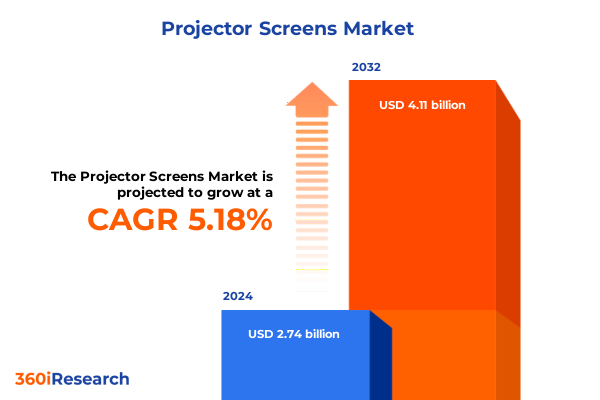

The Projector Screens Market size was estimated at USD 2.87 billion in 2025 and expected to reach USD 3.01 billion in 2026, at a CAGR of 5.23% to reach USD 4.11 billion by 2032.

Unveiling the evolution of projector screen solutions as dynamic display demands reshape the visual presentation landscape

The projector screen sector has experienced accelerated transformation as businesses, educational institutions, and consumers demand increasingly immersive and versatile visual display solutions. In recent years, the integration of higher resolution projection technologies alongside the proliferation of hybrid work and learning models has elevated the importance of reliable, high-performance screen surfaces. These developments have not only expanded the addressable applications for screens-ranging from home theaters to large-venue corporate presentations-but also underscored the need for product innovation focused on convenience, quality, and adaptability.

As digital content continues to dominate boardrooms, classrooms, and living rooms, market participants are compelled to refine their offerings to meet diverse user requirements. The intersection of improved projection technology, advanced screen materials, and emerging form factors has created fertile ground for novel solutions aimed at enhancing image clarity, reducing ambient light interference, and streamlining installation. Against this backdrop, stakeholders are presented with both challenges and opportunities to differentiate through targeted product portfolios and strategic partnerships that cater to an increasingly discerning customer base.

Examining the tectonic shifts in projector screen innovation driven by emerging technologies and evolving end-user expectations

Technological advancements have reshaped projector screen design, driving shifts that extend well beyond traditional framing and pull-down mechanisms. Ambient light rejecting (ALR) surfaces have moved to the forefront, addressing one of the most significant constraints in uncontrolled lighting environments. This innovation has enabled corporate lobbies and educational facilities to deliver crisp, high-contrast imagery without extensive light control, thereby broadening screen adoption. Simultaneously, the refinement of ultra-short-throw projection compatibility has spurred demand for slim, rigid screens capable of preserving image geometry even at steep projection angles.

The rapid uptake of portable and motorized solutions reflects changing user expectations around flexibility and ease of use. Wireless connectivity between projectors and display management software has enabled dynamic content switching, fostering collaborative workspaces and interactive presentations. Moreover, the emergence of eco-friendly materials in screen fabrication underscores a growing emphasis on sustainability, with manufacturers testing bio-based coatings and recyclable substrates that promise to lower environmental footprints. Taken together, these transformative developments are redefining how organizations and end users approach visual communication, compelling screen producers to innovate across materials, installation mechanisms, and integrated software functionality.

Assessing the combined effects of recent United States tariff adjustments on materials procurement and pricing within the projector screen supply chain

In early 2025, adjustments to United States import tariffs on select screen materials, including aluminum alloys and specialized coating compounds, have imposed notable cost pressures along the supply chain. These measures, enacted under revised trade policy frameworks, have increased the landed cost of certain raw inputs sourced predominantly from Asia. As a result, manufacturers have been prompted to reevaluate supplier diversification strategies and explore alternative material blends to preserve margin structures. In parallel, some domestic producers have leveraged tariff protections to expand localized assembly operations, reducing exposure to cross-border duties and logistical delays.

While higher input costs have been partially absorbed through operational efficiencies and optimized production workflows, end users are beginning to see incremental price adjustments at the point of sale. The cumulative effect of this tariff landscape has also accelerated investments in near-shore and on-shore manufacturing partnerships aimed at mitigating future trade volatility. From a strategic standpoint, organizations that proactively engaged in supply chain risk assessments during this period have been better positioned to negotiate favorable long-term contracts and maintain service levels despite external headwinds.

Revealing critical insights from diverse segmentation perspectives to navigate the multifaceted projector screen market dynamics

Insights drawn from the analysis of product typologies reveal that fixed screens remain the foundation for high-end boardroom and auditorium installations, where minimal maintenance and consistent image tension are paramount. Conversely, portable and retractable configurations have gained traction in multifunctional spaces, accommodating on-the-go presentations and flexible seating arrangements. By examining material composition, it becomes clear that fiberglass-backed and glass-beaded surfaces continue to underpin premium offerings, delivering superior gain and color accuracy. Meanwhile, matte white variants meet the needs of budget-sensitive segments, and perforated vinyl has found a niche in sound-integrated theaters where acoustics are critical.

Installation method is another defining dimension: ceiling mounts dominate fixed setups, enabling unobstructed floor plans, while tripod and floor-set solutions serve transient environments such as trade shows and temporary training venues. Wall-mounted screens strike a balance between permanence and space efficiency in classrooms and small meeting rooms. In terms of drive mechanism, motorized systems have outpaced pull-down alternatives as control software integration and remote operation have become table stakes. Fixed-frame screens, prized for uniform tension and zero wrinkle characteristics, hold a strong position in premium residential home theaters.

Aspect ratio preferences underscore the continued dominance of widescreen formats, with 16:9 viewing surfaces accounting for the bulk of newly specified installations in both professional and personal contexts. The enduring legacy of 4:3 ratios remains in legacy systems, and square 1:1 screens support niche requirements for interactive whiteboarding. Across user applications, professional deployments outnumber personal ones, driven by robust demand in education, government, and corporate sectors. Within these professional domains, verticals such as aerospace & defense, healthcare & pharmaceuticals, and IT & telecom exhibit particularly strong appetite for specialized screen finishes and form factors. Distribution channels further shape market access, as offline networks leverage direct sales teams and distributor partnerships to serve established clients, while online platforms drive rapid order fulfillment and end-user convenience.

This comprehensive research report categorizes the Projector Screens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Installation Type

- Mechanism

- Screen Aspect Ratio

- Application

- Distribution Channel

Illuminating dominant regional trends and growth drivers shaping the projector screen market across the Americas, EMEA, and Asia-Pacific markets

Regional distinctions have become increasingly pronounced as projector screen suppliers tailor their offerings to meet local infrastructure and regulatory considerations. In the Americas, end-users prioritize quick-install solutions and high-contrast surfaces suitable for both corporate and educational installations, with a growing emphasis on portable screens for hybrid work models. The region’s focus on retrofit projects in legacy facilities has also underlined the importance of adaptable mounting options and modular screen designs.

Across Europe, Middle East & Africa, product adoption is influenced by strict building codes and sustainability mandates, driving uptake of eco-certified materials and low-energy motorized systems. The presence of multinational corporations and international educational institutions in major urban centers has spurred demand for premium tensioned screens, while emerging markets within EMEA seek cost-effective portable alternatives to support small business and remote learning scenarios.

Asia-Pacific remains a hotbed of innovation and volume demand, propelled by rapid infrastructure development in commercial real estate, hospitality, and government sectors. Local manufacturers have scaled operations to supply both domestic and export markets, leveraging lower production costs to offer aggressive pricing. Meanwhile, rising consumer incomes in urban centers have bolstered interest in home theater installations, prompting a surge in mid-range fixed-frame solutions that cater to discerning residential customers.

This comprehensive research report examines key regions that drive the evolution of the Projector Screens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading global players and strategic partnerships steering competitive advancements in the projector screen industry landscape

Competitive intensity within the projector screen industry is underscored by a handful of established players that leverage strong brand equity, extensive distribution networks, and continuous product development. Elite Screens has consolidated its position through a broad portfolio that encompasses entry-level tripods and professional motorized formats, paired with strategic alliances in semiconductor and optics to enhance surface performance. Da-Lite has similarly focused on precision engineering, offering tensioned surfaces optimized for ultra-short-throw projection and incorporating interactive touch-sensitivity to address collaborative workspace needs.

Draper has pursued a differentiated strategy by introducing modular wall systems that integrate seamlessly with architectural finishes, enabling turn-key installations in commercial complexes. Meanwhile, Screen Innovations has carved out a premium niche with advanced ALR coatings and custom aspect-ratio customization, drawing significant interest from high-end residential clients and luxury venue operators. Smaller specialized firms have also emerged, targeting vertical-specific requirements, such as perforated acoustic screens for concert venues and reinforced materials for outdoor digital signage.

Recent partnerships between screen producers and technology providers have further intensified competition. Collaborations with software developers have resulted in cloud-enabled calibration tools and performance analytics, empowering facility managers to remotely monitor image quality. Joint ventures with projector OEMs have yielded bundled solutions that simplify procurement processes for large-scale deployments. Collectively, these dynamics are driving both incremental innovations and disruptive leaps, raising the bar for product performance and service differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Projector Screens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acer Inc.

- Adeo Screen sp. z o.o.

- AV Stumpfl GmbH

- Avers Screens by Kraftmann Cezary Czerny

- Barco NV

- BenQ Material Corporation by Qisda Corporation

- Dai Nippon Printing Co., Ltd.

- Draper, Inc.

- Elcor Screen

- Elite Screens Inc.

- Endurescreens Kft

- Enyroom AB

- EPV Screens

- Glimm Display

- Grandview Crystal Screen Co., Ltd.

- Guangzhou Xiong-Yun Audio-Visual Equipment Co., Ltd.

- Hisense International Co., Ltd.

- KAUBER

- Legrand AV Inc.

- Luxi Srl

- Optoma Technology, Inc.

- Quartet by Acco Brands

- Samsung Electronics Co., Ltd.

- Sapphire AV

- Screen Excellence Ltd.

- Screen Innovations

- Screenline Srl

- Severtson Screens

- Seymour-Screen Excellence LLC

- Silver Ticket Products

- Sim-Lab B.V

- Snap One, LLC by Resideo Technologies, Inc.

- So.Par SRL

- Stewart Filmscreen

- Stretchy Screens

- Strong/MDI Screen Systems, Inc. by Ballantyne Strong Inc.

- The Net Return

- Viz-Art Automation

- Xiaomi Corporation

- ZEBRONICS INDUSTRIES PRIVATE LIMITED

Proposing actionable strategies for industry leaders to capitalize on evolving projector screen market opportunities and sustain competitive differentiation

To thrive in this evolving environment, industry leaders should prioritize diversification of material sourcing by establishing multi-tier supply agreements that blend cost efficiency with quality assurance. Investing in research partnerships to develop next-generation ALR coatings and recyclable substrates can yield both environmental benefits and competitive advantage. At the same time, integrating smart control systems across motorized screens will address customer demand for remote management and predictive maintenance, resulting in stronger value propositions for enterprise clients.

Strategic channel expansion merits focused attention: digital commerce platforms should be optimized with immersive product configurators and virtual try-before-you-buy experiences, while offline sales channels must emphasize consultative services and post-installation support. Collaborations with end-users in key verticals-such as education and healthcare-can unlock co-development opportunities for specialized screen features, reinforcing vendor lock-in and brand loyalty. Finally, scenario planning exercises that account for potential shifts in trade policy and raw material availability will enable swift operational adjustments and safeguard profit margins against external disruptions.

Outlining rigorous research approaches and data validation techniques underpinning the comprehensive analysis of the projector screen market

This comprehensive analysis was conducted through a multi-stage research framework combining primary and secondary methodologies. Secondary data sources included industry publications, patent filings, and public corporate disclosures, carefully reviewed to map technology trends and product portfolios. Primary research involved in-depth interviews with procurement officers, facility managers, and technical specialists across diverse end-use sectors to validate market drivers and adoption barriers.

Quantitative data was synthesized using a data triangulation approach, reconciling insights from industry associations, customs trade statistics, and internal distribution records. Qualitative findings from expert consultations were integrated to contextualize regional nuances and sector-specific requirements. Rigorous data validation protocols were applied to ensure consistency and reliability, including cross-referencing supplier claims with independent laboratory performance tests.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Projector Screens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Projector Screens Market, by Type

- Projector Screens Market, by Material

- Projector Screens Market, by Installation Type

- Projector Screens Market, by Mechanism

- Projector Screens Market, by Screen Aspect Ratio

- Projector Screens Market, by Application

- Projector Screens Market, by Distribution Channel

- Projector Screens Market, by Region

- Projector Screens Market, by Group

- Projector Screens Market, by Country

- United States Projector Screens Market

- China Projector Screens Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing key findings and pivotal conclusions driving future trajectories and strategic innovations in the global projector screen industry domain

The insights presented herein underscore a pivotal moment for projector screen stakeholders: technological innovation and shifting end-use patterns are redefining the attributes that matter most, from ambient light rejection to installation flexibility. Geographic disparities in regulatory frameworks and infrastructure readiness have created distinct regional profiles, compelling suppliers to adopt nuanced go-to-market strategies. Meanwhile, evolving trade policies have injected new complexity into material sourcing decisions, highlighting the critical need for agile supply chain management.

Looking ahead, the convergence of digital integration, sustainable materials development, and user-centric design will chart the future course of this industry. Organizations that harness data-driven insights, invest in collaborative product development, and maintain strategic foresight in policy debates will be best positioned to capture emerging opportunities and navigate uncertainties. These foundational conclusions serve as a roadmap for decision-makers seeking to elevate their competitive standing in the global projector screen arena.

Driving engagement through a compelling call to action that empowers stakeholders to procure the definitive projector screen market intelligence report

For a comprehensive and authoritative understanding of the evolving projector screen market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage with an expert who can guide you through tailored insights, strategic recommendations, and detailed segment-level analysis essential for informed decision-making. Secure your copy of the definitive market research report today and position your organization to capitalize on emerging trends, mitigate supply chain uncertainties, and achieve sustained growth in this dynamic visual display landscape.

- How big is the Projector Screens Market?

- What is the Projector Screens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?