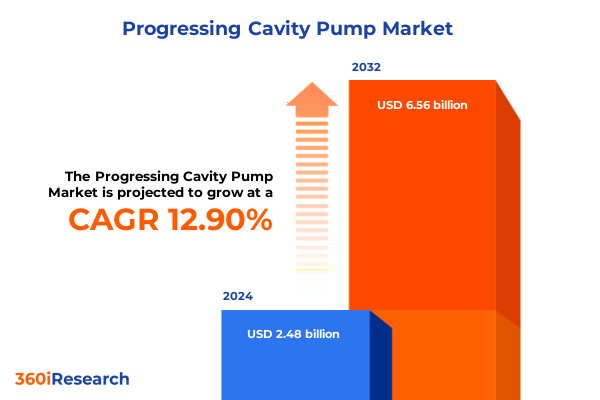

The Progressing Cavity Pump Market size was estimated at USD 2.77 billion in 2025 and expected to reach USD 3.10 billion in 2026, at a CAGR of 13.08% to reach USD 6.56 billion by 2032.

Setting the Stage for Unveiling Key Insights and Strategic Imperatives in the Dynamic Progressing Cavity Pump Market Landscape

Progressing cavity pumps have emerged as a cornerstone technology across diverse industrial sectors, facilitating the efficient and reliable transfer of high-viscosity fluids under demanding conditions. These positive displacement pumps are valued for their unique design, which enables smooth, pulseless flow and exceptional handling of abrasive or shear-sensitive materials. In the wake of accelerating global industrialization and sustainability imperatives, the strategic importance of progressing cavity pumps has never been more pronounced, necessitating a holistic understanding of market drivers, technological innovations, and regulatory impacts.

This executive summary distills key insights into the dynamic landscape guiding the progression of cavity pump applications and adoption. It seamlessly navigates through transformative technological shifts, the cumulative effects of recent tariff regimes, granular segmentation insights spanning end users to drive types, and regional growth differentials. High-level company strategies and collaborative ventures are examined to highlight competitive positioning, followed by targeted recommendations aimed at operational resilience and market expansion.

Underpinned by a robust research methodology blending primary stakeholder engagements and comprehensive secondary data synthesis, this summary offers a concise yet insightful foundation for strategic decision-making. In the sections that follow, stakeholders will gain clarity on how evolving market forces intersect to shape the next frontier of the progressing cavity pump domain.

Analyzing Pivotal Technological and Operational Shifts Redefining Efficiency and Performance Standards in the Progressing Cavity Pump Sector

In recent years, the progressing cavity pump sector has experienced transformative shifts propelled by advancements in digitalization, materials science, and energy optimization. Manufacturers are integrating real-time monitoring sensors and Internet of Things (IoT) connectivity into pump assemblies, enabling predictive maintenance and performance analytics that reduce unplanned downtime. Meanwhile, developments in composite and high-alloy materials have enhanced corrosion resistance and mechanical durability, extending service life in harsh chemical and wastewater applications.

Moreover, operational paradigms are evolving as end users prioritize modularity and customization. Configurable stator and rotor designs now allow for rapid reconfiguration to meet unique viscosity, temperature, and pressure requirements across industries such as oil and gas, food and beverage, and pharmaceuticals. Sustainability mandates are also reshaping workflows, with pump developers refining seal-less architectures and low-energy drive systems to minimize fugitive emissions and carbon footprints.

Consequently, companies that embrace these technological and operational shifts are well positioned to capture market share and foster long-term customer loyalty. As market competition intensifies, leveraging digital tools, next-generation materials, and energy-efficient innovations will be crucial for maintaining a leadership edge in the progressing cavity pump arena.

Assessing the Profound Cumulative Impact of United States Tariffs Implemented in 2025 on Supply Chains Production Costs and Market Dynamics

The introduction of new United States tariffs in 2025 has exerted significant influence on supply chain structures, production economics, and procurement strategies within the progressing cavity pump market. By imposing increased duties on imported pump components and finished assemblies, domestic manufacturers face heightened raw material costs for critical alloys, while end users contend with elevated acquisition expenses. These cumulative financial pressures have prompted a reevaluation of supplier relationships and sourcing geographies, driving a resurgence of localized manufacturing initiatives.

In addition to direct cost impacts, the tariffs have triggered broader strategic responses. Many OEMs are diversifying their supplier bases beyond traditional import hubs to mitigate exposure to duty fluctuations. Concurrently, collaborative partnerships are emerging between material producers and pump fabricators to innovate alternative alloy formulations that deliver comparable performance at reduced tariff liabilities. Furthermore, end users are reassessing total cost of ownership models, balancing upfront capital commitments against long-term operational efficiencies.

Looking ahead, the ongoing adaptation to tariff-driven market conditions underscores the importance of agile supply chain management and forward-looking procurement policies. By proactively addressing the cumulative ramifications of trade policy shifts, stakeholders can safeguard profitability and sustain reliable fluid handling solutions.

Extracting Actionable Insights from Key Segmentation Dimensions Spanning End Users Stage Material and Drive Types in the Progressing Cavity Pump Domain

A nuanced examination of market segments reveals that fluid handling requirements vary significantly across end-user industries, with chemical processing operations demanding high-precision metering for corrosive substances and construction applications focusing on abrasion resistance during grout injection. In food and beverage, sanitary designs are paramount to uphold hygiene standards, whereas mining environments prioritize resilience against solids-laden slurries. The oil and gas sector relies heavily on progressing cavity pumps for enhanced oil recovery techniques, while pharmaceuticals mandate gentle shear handling for sensitive formulations. Likewise, pulp and paper processes emphasize continuous flow stability, and water and wastewater facilities seek robust, low-maintenance equipment to manage fluctuating load profiles.

When considering pump architectures, multi-stage configurations are gaining traction in high-pressure scenarios, delivering staged compression across sequential chambers, while single-stage variants maintain prominence in moderate-pressure operations due to their simplicity and cost-effectiveness. Material selection exerts considerable influence on longevity and application fit; alloy steel components are favored for high-strength requirements, cast iron offers economical durability in non-corrosive settings, and stainless steel excels in corrosive or sanitary contexts.

Drive type further shapes performance outcomes, with electric motors driving the bulk of installations owing to their efficiency and ease of integration into automation systems. Hydraulic drives serve niche scenarios demanding remote or explosion-proof operation, and mechanical drives persist in specialized, low-maintenance roles. Understanding these segmentation insights helps stakeholders tailor product portfolios, align R&D priorities, and address specific end-user pain points within the progressing cavity pump domain.

This comprehensive research report categorizes the Progressing Cavity Pump market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Stage

- Material

- Drive Type

- End User

Delving into Regional Market Dynamics across the Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Drivers and Emerging Opportunities

Regional market dynamics for progressing cavity pumps are characterized by distinct growth drivers and adoption patterns. In the Americas, robust activity within water and wastewater treatment projects, coupled with advanced oil and gas extraction techniques, underpins steady demand for high-performance pump solutions. Local manufacturing bases continue to expand in response to favorable regulatory frameworks and incentives for domestic production, supporting the introduction of next-generation pump offerings tailored to stringent North American standards.

Within Europe, Middle East, and Africa, sustainability regulations and environmental compliance remain at the forefront of procurement decisions. This regulatory landscape has accelerated the deployment of low-emission pump technologies and seal-less designs that align with the region’s ambitious carbon reduction targets. In parallel, burgeoning investments in petrochemical facilities across the Middle East and North Africa have spurred demand for heavy-duty progressing cavity pumps capable of handling complex hydrocarbons under challenging conditions.

Asia-Pacific stands out as a high-growth theater driven by rapid industrialization, infrastructure expansion, and surging demand in mining, chemicals, and food processing sectors. Emerging economies are investing heavily in water treatment and agricultural processing initiatives, catalyzing the uptake of modular and energy-efficient pump systems. Moreover, local OEMs are forging alliances with global players to introduce advanced pump technologies and reduce lead times, reinforcing the region’s strategic importance within the global progressing cavity pump ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Progressing Cavity Pump market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Shaping Competitive Advantage and Driving Innovation within the Progressing Cavity Pump Marketplace

The competitive landscape is shaped by several established entities and emerging innovators that are continuously refining their product portfolios and strategic partnerships. Leading OEMs are investing in research and development to integrate digital monitoring capabilities, enhanced seal materials, and modular designs that cater to evolving end-user requirements. Strategic collaborations between pump manufacturers and materials science firms have resulted in the co-development of high-performance alloys and stator compounds that extend mean time between failures and reduce lifecycle costs.

Mergers and acquisitions have also played a pivotal role in consolidating expertise and expanding geographic reach. Major players are acquiring specialized technology providers to bolster their service offerings in remote monitoring and predictive analytics. Joint ventures between global corporations and regional fabricators facilitate faster time-to-market for localized pump variants, offering clients both global quality standards and regional support networks.

Additionally, a wave of start-ups is entering the market with niche solutions targeting specific industrial subsegments. These agile entrants emphasize customizable designs, rapid prototyping capabilities, and subscription-based maintenance models. As competition intensifies, stakeholders must remain vigilant of emerging threats and seize opportunities to differentiate through technological leadership and customer-centric services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Progressing Cavity Pump market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baker Hughes Company

- ChampionX Corporation

- Dover Corporation

- Halliburton Company

- Interpump Group S.p.A.

- Kawasaki Heavy Industries, Ltd.

- NETZSCH Pumpen & Systeme GmbH

- Nikkiso Co., Ltd.

- NOV Inc.

- PCM, Inc.

- Schlumberger Limited

- SEEPEX GmbH

- Sulzer Ltd.

- The Weir Group PLC

- Weatherford International plc

- Xylem Inc.

Formulating Pragmatic Action Plans and Strategic Recommendations to Empower Industry Leaders in Seizing Market Opportunities and Mitigating Operational Risks

Industry leaders should prioritize investment in digital transformation initiatives, embedding advanced sensors and analytics software into pump systems to enable real-time visibility into performance metrics and proactive maintenance scheduling. By leveraging this data-driven approach, operators can minimize downtime, reduce repair costs, and extend equipment lifecycles. In addition, forming strategic alliances with materials technology firms will accelerate the introduction of next-generation stator and rotor materials that deliver superior wear and corrosion resistance.

Furthermore, localizing key components of the supply chain can mitigate exposure to tariff volatility and logistics disruptions. Establishing regional manufacturing facilities or forging co-production agreements with local fabricators allows for faster response to customer demand and enhances supply security. Concurrently, diversifying end-user verticals by targeting high-growth segments such as wastewater treatment and pharmaceutical processing will balance portfolio risk and unlock new revenue streams.

Finally, executives should engage with regulatory bodies and industry consortia to shape standards around energy efficiency and emissions control. Proactively participating in policy discussions ensures that evolving regulations reflect practical operational realities and fosters goodwill with stakeholders. By adopting these multifaceted strategies, organizations will be well positioned to capture emerging opportunities and maintain resilience in an increasingly complex market environment.

Outlining a Robust Research Methodology Integrating Primary and Secondary Approaches for Comprehensive Analysis of the Progressing Cavity Pump Landscape

This research initiative employed a dual-phased methodology combining primary interviews and rigorous secondary data analysis. The primary phase encompassed structured interviews and roundtable discussions with senior executives, design engineers, and procurement specialists across major end-user industries. These engagements yielded firsthand insights into evolving application requirements, procurement considerations, and emerging technology adoption trends.

Complementing this, the secondary phase entailed an exhaustive review of industry publications, technical journals, patent filings, and regulatory frameworks. Publicly available company disclosures and trade association reports were systematically analyzed to capture historical developments, technological breakthroughs, and competitive positioning. Data triangulation techniques were applied to reconcile differing viewpoints and validate key findings.

Quantitative data sets were synthesized to map segmentation dimensions, regional dynamics, and competitive landscapes, while qualitative inputs informed strategic recommendations. Throughout the process, strict validation protocols ensured the accuracy and reliability of insights, providing stakeholders with a transparent, evidence-based foundation for decision-making within the progressing cavity pump domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Progressing Cavity Pump market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Progressing Cavity Pump Market, by Stage

- Progressing Cavity Pump Market, by Material

- Progressing Cavity Pump Market, by Drive Type

- Progressing Cavity Pump Market, by End User

- Progressing Cavity Pump Market, by Region

- Progressing Cavity Pump Market, by Group

- Progressing Cavity Pump Market, by Country

- United States Progressing Cavity Pump Market

- China Progressing Cavity Pump Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings and Strategic Takeaways to Illuminate the Future Trajectory and Value Creation Pathways in the Progressing Cavity Pump Market

The progressing cavity pump market is undergoing a significant transformation driven by technological innovation, regulatory shifts, and evolving end-user requirements. Advancements in digital monitoring, materials science, and energy-efficient drive systems are redefining performance benchmarks, while evolving trade policies have underscored the need for agile supply chain strategies. Segmentation analyses reveal that end-user demands, pump stage configurations, material selections, and drive type preferences collectively shape product development priorities.

Regional variations further highlight the importance of localized approaches, with the Americas emphasizing domestic manufacturing and water sector investments, EMEA propelling sustainable pump technologies under stringent environmental mandates, and Asia-Pacific capitalizing on rapid industrial expansion and infrastructural growth. Competitive dynamics are characterized by strategic R&D investments, collaborative ventures, and targeted M&A activity, all aimed at securing innovation leadership and expanding market penetration.

In sum, decision-makers must adopt a holistic perspective that integrates digital transformation, supply chain resilience, and regulatory engagement to unlock the full potential of progressing cavity pump applications. This comprehensive analysis provides a solid groundwork for strategic planning and sustained value creation in an increasingly complex ecosystem.

Engaging with Ketan Rohom to Secure In-Depth Market Intelligence and Unlock Strategic Advantages through Acquisition of the Comprehensive Research Report

The comprehensive research report on progressing cavity pumps delivers unparalleled market intelligence, equipping stakeholders with deep analytical insights and strategic foresight. By engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, decision-makers can access this meticulously crafted study that navigates through technological breakthroughs, regulatory influences, and competitive dynamics. This report synthesizes in-depth segmentation analyses, regional evaluations, and company profiles alongside actionable recommendations to support investment decisions and operational enhancements.

Purchasing the report ensures an exclusive window into primary interview findings with industry experts, rigorous secondary data validation, and evidence-based conclusions that drive confidence in strategic planning. With the nuanced understanding of end-user demands, supply chain challenges, and emerging regional growth pockets, executives can tailor growth strategies and innovation roadmaps to capture value effectively. Reach out to Ketan Rohom to secure your copy today and empower your organization with the critical insights needed to stay ahead in a rapidly evolving market.

- How big is the Progressing Cavity Pump Market?

- What is the Progressing Cavity Pump Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?