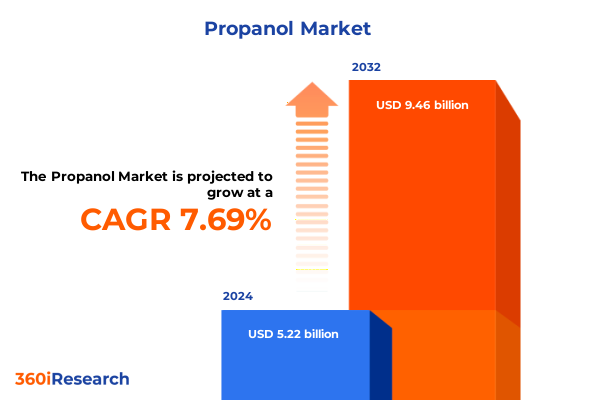

The Propanol Market size was estimated at USD 5.63 billion in 2025 and expected to reach USD 6.08 billion in 2026, at a CAGR of 7.68% to reach USD 9.46 billion by 2032.

Exploring the Critical Role of Propanol in Modern Industries Driven by Versatility, Regulatory Dynamics, and Emerging Market Demands

The propanol market stands at the intersection of versatility and innovation, serving as a vital component across a range of industries from personal care to industrial applications. Characterized by two primary isomers- isopropanol and n-propanol- this chemical intermediate has seen significant evolution in its production processes, driven by both technological developments and shifting regulatory landscapes. As industries strive to balance cost efficiency with performance and sustainability, propanol’s solvent properties and antiseptic capabilities have positioned it as an indispensable ingredient in formulations worldwide.

Against a backdrop of heightened environmental scrutiny and evolving compliance requirements, manufacturers are investing in cleaner production techniques and exploring bio-based feedstocks to reduce carbon footprints. Regulatory agencies across key markets continue to tighten restrictions on volatile organic compound emissions and impose stricter handling guidelines, prompting supply chain participants to reevaluate sourcing strategies and safety protocols. In this dynamic context, a clear understanding of propanol’s role, regulatory drivers, and emerging end-use trends is essential for stakeholders aiming to maintain a competitive edge and foster long-term resilience.

Unveiling Transformative Shifts Reshaping the Propanol Market with Sustainability, Digitalization, and End-User Innovation at the Forefront

Over the past several years, the propanol market has experienced transformative shifts as end-users increasingly prioritize products that align with sustainability targets and enhanced safety standards. The rise of greener chemistries has spurred investment in bio-based propanol production pathways, while advancements in process intensification and continuous manufacturing are driving efficiencies in purity and cost. Simultaneously, digital traceability solutions are gaining traction among suppliers and customers alike, providing real-time insights into availability, quality, and provenance across complex global supply chains.

These shifts are further amplified by heightened demand for disinfectants and antiseptics, particularly in healthcare and public venues, which has elevated propanol’s role in hygiene formulations. As digitalization converges with regulatory imperatives, manufacturers are leveraging predictive analytics to optimize inventory buffers and mitigate risk exposure. In tandem, research into novel applications-such as energy-efficient coatings and specialty pharmaceutical excipients-signals an expanding horizon of growth opportunities. Stakeholders who adapt to these converging trends will be well-positioned to capitalize on efficiencies and secure market share in an increasingly complex ecosystem.

Assessing the Cumulative Impact of 2025 United States Tariffs on Propanol Supply Chains and Competitive Dynamics across Domestic and Global Markets

The implementation of new U.S. tariffs on select chemical imports in early 2025 has created ripple effects throughout propanol supply chains and pricing structures. By imposing additional duties on imported alcohol intermediates, the U.S. administration aims to incentivize domestic production and safeguard national security interests, but this policy shift has also introduced a layer of complexity for downstream users. Cost pressures have risen for formulators in cleaner and detergent, cosmetic and personal care, and pharmaceutical sectors, prompting many to reassess inventory strategies and secure contracts with domestic producers to maintain margin stability.

In response, several large-scale chemical manufacturers have ramped up capacity investments within the United States, seeking to offset tariff burdens by bringing production closer to key end-use markets. Meanwhile, smaller distributors and contract manufacturers are negotiating long-term purchase agreements or exploring alternative sourcing from tariff-exempt jurisdictions. Although this realignment carries the promise of enhanced supply security, it also poses transitional challenges related to equipment qualification, regulatory certification, and logistics continuity. Overall, the cumulative effects of these tariffs underscore the critical importance of agility and strategic supplier partnerships in navigating a newly tariff-driven landscape.

Unearthing Key Segmentation Insights Highlighting Application, Product Type, End-User Industry, Purity Grade, and Distribution Channel Nuances

A comprehensive examination of market segmentation reveals distinct performance patterns across application, product type, end-user industry, purity grade, and distribution channel, each influencing procurement priorities and growth trajectories. When viewed through the lens of application, propanol’s role as a chemical intermediate spans sectors such as cleaner and detergent formulations-specifically floor and glass cleaners-while its efficacy in cosmetic and personal care applications underpins hair care, makeup removal, and skin care product lines. In the medical realm, disinfectant and antiseptic uses encompass hand sanitizers, hospital disinfectants, and surface disinfectants, highlighting propanol’s indispensable contribution to healthcare hygiene protocols. Moreover, the paint and coating segment leverages propanol in both automotive and industrial coatings, whereas pharmaceutical applications rely on it for excipients and tablet coatings. Finally, its fundamental solvent properties are harnessed in industrial and laboratory solvent processes.

Turning to product type, the market’s two core variants- isopropanol and n-propanol-each offer high-purity and standard-purity grades to meet varying performance requirements, from general-purpose cleaning agents to critical specialty formulations. End-user industry segmentation further underscores the chemical’s reach, as the automotive, chemical manufacturing, food and beverage, oil and gas, paints and coatings, personal care, and pharmaceutical sectors all deploy propanol across their value chains. Meanwhile, the importance of purity grade-spanning industrial, laboratory, and pharmaceutical classifications-continues to shape purchasing decisions, with stringent quality controls mandated for sensitive applications. Finally, distribution channels such as direct sales, authorized distributors, and online platforms each cater to different customer segments, influencing service levels, delivery lead times, and overall cost structures.

This comprehensive research report categorizes the Propanol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Distribution Channel

- Application

- End User Industry

Delivering Key Regional Insights into Propanol Demand Patterns and Strategic Dynamics across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics in the propanol market reveal differentiated demand drivers and strategic considerations across the Americas, Europe, Middle East and Africa (EMEA), and Asia-Pacific regions. In the Americas, robust industrial activity alongside a strong focus on sustainability has stimulated demand for cleaner and greener propanol solutions, particularly within the personal care and pharmaceutical sectors. North American producers are capitalizing on tariff-driven repatriation efforts, while Latin American markets continue to exhibit gradual uptake, supported by growing hygiene awareness and urbanization trends.

By contrast, EMEA markets are characterized by rigorous environmental and safety regulations that have accelerated adoption of low-emission production technologies and enhanced product stewardship practices. Western European countries lead in regulatory compliance and innovation, whereas emerging markets in Central and Eastern Europe, the Middle East, and Africa are ramping up infrastructure investments to improve access to high-purity chemical intermediates. Meanwhile, the Asia-Pacific region remains the fastest-growing market, driven by expansive manufacturing bases in China and India and rising consumption across automotive, chemicals, and personal care verticals. Capacity expansions in key Asia-Pacific hubs are intensifying competition while also creating opportunities for regional partnerships and technology transfer initiatives.

This comprehensive research report examines key regions that drive the evolution of the Propanol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies Shaping the Propanol Industry through Innovation, Capacity Expansion, and Strategic Partnerships Driving Competitive Advantage

Leading chemical manufacturers are deploying multifaceted strategies to capture propanol market opportunities, balancing capacity expansion with innovation and strategic alliances. Several top-tier companies have accelerated investments in high-purity production lines, leveraging catalyst optimization and continuous processing technologies to enhance yield and reduce energy consumption. At the same time, chemical firms are forging partnerships with downstream formulators and research institutes to co-develop bespoke propanol derivatives tailored to specific application requirements.

Consolidation through mergers and acquisitions remains a central theme among market participants seeking scale advantages and geographic reach. By integrating complementary assets, companies are extending their product portfolios and strengthening distribution networks. Furthermore, sustainability commitments are reshaping corporate roadmaps, with significant capital allocated to carbon capture initiatives and circular feedstock trials. Collectively, these approaches illustrate how leading organizations are positioning themselves for long-term growth, aligning their operational footprints with shifting market demands and regulatory frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Propanol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A B Enterprises

- BASF SE

- Bayer AG

- Carboclor S.A.

- Dairen Chemical Corporation

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- Eastman Chemical Company

- Exxon Mobil Corporation

- ISU Chemical

- KH Chemicals

- LCY Chemical Corp.

- LG Chem Ltd.

- Lyondellbasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- OQ Chemicals GmbH

- Royal Dutch Shell PLC

- Sasol Limited

- Seqens

- Solvay S.A.

- Tasco Group

- The Dow Chemical Company

- Tokuyama Corporation

- Tokyo Chemical Industry Co., Ltd.

- Wenzhou Huaqiao Chemical Reagent Co., Ltd

- Zhejiang Xinhua Chemical Co., Ltd.

Providing Actionable Recommendations for Industry Leaders to Enhance Supply Chain Resilience, Sustainability, and Growth in the Evolving Propanol Landscape

To thrive in the evolving propanol landscape, industry leaders should adopt a multifaceted strategy that emphasizes supply chain resilience, regulatory alignment, and sustainable innovation. By diversifying supplier portfolios to include both domestic producers and tariff-exempt sources, organizations can mitigate the impact of trade policy disruptions while maintaining consistent access to high-purity propanol. Concurrently, investing in green manufacturing technologies-such as bio-derived feedstocks and energy-efficient processes-will not only address environmental mandates but also create differentiation in increasingly eco-conscious end-use markets.

Additionally, embracing digital tools for real-time data analytics and traceability will empower procurement and operations teams to anticipate supply constraints and optimize inventory levels. Collaborating with end users through co-development partnerships can yield tailored propanol solutions, unlocking new application avenues in coatings, pharmaceuticals, and specialty chemicals. Lastly, strengthening distribution channel strategies by blending direct sales with digital commerce platforms will enhance customer service agility and market penetration, particularly among small and medium-size enterprises. By pursuing these actionable recommendations, stakeholders can bolster competitiveness and adapt effectively to continuously shifting market forces.

Detailing Rigorous Research Methodology Ensuring Data Integrity and Analytical Rigor in Assessing the Propanol Market’s Competitive and Regulatory Dynamics

This market analysis is founded on a rigorous methodology designed to ensure data integrity and analytical precision. The research process began with extensive secondary research, including review of regulatory filings, industry publications, and trade association reports, to establish baseline insights into propanol production trends and regulatory developments. Complementing this, primary research involved structured interviews with key stakeholders, including chemical producers, distributors, formulators, and end-user representatives, to validate secondary findings and capture emerging use-case perspectives.

Quantitative data on production capacities, purity grades, and regional trade flows were compiled from proprietary databases and refined through cross-verification with customs records and industry consortia metrics. Qualitative inputs from expert panels and technical workshops provided nuanced understanding of process innovations and market dynamics. The analytical framework employed triangulation techniques to reconcile disparate data points, while scenario analysis was used to assess the implications of tariff changes and sustainability mandates. Throughout the study, robust data governance protocols and peer reviews ensured consistency, accuracy, and transparency of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Propanol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Propanol Market, by Product Type

- Propanol Market, by Purity Grade

- Propanol Market, by Distribution Channel

- Propanol Market, by Application

- Propanol Market, by End User Industry

- Propanol Market, by Region

- Propanol Market, by Group

- Propanol Market, by Country

- United States Propanol Market

- China Propanol Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Insights and Strategic Imperatives to Illuminate the Future Trajectory and Value Proposition of the Global Propanol Market

In synthesizing the key insights presented, it is evident that propanol’s intrinsic properties have cemented its strategic importance across diverse applications, from hygiene formulations to industrial coatings and pharmaceutical excipients. The convergence of sustainability mandates, digital transformation, and health-driven demand underscores the need for agile supply chain strategies and innovation-centric partnerships. Furthermore, the introduction of U.S. tariffs in 2025 has reconfigured competitive dynamics, catalyzing domestic capacity growth while compelling market participants to navigate higher cost environments and regulatory complexities.

Segmentation analysis and regional perspectives highlight differentiated growth patterns, with a clear shift toward high-purity grades and digital distribution channels in mature markets and rapid expansion in Asia-Pacific manufacturing hubs. Key players are responding through targeted investments, mergers and acquisitions, and sustainability programs that align with evolving customer expectations. As the global propanol market continues to mature, industry leaders must balance near-term tactical adjustments with forward-looking strategies to capture emerging opportunities and mitigate potential disruptions. Ultimately, those organizations that integrate deep market intelligence with operational excellence will be best positioned to secure competitive advantage and drive sustainable growth.

Empowering Decision-Makers to Act Now with Direct Engagement Opportunities to Acquire Comprehensive Propanol Market Intelligence from Ketan Rohom

Engaging directly with Ketan Rohom unlocks unparalleled strategic support tailored to your organization’s specific needs in the propanol market. His expertise in sales and marketing for specialty chemicals ensures you receive targeted guidance on navigating regulatory challenges, optimizing distribution channels, and leveraging emerging applications for propanol. By securing this comprehensive market research, you gain access to actionable intelligence that can accelerate your decision-making process and deliver a competitive edge.

Take the next step in strengthening your market position by contacting Ketan Rohom to discuss how this in-depth analysis can be integrated into your strategic roadmap. His collaborative approach and deep understanding of the propanol landscape will empower your team to capitalize on growth opportunities, mitigate potential risks, and drive sustainable performance across all segments. Connect now to transform insights into impactful actions and secure a leadership stance in the evolving global propanol market

- How big is the Propanol Market?

- What is the Propanol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?