alliances with software integrators and cloud providers can accelerate the introduction of hybrid deployment models, enabling remote monitoring and analytics while retaining on-premise control where necessary.

Outlining Rigorous Research Methodology Combining Primary Interviews, Supply Chain Analysis, and Technological Maturity Assessments for Unbiased Insights

This study synthesizes insights from structured interviews conducted with C-level executives, control engineers, and channel partners across key end user industries. Primary research was complemented by in-depth discussions with technology providers and system integrators to capture nuanced perspectives on deployment challenges and innovation trajectories. Secondary data sources included industry association publications, technical whitepapers, and patent filings, enabling a comprehensive review of technological advancements and regulatory developments.

The research methodology employed a rigorous triangulation process, cross-validating findings from interviews with published data and expert commentary. Analytical frameworks were applied to evaluate the maturity of emerging PLC architectures, assess the resilience of supply chains in the context of tariff changes, and map strategic initiatives of leading vendors. The culmination of these methods ensures that the insights presented herein are both robust and reflective of current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Programmable Logic Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Programmable Logic Controller Market, by Product Type

- Programmable Logic Controller Market, by Offering

- Programmable Logic Controller Market, by Technology

- Programmable Logic Controller Market, by Power Supply

- Programmable Logic Controller Market, by Size

- Programmable Logic Controller Market, by Deployment Mode

- Programmable Logic Controller Market, by End User Industry

- Programmable Logic Controller Market, by Region

- Programmable Logic Controller Market, by Group

- Programmable Logic Controller Market, by Country

- United States Programmable Logic Controller Market

- China Programmable Logic Controller Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing Key Discoveries on Programmable Logic Controller Trends, Tariff Impacts, and Strategic Imperatives for Industry Stakeholders

As programmable logic controllers assume an ever more central role in modern automation strategies, organizations must navigate a landscape characterized by rapid technological convergence and complex trade dynamics. Edge computing, artificial intelligence, and enhanced cybersecurity are collectively redefining the capabilities of control systems, while tariff adjustments have underscored the need for adaptive sourcing strategies and supply chain resilience. Through careful segmentation analysis and regional evaluation, it becomes clear that tailored approaches are required to address diverse application requirements and geographic priorities.

Leading vendors are responding with integrated solution portfolios that blend hardware innovation, software ecosystems, and strategic partnerships. For industry stakeholders, the imperative is to align investment decisions with actionable insights, ensuring that controller architectures support both immediate operational needs and long-term transformation goals. The fusion of advanced analytics, flexible deployment models, and collaborative ecosystems sets the stage for a new era of intelligent automation, one in which programmable logic controllers will continue to serve as the linchpin of competitive advantage.

Unlock Insights and Propel Automation Excellence Today by Connecting with Ketan Rohom to Access the Programmable Logic Controller Market Research Report

To embark on a journey toward greater operational intelligence and automation leadership, engage directly with Associate Director, Sales & Marketing Ketan Rohom. By securing full access to the comprehensive programmable logic controller market research report, you will benefit from in-depth analyses, strategic insights, and actionable recommendations tailored to elevate your organization’s competitive positioning. Ketan Rohom brings extensive expertise in aligning customer objectives with research deliverables, ensuring you receive the guidance and support necessary to translate market intelligence into tangible business outcomes. Reach out to Ketan Rohom today and take the decisive step toward unlocking unparalleled intelligence in programmable logic controller technology and implementation.

- How big is the Programmable Logic Controller Market?

- What is the Programmable Logic Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?