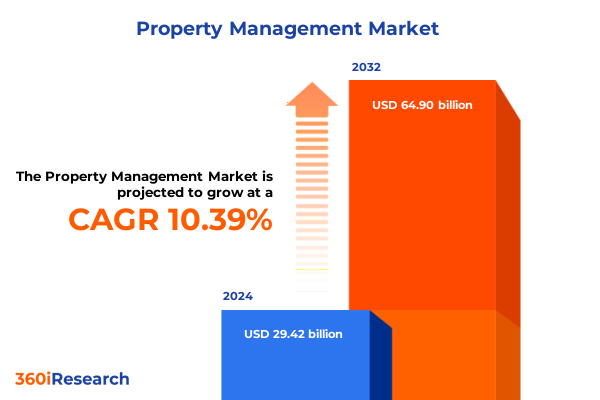

The Property Management Market size was estimated at USD 32.36 billion in 2025 and expected to reach USD 35.59 billion in 2026, at a CAGR of 10.45% to reach USD 64.90 billion by 2032.

Setting the Stage for the Evolving Property Management Landscape with Comprehensive Market Dynamics Emerging Trends and Strategic Imperatives

The property management sector stands at the nexus of technological advancement, evolving regulatory frameworks, and shifting tenant expectations. As organizations strive to optimize operational efficiencies and enhance customer experiences, an integrated view of market forces is essential to navigate this complexity. Modern property managers are tasked with balancing cost-effectiveness against tenant satisfaction, all while adapting to an environment increasingly shaped by data analytics, automation, and sustainability imperatives.

Against this backdrop, we delve into a comprehensive exploration of transformative market trends, geopolitical influences such as tariff adjustments, and the nuanced segmentation that underpins strategic choices. By examining recent shifts in technology adoption, contractual frameworks, and deployment models, this report lays the groundwork for actionable insights. As you embark on this executive summary, you will gain clarity on the drivers redefining property management and the strategic imperatives poised to shape the industry’s trajectory.

Unveiling the Transformative Shifts Redefining Property Management Through Technology Innovation Regulatory Evolution and Changing Tenant Behaviors

Significant technological breakthroughs are rewriting the rules of property management, ushering in automation, artificial intelligence, and the Internet of Things as central pillars of operational excellence. Sensor-driven facility monitoring now enables proactive maintenance schedules, reducing downtime and extending asset lifecycles. Concurrently, AI-powered tenant engagement platforms streamline communication workflows, offering personalized experiences that improve satisfaction and retention.

Beyond technology, regulatory evolutions are reshaping compliance mandates, particularly around data privacy, energy efficiency standards, and tenant rights. Stricter guidelines for environmental reporting compel operators to adopt sustainable practices and upgrade aging infrastructure. At the same time, evolving labor regulations influence vendor relationships and service delivery models, prompting property leaders to recalibrate their contractual terms and risk management strategies.

Demographic shifts further intensify market complexity. The rise of remote work patterns has transformed demand for mixed-use and suburban properties, while younger generations prioritize flexible lease structures and digital-first interactions. These intersecting forces demand a holistic response from industry stakeholders, as strategic agility becomes the hallmark of success in a landscape defined by continuous innovation and regulatory refinement.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Property Management Operations Supply Chains and Service Cost Structures

In 2025, adjustments to United States tariff schedules have had far-reaching effects on property management operations and service delivery models. Increased duties on imported hardware components have driven up the costs of sensors, access control systems, and smart building modules, compelling providers to revisit procurement strategies and explore alternative supply chains.

Service firms have responded by renegotiating vendor agreements, seeking localized manufacturing partnerships to hedge against future trade volatility. These adaptations extend beyond procurement, as cost pressures trickle down to maintenance contracts and software licensing fees, necessitating closer collaboration between property managers and technology vendors to ensure transparent cost structures.

Moreover, the tariff landscape has accelerated investments in domestic innovation. Providers are deploying in-house research and development to create proprietary hardware solutions, fostering resilience against external shocks. This shift not only mitigates tariff exposure but also enhances competitive differentiation through tailored offerings. As tariffs continue to reshape global trade flows, property management stakeholders must remain vigilant and adaptive, integrating tariff risk assessments into their long-term strategic planning.

Illuminating Core Segmentation Insights to Guide Tailored Service Offerings Across Diverse Property Management Verticals and Client Needs

A nuanced understanding of market segments allows stakeholders to tailor offerings along multiple dimensions. When considering the spectrum of services, it becomes clear that managed services and professional services each respond differently to client demands; within professional services, customer support, onboarding, SLA management, and training and consulting emerge as critical functions that require specialized expertise and bespoke delivery models. Software solutions, segmented into facility property management, lease management, marketing and tenant communication, reporting and analytics, and security and payments modules, illustrate how modular digital platforms offer flexible configurations suited to varying operational priorities.

Ownership structures further influence market dynamics, as organizations weigh in-house management against third-party outsourcing, balancing control with external expertise. The choice between long-term and short-term contract tenures underscores the importance of aligning service commitments with asset lifecycle objectives and risk tolerance. Deployment models, spanning both cloud-based environments and on-premise installations, reveal divergent preferences driven by security considerations, scalability needs, and integration complexities.

Property type segmentation demonstrates the breadth of application, covering commercial venues like campgrounds and RV parks, data centre hubs, educational and healthcare institutions, logistics and distribution centers, office and coworking spaces, retail environments, and warehouses, as well as government and military facilities, including defense installations and public housing authorities. Industrial sites such as manufacturing plants, energy production facilities, and R&D centers, alongside residential formats from apartments and gated communities to townhouses and villas, each impose unique operational demands. Finally, geographic location-whether rural, suburban, or urban-and property scale, from expansive portfolios to small and medium assets, round out the segmentation framework, guiding providers in prioritizing resources and developing differentiated value propositions.

This comprehensive research report categorizes the Property Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Ownership

- Nature

- Deployment

- Property Type

- Geographic Location

- Property Size

Exploring Regional Nuances Across Americas Europe Middle East & Africa and Asia-Pacific Fueling Unique Opportunities and Challenges in Property Management

Regional landscapes in property management each present distinct opportunities and challenges that shape strategic priorities. Within the Americas, mature regulatory environments and advanced infrastructure underpin a focus on integrated technology adoption and consolidation among industry leaders. Clients increasingly demand sophisticated reporting tools and environmentally conscious solutions, positioning providers to innovate around carbon reduction and energy optimization services.

Across Europe, the Middle East, and Africa, regulatory diversity necessitates agile compliance strategies, as data protection regulations and building codes can vary significantly from one jurisdiction to the next. Sustainability mandates on energy performance drive investment in green retrofits, while rising urbanization in key metropolitan areas fuels demand for mixed-use developments that blend residential, retail, and office functions.

In Asia-Pacific markets, rapid urban expansion and government initiatives promoting smart city ecosystems have created fertile ground for outsourced property management services. Providers leverage cloud platforms to support scalable deployments, while joint ventures with local firms help navigate complex regulatory landscapes. Together, these regional insights inform a strategic roadmap for market entry, investment prioritization, and service design across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Property Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players and Collaborative Strategies Driving Innovation Competitive Advantage and Growth in the Property Management Ecosystem

Leading players in the property management arena are distinguished by their ability to integrate comprehensive service portfolios with advanced software solutions. Multinational firms have accelerated innovation through strategic acquisitions of niche technology providers, enhancing their capabilities in tenant communication, predictive maintenance, and analytics-driven decision support. Emerging challengers, meanwhile, compete by focusing on specialized modules such as security and payments or by delivering hyper-local managed services tailored to specific property types or community demographics.

Collaborative partnerships between large-scale operators and agile software firms have become a hallmark of competitive strategy, enabling seamless end-to-end solutions that span facility operations, lease administration, marketing automation, and financial reporting. These alliances also facilitate the co-creation of sustainability offerings, such as energy benchmarking and carbon accounting services, allowing clients to meet regulatory requirements and corporate social responsibility goals.

Innovation hubs established by key industry players are fostering experimentation with AI-driven tenant experience platforms and blockchain-based lease management systems. Such initiatives not only demonstrate technical prowess but also solidify long-term client relationships by showcasing a commitment to continuous improvement and forward-looking service design.

This comprehensive research report delivers an in-depth overview of the principal market players in the Property Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accruent, LLC

- AppFolio, Inc.

- Aspire Systems

- Avail Property Management, Inc.

- Avenue

- Boom Properties

- Bozzuto & Associates, Inc.

- Breezeway Homes, Inc.

- CBRE, Inc.

- CDG Property Management

- Colliers International Property Consultants, Inc.

- CoreLogic, Inc.

- Cortland

- CoStar Group, Inc.

- Crédit Agricole S.A.

- Cushman & Wakefield PLC

- DoorLoop Inc.

- Entrata, Inc.

- Eptura, Inc.

- Greystar Global Enterprise, LLC

- HappyCo, Inc.

- Hemlane, Inc.

- Hines Group

- Hitachi, Ltd.

- Hive Properties

- Hughes Group Limited

- Inhabit

- Innago, LLC

- International Business Machines Corporation

- IQware Inc. by Fullsteam Operations LLC

- Jones Lang LaSalle Incorporated

- LeaseHawk, LLC

- LetHub

- Lincoln Property Company

- Livly, Inc

- London Computer Systems

- ManageCasa Inc.

- Matterport, Inc.

- MRI Software LLC

- Mynd Management, Inc.

- MyndLeaseX

- Nexus Property Management

- Ohmyhome Limited

- Oracle Corporation

- Planon Group

- Property Boulevard, Inc.

- Property Matrix

- PURE Property Management Company

- RealPage, Inc.

- Realpha Asset Management, Inc.

- Reapit Limited

- Rentec Direct LLC

- RentRedi, Inc.

- ResMan, LLC

- Roers Companies

- Royal York Property Management Franchising, inc.

- SAP SE

- Savills PLC

- Smart Property Systems Inc.

- Spacewell International NV

- Square Yards Group

- Strangford Management Ltd

- TenantCloud, LLC

- Tribe Property Technologies Inc.

- Trimble Inc.

- TruHome Property Solutions

- TurboTenant, Inc.

- Yardi Systems, Inc.

- Zumper, Inc.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Digital Transformation Regulatory Compliance and Operational Excellence

Industry leaders must adopt a strategic blueprint that capitalizes on digital transformation while ensuring operational robustness. To start, investing in unified technology platforms that integrate facility management, lease administration, and tenant engagement modules will foster greater data visibility and streamline cross-functional workflows. This integrated approach not only reduces redundant systems but also enhances user adoption and drives measurable efficiency gains.

Simultaneously, executives should cultivate resilient supplier networks by diversifying hardware and software partnerships, thereby hedging against trade fluctuations and geopolitical risks. Embedding tariff impact assessments into procurement decisions will safeguard cost structures and ensure continuity of critical services. Furthermore, establishing flexible contract models that accommodate both long-term stability and short-term agility will allow organizations to pivot rapidly in response to market shifts.

Finally, a concerted focus on sustainability and regulatory compliance can propel differentiation in competitive landscapes. By embedding energy management and ESG reporting capabilities within service offerings, property managers can help clients meet evolving standards and demonstrate tangible sustainability outcomes. Through these recommendations, industry leaders will be equipped to navigate complexity, drive innovation, and secure a sustainable growth trajectory.

Detailing the Comprehensive Research Methodology Data Sources and Analytical Framework Employed to Ensure Robust and Reliable Property Management Insights

This study synthesizes insights from a multi-phase research approach combining primary and secondary data sources with expert validation. Initial secondary research encompassed an extensive review of industry publications, regulatory filings, corporate reports, and technology white papers to establish a foundational understanding of market dynamics. Key themes such as tariff impacts, segmentation frameworks, and regional variances were identified and refined through this literature analysis.

Primary research involved one-on-one interviews with senior executives at property management firms, software providers, and industry consultants to capture qualitative perspectives on emerging trends and operational challenges. These insights were triangulated against transactional data and case studies to ensure coherence and reliability. Quantitative analyses were conducted through structured surveys targeting decision-makers across diverse property types and geographies, providing robust validation of thematic findings.

An analytical framework integrating SWOT (strengths, weaknesses, opportunities, and threats) analysis, Porter’s Five Forces, and scenario modeling underpinned the synthesis of strategic recommendations. Finally, an expert advisory panel reviewed the methodology and results, ensuring that conclusions are defensible and actionable for business leaders seeking to harness the evolving property management landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Property Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Property Management Market, by Offering

- Property Management Market, by Ownership

- Property Management Market, by Nature

- Property Management Market, by Deployment

- Property Management Market, by Property Type

- Property Management Market, by Geographic Location

- Property Management Market, by Property Size

- Property Management Market, by Region

- Property Management Market, by Group

- Property Management Market, by Country

- United States Property Management Market

- China Property Management Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing Strategic Insights and Emerging Trends to Chart the Future Trajectory of the Property Management Sector and Inspire Informed Decision-Making

The intersection of technological innovation, trade policy adjustments, and evolving tenant preferences is reshaping the property management sector at an unprecedented pace. Organizations that embrace integrated digital platforms, adaptive service models, and sustainability-driven solutions will outperform in a landscape defined by complexity and regulatory scrutiny. The nuanced segmentation and regional insights provided herein underscore the importance of a tailored approach that aligns offerings with specific market contexts.

Strategic agility remains paramount, as tariff-induced cost pressures and demographic shifts demand continuous recalibration of procurement, contract, and deployment strategies. By leveraging the actionable recommendations outlined above, decision-makers can build resilient operational frameworks that anticipate future disruptions and generate long-term value. Ultimately, success hinges on the ability to synthesize data-driven insights with creative service design, forging a competitive edge through both technological sophistication and customer-centric excellence.

Connect Directly with Ketan Rohom to Secure the Full Market Research Report and Propel Strategic Decision-Making in Property Management

For decision-makers seeking to elevate their strategic planning with data-driven insights and comprehensive analysis, engaging directly with Ketan Rohom offers a streamlined path to securing the full market research report. As Associate Director of Sales & Marketing, Ketan brings deep expertise in translating complex findings into actionable strategies tailored to diverse stakeholder needs. By connecting with Ketan, you gain immediate access to in-depth coverage of market transformations, tariff impacts, segmentation nuances, regional dynamics, and competitive landscapes.

Beyond simply purchasing a document, collaborating with Ketan ensures personalized guidance on leveraging key learnings to optimize operations, mitigate risks, and capture emerging opportunities. His consultative approach will align the report’s insights with your organization’s unique priorities, enabling you to craft targeted roadmaps for digital integration, cost management, and customer engagement. Reach out today to unlock the strategic advantage embedded within this exhaustive study and empower your leadership team to make informed, agile, and future-focused decisions.

- How big is the Property Management Market?

- What is the Property Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?