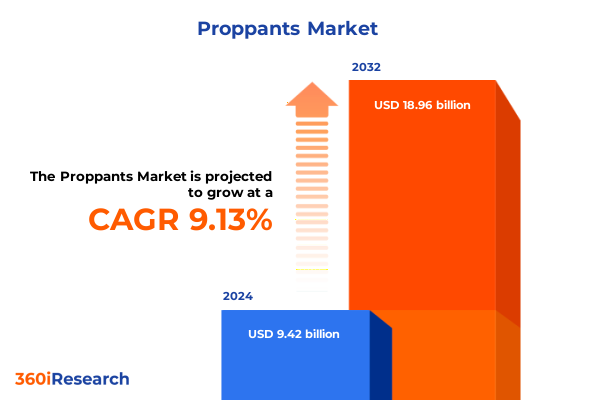

The Proppants Market size was estimated at USD 10.23 billion in 2025 and expected to reach USD 11.11 billion in 2026, at a CAGR of 9.21% to reach USD 18.96 billion by 2032.

Unlocking the Core Dynamics of the Global Proppants Industry Through Insightful Introduction to Market Drivers, Operational Mechanisms and Emerging Trends

The proppants industry stands at the intersection of energy demand growth and technological innovation, serving as a critical enabler for hydraulic fracturing and well completion processes. As global oil and gas operators continue to tap unconventional reserves, proppants have emerged as foundational materials that maintain fracture conductivity under extreme subsurface pressures. This introduction contextualizes the market’s importance by highlighting how proppant selection influences well productivity, cost efficiency, and environmental compliance.

Transitioning from conventional drilling to horizontal fracturing techniques has dramatically increased proppant consumption, prompting manufacturers and service providers to innovate in material science and logistics. Resin-coated sands extend well life by reducing flowback migration, while high-density ceramics withstand closure stresses exceeding 15,000 psi in ultra-deep reservoirs. Grain size optimization ensures uniform fracture width, enhancing hydrocarbon recovery rates. Together, these drivers underscore the industry’s complexity and the need for nuanced understanding of material performance and supply dynamics.

Charting the Transformation of the Proppants Landscape Amidst Technological Advances, Environmental Mandates and Shifting Energy Strategies

In recent years, the proppants landscape has undergone transformative shifts fueled by technological breakthroughs, regulatory pressures, and evolving operator preferences. Innovations in polymer chemistry have yielded next-generation coatings that improve proppant embedment resistance by up to 20%, optimizing conductivity in high-temperature and corrosive reservoirs. Simultaneously, the adoption of machine-learning algorithms for fracture design has enabled precise matching of proppant properties to geomechanical profiles, reducing waste and improving completion outcomes.

Environmental mandates have also reshaped manufacturing processes, with an increasing share of suppliers investing in low-emission kilns and water-efficient washing technologies. These advancements not only mitigate regulatory risks but also enhance brand reputation among environmentally conscious operators. Moreover, the emergence of in-basin sand production has shortened logistics chains, cutting lead times by 15% and reducing transportation carbon footprints. Collectively, these trends illustrate a market in flux, where agility and innovation determine competitive positioning.

Assessing the Comprehensive Ripple Effects of 2025 United States Tariffs on Proppant Supply Chains, Cost Structures and Industry Resilience

The United States’ imposition of elevated tariffs on imported proppant materials in early 2025 has introduced significant cost pressures and strategic recalibrations across the value chain. Ceramic proppants sourced from key global producers became subject to incremental duties, inflating landed costs and compelling operators to explore domestic alternatives or engage in captive manufacturing. Resin-coated sands and specialty glass spheres similarly faced tariff hikes, compounding the impact of rising freight rates on overall completion budgets.

In response to these measures, leading service providers renegotiated supplier contracts to include tariff-hedge clauses and diversified their material mix by incorporating in-region frac sand and lower-cost alternatives. Concurrently, technology licensors finalized joint ventures to establish fabrication hubs within U.S. industrial zones, thereby minimizing customs exposure and accelerating delivery schedules. While these adjustments initially squeezed margins, they have catalyzed a strategic shift toward supply chain resilience and local capacity expansion, positioning the industry to better absorb future regulatory fluctuations.

Deriving Actionable Intelligence from In-Depth Proppant Segmentation Analysis Spanning Types, Coatings, Grain Sizes, Applications and End User Industries

Understanding the market through multiple segmentation lenses reveals discrete opportunities and challenges for stakeholders at every step of the value chain. When dissecting the industry by proppant type-ceramic, resin-coated sand, and natural sand-operators recognize that ceramics, including fused alumina and sintered bauxite variants, command premium applications in deep and ultra-high pressure wells due to their superior crush resistance. Resin-coated sand, by contrast, offers optimized permeability control and reduced flowback in mid-range closures, while raw sand delivers cost-effective conductivity in standard shale basins.

Delving into coating types such as epoxy, phenolic, and urethane, each formulation presents distinct advantages in chemical compatibility, thermal resilience, and mechanical strength. Mesh gradations spanning 20/40, 30/50, and 40/70 grain sizes further tailor proppant placements to fracture width design, ensuring uniform proppant distribution and enhanced fracture conductivity. Application segmentation between gravel packing and hydraulic fracturing underscores divergent performance requirements: gravel packing in deep and shallow well completions demands stable pack integrity, whereas fracturing operations in coal bed methane, shale gas, and tight oil formations prioritize long-term conductivity under varying closure stresses.

Finally, mapping proppant demand by end-user industry highlights the energy sector’s reliance on robust frac media alongside industrial applications in chemical processes and mining. Within industrial contexts, proppants facilitate filtration and catalytic support, where chemical and mining sub-uses demand specialized surface chemistries and mechanical properties. This comprehensive segmentation analysis equips market participants with actionable intelligence to align product portfolios, R&D investments, and go-to-market strategies with distinct operational requirements.

This comprehensive research report categorizes the Proppants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Proppant Type

- Coating Type

- Grain Size

- Application Type

- End User Industry

Revealing Critical Regional Proppant Market Insights Across the Americas, Europe Middle East Africa and Asia Pacific Growth Corridors

Regional dynamics shape proppant sourcing, pricing, and logistical considerations in profound ways. In the Americas, North America dominates production, with states like Wisconsin and Texas collectively supplying over 70% of global frac sand capacity. This robust infrastructure supports extensive shale plays in the Permian, Bakken, and Marcellus basins, enabling in-basin sourcing that reduces transport costs and lead times by up to 20%. Latin America’s emerging pre-salt oil fields in Brazil are driving demand for high-performance resin-coated and ceramic proppants to optimize deepwater completions.

Across Europe, Middle East, and Africa, strategic investments in unconventional gas exploration in Poland, France, Saudi Arabia, and Algeria have elevated regional proppant consumption to roughly 10% of global volumes. European operators prioritize ceramic media for deep offshore and onshore wells, while the Middle East embraces resin-coated sands for their balance of cost and performance amidst rising closure pressures. Infrastructure upgrades at key Mediterranean ports have augmented import capacities, enhancing downstream distribution networks.

In the Asia-Pacific region, rapid growth trajectories in China, India, Australia, and Southeast Asia are reshaping global demand patterns. Government initiatives to reduce coal dependency have fueled shale gas projects in China, propelling an 18% expansion in domestic proppant manufacturing and a 35% increase in resin-coated sand adoption over the past two years. Australia’s coal bed methane ventures and India’s nascent fracturing operations further underscore APAC’s rising strategic importance, prompting global suppliers to establish localized production and distribution hubs.

This comprehensive research report examines key regions that drive the evolution of the Proppants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Proppant Market Players and Their Strategies to Pioneer Advanced Materials, Expand Capacity and Optimize Value Chains

Key industry participants leverage differentiated capabilities to capture market share and drive innovation. Carbo Ceramics, recognized for its engineered ceramic proppants, has expanded capacity in Louisiana by 500,000 metric tons to serve ultra-deep wells, reflecting a commitment to high-strength formulations. U.S. Silica Holdings continues to dominate raw and resin-coated sand supply, commissioning mines in Texas and Wisconsin to bolster annual output and enhance logistical flexibility. Hi-Crush Inc. provides integrated sand logistics and proprietary monocrystalline sand, optimizing in-basin delivery and reducing transit times for key Permian Basin operators.

Covia Holdings and Saint-Gobain Proppants diversify portfolios through advanced resin systems and sintered bauxite media, while Badger Mining Corporation targets industrial end-users with specialized filtration sands. Emerge Energy Services complements its white frac sand offerings with strategic storage assets, and Baker Hughes deploys digital proppant selection tools via its SandForce delivery system. Halliburton’s SandCastle silo solutions illustrate how service providers embed proppant management into completion workflows. Together, these companies drive competitive dynamics through capacity expansions, technological collaborations, and value-added services that enhance well performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Proppants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Badger Mining Corporation

- Carbo Ceramics Inc.

- Covia Holdings Corporation

- Emerge Energy Services LP

- Gulf Resources, Inc.

- Hi-Crush Inc.

- Preferred Proppants, LLC

- SBS Minerals Ltd.

- Shandong Huarun Sanwa Group Co., Ltd.

- Sibelco NV

- Smart Sand, Inc.

- U.S. Silica Holdings, Inc.

- Xinfeng Quartz Co., Ltd.

Delivering Strategic Recommendations for Industry Leaders to Navigate Volatility, Capitalize on Opportunities and Drive Sustainable Growth in Proppants

Industry leaders must adopt multidimensional strategies to thrive in a landscape marked by regulatory shifts, technological advancements, and evolving operator requirements. First, diversifying supply sources by balancing in-basin mining with contractual alliances reduces exposure to tariff volatility and transportation bottlenecks. Investing in modular fabrication facilities within major basins can further shorten lead times and enable rapid response to regional demand surges.

Second, accelerating R&D in eco-efficient manufacturing-such as low-emission kilns, closed-loop water systems, and biodegradable resin coatings-addresses both environmental compliance and operator ESG mandates. Collaborating with fracturing service companies on joint pilot programs accelerates field validation of sustainable proppant variants, enhancing market credibility.

Third, embracing digital tools for proppant selection and fracture design enhances precision in matching materials to reservoir conditions. Providing clients with data-driven simulation platforms and integrated logistics dashboards fosters deeper value-added partnerships. By implementing these actionable recommendations, industry leaders will bolster resilience, optimize operational efficiency, and secure competitive advantage amid a dynamic proppant market.

Outlining a Rigorous Research Methodology Harnessing Primary Interviews, Secondary Data Sources and Expert Validation for Credible Market Insights

The research methodology underpinning this executive summary integrates rigorous primary and secondary approaches to ensure data accuracy and relevance. Primary research involved in-depth interviews with senior executives from proppant manufacturers, oilfield service companies, and well operators to capture first-hand perspectives on market dynamics, technology adoption, and regulatory impacts. These qualitative insights were triangulated with quantitative data collected from industry associations, government trade publications, and logistics databases.

Secondary research encompassed a comprehensive review of technical journals, patent filings, and environmental compliance records. Key performance indicators such as production capacities, transport lead times, and cost structures were validated against real-time import-export statistics and company financial disclosures. Data synthesis leveraged advanced analytics tools to model segmentation scenarios, regional consumption patterns, and the cumulative impact of tariff policies. Finally, the findings were peer-reviewed by subject matter experts in petroleum engineering and supply chain management to reinforce credibility and ensure alignment with evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Proppants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Proppants Market, by Proppant Type

- Proppants Market, by Coating Type

- Proppants Market, by Grain Size

- Proppants Market, by Application Type

- Proppants Market, by End User Industry

- Proppants Market, by Region

- Proppants Market, by Group

- Proppants Market, by Country

- United States Proppants Market

- China Proppants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Major Findings and Implications to Conclude the Strategic Narrative of the Global Proppants Industry Executive Summary

In summary, the proppants market continues to evolve under the influence of technological innovation, environmental imperatives, and geopolitical factors. The segmentation analysis underscores the differentiated roles of ceramic, resin-coated, and sand proppants across diverse applications and end-user industries. Regional insights reveal how supply chain configurations and policy environments shape sourcing strategies in the Americas, EMEA, and APAC corridors. Leading companies capitalize on capacity expansions, sustainable manufacturing, and digital integration to maintain competitive positions.

The cumulative impact of U.S. tariffs in 2025 has accelerated localization efforts and prompted strategic realignment, heralding a more resilient and innovation-driven industry. Looking ahead, stakeholders who embrace modular production, eco-efficient processes, and value-added digital services will stand at the forefront of proppant market leadership. These findings form a coherent narrative designed to guide executive decision-making and strategic planning in an increasingly complex and dynamic sector.

Engage with Ketan Rohom to Secure the Complete Proppants Market Research Report and Empower Data-Driven Strategic Decisions Today

For decision-makers seeking to translate market intelligence into actionable strategies, the comprehensive Proppants Market Research Report offers unparalleled depth and clarity. To explore full datasets, regional analyses, expert interviews, and scenario planning modules, connect with Ketan Rohom, Associate Director of Sales & Marketing. Empower your organization with the insights required to optimize supply chains, anticipate regulatory shifts, and invest in next-generation proppant solutions that will drive competitive advantage.

- How big is the Proppants Market?

- What is the Proppants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?